Flipside Crypto - Bounty Brief #30

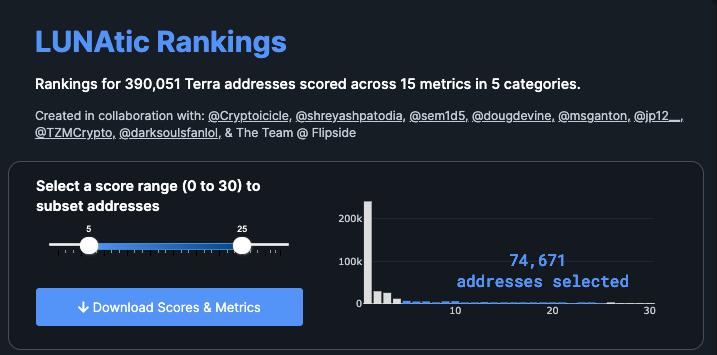

Hello there, bounty hunters — welcome to week #30 of the Bounty Brief! Calling all #LUNAtics: see how you stack up against other Terra degens with the new Terra ecosystem leaderboard from Flipside Crypto. You can dive even deeper into the Terra-verse with our Pylon bounties below. Or try our new Mirror Bounties and the return of the Magic Mirror scavenger hunt. We’ve also got a new set of Aave and THORChain bounty questions just waiting to be solved. Check ‘em all out below. 🪞 Mirror[Scavenger Hunt] Magic Mirror Hunt Bounty: up to $50 in MIR Looking to dive deeper into the Mirror protocol, MIR, mAssets, short positions, and more from the Mirror ecosystem, but not sure where to start? We’ve got just the thing. Our Magic Mirror Hunt is designed to help you introduce yourself to this protocol and the exciting ecosystem that surrounds it. That includes its native token, MIR, plus mAssets, farming, and more. Editor's note: We're reopening the Magic Mirror Hunt in order to introduce new people to this exciting protocol in the Terra ecosystem! The Hunt will be open to all users who have not completed the Magic Mirror Hunt already — if you have completed it previously, please do not submit, as you will not receive a reward! 👻 Aave[Easy] Gas Prices and Deposit/Borrow Amounts Bounty: up to .66 AAVE As gas prices have continued to rise, how have average deposit and borrow amounts changed in response? [Hard] Means of Repayment Bounty: up to 1.34 AAVE When people repay their loans, do they liquidate themselves and use collateral growth to do so, or are they paying off their loan with external (to Aave) funding? How does this relate to the collateral's price? [Hard] Will I actually get liquidated tho? Bounty: up to 1.34 AAVE Because of high gas prices, positions that could be liquidated are sometimes not as the expense to do so would not cover the return for doing so. Is there a safe zone for where liquidation happens? How is this related to gas prices? ⚡ THORChain[Easy] Wealth Distribution Bounty: up to 14 RUNE What is the distribution of wealth within the THORChain ecosystem? Show a histogram of the breakdown Hint: use transfers [Easy] Whale Activity Bounty: up to 14 RUNE Among the wallets that own 10k+ RUNE, which pools are they currently LP-ing to? [Easy] Liquidity Bounty: up to 14 RUNE Of the wallets that have supplied liquidity in THORChain pools, what percentage have removed at least some of the liquidity? Hint: use liquidity_actions [Hard] Pool Depth Bounty: up to 28 RUNE What is the current depth of each pool based on the number of LP-ers currently providing liquidity? Hint: use liquidity_actions [Hard] Pool Stats 🔢 Bounty: up to 30.2 $RUNE For each pool, show the following stats by day

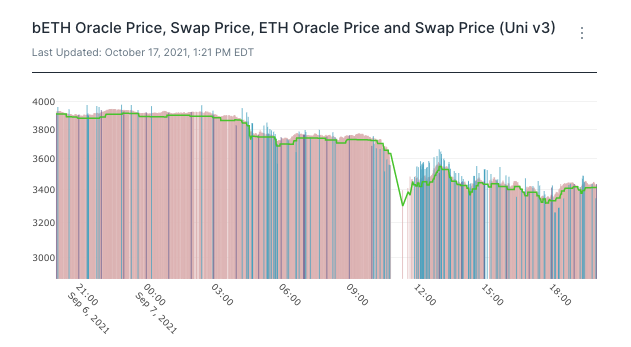

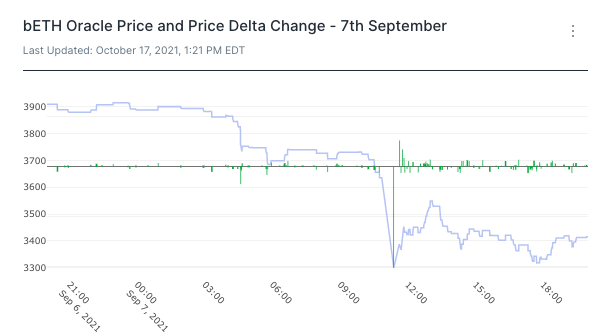

Hint: use daily_pool_stats [Hard] On-ramping 🛣️ Bounty: up to 30.2 $RUNE What is the breakdown of new users on-ramping onto thorchain by chain? Show a breakdown of each wallet’s first thorchain transaction. Which chain are they coming from? Are they swapping for RUNE or for an asset on another chain? Hint: use swaps + transfers [Hard] Affiliate Fees 🪙 Bounty: up to 30.2 $RUNE What Addresses are being used to collect affiliate fees? What are the incomes over time? Hint: use swap_events Read this (https://docs.thorchain.org/developers/transaction-memos#affiliate-fees) and this (https://medium.com/thorchain/affiliate-fees-on-thorchain-17cbc176a11b) to find out how to identify affiliate fees 💠 Pylon[Hard] Free Square 🟩 Bounty: up to 2,567 MINE Provide any interesting insights on Pylon. These will be judged by a council that includes other community members and the Flipside team! [Hard] Visualize governance staking of $MINE over time Bounty: up to 2,567 MINE What are the trends? Compare $MINE staking trends with $LUNA staking, do you think a lockup period would be beneficial? For those that have stopped staking, what did they decide to do instead in the Terra ecosystem? [Hard] LUNA Validators Bounty: up to 2,567 MINE For addresses that are staking MINE right now, what validators do they prefer for their LUNA staking? Are there any trends or commonalities? [Hard] Swaps + Pools Bounty: up to 2,567 MINE How many tokens have been distributed via Pylon swaps? How many tokens have been earned via Pylon pools? [Hard] Galactic Punks Bounty: up to 2,567 MINE How much UST has been deposited into the lottery since it’s inception? What has been the average UST deposit amount? 🏆Bounty Submission of the Week 🏆Welcome back to our Bounty Submission of the Week! In this week’s edition, we’re taking a closer look at Terra data with @mintingfarms. Specifically, we’re examining As @mintingfarms notes, bETH first made its appearance in mid-August of this year. Just a few weeks later, the newcomer saw its first real shakeup when ETH prices dropped from roughly “~3.9k to as low as ~3.0k” on September 7. So how did bLUNA react? As we can see in the graph above, the oracle price of bETH remains consistently lower than the bETH oracle price. What’s more, as @mintingfarms points out, the Ethereum Uniswap v3 price as the height of the bar charts exceeded most bETH oracle prices (in green). And when we examine the price ratio of bETH Oracle prices with the ETH price from Uniswap V3, as has been done above, we can see that the bETH oracle price was ~3.33% lower than the spot price of ETH on Uniswap v3 pool. “Compared to bLUNA oracle price updates, it appears that bETH oracles update on a less frequent basis,” @mintingfarms notes. “This steepest decline was registered a 10.1% decline in bETH oracle price from the preceding reading. Ignoring this anomaly in absence of oracle updates, the next highest registered decline was at 1.77%.” Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries: Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: If you liked this post from The Bounty Brief , why not share it? |

Older messages

Bounty Brief #29

Friday, October 29, 2021

Boo 👻 😱

Bounty Brief #28

Friday, October 22, 2021

Get some sushi 🍣 and embrace the God of Thunder ⚡

Flipside Roundup October 22

Friday, October 22, 2021

Discover new ways to get paid and see the best submissions from this week!

Bounty Brief #27

Friday, October 15, 2021

Discover new ways to get paid 💰💸🤑

Flipside Roundup October 15

Friday, October 15, 2021

Discover new ways to get paid and see the best submissions from this week!

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏