Recap of Professor's Office Hour (Weeks 11 & 12)

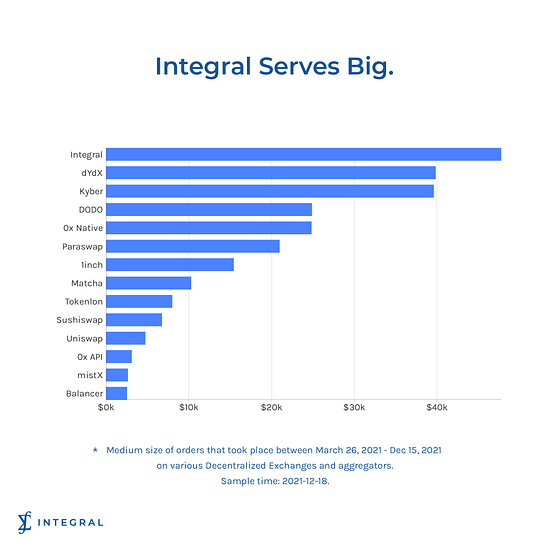

Weekly RecapMarketing & Business developmentEveryday we are beginning to see more trades of size come through our platform. This is the "niche" market we are targeting - large orders on-chain. The word "niche" may not be a proper word choice, as the market is soooooo big. The chart above tells the story. Integral = Big orders. And that's the reason we have built TWAP, to keep our dominance on large orders on-chain, both tech-wise and branding-wise. And with TWAP launching, we believe that we'll see more large trades like below as whales become confident and familiar with the fact that Integral is the place to trade size on-chain. More on the marketing front, one of our team members went to Miami and attended Dcentralcon, organized by one of our friends, Justin Wu. The trip gave us a lot of new inspiration and ideas on the usage of Integral TWAP. So as it turns out that, besides traditional OTC desks, there are other individuals in different fields who are very interested in this service and this gives us lots of confidence going forward. Regarding progress on the DeFi Trader Club: there are currently ~40 members in the group. The first round of user interviews generated some very positive feedback and the product is praised for having a very smooth experience. We will work on increasing the number of the members by co-marketing. Some of the whales asked about the solution to use TWAP to sell their farmed tokens and we are currently studying how to make this work. And lastly, our team is also busy preparing for the promotional materials for Integral TWAP, which ranges from documentations, info-graphics, new landing pages and videos. Product DevelopmentOur testnet is up and running! Please visit our TWAP-preview page to give it a try. We'll use January to open the testnet to more individuals and collect further feedback. If everything goes smooth, it will launch on mainnet in February. Below are two of the most important docs for Integral TWAP. Although they are still in draft stage, we feel like we are not far from getting them right. If you want to learn more about the working mechanisms of Integral TWAP, like how the price is calculated and how the trading flow looks, you are welcomed to read them and provide some feedback to us! Furthermore, one of our active community members has edited and simplified our above draft documentation for us on Gitbook, so if you would like to dive deeper be sure to check it out here. Meanwhile, audits for Integral TWAP are still ongoing. Currently no major issues (which is a good sign), and the product team is fixing some minor bugs. There are still many questions in regards to supporting more altcoins. Of course, to support altcoins the main challenge is still about finding the proper oracle. The tweet starts with a $OHM holder selling $OHM for USDC, then buying some ETH with these USDC. We thought it may be really cool that someday Integral TWAP can support OHM-ETH natively.   Q&AMarketing & CommunityAre you still planning to release a collection of NFTs? We are currently still working on the DeFi Superhero NFT collection. It will be a large collection created by a contributing artist to BAYC. There will be approx. 8k of them, with different rarities. What are the thoughts on listing? Volume is not that big (it's growing now btw), some exchanges may require you to increase volume first, or pay your way to listing. We believe that a solid product is the foundation of decent-performing tokens. It's the main source of token holders' growth and volume. As TWAP gets into launch, then growth stage, we believe this will improve. And by brand power I mean that having whales to believe that Integral is the place to place their large orders. Why is the team working so slowly? You have 15 developers, according to you, L2 migration requires the efforts of 2 developers. What is the team doing at the moment? We are sorry that it may appear that way but we can assure you we are working around the clock. 15 is the total number of the team members. We have got 6 developers. The developers are currently working on TWAP, patching some minor bugs and the Graph. Then they'll start working on L2. Also it's worth noting that building a finance app really needs some time, as one glitch will instantly drains all the money. ProductWhen are you planning to launch the TWAP product? It really depends on how the audits go. We just finished the first one, no major issues. We are having the second one. fingers crossed. If nothing happens, I'd say February. Hi, I just read more about Integral TWAP: "the Minimum Received corresponds to the worst-case scenario for your trade. After 30-min wait time elapses". Does this likewise mean, that if the price moves in my favor that I will receive more than displayed? My understanding is that during the 30 min time window it should work both ways/ directions, correct? Yes, you will receive more than the displayed minimum amount if the price is favorable. The "minimum received" only means that if the price moves unfavorably before your transaction gets mined, it will just fail to protect you from getting a bad price. For more info on this please take a read of our TWAP documentation. Finances and TreasuryCould you please talk about the protocols cash position and burn rates? Sure, the monthly burn rate is quite conservative and somewhere between $120k-160k. If you are referring to the cash position of the community treasury. You can view the wallet here. All the fees that we have collected so far have been used to seed the Uniswap V2 $ITGR pool. This pool was created with the DAO wallet and can view the LP token in this wallet. If you liked this post from Integral Resistance, why not share it? |

Older messages

Recap of the Professors' Office Hour (Week 9&10)

Tuesday, November 30, 2021

Please find below our recap of week 9 & 10, survey question results and the live community Q&A session that followed.

A Data-driven Farming Approach, Updated

Monday, November 15, 2021

40% of the weekly farming rewards will now applied to USDC-ETH pool.

Recap of Professor's Office Hour (Week 8)

Wednesday, November 3, 2021

DeFi Traders Club is not replacing the current community by any means. It's more of a new channel which helps us connect.

Introducing The DeFi Trader Club by Integral!

Tuesday, October 26, 2021

The DeFi Trader Club (DTC) will be an exclusive chat group connecting our core team with our high-volume traders and liquidity providers. Membership to this club is free, but invite-only and limited to

Recap of Professor's Office Hour

Tuesday, October 19, 2021

We are very pleased to have concluded our 7th weekly office hour. Please find below our recap, survey question results and the live community Q&A session that followed.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏