🚀 E-comm roll-ups: 2021's hottest trend?

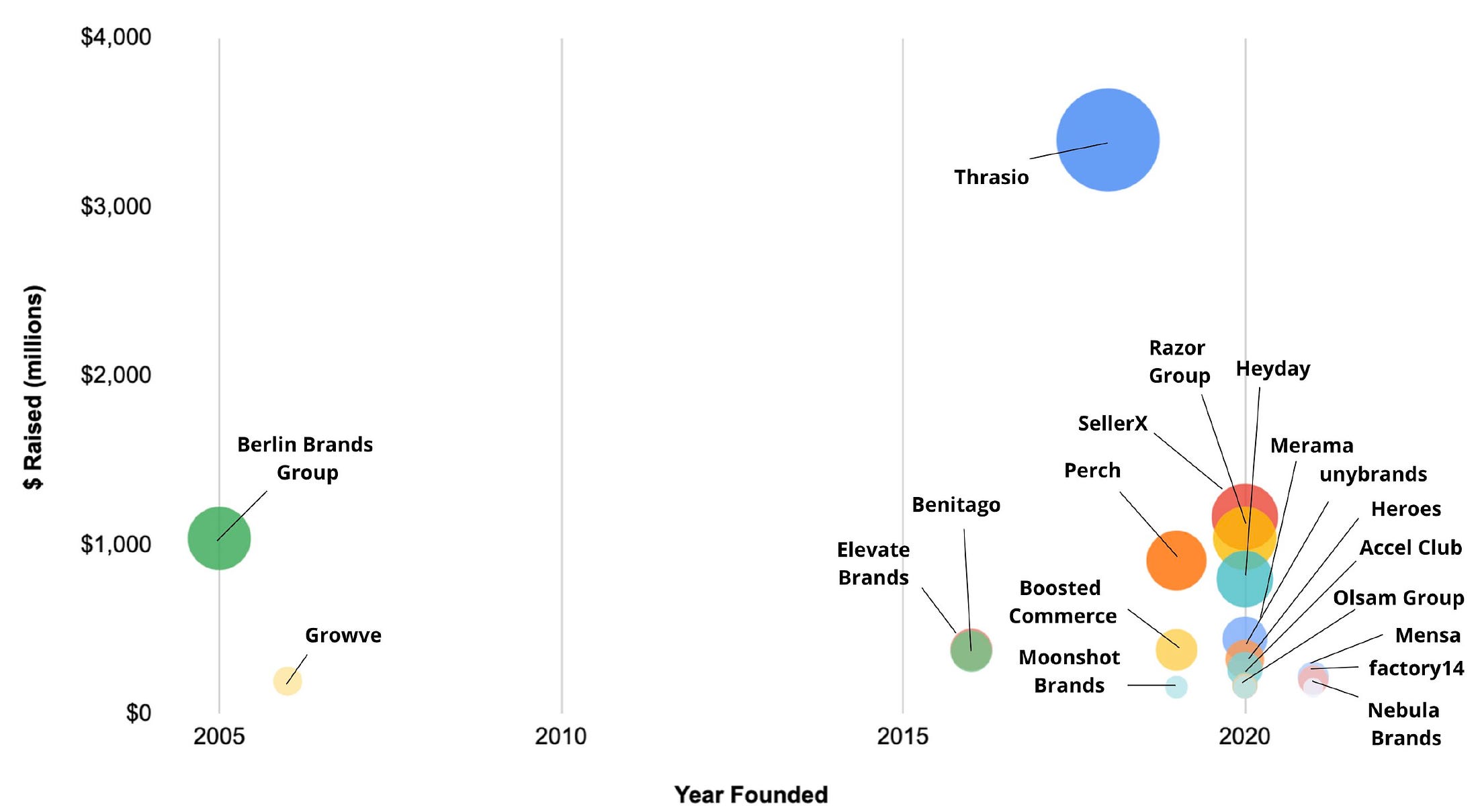

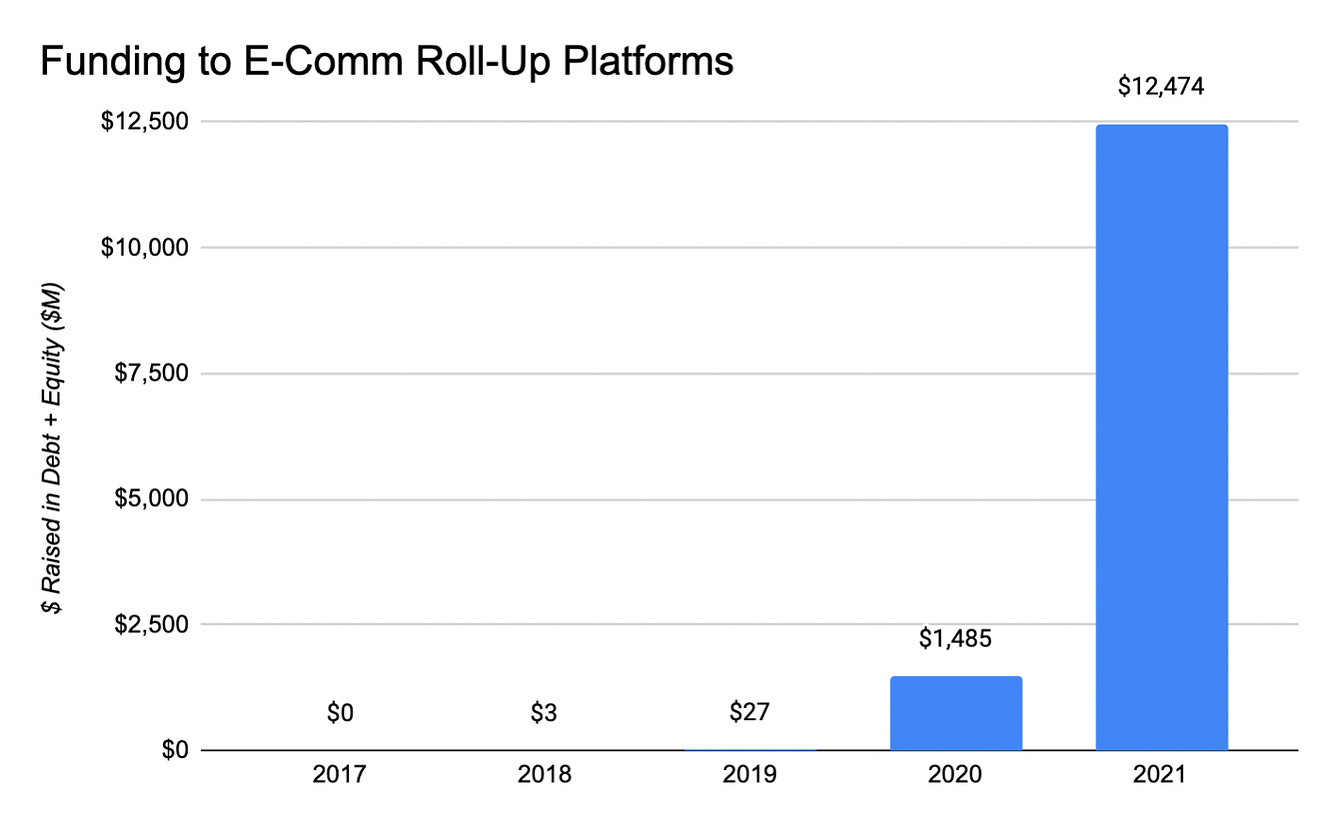

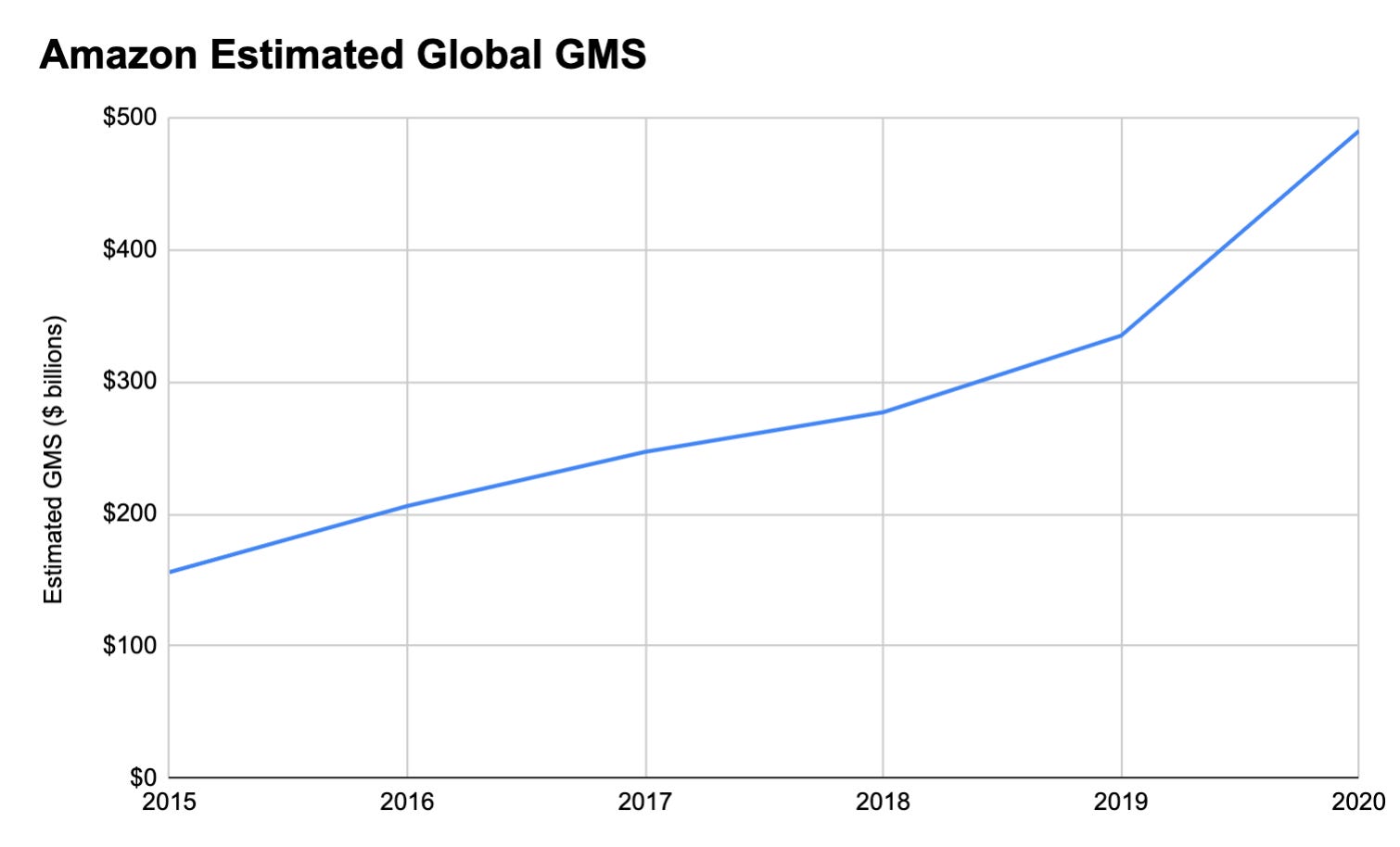

Welcome to the second week of holiday posts! As a reminder - given there’s less news this time of year, I’m covering trends from 2021 and things I hope to see next year. Last week, I shared five things that I got wrong this year. This week, I thought it would be fun to dive into one specific category: e-comm rollups. I'll share my thoughts on how they work, why they've attracted so much VC interest, and where the key opportunities + risks are. Overview & fundingIf I had to guess which space raised the most VC $ this year (other than crypto!), I’d pick e-comm roll-ups. Almost every week, we saw massive rounds get announced - Thrasio’s $1B Series D, Perch’s $775M Series A, and Elevate’s $250M Series B are just a few examples. To quantify funding in this space, I identified 65 e-comm roll-up platforms worldwide. Using Pitchbook + Crunchbase, I found funding for 46 - they raised a total of $12.5B (equity and debt) this year. These same companies only raised $1.5B prior to 2021, so this year marked a meaningful increase. And it’s not just PE funds or growth investors providing this capital - early stage VC funds are getting into the game. Below is data from Pitchbook on the most active venture funds investing in e-comm roll-ups. What are these companies doing with all this cash? They’re buying e-commerce brands, most of which sell exclusively on Amazon and use Amazon’s fulfillment services (called FBA). These brands focus on (1) deciding what to sell, (2) designing and manufacturing products, and (3) optimizing their listings. Amazon packages and ships the orders, and even manages things like returns and customer service. NB: We’re starting to see e-comm roll-ups focused on brands operating on other marketplaces (e.g. eBay, Walmart) or that sell direct-to-consumer (primarily Shopify stores). But the majority of volume in this space is concentrated in Amazon brands. Many brands are run by individuals or small teams, who do an impressive job of growing them - sometimes to millions of revenue. But where do they go next? They have to choose between maintaining organic (but relatively slow) growth, raising $ to scale more quickly, or working with a broker to find a buyer (typically a long & painful process). E-comm roll-up companies offer another option: a quick & seamless sale. How does it work?Roll-up platforms are kind of like VC firms - they source deals (brands to acquire) through a number of channels, both inbound and outbound.

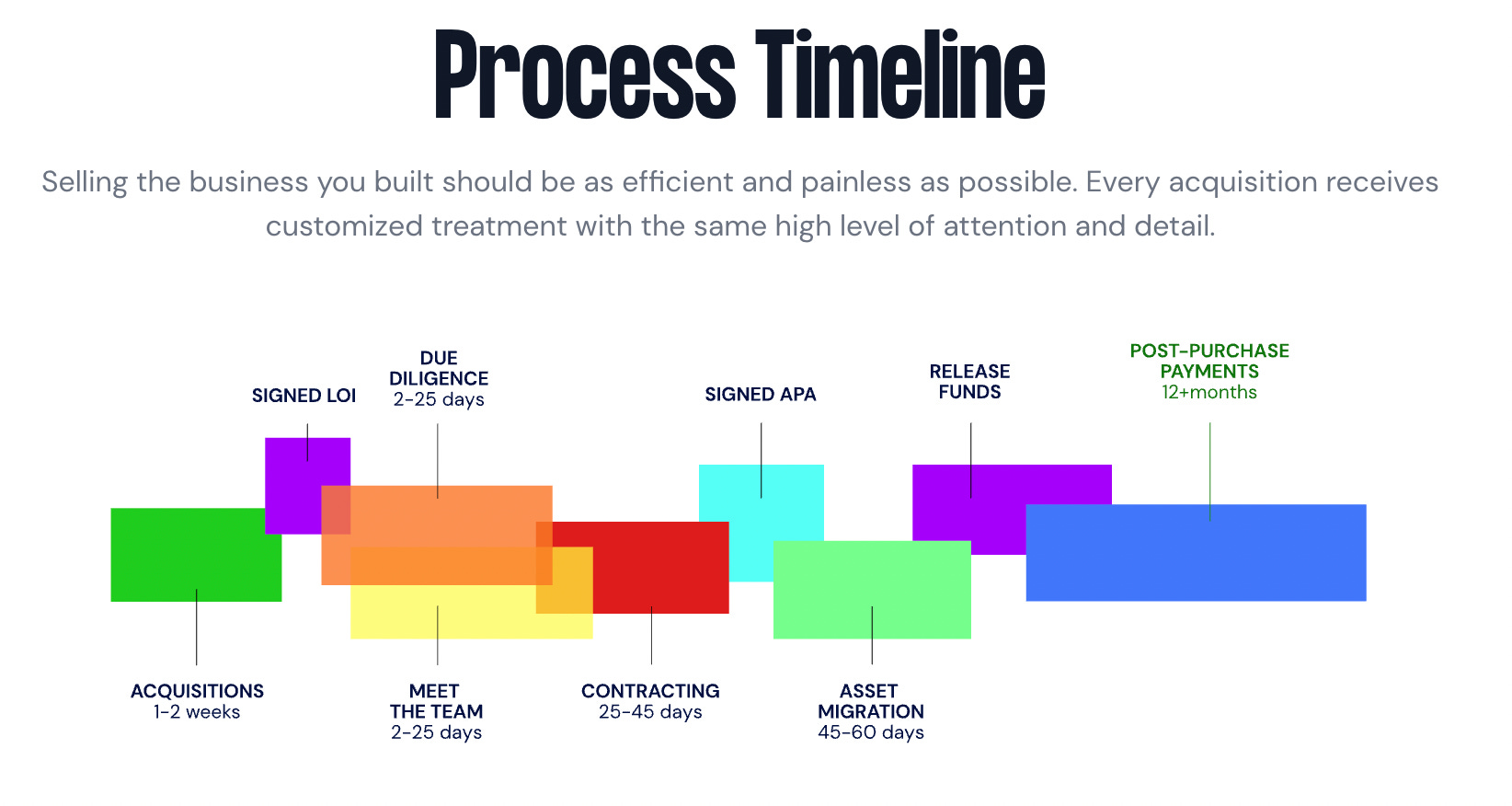

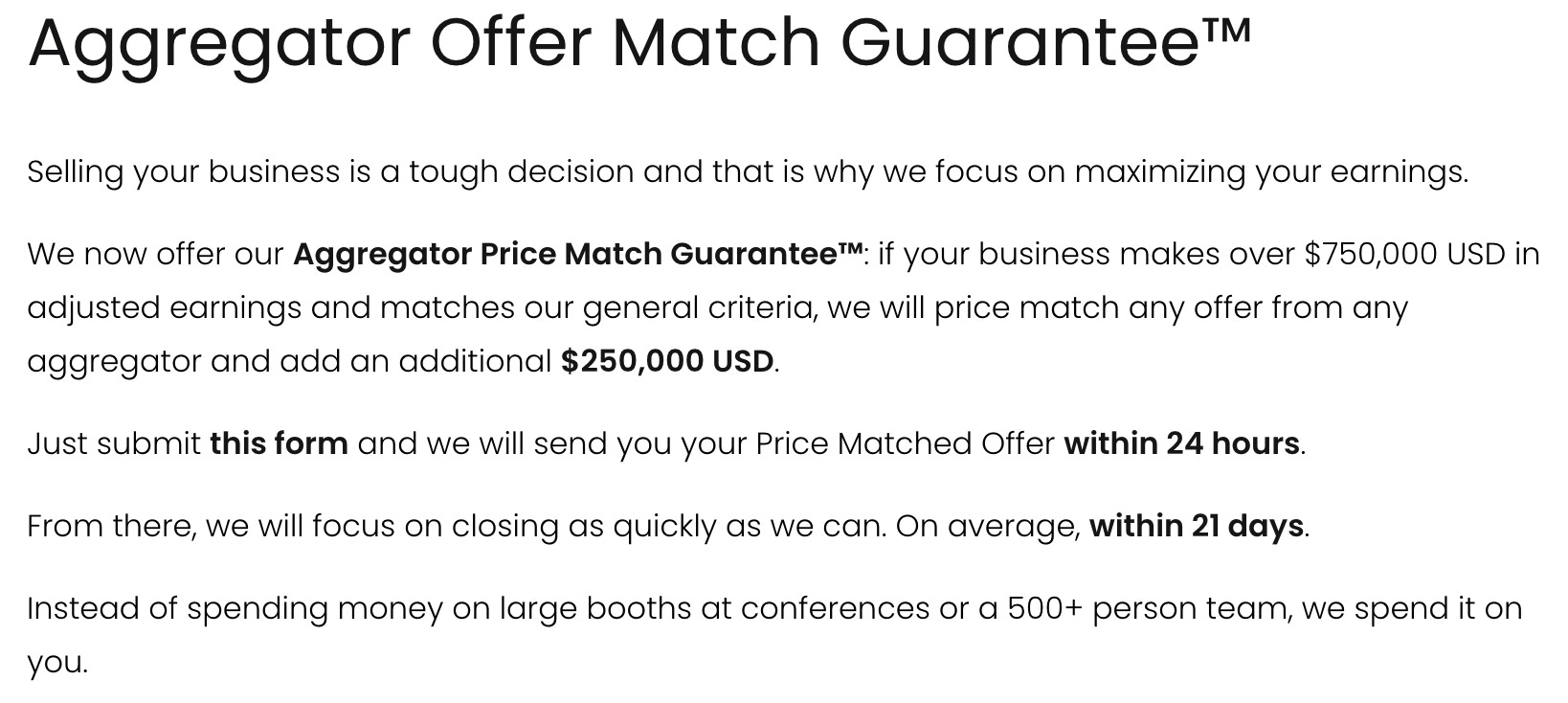

Once a brand is in the pipeline, diligence begins. This process varies by platform, but typically involves a deep dive into financial and operational data, meetings with the team, and vetting the product(s). Most platforms give brand operators an estimated valuation upfront - which allows them to make a more informed decision around proceeding with diligence (or not!). Roll-up platforms promise a quick and transparent process measured in days, not months. When they dive into a brand’s data, they’re primarily looking to validate the financials and identify any “black hat tactics” - like paying for positive reviews for your own products or negative reviews for a competitor’s products. After the platform and operator agree to a deal, the process of migrating the brand begins (Benitago has a guide on how this works). The seller also starts receiving payouts on a pre-arranged schedule. Some sellers receive the full value upfront, while others get portions over time - with the ability to earn more (or less) based on the brand’s performance. What do they look for in brands?Most platforms are looking to acquire brands with a strong foundation and potential for future growth. This usually manifests in a few characteristics:

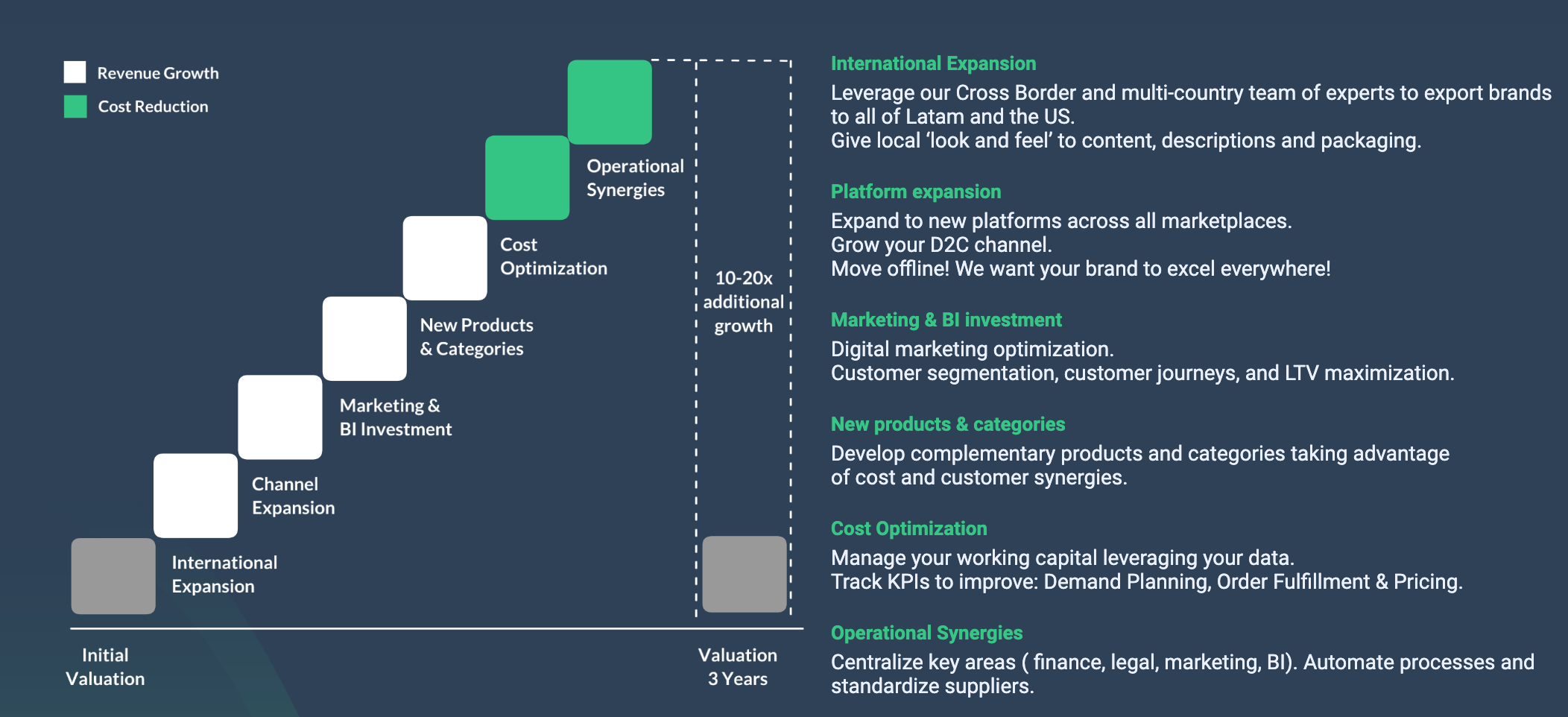

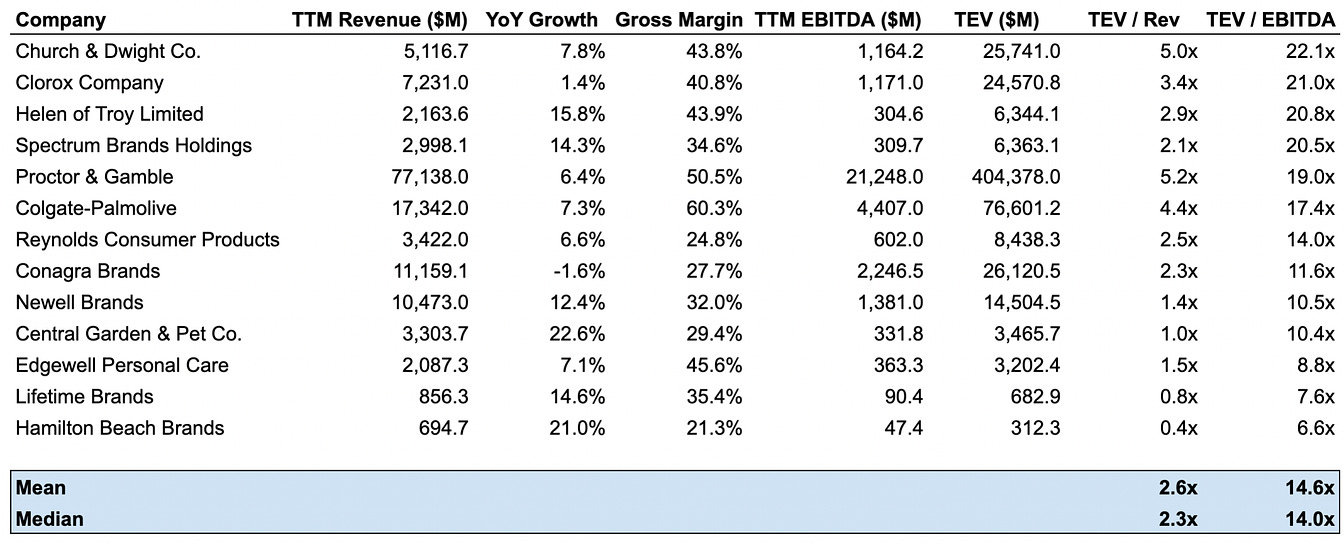

What do they do post-acquisition?E-comm roll-up platforms are kind of like private equity firms. They acquire brands and improve their operations, with the goal of generating more cash and/or eventually selling them at a markup. Most execute a detailed “playbook” for new brands they acquire, with a focus on growth. A few examples of the types of things they work on:

Part of the pitch for roll-up platforms is using economies of scale to lower costs for each individual brand. Each brand in the portfolio can leverage the platform’s centralized teams for things like finance & accounting, marketing, talent, legal, and even product development. What I like

What I worry about

Areas for future growthThis space will further evolve - here’s a few trends I’m keeping an eye on:

That’s it from me! If you’ve spent time in this space, I’d love to hear from you - do you agree or disagree with this analysis? What did I miss? Feel free to respond to this email or tweet me @venturetwins. jobs 🎓Rupa Health - Growth Analyst (SF, Remote) Faire - Marketplace Success Specialist (SF) Patreon - Product Manager (SF)* Parafin - Biz Ops & Strategy Lead (SF)* Goodwater Capital - Investment Associate (Burlingame) Techstars Music - Ops Associate (LA) Equal Ventures - Insurtech/Fintech Associate (NYC) Good Dog - Product Manager (NYC) Forum Brands - Product Launch Analyst, Strategic Associate (NYC) Titan - Investment Writer, Product Manager* (NYC) IndieBio - Partnerships & Program Lead (NYC) *3+ years of experience required! internships 📝LinkedIn - Product Design Intern (Remote) Vetcove - Business Intern (Remote) Thingtesting - Social Media Intern (Remote) Atomic - Product & Engineering Interns (Remote) Addepar - Community Marketing Intern (Remote) MasterClass - PM Intern (SF) Braze - Customer Success, Data & Analytics Interns (SF, NYC) Pinterest - Product Analyst Intern (SF) Audible - MBA Acquisition Intern (Newark) Rent the Runway - Revenue Growth Intern, Diversity Launchpad (NYC) Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 My biggest misses of 2021

Sunday, December 12, 2021

It's my "anti-portfolio" of predictions - 5 things I got wrong this year!

🚀 The artist formerly known as Square

Sunday, December 5, 2021

Plus, an exclusive preview of Andrew Chen's "The Cold Start Problem"!

🚀 Who will build the next Pokémon GO?

Sunday, November 28, 2021

Plus, announcing an investment in a startup that makes real estate social.

🚀 Meme culture makes history

Monday, November 22, 2021

A crypto collective's bid for the US Constitution.

🚀 Would you pay for Twitter?

Sunday, November 14, 2021

Plus, you can now own a stake in creators' future earnings 👀

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏