Block Breakdown - The safest stablecoin yield?

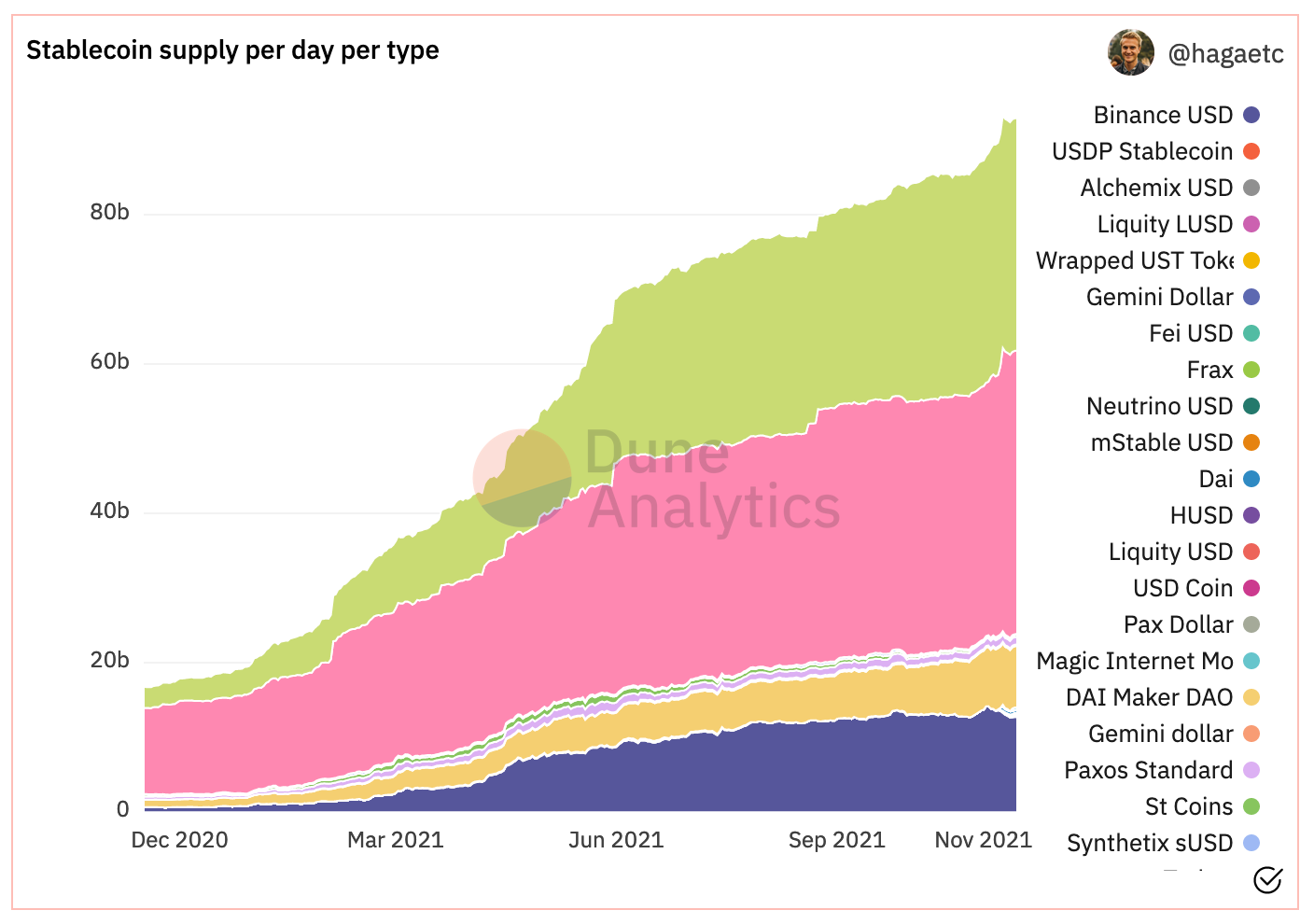

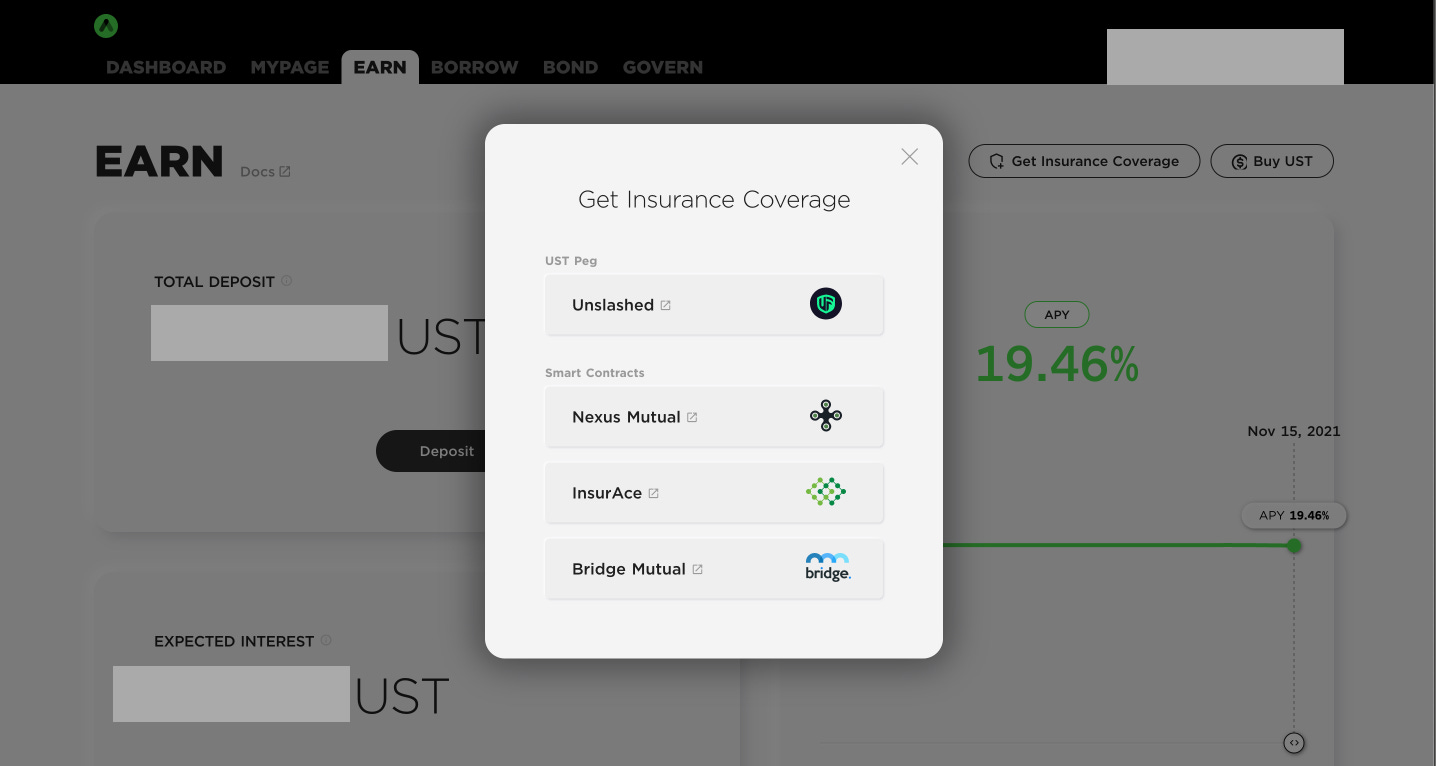

Hi friends 👋 Stablecoins - coins that attempt to maintain a peg 1:1 to the dollar - have been growing exponentially this year and are approaching $100bn in total supply. It is a strange reality that an industry that began to escape inflationary fiat currencies has come to rely so heavily on their crypto shadow. And yet, with many cryptocurrencies being extremely volitile, when markets plunge traders head to stablecoins. Not all stablecoins are created equal however, and in particular there is a lot of concern that Tether, long rumoured to be not all it claimed to be, could be the cause of the next financial crash. I feel like at the moment much of crypto has its fingers in its ears with regards to Tether, given there are around $70Bn of USDT in existence, a number that keeps on growing. I shudder to think about what a bank run on Tether would look like. Anyway, that's not the subject of this post, I want to talk about stablecoin yield. Today I want to talk about UST (not to be confused with USDT), which is part of the Terra blockchain ecosystem. It's an algorithmic stablecoin, which means that it relies on algorithms to maintain its peg, and is not backed by assets. Algorithmic stablecoins are quite new, and haven't always worked perfectly, as you can see from this chart.... This does create some risk of using UST, but don't give up on it quite yet because we are going to address this peg risk later on. For now, let's see how we can get some UST. First you need the Terra Station wallet, either on desktop or mobile. You can then go to a number of different exchanges to buy UST. Ok, you have some UST, now let's put it to use. On Terra, there is a protocol called Anchor Protocol that offers a cool ~19% APY, not bad for holding a stablecoin. Assuming it is stable. Well, let's not assume, let's buy some insurance. Yes that's right you can buy insurance against UST losing value against USD. Oh and you can get insurance against smart contract risk, so if Anchor gets hacked, you are also insured. I think these are probably the two main risks, and we can eliminate them with insurance. There are several providers, and they are one click away through Anchor. I chose Unslashed, because it can give both smart contract and peg insurance in one click. Note that you have to buy insurance in ETH, whereas your UST is on Terra. I clarified with the Unslashed team that in the event of a claim, basically you just have to sign a message on both wallets to prove they are both yours. Getting covered for both will cost you about 4% per year. Once you pay for the insurance, it will therefore reduce your total yield down to about 15%, still substantially better than the 0.01% you get in your bank account. So with smart contract and peg risk covered, I think this is probably the highest and safest yield around. You now have a high yield, insured, savings account. 🥳 Let me know if you know of any better opportunities. Until next time. Jamie Get UST and stake it on Anchor Protocol: If you enjoy Block Breakdown, access subscriber only benefits for $5 per month, or $50 per year. This is the introductory price, and it will increase in future, but if you subscribe now you will always stay at this lower price. 🚨 Disclaimer: This is not investment advice. Everything in this newsletter is for entertainment and education purposes only. Do your own research. Think for yourself. Any financial interests the Block Breakdown team has in any project mentioned will be clearly highlighted. If you enjoy Block Breakdown, consider becoming a full subscriber for $5 per month, or $50 per year. This is the introductory price, and it will increase in future, but if you subscribe now you will always stay at this lower price. |

Older messages

Why you should try Arbitrum and Optimism

Monday, October 18, 2021

Hi friends 👋 You have probably noticed that doing stuff on Ethereum can be very expensive at the moment... And this is pricing out many people that don't understand why they should spend $$$ just

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏