OKExChain: Will the Federal Reserve and Jerome Powell Prevent the U.S. from Creating a National Bitcoin Reserve?

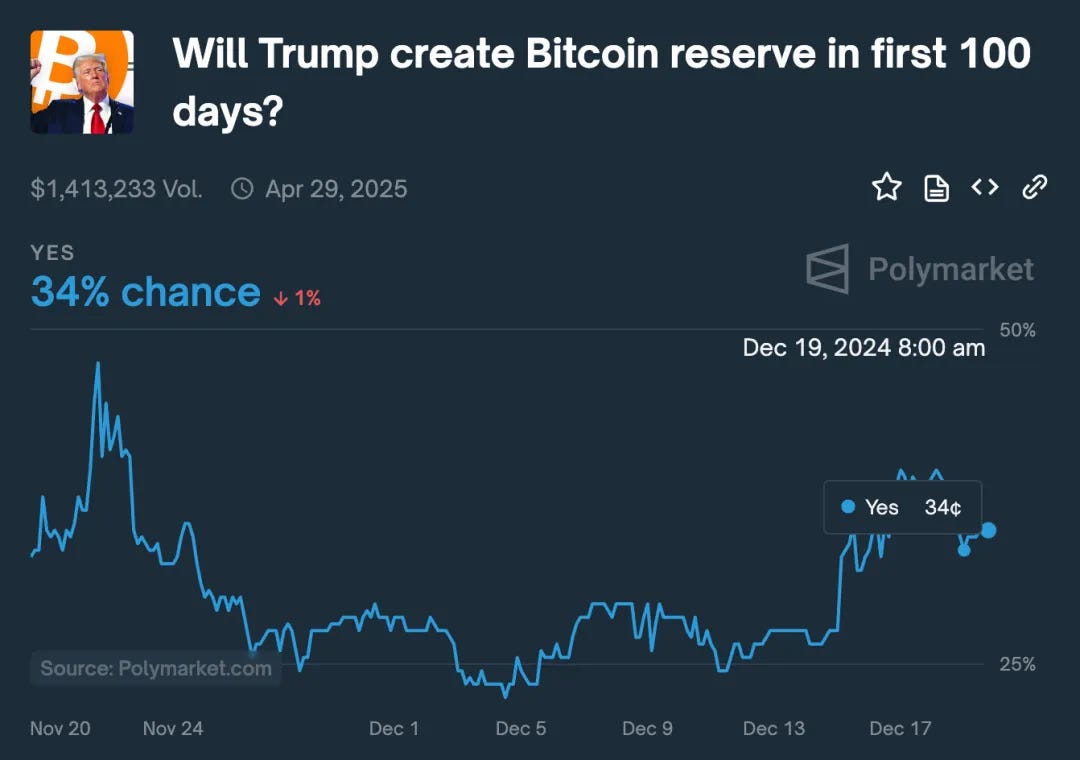

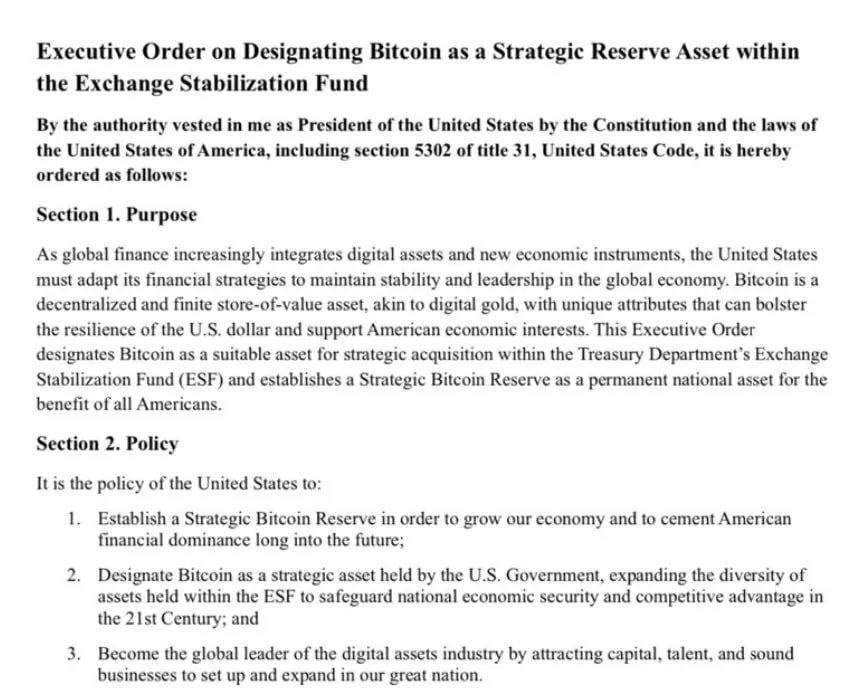

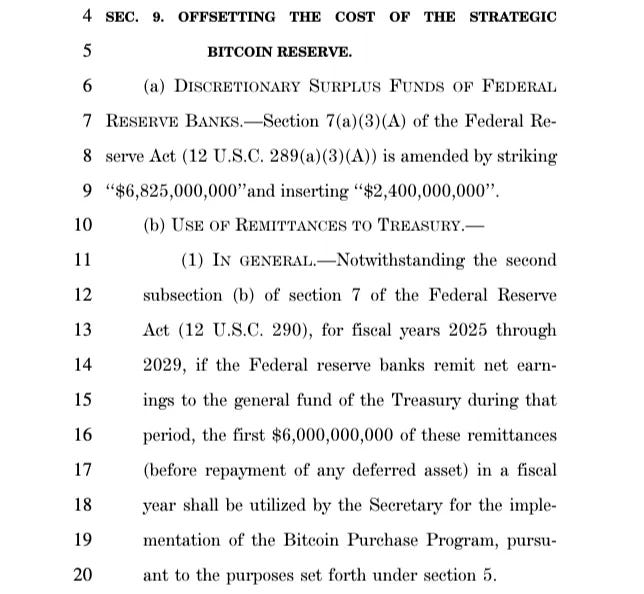

Author | Jason Jiang & Hedy Bi In the early hours of today, Federal Reserve Chairman Jerome Powell made it clear during a press conference following the monetary policy meeting that the Fed has no intention of participating in any government plan to accumulate Bitcoin. He emphasized that such matters fall under the jurisdiction of Congress, and the Fed has no plans to seek a change in existing laws to allow for Bitcoin holdings. Powell’s statement immediately shook the market, causing Bitcoin’s price to quickly pull back from its high earlier in the week. According to the prediction market Polymarket, the likelihood of a Bitcoin Strategic Reserve dropped from a peak of 40% on the 18th to 34% after Powell’s speech. The cryptocurrency market’s total market value also plummeted, with a loss of approximately 7.5%. This statement not only left the market uncertain about the prospects of a “Bitcoin Strategic Reserve” (BSR), but it also refocused attention on a deeper question: Does the Federal Reserve really have the power to block the BSR plan? First, it is important to clarify the position of the Federal Reserve in the U.S. financial system. The Federal Reserve’s superior body is the U.S. Congress: Congress is the highest authority for all financial regulatory agencies, responsible for enacting financial regulations and policies through legislation, and authorizing other financial institutions (such as the SEC and the Federal Reserve) to exercise their functions. In the U.S. financial market, monetary policy and fiscal policy are the two main tools of government economic management, with the Federal Reserve and the Treasury Department respectively responsible for them. These institutions maintain checks and balances while also operating independently to ensure the smooth functioning of the U.S. economy and financial system. While the Federal Reserve enjoys a high degree of independence in monetary policy and national economic stability, it does not have a “veto power” over the decision to establish a BSR. If the Trump administration wanted to quickly establish a BSR, the most direct way would be to sign an executive order after taking office, instructing the U.S. Treasury Department to use the Exchange Stabilization Fund (ESF) to directly purchase Bitcoin. The ESF is a special fund managed by the U.S. Treasury Department, primarily used for foreign exchange market interventions, supporting the stability of the U.S. dollar, and responding to international financial crises. The fund includes assets like the U.S. dollar, Special Drawing Rights (SDRs), and gold. The operation of the fund is not controlled by Congress, and the President and Treasury have significant autonomy in its use. In theory, the President could issue an executive order directing the Treasury to adjust the allocation of the ESF funds to purchase or reserve specific assets, bypassing direct congressional approval for appropriations, thus reducing political resistance. The executive order drafted by the Bitcoin Policy Institute recently aims to establish the BSR in this manner. This approach is the easiest to implement, as the use of ESF funds does not require prior approval from Congress, though Congress could restrict its operations through investigations or legislation. For example, during the COVID-19 pandemic in 2020, Congress imposed strict limitations on some of the Treasury Department’s fund operations. Furthermore, the sustainability of a BSR established through an executive order is questionable, because an executive order is essentially an expansion of executive power, and a future administration could revoke or amend previous decisions through a new executive order. To establish and maintain a long-term stable BSR, another path would need to be chosen: through congressional legislation, incorporating Bitcoin into the “Strategic Reserve Act” or similar laws to explicitly recognize Bitcoin as a national strategic reserve asset. This approach has stronger legality and would establish a long-term framework for Bitcoin reserves. The “U.S. Bitcoin Strategic Reserve Act,” proposed by Republican Senator Cynthia Lummis, follows this path. The bill has already been formally submitted to Congress and is under review by the Senate Banking Committee. It will need to pass both the Senate and the House of Representatives and be approved by the President before it can become law. Therefore, establishing a strategic Bitcoin reserve via this route would take more time and may encounter various obstacles along the way. Whether through a presidential executive order or congressional legislation, from the proposals currently on the table, it seems that the implementation of a strategic Bitcoin reserve would ultimately require the Treasury Department to take the lead, rather than the Federal Reserve. In addition to the above options, the Federal Reserve and the Treasury Department could theoretically choose a middle path for Bitcoin allocation. The Federal Reserve could purchase Bitcoin through open market operations and add it to its balance sheet. Given its relative independence, the Federal Reserve’s actions would not need congressional approval, but a clear policy framework would be needed to support its Bitcoin purchases. Given the Federal Reserve’s recent statements, the likelihood of this approach being implemented in the short term seems low. The Treasury Department, on the other hand, could establish a special fund to invest in Bitcoin as part of a fiscal investment plan. While this wouldn’t change the existing legal framework, such financing would require congressional approval. Regardless of the path taken, the Federal Reserve’s “no” does not outright reject the proposal for a BSR, and the Trump administration’s pragmatism has shown support through action. According to on-chain data, just two minutes after Powell began his speech, the Trump family’s crypto project, World Liberty, quietly took action by starting to purchase altcoins. This scene undoubtedly reveals a deeper game: on one hand, the Federal Reserve’s indifferent response to the Bitcoin strategic reserve plan reflects the government’s cautious stance toward emerging assets; on the other hand, the actions of the Trump family’s crypto project hint at the subtle struggle between traditional power and market innovation. The delicate game between the government, traditional finance, and the crypto market may very well be the prelude to the future fate of the crypto market. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Yi He on Binance Alpha and Wallet: Most Projects Are Air, Facing Talent Shortage in Web3, and Wallet as an Airdrop…

Monday, December 23, 2024

This article is a summary of a recent AMA hosted on Binance's official Twitter, focused on the relaunch of Binance Wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Dec 16 to Dec 22)

Sunday, December 22, 2024

On December 19, the Bank of Japan announced it would maintain its unsecured overnight call rate at 0.25%, leaving the policy rate unchanged. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Sonic Mainnet Officially Launched, Opensea Hints at Token Launch, NFT Trading Volume Shows…

Saturday, December 21, 2024

Avery Ching, Co-Founder and Chief Technology Officer of Aptos, will assume the role of Chief Executive Officer to lead the company into its next phase. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: Trump Pledges Full Support for Blockchain Industry Development, Nasdaq 100 Adds MicroStrategy…

Friday, December 20, 2024

The Federal Reserve announced its rate decision, setting the upper limit at 4.50%, in line with expectations and lower than the previous rate of 4.75%. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The story of BWEnews: China’s most Famous Cryptocurrency News Trader

Thursday, December 19, 2024

This provocative introduction comes from Vida, who claims to be the richest Gen Zer on Zhihu, with at least $7 million in available cash (approximately ¥51 million). ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏