Game Theory in Action – The Example of Vladimir Putin’s Russia With Bitcoin

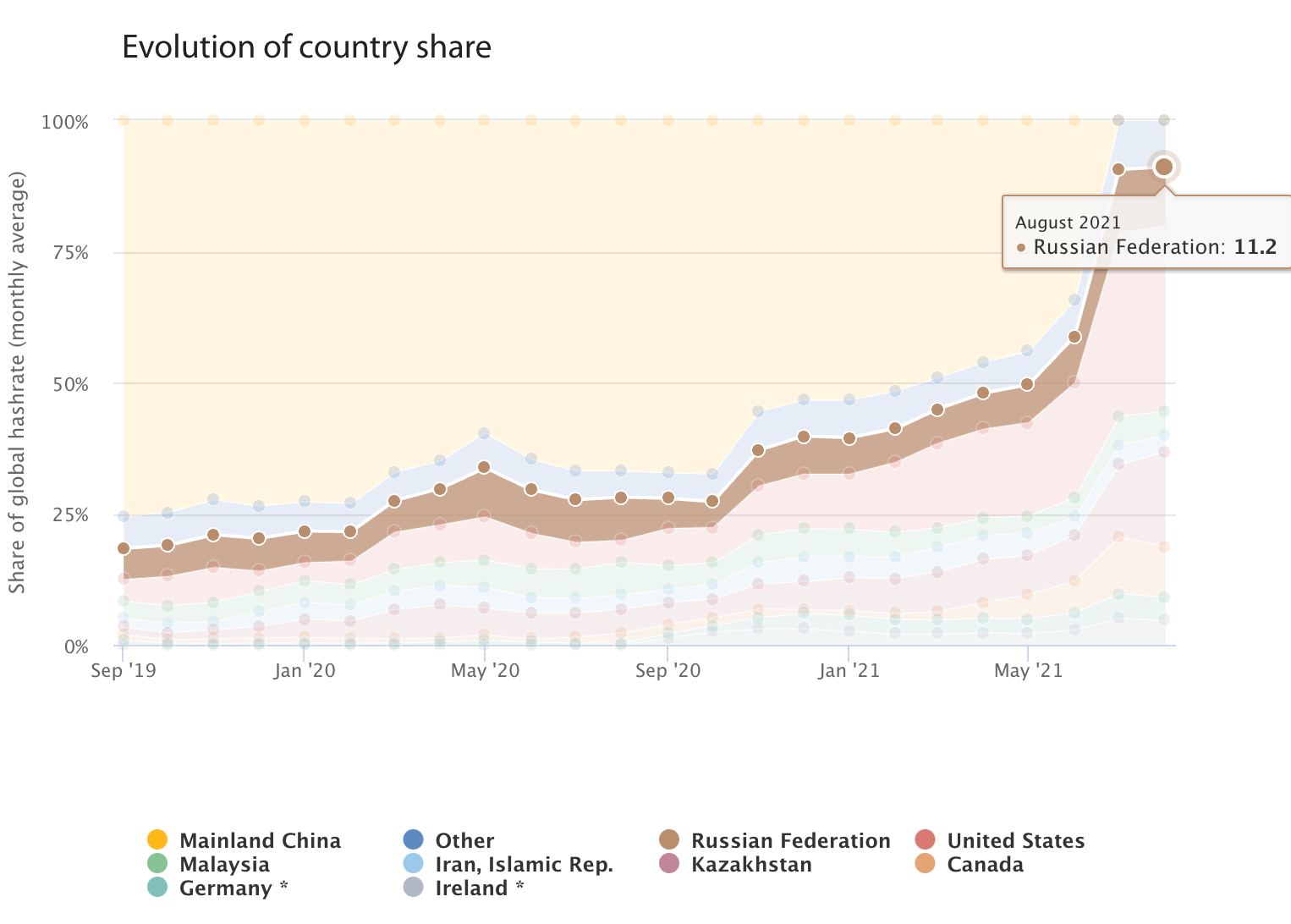

Game Theory in Action – The Example of Vladimir Putin’s Russia With BitcoinRather than a ban, Putin has approved a roadmap for the regulation of Bitcoin.The position of most governments around the world regarding Bitcoin and cryptocurrencies has never been crystal clear. Most countries have been wavering between a desire to ban it and a desire for more or less strict regulation. Despite this, most of the major Western powers seem to have realized that Bitcoin is here to stay. Rather than fighting unnecessarily and justifying the very existence of Bitcoin, it was agreed to think about regulations that would help to make the most of Bitcoin. These regulations will be more or less strict by attacking the exchange platforms and users, but there is no longer any question of a ban. A utopian ban that China has proclaimed for the umpteenth time in two steps in 2021. First in May 2021 for Bitcoin mining, then in September 2021, for the possession of Bitcoin and cryptocurrencies. Great geopolitical ally of Xi Jinping's China, Vladimir Putin's Russia has always oscillated between banning Bitcoin and cryptocurrencies, and more or less strict regulation. What has always struck me in the case of Russia is that the positions in the upper echelons of power have always been very divided. This explains the great confusion that has always reigned in Russia regarding Bitcoin. Bank of Russia advocates a ban on Bitcoin at all levelsWe had a perfect example at the beginning of 2022. On January 20, when Bitcoin was around $43K, the Bank of Russia issued a “Consultation Paper” arguing for a government ban on Bitcoin and cryptocurrencies at all levels: production, trading, and possession by citizens and banks within Russia. This news had then promoted a fall in the price of Bitcoin, while Russia still accounts for between 10 and 15% of the Bitcoin Hash Rate. Since China has voluntarily left the race for Bitcoin Hash Rate domination, this puts Russia in third place behind America (between 40 and 45% of the Bitcoin Hash Rate) and Kazakhstan (between 20 and 25% of the Bitcoin Hash Rate): Called “Cryptocurrency risks and possible regulation measures: consultation paper”, the document issued by the Bank of Russia justifies its frontal attack on Bitcoin and cryptocurrencies like this:

This statement by the Bank of Russia is deliberately catastrophic. Of course, economic sanctions by America and the European Union have caused capital outflows that weigh on the ruble. However, Bitcoin should be seen more as a solution than a problem. Capital outflows are motivated primarily by the desire to protect one's purchasing power. Bitcoin offers a very convincing alternative to buying US dollars or Euros. For these purchases to be even more relevant, these Bitcoin units would have to be issued by Russian mining companies. Buying BTC issued by foreign companies would be another capital outflow. And this is where Russia has a significant asset to offer. Vladimir Putin would lean towards regulation rather than banning given Russia's advantages in Bitcoin miningRussia can offer ultra-competitive electricity costs. It is no coincidence that thousands of mining machines have migrated from China to Russia after Xi Jinping imposed a ban in May 2021. While China's attitude has been to ban Bitcoin before now questioning the wisdom of this decision, the head of the financial policy department of Russia's Ministry of Finance has advocated a more sensible approach:

Here we can see a disagreement between the Bank of Russia, which is the equivalent of the American Federal Reserve, and the Ministry of Finance. It is therefore up to the Kremlin to make the final decision. As always, I dare say. And this is where things get interesting. In October 2021, Vladimir Putin gave an interview to CNBC in which he explained that “Bitcoin and cryptocurrencies have the right to exist and can be used as a means of payment”. In recent days, Vladimir Putin responded to the controversy caused by the Bank of Russia report by saying this:

Game theory is at work here. Russia has no interest in letting America take the lead in Bitcoin Mining aloneThis is where the game theory that all Bitcoiners have been talking about for years comes into play. Putin can see that America is going to dominate this sector, which looks strategic for the future. As the third-largest country in the Bitcoin network's Hash Rate, Russia has some serious assets to bring to bear if it wants to compete with America. Why not take advantage of this? Taking advantage of Russia's strengths to mine Bitcoin would be all the more welcome for Vladimir Putin's country as in the context of tensions around Ukraine, America and the European Union could impose even stronger sanctions on Russia. These sanctions could go as far as removing Russia from the SWIFT global interbank payment network. Nearly 500 Russian banks and financial institutions would be deprived of access to this global network, which is a monopoly in the field. This is when Bitcoin could be a significant alternative to circumvent these sanctions, as Iran has been doing for several years or as other countries are forced to do to resist American imperialism. Please note that I am not defending Putin's attitude on the Ukrainian issue. I'm simply giving you the arguments that lead Putin to consider Bitcoin and cryptocurrencies again. As you can see, the reasons do exist. So, when will Russian oil or gas be denominated in Bitcoin? It's probably not going to happen tomorrow, but it could happen much faster than we could have imagined if tensions between Russia and America were to go up another notch in the coming months and years. The latest news from the Kremlin tells us that the Russian government has decided to follow the recommendations of the Ministry of Finance. This means that Vladimir Putin has approved a roadmap for the regulation of Bitcoin and cryptocurrencies, rather than a ban that would have more negative than positive effects for Russia in the long run. Pragmatism seems once again to prevail, as always with Bitcoin. Be careful, though, because we are not immune to a new turn of events. Russia has accustomed us to this for years with Bitcoin and cryptocurrencies. More on this in the next episode. In Bitcoin We TrustComment & Earn!Share your thoughts and opinions on the topics covered within this blog in the comments below for your chance to win yourself an NFT. Click here for more information on our engagement rewards. If you liked this post from Cryptowriter, why not share it? |

Older messages

Round 29 Cryptowriter NFT Engagement Winners!

Monday, January 31, 2022

Top 10 Most Engaged Users Our analytics consider the total amount of likes, comments, and shares to determine the top 10 most engaged users across our entire publication. Most engaged winners receive 1

Review of the Bitcoin Mining Council’s Latest Report — Part 1

Monday, January 31, 2022

Q4 2021: Comparative Power Consumption data

EOSweekly: Fractally, Ecosystem Chart, Ultra, ENF, PowerUP, EOS Support, Eco Study

Sunday, January 30, 2022

Fractally, really… governance, messaging, and more will be scalable with core values in tact. The road ahead is once again charted. ENF released it's quarterly report. A study captures EOS energy

Cosmos SDK Club : OmniFlix

Thursday, January 27, 2022

Cosmos Metaverse, p2p and Beyond

AotC - Back soon!

Monday, January 24, 2022

In the meantime, AMA!

You Might Also Like

Let's make money from crypto WITHOUT trading

Friday, December 27, 2024

CRYPTODAY 139 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

CryptoQuant CEO says US could feasibly cut debt by embracing strategic Bitcoin reserve

Thursday, December 26, 2024

Analysts see US Bitcoin reserve as symbolic step toward debt reduction, amid challenges and speculation. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Shen Yu's "Four Wallets" Strategy: A Guide to Crypto Investment Management

Thursday, December 26, 2024

This content summarizes an AMA hosted by E2M Research on Twitter Spaces, featuring Shen Yu (Twitter @bitfish1), Odyssey (Twitter @OdysseyETH), Zhen Dong (Twitter @zhendong2020), and Peicai Li (Twitter

Reminder: Bitcoin Hits A New ATH Once Again After Touching $108K

Thursday, December 26, 2024

Monday Dec 23, 2024 Sign Up Your Weekly Update On All Things Crypto TL;DR In this issue, we dive into: Bitcoin Hits A New ATH Once Again After Touching $108K Avery Ching To Become New Aptos Labs CEO As

Bitcoin sees brief rebound to $99,000 on Christmas day

Wednesday, December 25, 2024

Holiday excitement lifted Bitcoin past $99000, but it quickly corrected to $98000 where it still holds strong support. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Opinion: Market Panic After FOMC Shows Some Overreaction

Wednesday, December 25, 2024

Last night, the market experienced a significant pullback, primarily due to investor concerns over the Federal Reserve possibly shifting towards a more “hawkish” policy stance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s pro-crypto pledge could see day-one executive orders, industry players hope

Tuesday, December 24, 2024

A Bitcoin strategic reserve, access to banking services, and the creation of a crypto council are among the items on the industry's 'wishlist.' ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s 2024 Year in Review

Tuesday, December 24, 2024

A data-driven overview of events that shaped crypto in 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

OKExChain: Will the Federal Reserve and Jerome Powell Prevent the U.S. from Creating a National Bitcoin Reserve?

Tuesday, December 24, 2024

In the early hours of today, Federal Reserve Chairman Jerome Powell made it clear during a press conference following the monetary policy meeting that the Fed has no intention of participating in any

Crypto community cheers as Trump names pro-crypto advisors Stephen Miran and Bo Hines for economic and digital ass…

Monday, December 23, 2024

Trump fosters economic expansion and digital innovation with Miran and Hines at the helm of economic and crypto councils. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏