How concentrated corporate power makes inflation worse

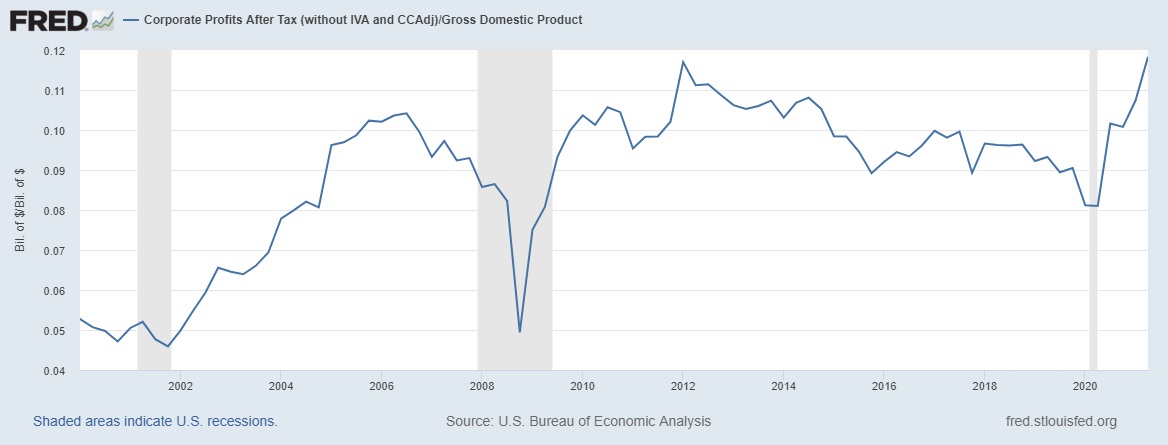

Welcome to Popular Information, a newsletter about politics and power — written by me, Judd Legum. Why are prices from everything from laundry detergent to potato chips to My Little Pony going up? Inflation is a complex phenomenon. Supply chain disruptions, increased labor costs, and surging demand all play a role. But one factor driving inflation is seldom discussed: mega-corporations with massive market power. In competitive markets, profit margins should approach zero, as long as there are reasonable substitutes available for a given product. But corporate profits as a share of the American economy have risen dramatically over the last two decades, from 5% of GDP to nearly 12%. As prices have increased in recent months, corporate profits have surged to record highs, according to data from Bloomberg:

As Colas alludes to, corporations are not being forced to raise prices to stay afloat. They are choosing to raise prices to maintain large profit margins because they have enough market power to do so without losing customers. Let's take Procter & Gamble (P&G), one of the largest consumer product companies in the world, as an example. In April 2021, P&G announced that it "will start charging more for household staples from diapers to toilet paper, the latest and biggest consumer-products company to announce price hikes." To justify the increases P&G cited "rising costs for raw materials, such as resin and pulp, and higher expenses to transport goods." The price increases, P&G said, will "be in the mid-to high-single-digit percentage points." In the fiscal quarter ending March 31, 2021, P&G reported an "operating income," or profit, of $3.785 billion. That represented a 20.9% profit margin compared to total sales. In the fiscal quarter ending September 30, 2021, after some of P&G's price increases went into effect, the company reported a profit of $5.06 billion. That represented a profit margin of 24.7%. The company spent $3 billion in the quarter buying its own stock. It's clear that the price of Pampers and Tide cannot be explained by "rising costs for raw materials" or transportation alone. Rather, the price increases were necessary to maintain — and even increase — large profit margins. But how can P&G get away with selling diapers at a huge margin? Shouldn't competitors in the diaper industry undercut P&G on price and grab market share? Unfortunately, there isn't much competition in the diaper market. "The lion’s share of the market for diapers meanwhile is controlled by just two companies (Kimberly-Clark and P&G), limiting competition for cheaper options," according to a report released this month from the Roosevelt Institute. Kimberly-Clark, which produces Huggies and Pull-Ups, announced similar price increases at the same time as P&G. Data provided to Popular Information by Accountable.us told a similar story across a range of industries. Corporations that are raising prices are also amassing huge profits and spending billions of stock buybacks. While a variety of factors are at play, insufficiently competitive industries have stripped consumers of bargaining power. The costs of these price increases are often borne by those who can least afford them and the benefits go to wealthy shareholders and executives. "[A]cross a range of sectors that produce the goods that people need to provide for their families, companies are extracting from their consumers using the excuse of inflation -- all while lining their shareholders' and CEO's pockets," Rakeen Mabud, Chief Economist at the Groundwork Collaborative, told Popular Information. "This has nothing to do with inflation, and everything to do with corporate greed by those who are focused on enriching themselves at the expense of workers and families." Other major brands announcing price increases and large profitsIn April, PepsiCo — the parent company of Frito-Lay, Gatorade, Quaker, Tropicana, and other brands — announced it was increasing prices. The company blamed "higher costs for some ingredients, freight and labor." In July, the company announced its "pricing was up about 5% in the North America businesses." Those price increases supported better than expected performance. The company recorded $3 billion in operating profits and increased its projections for the rest of the year. The company expects to send $5.8 billion in dividends to shareholders in 2021. PepsiCo's chief competitor, Coca-Cola, took a similar approach. The company — which owns Dasani, Powerade, Minute Maid, and Fairlife — announced in July that it "plans to raise prices." These price increases were good for business. The company recorded $10 billion in revenues (up 16% from the previous year) and increased its profit margins to 28.9%. Coca-Cola has over $11 billion in cash reserves. The trend extends beyond the food industry. Whirlpool — which owns Kitchenaid, Maytag, Amana, and other appliance brands — increased prices 5 to 12% in 2021. The purpose of the increase, announced in July, was purportedly to "compensate for increased raw material costs, including for steel and plastics." In the 3rd quarter, however, Whirlpool announced profits of $608 million and revised its estimates for profit margins moving forward — from 10% to 11-12%. While the price increases were billed as offsetting raw material costs, they ended up increasing profit margins significantly. Numerous other companies that announced price increases to compensate for increased labor and material costs are reporting large profits, including Conagra, Hasbro, and Chipotle. In June, two of the nation's largest supermarket chains, Kroger and Albertsons, said "that they expect to benefit from rising prices." According to retail analyst Burt Flickinger, the stores will "mark up the full rate of inflation plus a little bit more." Kroger CEO Rodney McMullen was quite open about his intention to exploit inflation to increase profits. "A little bit of inflation is always good in our business," McMullen said. Popular Information spends a lot of time scrutinizing how corporations exercise their power — and holding corporations accountable for their actions. To maintain our complete independence in pursuit of this goal, Popular Information does not accept advertisements of any kind. That means 100% of our funding comes from readers. That gives us the freedom to pursue stories you won't find anywhere else. You can support this work with a paid subscription. If the cost of this newsletter ($6/month or $50/year) would create a financial burden for you, please stay on this free list. But, if you can afford it, consider becoming a paid subscriber now. |

Older messages

UPDATE: Republican lobbyists are "frustrated," push corporate PACs to resume contributions

Tuesday, November 9, 2021

It's been more than 10 months since a pro-Trump mob, inspired by Republican members who had pledged to vote to overturn the results of the presidential election, stormed the Capitol. Following the

Right-wing operatives deploy massive network of fake local news sites to weaponize CRT

Monday, November 8, 2021

Last Tuesday night, Glenn Youngkin (R) was elected the next governor of Virginia. At 9:15 PM, Garrit Lansing, president of WinRed, the main online fundraising vehicle for Republican candidates, sent

One thought about Tuesday's election

Thursday, November 4, 2021

This newsletter is about accountability journalism, not political punditry. But today I do want to share my thinking about the outcome of Tuesday's elections — and the ensuing discourse. Post-

GM says it supports Build Back Better... and the lobbying campaign to kill it

Wednesday, November 3, 2021

From the outset, lobbying groups representing large businesses and top CEOs, including the US Chamber of Commerce and the Business Roundtable, have opposed Biden's Build Back Better (BBB) package.

Youngkin campaign pushes election fraud claims: "I know how Democrats are cheating"

Tuesday, November 2, 2021

The race between Glenn Youngkin (R) and Terry McAuliffe (D) to be the next governor of Virginia is very close. Several recent polls show Youngkin ahead. When all the votes are counted Tuesday night,

You Might Also Like

⚡️ The Most Exciting Game Releases Of 2025

Wednesday, January 8, 2025

Plus: Sony gets adaptation-happy with two new movie announcements. Inverse Daily As 2025 kicks off, we're already looking forward to a year packed with anticipated game releases. Here are the most

The Beauty Staples We’re Bringing Into 2025

Wednesday, January 8, 2025

Our beloved (but somewhat boring) can't-live-withouts. The Strategist Beauty Brief January 08, 2025 Every product is independently selected by editors. If you buy something through our links, New

On Priesthoods

Wednesday, January 8, 2025

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

☕ City of mobility

Wednesday, January 8, 2025

Toyota debuts Woven City. January 08, 2025 View Online | Sign Up Tech Brew Presented By Attio It's Wednesday. Tech Brew's Jordyn Grzelewski, who's on the ground in Las Vegas at CES 2025,

The danger of Meta’s big fact-checking changes

Wednesday, January 8, 2025

Plus: The TikTok case heads to the Supreme Court, the first human fatality from bird flu, and more. January 8, 2025 View in browser Li Zhou is a politics reporter at Vox where she covers Congress and

Trump Report Blocked, Surfing Bats, and the Misogi Challenge

Wednesday, January 8, 2025

A federal judge temporarily blocked the release of special counsel Jack Smith's report on investigations into President-elect Donald Trump on Tuesday. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Meta goes MAGA

Wednesday, January 8, 2025

On Tuesday morning, Meta CEO Mark Zuckerberg announced changes to how the company will handle content moderation across Facebook, Instagram, and Threads. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Numlock News: January 8, 2025 • Nuns, Mars, Monopoly

Wednesday, January 8, 2025

By Walt Hickey ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

☕️ The big switch

Wednesday, January 8, 2025

Meta ends fact-checking... January 08, 2025 View Online | Sign Up | Shop Morning Brew Presented By Bland.AI Good morning. At a press conference yesterday, President-elect Trump pledged, with a degree

DEF CON's hacker-in-chief faces fortune in medical bills after paralyzing neck injury [Wed Jan 8 2025]

Wednesday, January 8, 2025

Hi The Register Subscriber | Log in The Register Daily Headlines 8 January 2025 ambulance_speeding DEF CON's hacker-in-chief faces fortune in medical bills after paralyzing neck injury Marc Rogers