Earnings+More - Jan 31: Ontario sets a date

Jan 31: Ontario sets a dateOntario launch, New York OSB update, PointsBet earnings call notes, Florida petition fail, startup focus - Sporttrade +MoreGood morning. On Friday, Ontario finally announced a launch date for regulated sports-betting and igaming. Also in today’s newsletter:

I got you babe. Click here: Ontario launchSet the date: Licensing authority iGaming Ontario confirmed that operators will be able to take single sports bets on April 4. It is thought the tax rate will be set at 20%. Sizing Ontario: By population (c.14.5m) Ontario would be the fifth biggest U.S. state and thus is the second biggest market in the regulated North American sports-betting and igaming sector to open to date. Analysts estimate it could be worth close to $1bn of GGR in its first year of operation. Welcoming the news:

Who’s in?

The shape of things to come: Truist noted late last year that Canadian bettors won’t necessarily follow the path trodden by their counterparts in the U.S. It means more betting on hockey, fans betting more on players rather than teams and less of a focus on NFL and NCAA football. Not everyone’s happy: Great Canadian Gaming, which earlier in January launched a campaign to halt the deregulation, complained that the legislation fell short of providing a fair and competitive market. This was supported by the Mississaugas of Scugog Island First Nation who condemned the launch. Go deeper: Follow the developments in Ontario and Canada with The Parleh. **Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. Its industry-leading Superfeed is used by the biggest betting brands in the world including bet365, Flutter and Entain. The content engine powers on-site engagement by delivering impartial expert betting insight for 20 sports in 70 languages. For more information visit: spotlightsportsgroup.com New York dataBillion-dollar baby: The news that New York has broken through the billion-dollar barrier after only three weeks is confirmation - as if it were needed - that New York will indeed be the biggest single state market so far. Analysts at Macquarie noted the $1.2bn figure from the New York State Gaming Commission data means that in monthly handle terms, it has taken New York less than three weeks to achieve what New Jersey managed after three years.

On ramp: Suggesting the promotional backdrop was “relatively rational”, the Macquarie team said Caesars would be happy with its early lead (45.7% of GGR). But they noted BetMGM’s performance - 5.8% share in its debut week - highlighted the degree to which “being live on Day One can impact a sportsbook’s ramp.” Louisiana launchTiger warning: Louisiana duly got underway on Friday with seven operators making it to the starting line including Barstool, BetRivers, Caesars, DraftKings, FanDuel, WynnBet and BetMGM. However, controversy followed hot on their heels after reports emerged on social of Caesars - which has a sports-betting partnership with LSU - emailing all students with a $300 in free bets offer. Data note: Louisiana’s 11 retail sportsbooks took in $39.5m in handle in Dec21. PointsBet earnings callBold claims: PointsBet has recently upgraded its in-play proposition in the U.S. including zero suspension and 100% uptime betting recently on the Raiders/Bengals play-off game and a new in-play same-game parlay product. CEO Sam Swanell said these types of product upgrades were “beyond the capabilities of most operators” and made PointsBet the “King of in-play”. Sparky: Swanell trumpeted the capability brought in by the Banach Technology acquisition last March saying in-play handle was up 44% since the recent upgrade. COO Mark Hughes, previously CEO at Banach, said the new algo reduced the amount of time the in-play product was suspended by 40% and led to a 50% reduction in bets rejected.

Cutting their cloth: PointsBet hopes a reputation for market-leading in-play will obviate the need to match the market leaders in marketing spend as punters “gravitate” towards more product-led offerings. Despite marketing in Q2 hitting $27.9m - exceeding the $24.1m U.S. net win - PointsBet failed to hit its targeted 10% market share in any of the seven states it was operable in during Q2. Market share notes: PointsBet claimed a blended market share of 4.2% across operable states. According to analysts at EKG, PointsBet has a total market share of 2.6%.

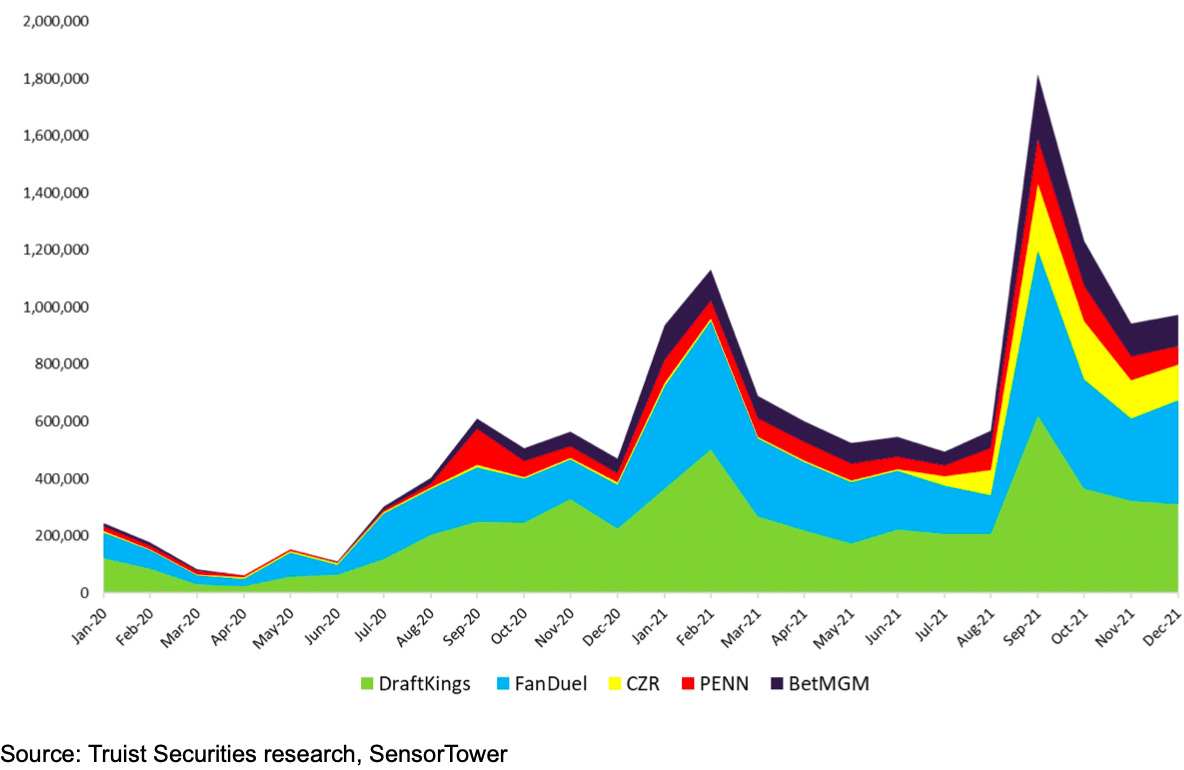

Burning cash: The Australian business is profitable, producing A$53.1m in Q2. But such are the demands for investment in the U.S. business while it sustains continued losses that PointsBet saw net cash outflows in Q2 of A$96.5m. The company received A$400m from an issue of shares in Q1 and at the end of Q2 its cash balances stood at $523.3m. Chart - monthly interactive app downloadsOn the download: The Truist analyst team says that data from Sensor Tower suggests total North American sports-betting and igaming app downloads in Dec21 were up +105% YoY and +2% MoM with the top five accounting for 87% of all downloads. “We believe these trends speak to additional states legalized vs. 2020 with the sequential increase likely lending to higher OSB promo spend.” Florida petition failureOut for the count: Despite the best efforts of Barstool’s Dave Portnoy - or perhaps because of - the Florida Education Champions petition effort backed by DraftKings and FanDuel admitted failure on Friday, blaming the Covid resurgence for an inability to pick up in-person signatures. Coming up short: The separate Florida Voters for Change, backed by Las Vegas Sands, that hopes to get a question about a North Florida casino onto the November ballot, limps on but beset by legal challenges. As of Friday, it was reportedly 400,000 shy of the 900k+ verified signatures needed. Further reading: On Wagers.com, why the Florida petition effort was doomed. FuboTV analyst updateFantasy island: Analysts at LightShed Partners have raised FuboTV to Neutral from an outright Sell, but caution that the sports-streaming to sports-betting company “could very well be a zero” within two years. “Fubo’s financial challenges could worsen in 2022 if their recent sports rights licensing deals do not drive enough incremental subs,” they added.

Further reading: On the perils of replacing a great business model with a less great one. Q4 earnings previewThe good, the bad and the unacceptable: The macro backdrop and recent share price performances make it “tough to imagine this upcoming earnings season will serve as a stabilizing force,” said the team at Wells Fargo.

Q4 topic watch: Wells Fargo provides a bingo card checklist of key issues. These include the omicron impact on Las Vegas Strip trends; the wall of worry for regional operators; which companies did and didn’t undertake stock repurchases in Q4; and the ‘path to profitability in sports-betting and igaming. On this last point, the team noted the NY, LA and Ontario launches, while pushing revenue estimates up, will also see EBITDA losses mount. They forecast ~$700m of 2022 EBITDA losses for DraftKings and ~$685m for Caesars.

Startup focus - SporttradeWho, what, where, when: The New Jersey-based sports trading app developer was founded in 2019 by Alex Kane with the aim of offering two-sided trading for sports with players buying and selling in the same manner as they do on financial trading apps such as Robinhood. Funding backgrounder: The company completed a $36m fundraise in June last year led by Nasdaq Jump Capital, Hudson River Trading, Impression Ventures, Tower Research Ventures, Jim Murren (former CEO of MGM Resorts) and Tom Wittman (former CEO of Nasdaq Stock Exchange). So what's new? It plans to launch on the iOS platform in June this year, initially in New Jersey. The company also has a market access agreement for Colorado with more states to follow in 2022. The longer pitch: Kane says the meme stock frenzy last year pointed to a shift in consumer behavior around trading. “Financial markets simply aren’t niche in the US,” says Kane. “It’s mainstream. The U.S. is a very fertile ground.” It means that when it comes to sports, there is an audience that is keen to “trade the spread”.

Kane suggests Sporttrade, which has built its entire backend and PAM, will be a business that will benefit from the network effect. “As that happens, then the pricing will get tighter and then we will have more money for marketing.” Low6 fundraiseLow key: UK-based sports-gamification provider Low6 has raised $5m from unnamed investors in order to fund expansion into the U.S. The company said it would be seeking an IPO later in the year. Low6 will be featured in Startup Focus in the coming weeks.

The week in sharesDraftKings managed to arrest the slide in its share price which at one point saw the price fall to a low of $17.63 before a 6.5% rise on Friday helped it end the week up nearly 10% to $20.64. Penn National was similarly helped by a near 5% rise on Friday as the Ontario news came through, ending the week at $44.20. Analysts at Jefferies said investors have “continued to inquire” on the relative weakness of Caesars to the rest of the sector driven, they suggest, by feast over its “elevated” leverage.

Further reading: Why is DraftKings being shorted? The week aheadOn Wednesday Joey Levy of SimpleBet, Jordan Gnat at Playmaker, Ken Hershman from Champion Gaming and Rivalry’s Steven Salz will take part in a webcast called ’the boom in the sports gambling industry’, hosted by Canadian financial services firm TMX. Later on Wednesday, Red Rock Resorts reports its Q4s. In Q3 it trumpeted “seismic” margin improvements. Penn National Gaming and Boyd Gaming report on Thursday. For Penn the focus is expected to be on its plans in Ontario while with Boyd analysts will be looking for any sign of regional weakness after a record Q3. NewslinesStretcher bond: Gaming Innovation Group has successfully completed a SEK100m bond issue under the Group’s existing senior secured bond framework in order to partly finance its recent €50.8m Sportnco acquisition. Following this bond issue, the outstanding amount of the bond is SEK550m. Bd spprt: Playtech shareholder Abrdn said it would vote in favor of Aristocrat’s support saying it “represents a fair assessment of value and certainty of cash”. The shareholder vote is due on Wednesday, Feb 2 but the company remains unsure about the intentions of a key block of Asian-based investors. What we’re readingJoe Asher: “Sports betting is probably the single greatest customer acquisition tool in the history of the U.S. casino business.” Deep freeze: Surviving the crypto winter. May the sun never set: Superbet lays out its ambitions. On social Marc Andreessen @pmarca My conspiracy theory is that there are only 1.5 million people in the world, 1.75 million tops. You all just move around. I challenge anyone to disprove this with photographic evidence.Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Jan28: Weekend Edition no.31

Friday, January 28, 2022

PointsBet Q2, Genius Sports investor day, Deutsche Bank on promotional spend, Sector Watch - social gaming +More

Jan26: Standard General bids for Bally

Wednesday, January 26, 2022

Bally's Corporation offer, Wynn Resorts IR in UAE, Playtech update, Jefferies winter summit recap, Synalogik funding +more

Jan 24: Caesars, DraftKings lead gaming stocks south

Monday, January 24, 2022

The week in shares, New York sports-betting, Playtech takeover doubts, Allwyn float, Startup focus - Chalkline +More

Jan 21: Weekend Edition no.30

Friday, January 21, 2022

New York revenue, Entain/BetMGM analyst reaction, PlayUp/FTX investment, Better Collective, SciPlay analyst updates, NeoGames/Aspire Global reaction, sector watch - retail financial trading

Jan 20: Entain battles through tough Q4

Thursday, January 20, 2022

Entain trading update, BetMGM analyst reaction, New York casinos +More.

You Might Also Like

I built an online tool site in 5 minutes

Sunday, December 22, 2024

AI tools are getting even more incredible

How to Describe a Hallucination

Saturday, December 21, 2024

If hallucinations defy the grasp of words, how should we try to describe them?

+28,000% Engagement with Pinterest?

Saturday, December 21, 2024

Exploding impressions and engagement

The importance of pillar pages for SEO

Saturday, December 21, 2024

88% of SEOs believe topical authority is very important to their SEO strategy, according to a Surfer SEO study. One of the most effective ways to strengthen your topical authority is by creating pillar

The importance of pillar pages for SEO

Saturday, December 21, 2024

88% of SEOs believe topical authority is very important to their SEO strategy, according to a Surfer SEO study. One of the most effective ways to strengthen your topical authority is by creating pillar

The best books about AI&ML, 2024 edition

Saturday, December 21, 2024

For Your Holiday Reading

How to control your audience

Saturday, December 21, 2024

And turn them into raving fan-customers

$166K MRR - simple employee scheduling tool..

Saturday, December 21, 2024

+ What do you think?

Your SaaS New Year’s Resolutions for 2025

Saturday, December 21, 2024

Here are Your Top 10 New Year's SaaS Resolutions To view this email as a web page, click here saastr daily newsletter Your SaaS New Year's Resolutions for 2025 By Jason Lemkin Thursday,

Presence Over Pressure: Leading with Confidence in Chaos

Saturday, December 21, 2024

We spoke with Jon Giesbrecht, the Director of Mental Performance and Player Development for the Vancouver Bandits, about how mindfulness and emotional regulation elevate performance in basketball,