Bitcoin Is Moving In Lockstep With Treasury Yields?!

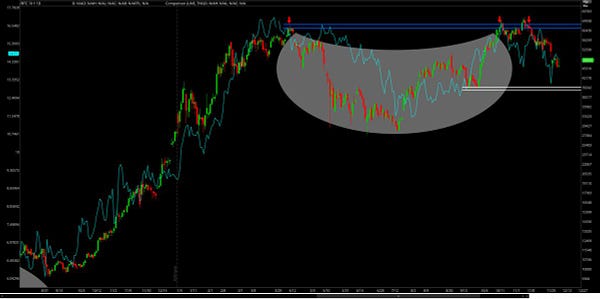

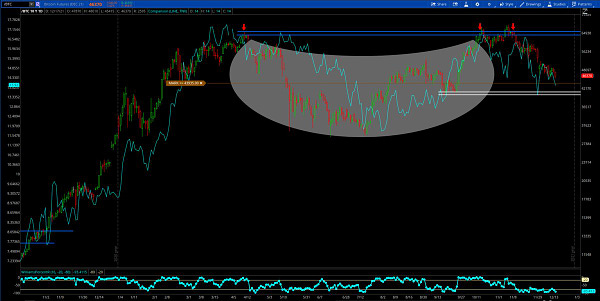

To investors, The global financial markets are obsessively watching what the Federal Reserve is going to do with interest rates in the coming months. Based on the most recent FOMC meeting, Fed Chairman Jerome Powell has signaled that the Fed is likely to hike interest rates approximately three times in 2022. I don’t want to spend our time together this morning debating whether the Fed will actually raise interest rates or not, but rather I want to talk through what is likely to happen if interest rates are increased. The general consensus is that high growth stocks, risk assets, and other recent big performers would sell off when that occurs. As any student of history knows, we have seen this story play out before.  History doesn’t always repeat. It sure does rhyme though. Keith Rabois’ expectations are shared by a large portion of the investing community, particularly those who understand interest rates and their relationship to risk assets.  So if we are operating under the assumption that risk assets will sell off when the Fed raises interest rates, we should expect bitcoin to suffer the same fate, right? Well….no one knows yet. The prevailing consensus view has been that bitcoin is a risk asset. It has an inverse relationship with interest rates. When central banks and politicians manipulate interest rates lower, and pump trillions of dollars into the market, bitcoin should go higher. Over the last 18-24 months, we saw interest rates moved lower and trillions of dollars injected into the economy, along with bitcoin’s price going up hundreds of percent. But what if bitcoin’s price increasing has less to do with interest rates and QE? What if bitcoin’s price increasing was more related to the bitcoin halving in May 2020? Hear me out for a second. The inverse correlation between tech stocks and treasury yields has been playing out exactly how you would expect. Yields go up and risk assets sell off. Yields go down and risk assets go up.   This inverse relationship is not what we are seeing between bitcoin and Treasury yields though. We are actually seeing the exact opposite. Bitcoin’s price appears to be moving in lockstep with Treasury yields.     So if this short-term trend continues to play out, what would that mean for bitcoin? Again, no one knows for sure. But it would be very interesting if the prevailing consensus view is misplaced and bitcoin would actually benefit from increasing interest rates. That would violate the framework that many people have been viewing the digital currency through. Caleb Franzen elaborates here:    So why could this idea of bitcoin and yields increasing together potentially be true? Well…one idea is that some people actually deem bitcoin to be their reserve currency. They view cheap capital via low rates as a path to borrowing money and making investments that could earn them more bitcoin. If rates were to rise, risk assets would sell off and these people would go back into their safe haven asset — bitcoin. This may sound insane to the legacy Wall Street crowd, but there is an increasing number of young people who see the digital currency as that safe haven asset in their portfolio. The entire point of investing in anything outside of bitcoin is to outperform bitcoin and eventually convert back into bitcoin. Obviously, if you’re a good investor than you can pick up more bitcoin. If you’re a bad investor, you end up with less bitcoin. This is the new risk-reward that many young people are evaluating. Ultimately, none of us know what the Fed is going to do in 2022. We also don’t know how every single asset will react. If we see bitcoin moving in lockstep with interest rates though, my guess is that an entirely new crop of investors are going to start paying attention. Who doesn’t want an asset that moves with interest rates, yet produces a materially higher compound annual growth rate? Keep your eyes on the relationship between risk assets, bitcoin, and Treasury yields. We are likely to learn a lot over the next 12 months. It will be worth learning, regardless of what occurs. Hope each of you has a great day. I’ll talk to everyone tomorrow. -Pomp SPONSORED: This year has seen unbelievable growth of this community and I wanted to pass on a small thank you to all my old and new subscribers alike. To get your free unique code for a $40 credit at unstoppabledomains.com simply fill in this form. Unstoppable Domains are the #1 provider of NFT domains, These domains make sending and receiving crypto easy, can be used as your username on Twitter and better yet they don't have any renewal or gas fees. Don’t forget to fill in this form to get your unique $40 USD voucher. Thanks, Pomp.bitcoin Please see full terms and conditions here Scot Wingo is the Co-Founder & CEO of Spiffy, an on-demand car cleaning and car servicing app. In this conversation, we discuss inflation, entrepreneurship, crypto, Web3 and NFTs. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber. |

Older messages

The Automated Central Bank Is Superior

Friday, December 17, 2021

Listen now (5 min) | To investors, There has been immense scrutiny on the Federal Reserve and central banks around the world over the last 18 months. Everyone from investors to business owners to

Young People Have Lived Through More Market Downturns Than Any Other Generation In History

Wednesday, December 1, 2021

Listen now (6 min) | To investors, There was an article in the Financial Times recently that discussed market cycles, sell-offs, and investor risks. My friend Josh Wolfe from Lux Capital shared it on

Bitcoin's On-Chain Distribution Continues To Be More Decentralized

Monday, November 29, 2021

Listen now (2 min) | To investors, Bitcoin's on-chain distribution continues to become more decentralized over time. We can explicitly prove this claim by looking at the on-chain metrics, which

10 Epic Bitcoin Mining Photos

Wednesday, November 24, 2021

Listen now (3 min) | To investors, I thought it would be fun to assemble the most breathtaking photos that I could find related to bitcoin mining as we head into Thanksgiving here in the United States.

Bitcoin City Will Be Funded By Bitcoin Bonds

Monday, November 22, 2021

Listen now (7 min) | To investors, The President of El Salvador announced on Saturday night that he was planning to build the world's first “Bitcoin city,” which would live at the foot of a volcano

You Might Also Like

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Bitcoin Reserve, Tokyo Beast’s $1M Championship & King of Destiny’s 2M $GOD Showdown – Your Ultimate Crypto & Gaming Update!

Sunday, March 9, 2025

PlayToEarn Newsletter #263 - Your weekly web3 gaming news

The Profile: The man who wants to know everything & the med spas offering balding treatments

Sunday, March 9, 2025

This edition of The Profile features Tyler Cowen, Lalisa Manobal, Zhang Shengwei, and others. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But

Startups gear up for EU defense surge

Sunday, March 9, 2025

Also: Female founder face anti-DEI wave, our Global Markets Snapshot wraps up February's action & more Read online | Don't want to receive these emails? Manage your subscription. Log in The

Sunday Thinking ― 3.9.25

Sunday, March 9, 2025

"Whenever honesty is missing, walls slowly start appearing."

🚨 Weekend Wrap-Up: Chatbots Are Stealing 96% Of Your Clicks

Sunday, March 9, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 How to create a unicorn

Sunday, March 9, 2025

Vanta opens up about building a security game-changer. 🔐

Brain Food: Guts Over Brains

Sunday, March 9, 2025

Your reputation isn't just what people say about you—it's the position from which you make every move. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏