Earnings+More - Jan26: Standard General bids for Bally

Jan26: Standard General bids for BallyBally’s Corporation offer, Wynn Resorts IR in UAE, Playtech update, Jefferies winter summit recap, Synalogik funding +moreGood morning. More news on the corporate front this morning with big moves involving two of the gaming giants.

Midnight at the oasis! Get more here: Standard General offer for Bally’s Corporation

Risk-off: The opportunistic bid from Standard General, a New York-based hedge fund, would take advantage of the 60%+ fall in Bally’s share from their 52-week highs. The hedge fund said the bid was attractive when “viewed against the operational risks inherent in the company's business and the market risks inherent in remaining a public company”. What’s the plan Stan? Standard General’s central proposition is to effect a sale and leaseback of Bally’s properties, which analysts at Wells Fargo estimate could bring in ~$1.4bn. Bally still owns most of its regional gaming properties. Waterworld: Truist noted that the offer is some way below their price target of $55 a share and “would likely leave several minority shareholders underwater”. One part of the original buyout offer for Gamesys included the option of taking Bally shares.

Digital disconnect: The Jefferies team highlighted that the market is “not pricing in” the U.S. digital opportunity and as per its own modeling, the offer “reflects the current value of the land-based business and the Gamesys earnings stream”.

Bally Bet 2.0: In a note issued before the Standard General announcement, the analysts at Truist reported back from management meetings with Bally. Suggesting the rollout of the ‘next-gen’ Bally bet sportsbook would follow "in the coming months", they added that Bally Bet 3.0 was also in the pipeline and will include a watch-and-play product to sync with partner Sinclair Broadcasting's media capabilities. Gamesys update: Also notable was the information on Gamesys' non-US operations where Truist reported the business has seen lower than expected volumes of new sign-ups and lower-than-expected margins (3.9% vs. usual 4.6%). ** Sponsor’s message: Venture capital firm Yolo Investments is home to €350m of equity in more than 50 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 28-company, €135m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high-roller live casino brand, Bombay Club. As a proud sponsor of Earnings+More from Wagers.com, Yolo Investments wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat. Wynn Resorts IR in UAEIsland life: Wynn Resorts will break new ground by building the first integrated resort in the United Arab Emirates. The 1000-room resort and casino will be built on Al Marjan island in the emirate of Ras Al Khaimah with the opening scheduled for 2026. Analysts at Wells Fargo suggested the project would be akin to the Boston Encore in size and scope. Wynn’s stake in the project will be between 25-40%. Wells Fargo estimated at completion the project would drive ~$300m in EBITDA of which Wynn would get a sizeable slice. The gamble: Ras Al Khaimah’s Tourism Development Authority (RAKTDA) has formed a new division to regulate gambling. It told Bloomberg its priority “is to create a robust framework that will ensure responsible gaming at all levels.” Analysts at CBRE said the formation of RAKTDA suggested gaming areas would be included in any IR developments, “though gaming has not yet been clearly defined”. Wells Fargo noted that 90% of UAE residents were ex-pats and “presumably” permitted to gamble. Sheikh your moneymaker: The UAE development comes days after news emerged that Wynn was looking to sell WynnBet for a knockdown $500m. Recall, WynnBet was valued at $3bn+ when it was to merge with the Austerlitz SPAC in May 2021. CRBE noted that the rumored sale of Wynn Interactive “could be a logical source of capital for the Marjan project” and said the U.S. OSB space was ”ripe for further and substantial consolidation”.

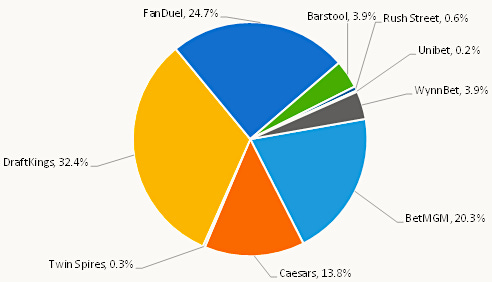

Seventh avenue: Yesterday, WynnBet announced it would be live in New York, Louisiana and Iowa "in the coming weeks". In New York, it would be the seventh book to go live after PointsBet became the sixth on Monday night. Further reading: The $500m consolidation in sports betting. On social: Playtech takeover speculationNuclear option: Sky News has reported that Playtech is considering a break-up if shareholders vote down the 680p offer from Aristocrat. Playtech has acknowledged the “speculation on the company’s future strategy” and said it reiterates its recommendation of the offer from Aristocrat as the best route for delivering “longer-term value”. The break-up plan would involve the separate sales of the B2B arm and the Snaitech business. Jefferies winter summit reviewComing out of hibernation: Jefferies have reported back on their virtual winter summit which took place earlier this week, suggesting the presenting companies (MGM, Scientific games, Golden Entertainment and Everi) were “generally exiting Covid with considerably improved capital positions, which raises discussion on uses of cash.” Of note, they pointed out that Scientific Games was now less than three times leveraged following recent divestitures, while MGM was “progressing toward” having ~$9bn of cash “without clear needs”. Earnings in briefAustralian-listed pari-mutuel technology provider BetMakers saw Q2 revenues rise 17% QoQ and 521% YoY to AU$24.6m and generated AU$2.8m in operating cash flow during the quarter. The group has AU$110.9m in cash at period end. Over the period, the company signed a deal to provide tote and horse racing markets for Caesars’ retail sportsbook in Nevada and extended its agreement to be the exclusive provider of fixed-odds horse racing data to Monmouth Park racetrack and the New Jersey Thoroughbred Horseman Association (NJTHA). UK-listed Mobile games developer Gaming Realms enjoyed a 27% YoY rise in FY21 revenues to £14.5m and a 70% rise in adj.EBITDA to £5.6m. The growth was driven by the group’s games going live in Michigan and Pennsylvania and with 35 new international partners in the Netherlands, Romania and most recently in Spain with Gamesys. Synalogik funding roundEvery little helps: The gambling regtech platform provider has raised #3m in a Series A funding round backed by Bill Currie, founder of retail, e-commerce and tech investment fund the William Currie Group and Sir Terry Leahy, former CEO of Tesco. Gambling Industry veteran Mark Blandford also increased his existing stake. Synalogik said it will use the money raised to scale its AML and affordability customer profiling platform across more territories and fund additional products in data aggregation, risk identification and “decision intelligence”. Macau updateOn the nod: Macau’s legislators have approved the first reading of the draft gaming bill that includes provisions for six concessions, each with a maximum 10-year term and a possible three-year extension. Concerns were raised by legislators over the fate of the satellite casinos which are currently controlled by independent investors and now could be tied to the gaming concessions. DatalinesArizona Nov21: Betting handle was down 4% MoM to $466.7m, retail and online GGR was up 37% to $51.4m, with mobile making up $50.7m of the aggregate figure. Hold was up to 11% on Oct21’s 7.7%. Net revenue, excluding federal handle tax, was $32.4m, meaning promotions were ~$18 mm or 36% of mobile GGR, down from 70% in October. DraftKings led in market share handle with 32.4%, FanDuel was second with 24.7%, BetMGM third with 20.3%, Caesars fourth with 13.8%, Barstool fifth with 3.9% and WynnBet was sixth with 3.9%. Tennessee Dec21: Betting handle was down to $341.8m vs. $365.7m in Nov21, revenue dropped to $24.6m vs. c$40m in Nov21. Sportsbooks’ hold was 7.2%, some way off the 10% mandatory minimum required in Tennessee. Operators will likely pay a “true-up” payment to make up the shortfall in the state’s tax revenues. Italy Dec21: GGR for dot it operators rose to €312m vs. €304.2m Nov21, but was down 13% on the record €359m recorded in Dec20. Online casino GGR rose to €165.5m, its highest ever total, with Playtech-owned Snai leading on market share of 9.1%, Flutter’s Sisal was second with 8.5%, Pokerstars third with 8.2% and Lottomatica fourth with 7.5%. Sports betting GGR was down MoM and YoY to €204.8m, OSB recorded GGR of €125.1m and retail €79.7m. FY21 revenues for OSB and icasino were up 46.1% YoY to €3.46bn. NewslinesIn-person removal: Nevada’s in-person registration requirement could be gone within a month, according to ex-Nevada Gaming Control chair A.G. Burnett. Currently, Nevada and Illinois are the only two states requiring in-person registration for online sports-betting accounts. The measure will be rescinded in Illinois in March. Double Dutch: Aspire Global will provide its full turnkey betting and gaming solution to online operator BoyleSports for the Netherlands market. The online sportsbook and casino is set to apply for a Dutch license and will go live once it has received it. Esports pioneer: Esports Entertainment has received a transactional waiver from the New Jersey Division of Gaming Enforcement and will launch its VIE.gg website this weekend. The site, which soft-launched on Monday, was the first operator to gain a license for esports betting in May 2021. Entry on payment: Paysafe has announced it has entered the New York market and is now processing online deposits and payouts for New York players. It added that its Income Access affiliate services provider was also now operational with “several brands” in the market. DRF 18th: Affinity Interactive’s launch of its DRF Sports website makes it the 18th online sportsbook to go live in Iowa. The state is number 3 when it comes to the number of active operators, after Colorado and New Jersey. DRF’s platform is supplied by Kambi. What we’re readingTokenize this: The great token scam. The great hi-tech robbery: NFT forgeries for sale Thanks for reading Wagers.com Earnings+More! Subscribe for free: Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Jan 24: Caesars, DraftKings lead gaming stocks south

Monday, January 24, 2022

The week in shares, New York sports-betting, Playtech takeover doubts, Allwyn float, Startup focus - Chalkline +More

Jan 21: Weekend Edition no.30

Friday, January 21, 2022

New York revenue, Entain/BetMGM analyst reaction, PlayUp/FTX investment, Better Collective, SciPlay analyst updates, NeoGames/Aspire Global reaction, sector watch - retail financial trading

Jan 20: Entain battles through tough Q4

Thursday, January 20, 2022

Entain trading update, BetMGM analyst reaction, New York casinos +More.

Jan 19: BetMGM CEO: market getting smarter

Wednesday, January 19, 2022

BetMGM FY21 update, Full House Q4 preliminary results, Esports Technologies earnings guidance, Michigan Dec21, NeoGames/Aspire reaction.

Jan 18: Achievable aims: NeoGames buys Aspire

Tuesday, January 18, 2022

NeoGames buys Aspire Global, 888 trading update, Truist sports-betting survey, Ontario tax objections, +More

You Might Also Like

Recruiting Brainfood - Issue 428

Sunday, December 22, 2024

Merry Christmas everybody - it's the Brainfood Christmas Special, so we bear gifts and reflections from the world of TA / HR on the year 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Simple hack to get 4x more shares

Sunday, December 22, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

I built an online tool site in 5 minutes

Sunday, December 22, 2024

AI tools are getting even more incredible

How to Describe a Hallucination

Saturday, December 21, 2024

If hallucinations defy the grasp of words, how should we try to describe them?

+28,000% Engagement with Pinterest?

Saturday, December 21, 2024

Exploding impressions and engagement

The importance of pillar pages for SEO

Saturday, December 21, 2024

88% of SEOs believe topical authority is very important to their SEO strategy, according to a Surfer SEO study. One of the most effective ways to strengthen your topical authority is by creating pillar

The importance of pillar pages for SEO

Saturday, December 21, 2024

88% of SEOs believe topical authority is very important to their SEO strategy, according to a Surfer SEO study. One of the most effective ways to strengthen your topical authority is by creating pillar

The best books about AI&ML, 2024 edition

Saturday, December 21, 2024

For Your Holiday Reading

How to control your audience

Saturday, December 21, 2024

And turn them into raving fan-customers

$166K MRR - simple employee scheduling tool..

Saturday, December 21, 2024

+ What do you think?