“Tokenomics” has become a popular term in the last few years to describe the math and incentives governing crypto assets. It includes everything about the mechanics of how the asset works, as well as the psychological or behavioral forces that could affect its value long term.

Projects with well-designed tokenomics are much more likely to succeed in the long term because they’ve done a good job of incentivizing buying and holding their token.

Projects with poor tokenomics are doomed to failure, as people rapidly sell the tokens at the first sign of trouble.

If you’re considering whether or not to buy a crypto asset, understanding the tokenomics is one of the most useful first steps you can take to make a good decision.

So as someone who’s been writing about DeFi for nearly a year now, and who designed the tokenomics for a popular crypto videogame, here’s what I look at when I’m evaluating the tokenomics of a new project.

It All Comes Down to Supply and Demand

As in normal economics, the two forces we are most interested in are Supply and Demand. Understanding how those are baked into the tokenomics give us a good sense of how desirable a given token or cryptocurrency should be.

Supply: Emissions, Inflation, and Distribution

Let’s start on the supply side since it’s a little easier to understand. The main thing you’re trying to figure out is:

Based on supply alone, should I expect this token to hold or increase its value? Or will that value be inflated away?

On the supply side, a token will increase in value if fewer of those tokens exist—we call that deflation. A token will decrease in value if more of them exist—that’s inflation. When you’re evaluating the supply side you don’t have to worry about things like whether the token has any utility, or whether it will generate income for its holders. You’re really just thinking about the supply and how it will change over time.

The questions you want to ask are:

- How many of these tokens exist right now?

- How many will ever exist?

- How quickly are new ones being released?

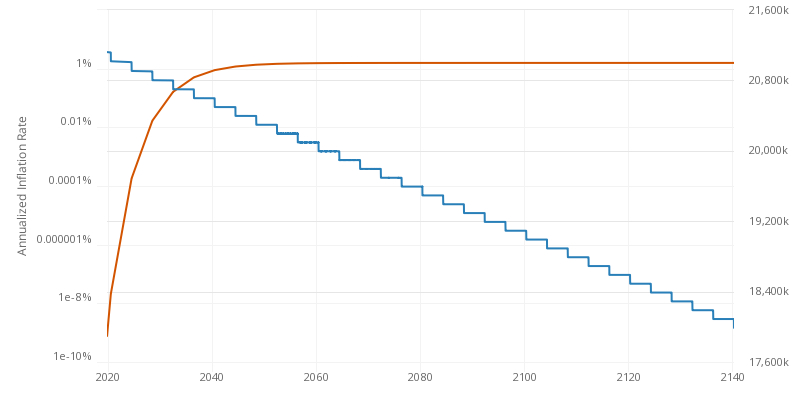

Bitcoin was created with a simple supply curve that is emitted over about 140 years.

There will only ever be 21,000,000 bitcoin, and they’re released at a rate that gets cut in half every four years or so. Roughly 19,000,000 already exist, so there are only 2,000,000 more to be released over the next 120 years.

That means 90% of the supply is already in circulation, and here will only be 10.5% more bitcoin 100 years from now, so you shouldn’t expect any serious inflationary pressure bringing down the value of the coin.

What about Ethereum? The circulating supply is around 118,000,000, and there’s no cap on how many Ether can exist. But Ethereum’s net emissions were recently adjusted via a burn mechanism so that it would reach a stable supply, or potentially even be deflationary, resulting in somewhere between 100-120m tokens total. Given that, we shouldn’t expect much inflationary pressure on Ether either. It could even be deflationary.

Dogecoin has no supply cap either, and it is currently inflating at around 5% per year. So of the three, we should expect inflationary tokenomics to erode the value of Doge more than Bitcoin or Ethereum.

The last thing you want to consider with supply is allocation. Do a few investors hold a ton of the tokens which are going to be unlocked soon? Did the protocol give most of its tokens to the community? How fair does the distribution seem? If a bunch of investors have 25% of the supply and those tokens will unlock in a month, you might hesitate before buying in.

What about some DeFi tokens? Yearn, one of the first DeFi protocols I wrote about, has a fixed supply of 36,666 YFI. There are no emissions and no inflation, so you shouldn’t expect the value of 1 YFI to decrease from inflationary pressure.

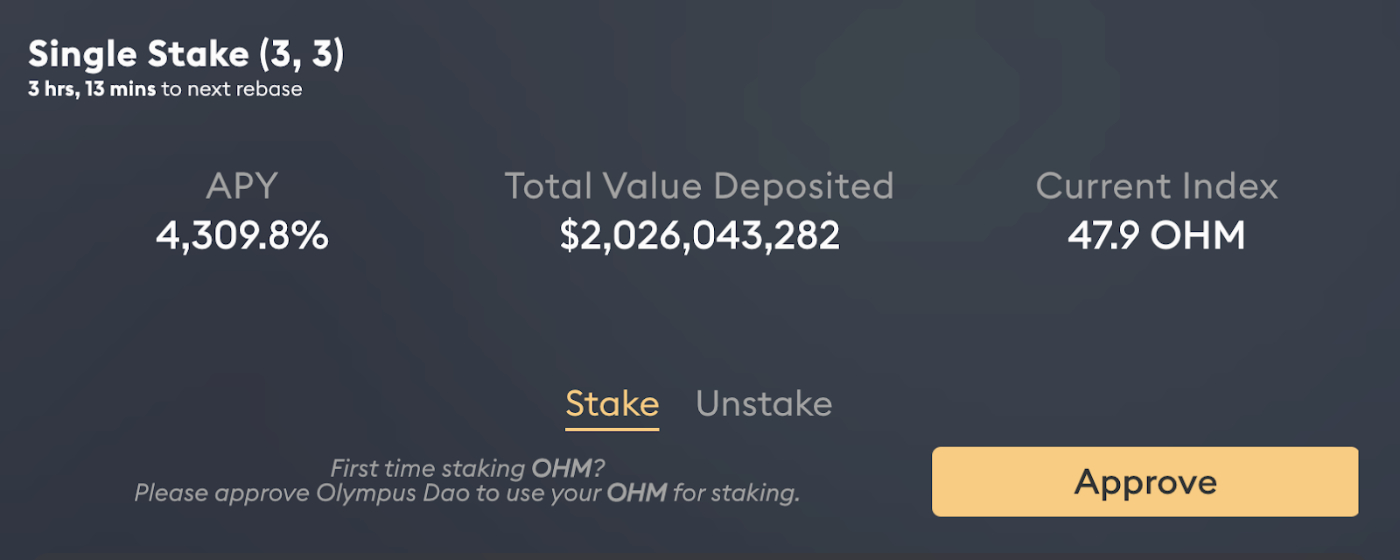

Meanwhile, Olympus, a protocol I wrote about more recently, has an insanely inflationary printing schedule with huge amounts of new OHM tokens being printed every day. So theoretically you should expect holding OHM to be a bad bet. But as we’ll see shortly, Supply alone is not enough to understand whether holding a token is worthwhile.

Those are the main considerations for Supply. Now demand is where things get more interesting.

Demand: ROI, Memes, and Game Theory

I could go into my backyard, break a few rocks, and then say they’re the only rocks I’m ever going to break and put up for sale. I have a fixed supply of 10 rocks. 0 inflation rate. So they should be worth millions, right?

Well, no, because no one wants my broken rocks.

At this simple level, there’s nothing inherently different between my rocks and Bitcoin. Having a fixed supply alone does not make something valuable. People also need to believe it has value, and that it will have value in the future.

If you want to know whether a token will have demand-side value in the future, you’ll want to look at return on investment (ROI), memes, and game theory. Let’s start with ROI since it’s the easiest.

Return on Investment

ROI in this case is not how much you think the token price will go up. It’s how much income or cash flow the token is able to generate for you simply by holding it.

For example, if you hold Ether you can stake it to help secure the network once Proof of Stake launches. In return for Staking your ETH, you get paid in more ETH, at a rate of about 5%.

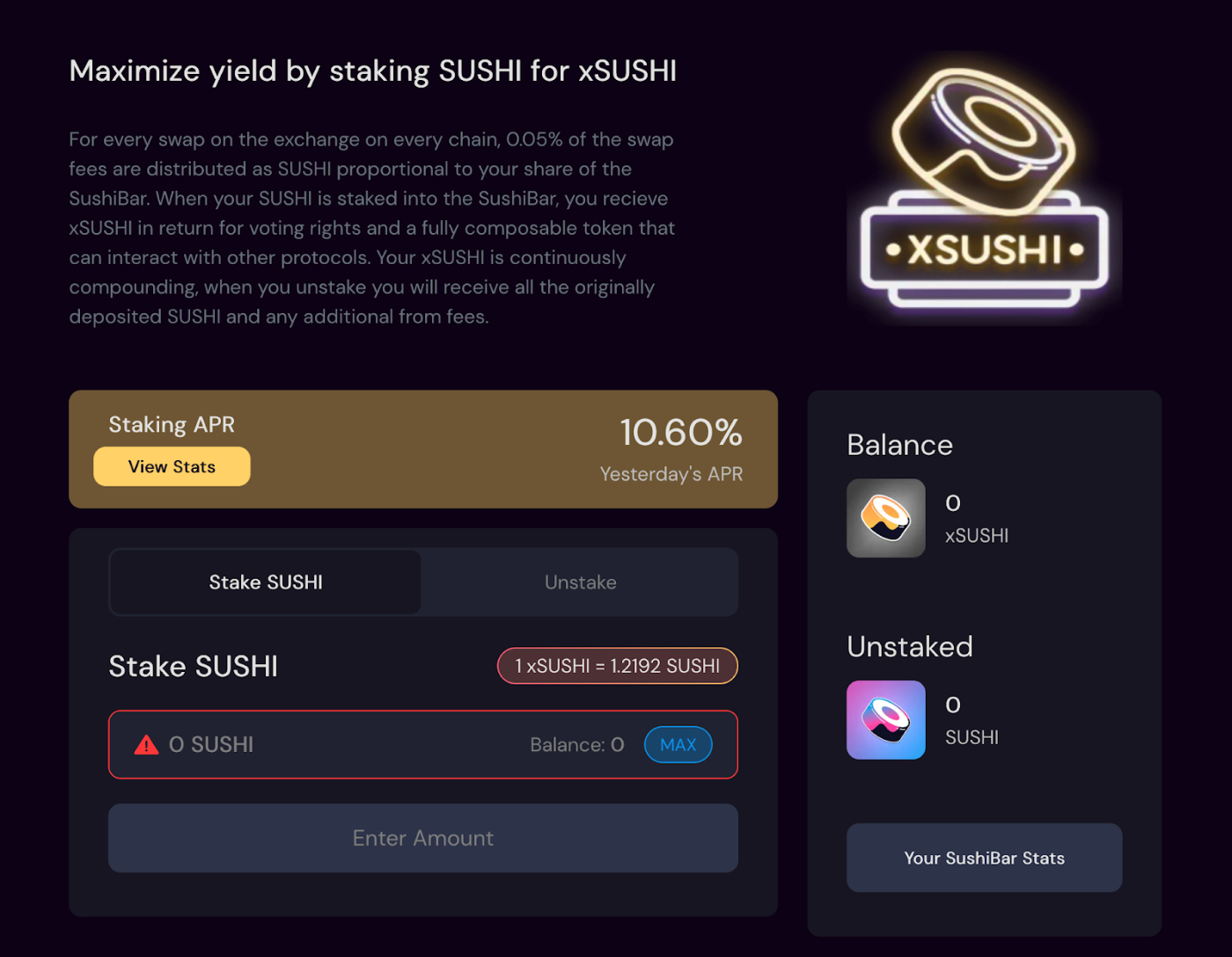

Some tokens allow you to tap into the earnings of the protocol they represent. If you hold SUSHI, you can stake it to earn a share of the Sushi protocol revenues, currently for about a 10.5% APR.

Another form of ROI comes from “rebasing,” similar to a stock split where by holding a token and staking it, you continue to get more of that token as the protocol inflates its supply. This is how Olympus works and is why their heavy inflation rate is not necessarily a bad thing since you can retain the share of the protocol that you own.

ROI is important to consider because if a token has no intrinsic ROI or cashflows, then it’s harder to justify holding it. You have to believe other people’s belief in the number going up is enough to sustain it.

Or, you have to believe the memes.

Memes

The other reason people might want a token is simply the belief that other people want the token, and will want it in the future.

You can call it faith, conviction, or memes, but, whatever you call it, the machine that generates belief in the growth of future value is always going to be an important consideration.

How do you evaluate this though? Everything else in the tokenomics has been pretty measurable, but memes? This is one that requires you to hop into the community and get a feel for it.

What’s the energy like in their Discord? How active are they on Twitter? Do people make this token or protocol part of their identity? How long have people been active in the community?

Belief in future value is often one of the most powerful drivers of demand. Bitcoin has no cash flow, no staking rewards, nothing. It just has the belief that it could be a long term store of value to rival gold. Or more ambitious beliefs like definancialization and hyper-bitcoinization. But it’s all beliefs at the end of the day.

So while it’s tempting to be purely analytical, don’t discount how far a token can get with faith, clever memes, and a cult-like following.

There’s a third element here to demand which can combine parts of memes and parts of ROI. Let’s call it Game Theory.

Game Theory

Game Theory asks you to consider what additional elements in the tokenomics design might help increase the demand for the token. This is where tokenomics can get particularly complex, and is the main area I’ll focus on in the followup “102” version of this post.

But one common version of good tokenomic game theory is lockups. The protocol creates an incentive for locking your tokens in a contract, usually in the form of greater rewards.

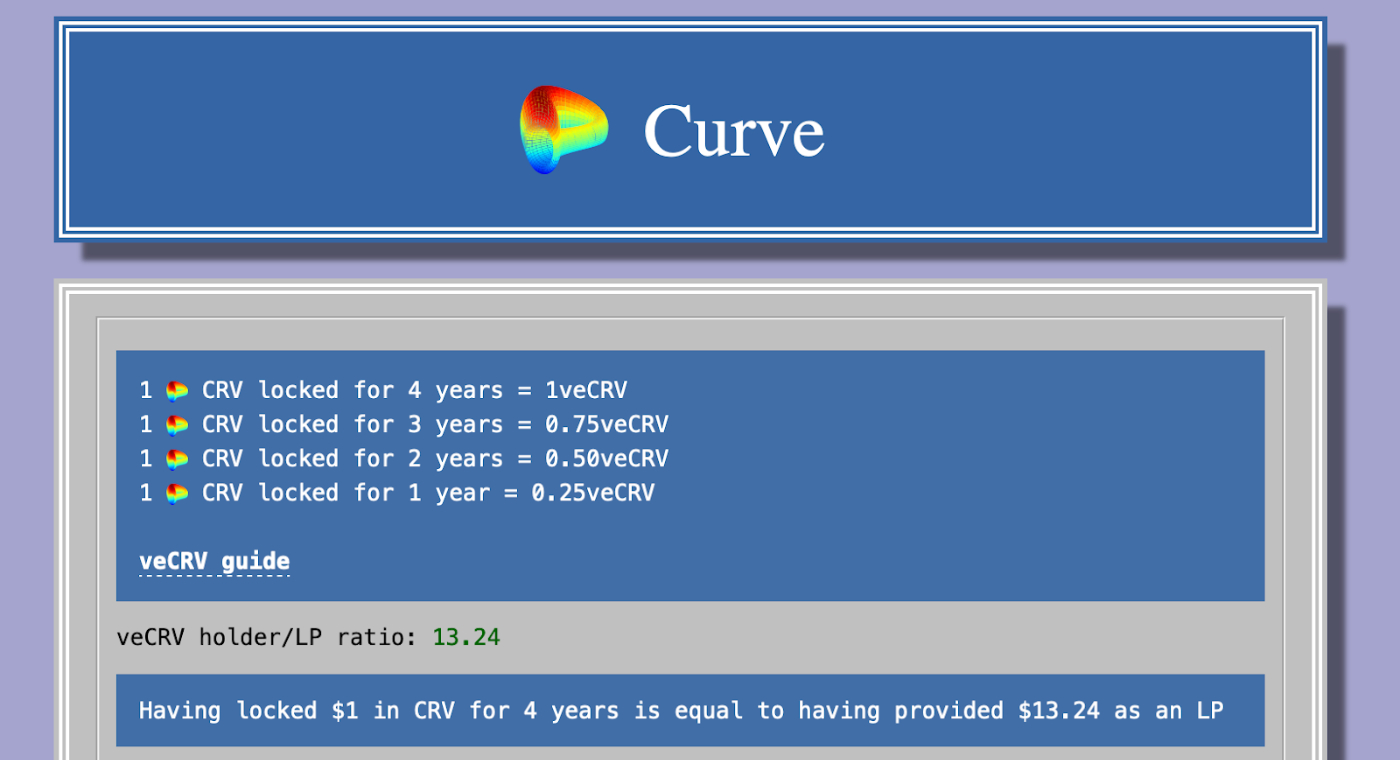

The classic example of this is Curve.

Similar to Sushi, you can lock your CRV tokens to earn a share of the protocol revenue. But the longer you lock your tokens for, up to 4 years, the greater your rewards.

In addition, the more tokens you have locked and the longer you have them locked for, the lower your fees when you use all the other parts of Curve.

So Curve has exceptionally strong incentives and game theory around holding its token. You can earn a decent ROI from staking it, and you can earn a higher ROI from all other parts of the app. And you earn the most by locking up your tokens for four years, which dramatically reduces the incentives to sell CRV.

Tokenomics in Practice: Evaluating a Project

Now that you know the main questions to ask, let’s go through the process of evaluating a project.

We’ll start with one of my favorites: Convex Finance.

Convex Finance

Convex is a platform that sits on top of Curve (above) and helps you earn a higher yield by aggregating many investors together. It lets you earn most of the higher yield you would get on Curve if you had locked up thousands of CRV tokens for 4 years, without having to do the locking yourself.

By hopping into their docs, we can start to answer the questions I laid out in this article.

Supply

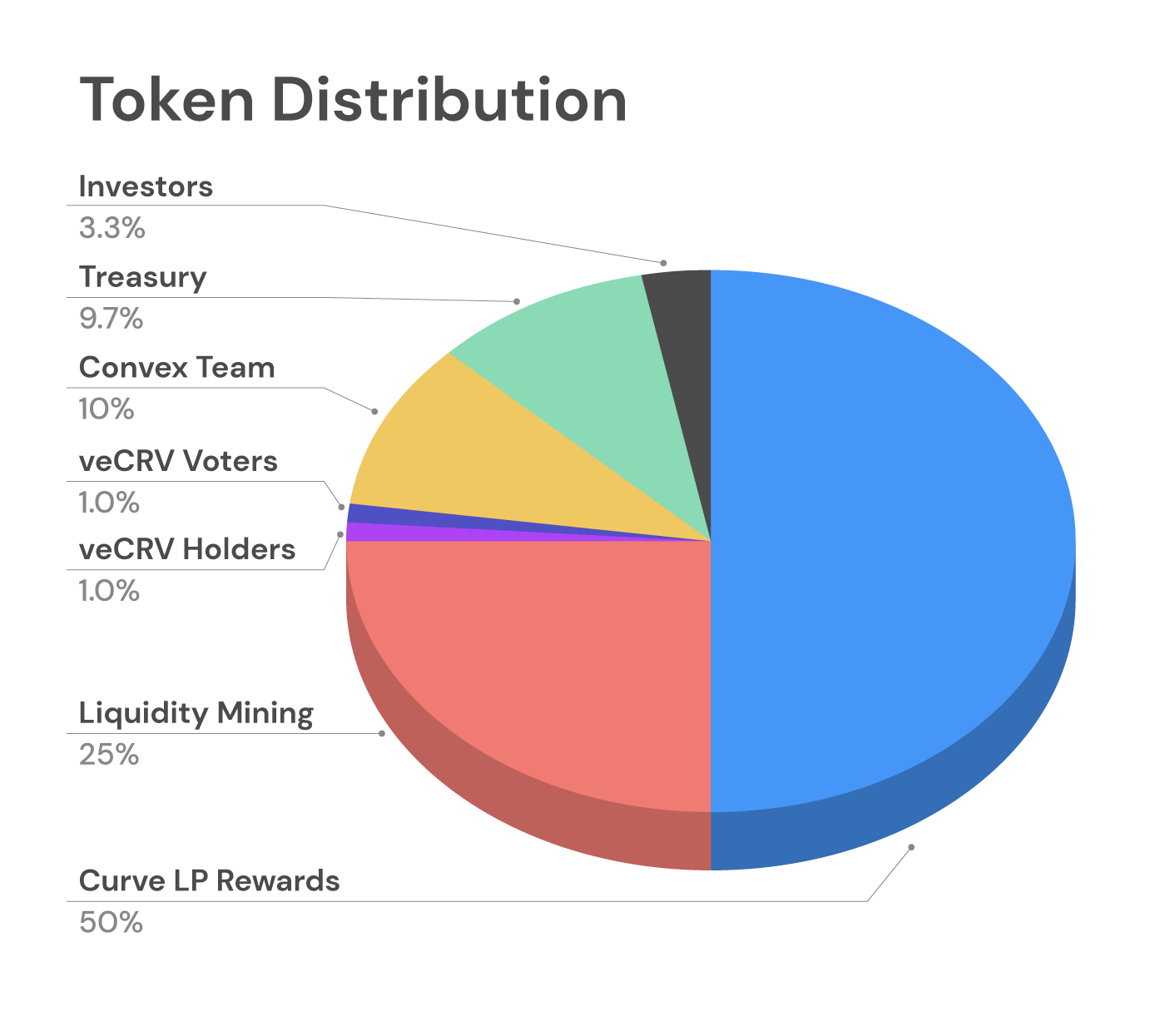

Convex has a fixed max supply of 100m which will be released overtime at a decreasing rate, depending on CRV deposits.

According to Coingecko, 78.5m of those 100m have already been created, meaning the current supply will inflate by another ~33%.

Of those tokens, the vast majority are going to the people using Convex. So this is a very fair token distribution, only a comparatively small amount is being retained for the team and investors. For comparison, imagine if Amazon gave away 75% of its stock to people who used Amazon:

So there’s a fixed supply, the remaining supply is being released at a decreasing rate, most of the tokens are going to the community, and there’s a max 33% dilution from here. Things look pretty good on the supply side.

What about demand?

Demand

To evaluate demand you need to ask: why would you hold the CVX token?

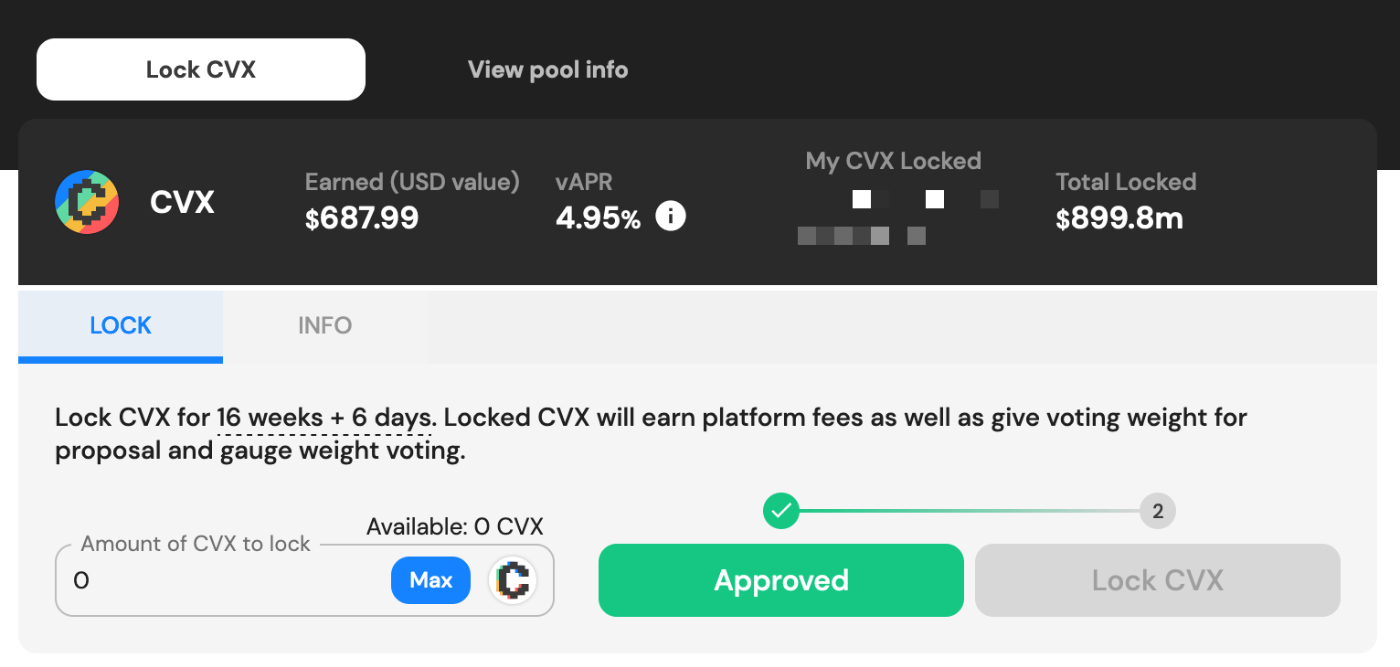

By holding the CVX token, you get a share of all Convex Finance revenue. That’s not a huge amount, but it earns about 4% right now:

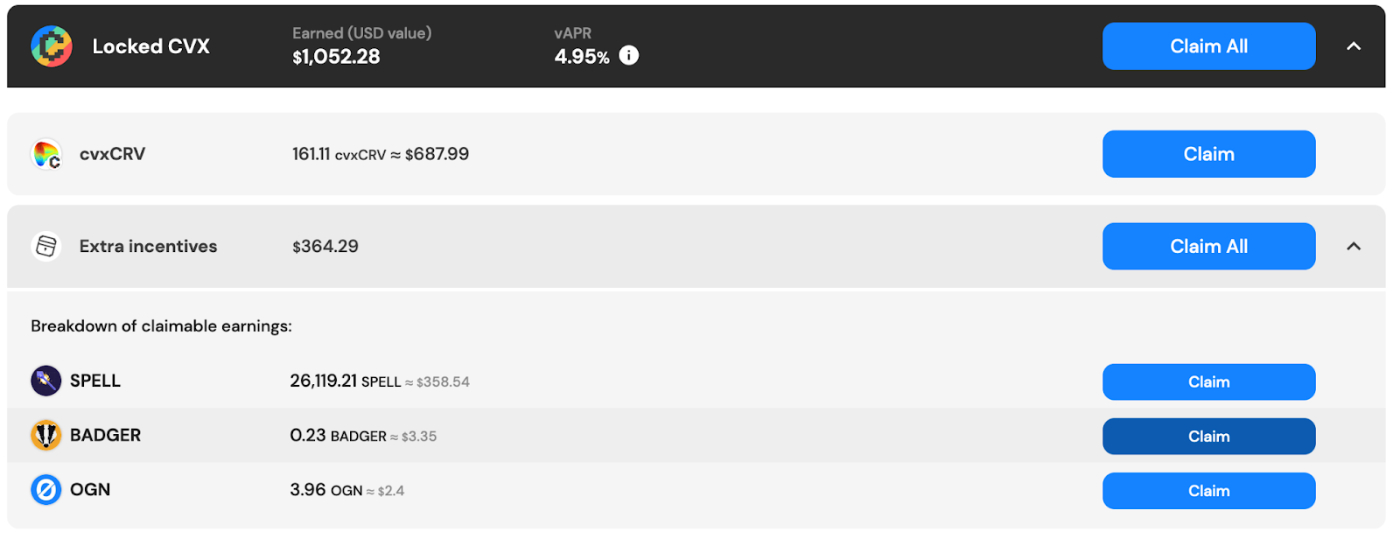

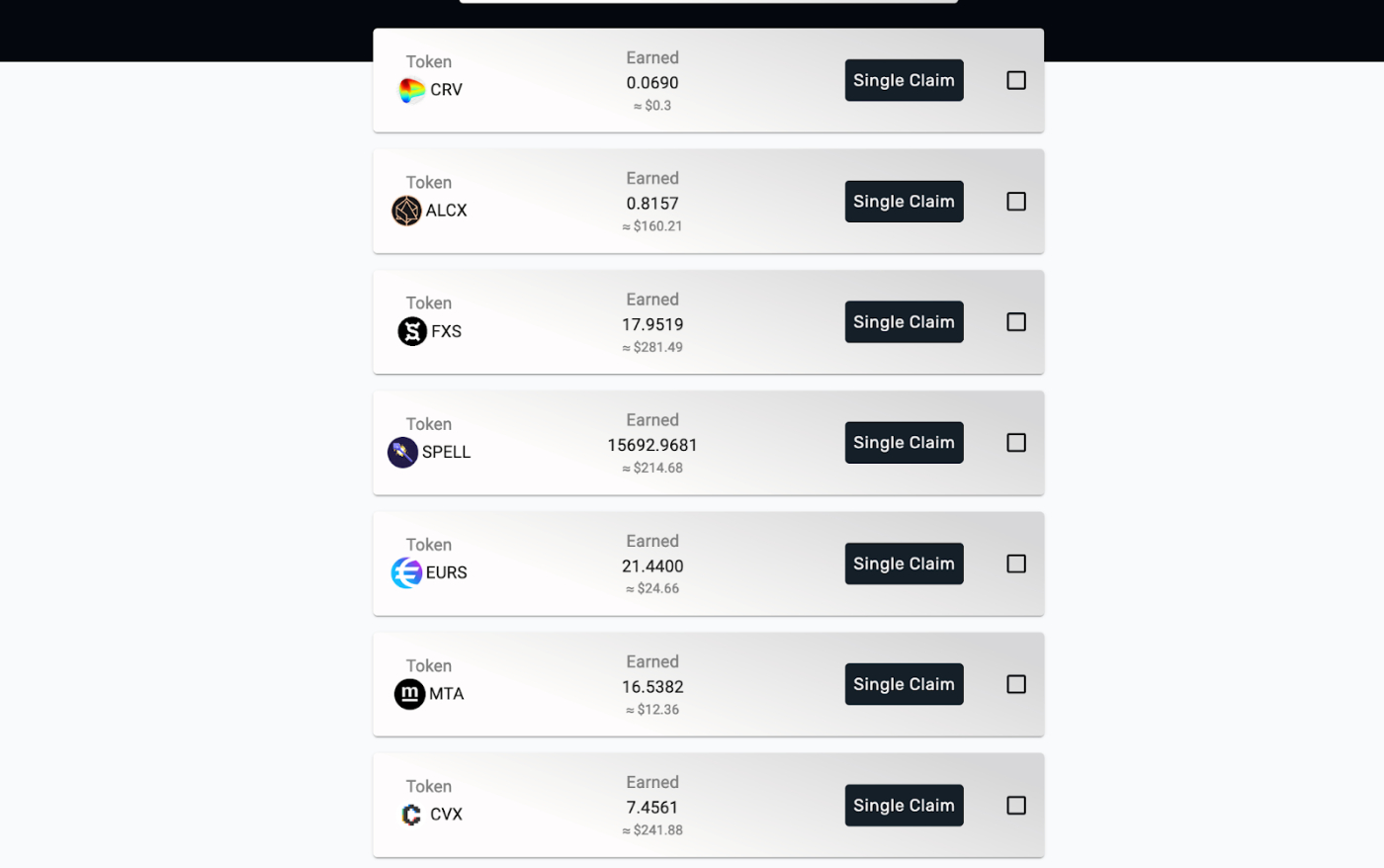

That’s not all, though. You can also lock your CVX tokens for 16 weeks at a time, and when you do so, you get bonus rewards from various protocols who want to reward Convex stakers:

Here the APR is still just 5%, but that’s not including the bonus rewards you get from other platforms:

And on top of that, you can delegate your Convex to other voters, in return for “bribes” using the service Votium.

So there is a pretty significant ROI on staking your CVX tokens, even if the value doesn’t change at all. And it has very strong game theory supporting holding the token, since you only earn these rewards if you lock your tokens for 16 weeks at a time.

The memes aren’t as strong since it’s a somewhat boring back-office DeFi protocol. But they don’t need to be. It’s a cash flow machine.

So Convex has a fixed supply, which is mostly allocated to the community. Most of the tokens are in circulation, and there won’t be much more inflation. Holding CVX is heavily rewarded via protocol fees and other rewards to token holders, so there’s less reason to sell if the price dumps.

To me, this is one of the better tokenomics designs out there, and a fantastic example of a well designed project. All the pieces come together to design a robust financial incentive system that doesn’t rely on faith to prop up the value.

Evaluating on Your Own

This should give you a good initial foundation to evaluate any new project you come across. By reading the docs or whitepaper, you should get a good sense of how the supply is going to be managed, and what forces will drive demand for the token or cryptocurrency.

And the question to keep in the back of your mind isn’t necessarily “will this appreciate against the dollar?” but “Will this appreciate against (BTC, ETH, SOL, whatever you prefer)”. Most crypto assets are highly correlated and move together, and if you’re holding anything besides the big foundational coins, it should be based on some belief that its tokenomics and incentives will result in it outperforming the base currencies it's built on.

In the next part of this series on Tokenomics, I'll get more into the various Game Theory strategies protocols employ to drive demand for their tokens.