Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #264

Aloha 🍹 from the Lobby: Enterprise conference where I had the chance to hang out with a great group of enterprise founders and investors and have some fascinating discussions on the state of investing, building and scaling, and what’s next in enterprise. While we dove deep into the state of dev tools, cybersecurity, and enterprise/web3, one of the huge topics that came up repeatedly was around valuations, size of funding rounds, and the impact it can have for both investors and founders. A lot of this discussion reminded me of what Fred Wilson posted earlier this week on why entry price matters for seed funds.

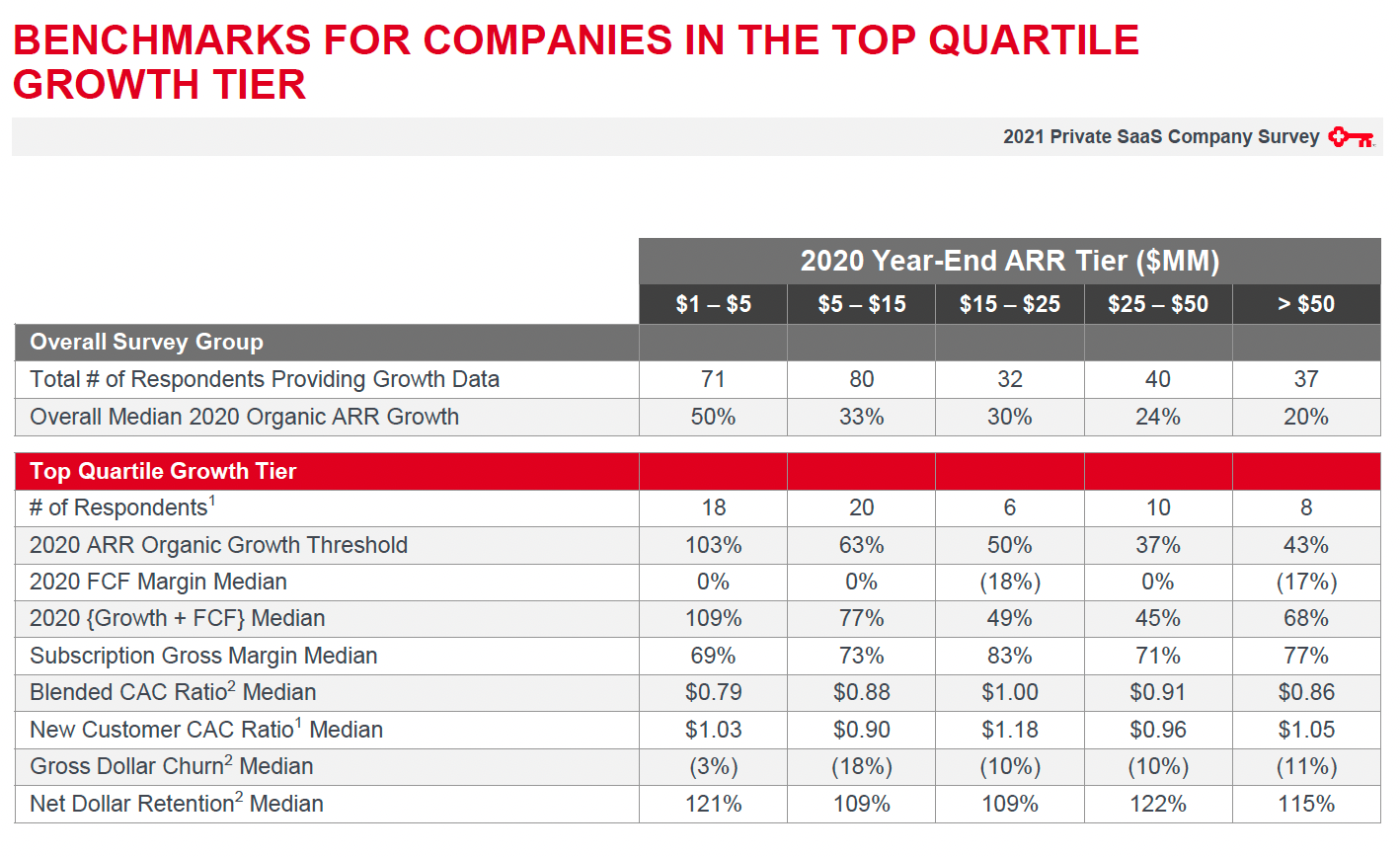

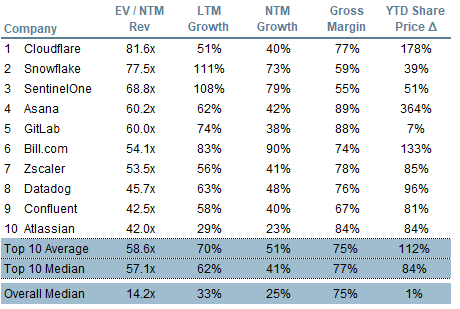

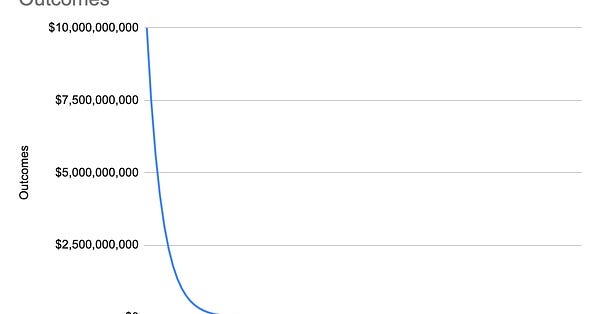

And here’s some historical context on that $100B outcome…   Unlikely - so this will be an interesting next year as more 💰 pours into every stage and VCs need to think through entry price and founders need to think through the impact of raising too quickly at too high a price. What this comes down to is having shared expectations and alignment around the true state of the business and how long it may take to actually scale. Without that, bad things can happen…  And with deals closing so fast, founders and investors rarely have a chance to really get to know one another due to timing, and unless they’ve had a long standing relationship prior, both sides are taking a huge leap of faith on the personal dynamics and fit. This post from Anu further highlights that:  Allison Braund-Harris @HardlyAllison Choose your board wisely: “Board of Directors, on average, last longer than marriages in the US” - @anuhariharan at @ycombinator. https://t.co/FryWeFAUD1While this is great for the companies crushing it, for those in the middle or who are taking a little longer to ripen, I do worry about the possibility of abandonment from their investor or other problems arising. It will surely be an interesting 2022 as I believe more 💰 will continue pouring into enterprise startups, and we may see some of the first signs of companies that raised at too high a price get stuck for their next round.  As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups

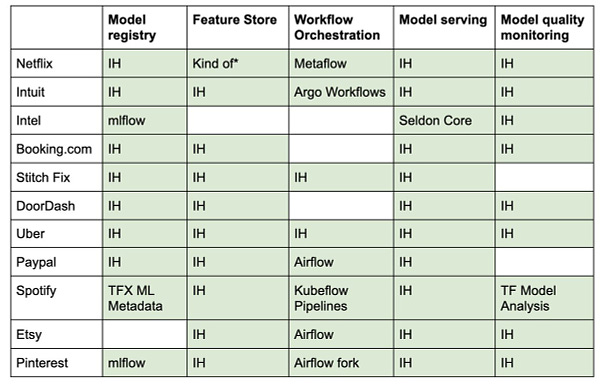

Enterprise Tech

Markets

If you liked this post from What's Hot in Enterprise IT/VC, why not share it? |

Older messages

What's 🔥 in Enterprise IT/VC #263

Saturday, November 13, 2021

Going down the crypto 🐰 hole...

What's 🔥 in Enterprise IT/VC #262

Saturday, November 6, 2021

Breaking down HashiCorp's S-1 + playbook for building a massive OSS company + The 🐮 Case for Cloud Native and Infra

What's 🔥 in Enterprise IT/VC #261

Saturday, October 30, 2021

🤯 ☁️ + 73M developers on Github with 84% of Fortune 500 using

What's 🔥 in Enterprise IT/VC #260

Saturday, October 23, 2021

🙏🏼 5 years of What's 🔥!!! IT Spending 💰 forecasted to grow 📈 at fastest rate in over 10 years!

What's 🔥 in Enterprise IT/VC #259

Saturday, October 16, 2021

GitLab 😲 and the importance of doing things your own way

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏