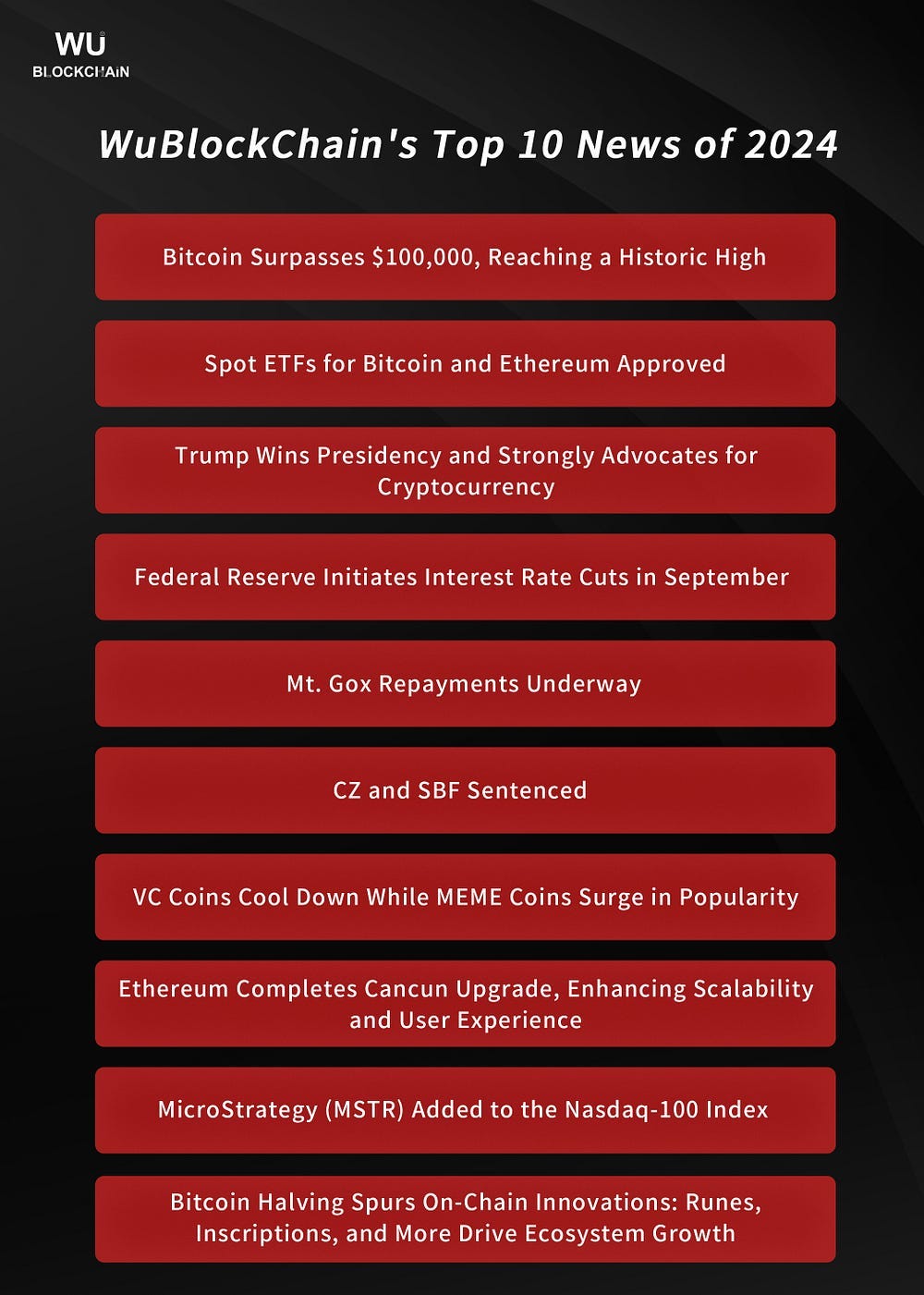

WuBlockChain's Top 10 News of 2024: Spot ETFs for Bitcoin and Ethereum Approved, Trump Secures Presidency with Str…

1. Bitcoin Surpasses $100,000, Reaching a Historic High Bitcoin reached an all-time high of $107,796 around 2:00 AM on December 17. The Bitcoin-to-Gold Ratio surged to 37.3, setting a new record, signifying that one BTC can now purchase approximately 37 ounces of gold. This metric is often used to compare the relative strength and investor preference between the two assets. Compared to the previous cryptocurrency bull market peak in November 2021, when the ratio stood at 36.7, it has now risen by about half a percentage point. Sidney Powell, CEO and co-founder of institutional capital markets platform Maple Finance, remarked, “Reaching a new high underscores Bitcoin’s continued adoption and maturity as an asset class.” 2. Spot ETFs for Bitcoin and Ethereum Approved On January 10, 2024, the U.S. Securities and Exchange Commission (SEC) granted its first approval for Bitcoin spot exchange-traded funds (ETFs), authorizing 11 ETFs to commence trading on January 11. Following the approval, Bitcoin’s price briefly surged past $47,000 before retreating to around $45,000. As of December 27, 2024, Bitcoin is priced at approximately $96,178, more than doubling since the approval date. Subsequently, on July 22, 2024, the SEC approved multiple Ethereum spot ETF applications, with these ETFs officially launching on U.S. markets on July 23. On the first trading day, Ethereum was priced at about $3,800. By December 27, 2024, Ethereum’s price had slightly declined to approximately $3,373. As of press time, according to SoSoValue data, the total net asset value of Bitcoin spot ETFs stands at $109.332 billion, accounting for 5.73% of Bitcoin’s total market capitalization, with cumulative historical inflows reaching $35.910 billion. Ethereum spot ETFs hold a total net asset value of $12.120 billion, representing 2.99% of Ethereum’s total market capitalization, with historical cumulative inflows of $2.6 billion. 3. Trump Wins Presidency and Strongly Advocates for Cryptocurrency In the 2024 U.S. presidential election, Donald Trump achieved a historic comeback, securing victory once again after four years. In his victory speech, he explicitly pledged to advance the cryptocurrency industry, promising to implement innovation-friendly regulatory policies, attract global blockchain enterprises to invest in the United States, and leverage blockchain technology for financial and government transparency reforms. This announcement marked a significant policy shift in the U.S. cryptocurrency landscape, with the market reacting positively as Bitcoin prices surged by 3% following the news. As part of his initiatives, Trump appointed David Sacks as the administration’s “AI and Cryptocurrency Czar,” a role dedicated to fostering market growth in the crypto sector, supporting blockchain innovation, establishing a regulatory framework for the stablecoin market, and collaborating with regulators to streamline compliance processes for businesses. 4. Federal Reserve Initiates Interest Rate Cuts in September In September 2024, the Federal Reserve announced a 25-basis-point cut to the federal funds rate during its latest Federal Open Market Committee (FOMC) meeting, marking the start of the current rate-cutting cycle. This was the first rate reduction since 2022, signaling the Fed’s response to slowing economic growth and declining inflation. Federal Reserve Chair Jerome Powell stated at the press conference that recent economic data indicates a gradual cooling of the labor market and inflation nearing the 2% target. He emphasized that the current rate cut aims to provide greater support for economic growth and affirmed the Fed’s commitment to monitoring data to adjust monetary policy flexibly. The rate cut had a profound impact on financial markets. Major U.S. stock indices rose broadly, with technology stocks performing particularly well. The bond market saw a steepening yield curve, while the cryptocurrency market experienced a notable rebound, with Bitcoin breaking key resistance levels. Emerging markets also benefited, with increased capital inflows, currency appreciation, and improved economic confidence. Analysts suggest that the Fed’s rate cut could signal a global return to accommodative monetary policies. However, the sustainability of this trend will depend on future economic data and the achievement of policy objectives. 5. Mt. Gox Repayments Underway In 2024, the long-awaited repayment plan for the Mt. Gox Bitcoin exchange finally entered its implementation phase. The 2014 bankruptcy of the exchange, which resulted in the loss of 850,000 Bitcoins, sent shockwaves across the globe. Over the years, legal battles, asset liquidation, and market volatility repeatedly delayed the repayment process, making it one of the most complex cases in cryptocurrency history. According to the latest announcement from the trustee, repayments will be conducted in batches. The first group of victims has begun receiving partial compensation, comprising Bitcoin, Bitcoin Cash, and fiat currency assets. While the amounts fall significantly short of the original losses, this progress marks the nearing resolution of a decade-long legal and trust crisis. It also offers valuable legal and regulatory insights for handling similar cases in the future. 6. CZ and SBF Sentenced In 2024, two iconic figures in the cryptocurrency industry — Binance founder Changpeng Zhao (CZ) and former FTX CEO Sam Bankman-Fried (SBF) — were both sentenced, drawing global attention. CZ was convicted for failing to fulfill anti-money laundering and compliance obligations, leading to Binance being used for illicit transactions. He was sentenced to three months in prison and fined a substantial amount. CZ has since been released. SBF, on the other hand, was sentenced to 20 years in prison for his involvement in the massive misappropriation of customer funds at FTX. The court found that he deliberately transferred assets before the exchange’s collapse to fund high-risk trades for affiliated companies, ultimately causing billions of dollars in losses for customers. SBF is currently serving his sentence, with his appeal having been denied. 7. VC Coins Cool Down While MEME Coins Surge in Popularity In 2024, the cryptocurrency market exhibited a clear bifurcation. Tokens from traditionally venture capital-backed projects (VC tokens) significantly cooled due to market weakness and regulatory pressure. For example, Layer 2 project tokens like Starknet (STRK) and zkSync (ZK), which are supported by top-tier institutions and boast large funding records, saw their prices plummet throughout the year, with trading volumes consistently shrinking and investor confidence weakening. In stark contrast, the MEME coin market flourished. Emerging MEME coins such as PEPE, WIF, and NEIRO sparked a wave of investment, with several tokens achieving short-term gains of tens of times their original value, drawing in vast amounts of capital and retail investors. This phenomenon is largely driven by community-driven enthusiasm and speculative expectations of high returns. Analysts note that the popularity of MEME coins is more reliant on market sentiment and social media propagation, lacking the practical application foundation of traditional VC-supported projects. However, amid the current downturn in the cryptocurrency market, short-term speculative demand has made MEME coins a haven for investors. 8. Bitcoin Halving Spurs On-Chain Innovations: Runes, Inscriptions, and More Drive Ecosystem Growth In 2024, the year of Bitcoin’s halving, the Bitcoin network witnessed multiple innovations that captured the industry’s attention. These new features not only expanded Bitcoin’s use cases but also injected fresh vitality into its long-term development. Among the most notable innovations is the Runes technology. This lightweight token protocol allows users to issue and manage tokens on the Bitcoin network while maintaining the network’s security and simplicity. Compared to Ethereum’s ERC-20 standard, Runes emphasizes resource efficiency and decentralization, and has already attracted several projects to join its ecosystem experiment. Inscriptions, based on the Ordinals protocol, allow Bitcoin to function similarly to NFTs (non-fungible tokens) by embedding text, images, and other data. This innovation has sparked a surge in the art and collectibles sectors, with on-chain inscription transaction volumes hitting new records. Some rare inscriptions have even reached auction prices exceeding a million dollars. 9. Ethereum Completes Cancun Upgrade, Enhancing Scalability and User Experience In 2024, Ethereum successfully implemented the Cancun upgrade, marking another significant network improvement following the Shanghai upgrade. This update introduced the highly anticipated EIP-4844 proposal (Proto-Danksharding), signaling a major step forward for Ethereum in terms of scalability and fee optimization. EIP-4844 introduced “data blobs,” a technology that significantly reduces the cost of Rollup solutions on Ethereum, with expectations to lower on-chain transaction fees to just a tenth of their current level. This advancement creates a more favorable environment for decentralized finance (DeFi) and on-chain gaming applications, while also enhancing Ethereum’s transaction throughput. Following the upgrade, the Ethereum network has demonstrated stability, with positive feedback from both the developer community and users. Ethereum co-founder Vitalik Buterin stated that the Cancun upgrade is a crucial component in the “scalability trilogy” for Ethereum 2.0, and further improvement proposals will continue to be advanced in the future. 10. MicroStrategy (MSTR) Added to the Nasdaq-100 Index link MicroStrategy (MSTR) has been included in the Nasdaq 100 Index, making it the 40th largest company in the index. This inclusion grants MicroStrategy a place in one of the world’s largest ETFs, the Invesco QQQ Trust (QQQ), which manages over $300 billion in assets. As of December 22, 2024, MicroStrategy holds 444,262 Bitcoins, valued at approximately $62,257 per Bitcoin, totaling around $27.7 billion. The company has achieved a year-to-date return of 73.7% and a quarterly return of 47.4%. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Shen Yu's "Four Wallets" Strategy: A Guide to Crypto Investment Management

Thursday, December 26, 2024

This content summarizes an AMA hosted by E2M Research on Twitter Spaces, featuring Shen Yu (Twitter @bitfish1), Odyssey (Twitter @OdysseyETH), Zhen Dong (Twitter @zhendong2020), and Peicai Li (Twitter

Opinion: Market Panic After FOMC Shows Some Overreaction

Wednesday, December 25, 2024

Last night, the market experienced a significant pullback, primarily due to investor concerns over the Federal Reserve possibly shifting towards a more “hawkish” policy stance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

OKExChain: Will the Federal Reserve and Jerome Powell Prevent the U.S. from Creating a National Bitcoin Reserve?

Tuesday, December 24, 2024

In the early hours of today, Federal Reserve Chairman Jerome Powell made it clear during a press conference following the monetary policy meeting that the Fed has no intention of participating in any

Yi He on Binance Alpha and Wallet: Most Projects Are Air, Facing Talent Shortage in Web3, and Wallet as an Airdrop…

Monday, December 23, 2024

This article is a summary of a recent AMA hosted on Binance's official Twitter, focused on the relaunch of Binance Wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Dec 16 to Dec 22)

Sunday, December 22, 2024

On December 19, the Bank of Japan announced it would maintain its unsecured overnight call rate at 0.25%, leaving the policy rate unchanged. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏