Bitcoin Frees You From a Banking System That Is Totally Anachronistic

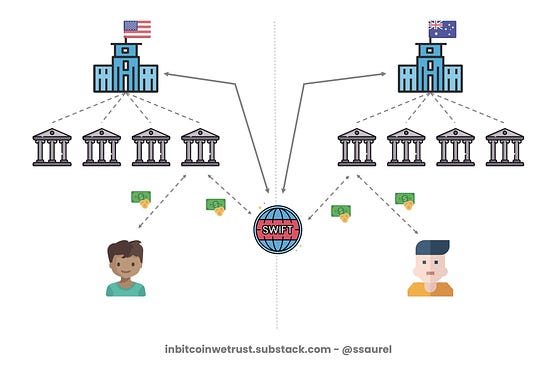

Bitcoin Frees You From a Banking System That Is Totally AnachronisticBitcoin removes unnecessary middlemen.Technological progress is leading to a digitalization of the world in all areas. This digitalization of the world is gradually leading to the elimination of all intermediaries in many areas. I am talking here about all the trusted third parties that are added to exchanges between people and who come to guarantee that the conditions of exchange are respected. Of course, middlemen do not work for free. The more middlemen you have in an exchange between two people, the higher the fees will be. In the world of supply chains, this is called disintermediation. If I take the example of farmers, we are seeing more and more fruit and vegetable producers seeking to sell directly to their customers in order to prevent third parties from entering the distribution chain. These third parties do not add value, but they are prohibitively expensive. Thanks to digitalization, producers are increasingly able to reach their customers directly. Customers also benefit from lower prices. It’s a win-win situation. At the level of the banking world, the problem of intermediaries is also omnipresent. I will go even further since I sincerely believe that the current banking system is totally anachronistic. I’ll give you a telling example. Let’s take the example of a cross-border transaction with the current banking systemAdam who lives in the United States has a bank account with $100,000 which he has managed to save by working hard. Nathan, one of his friends lives in Australia. For some private reason, Nathan needs $20,000 very quickly. Nathan asked his friend Adam if he could lend him the money. Adam has every right to lend Nathan $20,000 since he has $100,000 in his bank account. That money is his. He should be able to enjoy it as he wishes. So Adam goes to his bank’s website and tries to make a $20,000 transaction to Nathan’s Australian bank. First failure. His bank’s online site tells him that he cannot transfer such an amount over the Internet. Since it’s the weekend, Adam’s gonna have to wait until his bank branch opens. Nathan, that absolutely needs that $20,000, has to wait. Adam goes to his bank branch and explains that he wants to make a bank transaction to Australia for $20,000. Since it’s his money, Adam thinks it won’t be a problem. Second mistake. Adam’s U.S. bank is asking him to explain the $20,000 transfer. When you think about it, it’s pretty amazing. Adam worked hard to earn that money, and now he can’t enjoy it the way he wants to. If Adam refuses to justify the reasons for the transfer, the bank may prohibit it, or even alert government authorities in the worst-case scenario. The risks of censorship with the current banking system are omnipresent. Adam’s doing it. He explains that his friend Nathan needs the money for a specific reason. He has to reveal part of Nathan’s private life in order to be able to make his money transfer. There is a real problem of privacy. Finally, Adam managed to initiate his transaction to Nathan’s bank. So you think Adam did the hard part. Well no! The transaction hasn’t even come close to Nathan’s Australian bank yet. For an international transfer of this type, it will be necessary to use the SWIFT interbank payment network. This implies delays of 2 to 5 days at best. In terms of transaction fees, Adam will soon be disappointed too. The complete process of this simple $20,000 transaction between two friends is as follows: As you can see, once the American bank has sent the bank transfer over the SWIFT network, the Australian bank will be contacted. Then the Australian bank can credit Nathan’s account. Since private banks are attached to the central banks of their respective countries, the Fed and the Reserve Bank of Australia will be able to audit the transactions carried out by the banks attached to them. Once Nathan’s account is credited, an acknowledgment of receipt goes the other way around. After a week, Adam was able to send the $20,000 to his friend Nathan in Australia. The current banking system is anachronistic and flawedTotally anachronistic, the current banking system highlights the limitations of such a centralized network. Transaction times are long and transaction fees are high as each intermediary takes its fees. Finally, the privacy of individuals is not respected. In fact, you should have the right to use your money as you want without having to justify your reasons for spending $20,000. In the current banking system, you are deprived of this right. Bitcoin provides an extremely simple and effective answer to this major problem of the banking system. By creating Bitcoin, Satoshi Nakamoto wanted to address all the issues related to central banks in terms of monetary creation, but also in relation to private banks in which we cannot have total confidence:

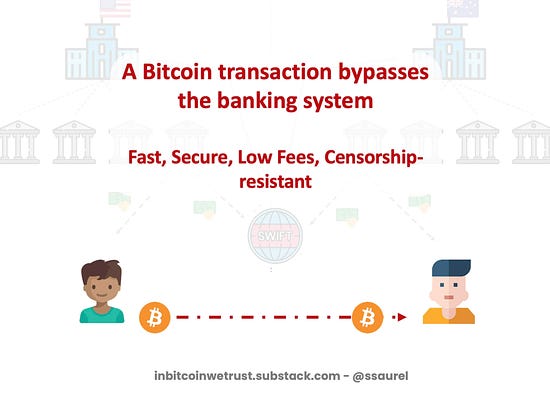

Now, let’s imagine the following with the Bitcoin network. Bitcoin is the best solution for cross-border transfersAdam owns the equivalent of $20,000 in Bitcoin. So he decides to send this amount in Bitcoin from his wallet to Nathan’s wallet, who creates an address on the network for the occasion. In approximately 10 minutes, Nathan’s address on the Bitcoin network is credited with the amount of Bitcoin transferred by Adam. Even better, the transaction fees do not depend on the amount sent with Bitcoin. Whether you send $10, $20K, or $100 million, the transaction fees may be the same. Most of the time, transaction fees on the Bitcoin network are between $0.50 and $1.00. Sometimes these transaction fees can rise sharply, but this never lasts very long. By timing your transactions, you can keep them at extremely attractive levels compared to the current banking system. It is common for transactions of several tens of millions of dollars to be made over the Bitcoin network for transaction fees that remain below the one U.S. dollar. Given the capabilities of the Bitcoin network, the banking system clearly can’t fight it. Bitcoin frees you from the banking system by giving you the ability to bypass it completely: The other obvious advantage of Bitcoin is that it has no leader. No one’s going to ask you why you’re making a Bitcoin transaction with Nathan. No one will require justification or your transaction will be censored. By making Bitcoin your own bank, you have at your disposal a fast, secure, low fees, and censorship-resistant tool. Your Bitcoin can never be confiscated as long as you take care to keep your private keys safe. With Bitcoin, you are in complete control. For this reason, Bitcoiners often say that Bitcoin gives power to the people. Final ThoughtsBitcoin works in a much simpler way because it does not require any middlemen that will charge you transaction fees. With its decentralized network, you have the near guarantee that the Bitcoin network is always running. Bitcoin’s uptime of 99.98% since its inception is there to prove that. Regardless of the time of day, and the day of the week, you will be able to use the Bitcoin network to make transactions. Bitcoin is therefore in line with history: that of the digitalization of the world and a regaining of control by the people. As such, time is on Bitcoin’s side in the face of an outdated banking system that is flawed. Sooner or later, a majority of people will come to realize the superiority of Bitcoin. Under these conditions, Bitcoin’s adoption can only increase sharply in the coming years. In Bitcoin We TrustComment & Earn!Share your thoughts and opinions on the topics covered within this blog in the comments below for your chance to win yourself an NFT. Click here for more information on our engagement rewards. If you liked this post from Cryptowriter, why not share it? |

Older messages

EOSweekly: DAC Tokens, EOS on Web 3.0, API+, Wallets, Helios

Sunday, January 9, 2022

The age of DAC tokens approaches. Amidst mainstream attention for Web 3.0, EOS Support dishes out a wallet guide. API+, Recover+ and more out of the ENF camp. Helios tackles global issues like supply

Still Thinking Bitcoin Is a Madoff-Style Ponzi Scheme? Listen to the World’s Best Hedge Fund Managers Investing in…

Saturday, January 8, 2022

This will probably strengthen your convictions if need be.

Round 26 Cryptowriter NFT Engagement Winners!

Friday, January 7, 2022

Top 10 Most Engaged Users The top 10 most engaged users across our entire publication. Our analytics take into account the total amount of likes, comments, and shares. Most engaged winners receive 1

Cosmos Proof of Stake

Wednesday, January 5, 2022

Passive Income

EOSweekly: Dan's Whitepaper Circulating, Yves' WG+, Year in Review, Community Togetherness, Bullish, Chintai

Monday, January 3, 2022

Dan is closer to deploying the 'killer' crypto app. Yves' WG+ strengthen the mainnet's core. An annual review, fireside chat, and New Year's hangout help the community take in the

You Might Also Like

BlackRock doubles down on IBIT exposure through its Global Allocation Fund

Friday, December 27, 2024

The fund now holds over $17 million worth of shares from the spot Bitcoin ETF, which is among the 35 largest funds to ever launch. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockChain's Top 10 News of 2024: Spot ETFs for Bitcoin and Ethereum Approved, Trump Secures Presidency with Str…

Friday, December 27, 2024

Bitcoin reached an all-time high of $107796 around 2:00 AM on December 17. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Let's make money from crypto WITHOUT trading

Friday, December 27, 2024

CRYPTODAY 139 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

CryptoQuant CEO says US could feasibly cut debt by embracing strategic Bitcoin reserve

Thursday, December 26, 2024

Analysts see US Bitcoin reserve as symbolic step toward debt reduction, amid challenges and speculation. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Shen Yu's "Four Wallets" Strategy: A Guide to Crypto Investment Management

Thursday, December 26, 2024

This content summarizes an AMA hosted by E2M Research on Twitter Spaces, featuring Shen Yu (Twitter @bitfish1), Odyssey (Twitter @OdysseyETH), Zhen Dong (Twitter @zhendong2020), and Peicai Li (Twitter

Reminder: Bitcoin Hits A New ATH Once Again After Touching $108K

Thursday, December 26, 2024

Monday Dec 23, 2024 Sign Up Your Weekly Update On All Things Crypto TL;DR In this issue, we dive into: Bitcoin Hits A New ATH Once Again After Touching $108K Avery Ching To Become New Aptos Labs CEO As

Bitcoin sees brief rebound to $99,000 on Christmas day

Wednesday, December 25, 2024

Holiday excitement lifted Bitcoin past $99000, but it quickly corrected to $98000 where it still holds strong support. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Opinion: Market Panic After FOMC Shows Some Overreaction

Wednesday, December 25, 2024

Last night, the market experienced a significant pullback, primarily due to investor concerns over the Federal Reserve possibly shifting towards a more “hawkish” policy stance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s pro-crypto pledge could see day-one executive orders, industry players hope

Tuesday, December 24, 2024

A Bitcoin strategic reserve, access to banking services, and the creation of a crypto council are among the items on the industry's 'wishlist.' ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s 2024 Year in Review

Tuesday, December 24, 2024

A data-driven overview of events that shaped crypto in 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏