The Pomp Letter - 2021 Crypto Job Report

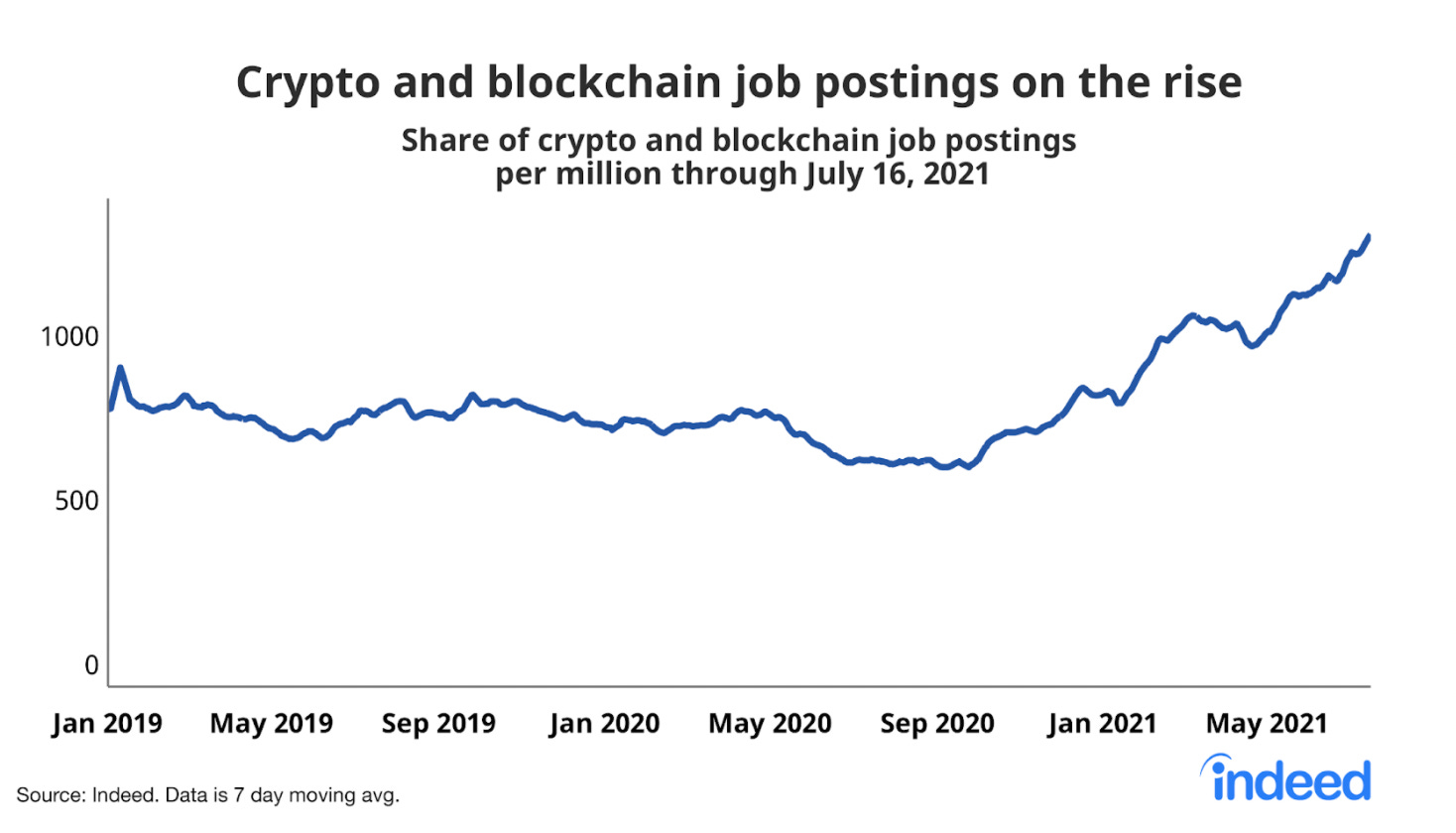

To investors, The job market in the bitcoin and crypto industry has exploded over the last 12 months. My team and I have built a standalone business that has become the largest employment and training company in the space. I asked Colton Sakamoto, CEO of that business, to put together a report on the trends in 2021. Below is the report. Enjoy! 2021 was an inflection point that accelerated mass adoption of Bitcoin and crypto. Led by El Salvador making bitcoin legal tender, Coinbase going public, and Square rebranding to Block, Bitcoin and crypto took the world by storm. Out of fear of being unseated, the incumbents were also forced to adopt a Bitcoin and crypto strategy. Facebook underwent a rebrand and changed their name to Meta. Fintech companies like Robinhood, Webull, and SoFi adjusted their stances to accommodate crypto users. Even legacy financial institutions including Blackrock, Goldman Sachs, Morgan Stanley, and State Street added or expanded their bitcoin and crypto offerings. With disruption comes opportunity. In 2021, thousands of the brightest minds around the world left their jobs to join the Bitcoin and crypto revolution. According to LinkedIn, Bitcoin and Crypto job postings grew 395% in 2021, representing more than 3x the growth of the broader tech industry.

Top talent is pouring into the Bitcoin and crypto industry. Here’s what the Bitcoin and crypto job market looked like in 2021: Estimations of hiring in 2021 put the total well above 10,000 people joining the Bitcoin and crypto industry. The Block collected responses from just 27 crypto firms and discovered that the interviewed companies hired 8,400 people in 2021. A LinkedIn “crypto” search reveals close to 200,000 people working in the industry in total. Job seeker demand for the crypto industry continues to rise, and new openings are quickly filled.

Exchanges were responsible for the most hires

As retail demand for digital assets exploded in 2021, so did headcount at crypto exchanges. Coinbase more than doubled their headcount over the past year, and they expect to continue to hire aggressively in 2022. Retail demand drives infrastructure, and infrastructure drives hiring.

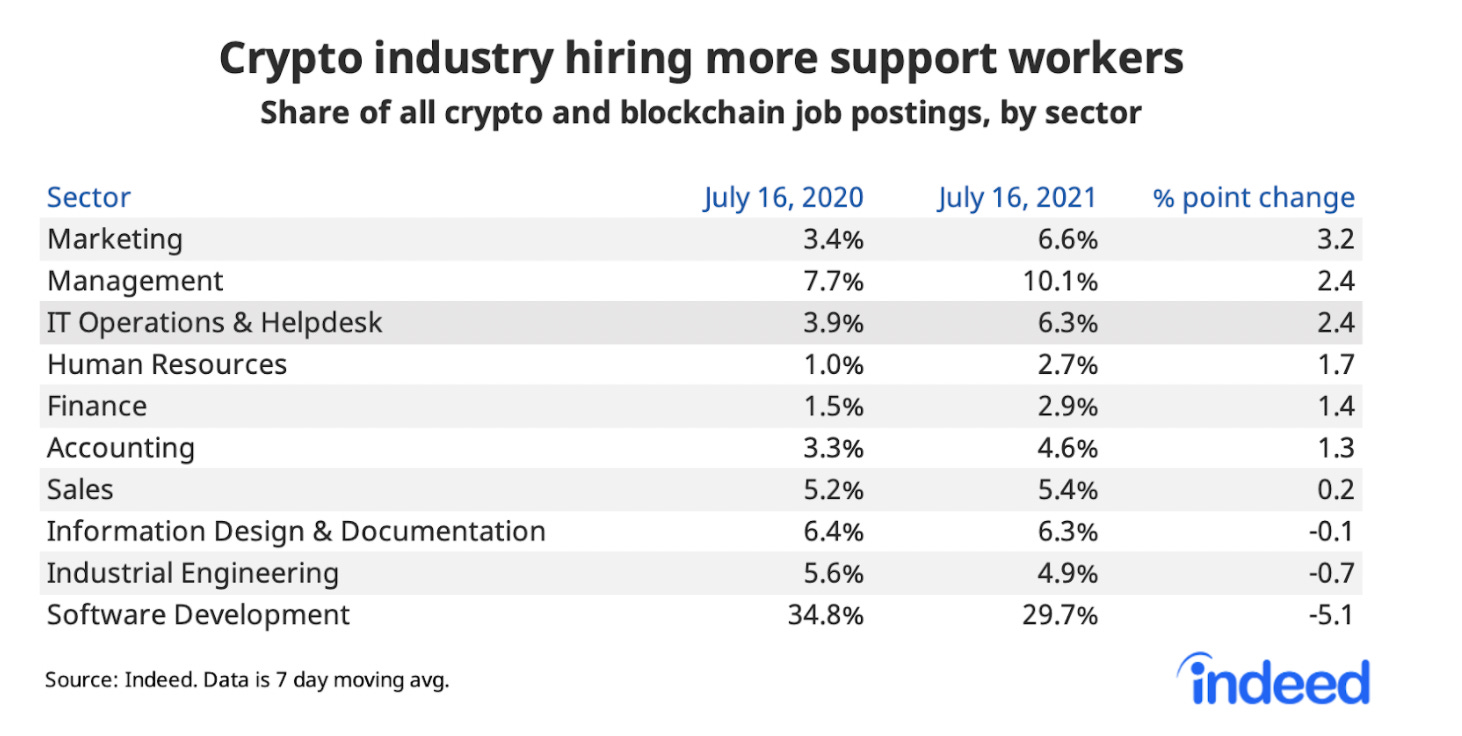

All skill sets neededThere is a common misconception that bitcoin and crypto companies are only looking for shadowy super coders. 2021 job data ran counter to this narrative. Accounting, Marketing, Sales, and Business Development openings were on the rise in 2021, and we can expect the continuation of this trend as more startups are formed, more companies go public, and job seeker interest continues to rise. Remote first36% of all crypto job postings allow for remote work, compared to just 7% for all other US job postings. Led by companies without headquarters like Coinbase and Kraken, crypto companies are looking for top talent and are often location agnostic. Gone are the days of commuting to a 9-5. Remote work is here to stay, and the crypto industry is leading the charge for remote-first work. $30B in Venture Capital FundingVenture funding in 2021 went parabolic in the crypto sector as VCs continue to place big bets on bitcoin and crypto companies. The crypto industry received more than $30B in funding across 1,700 deals in 2021, which represents a 709% year-over-year increase in total funding.

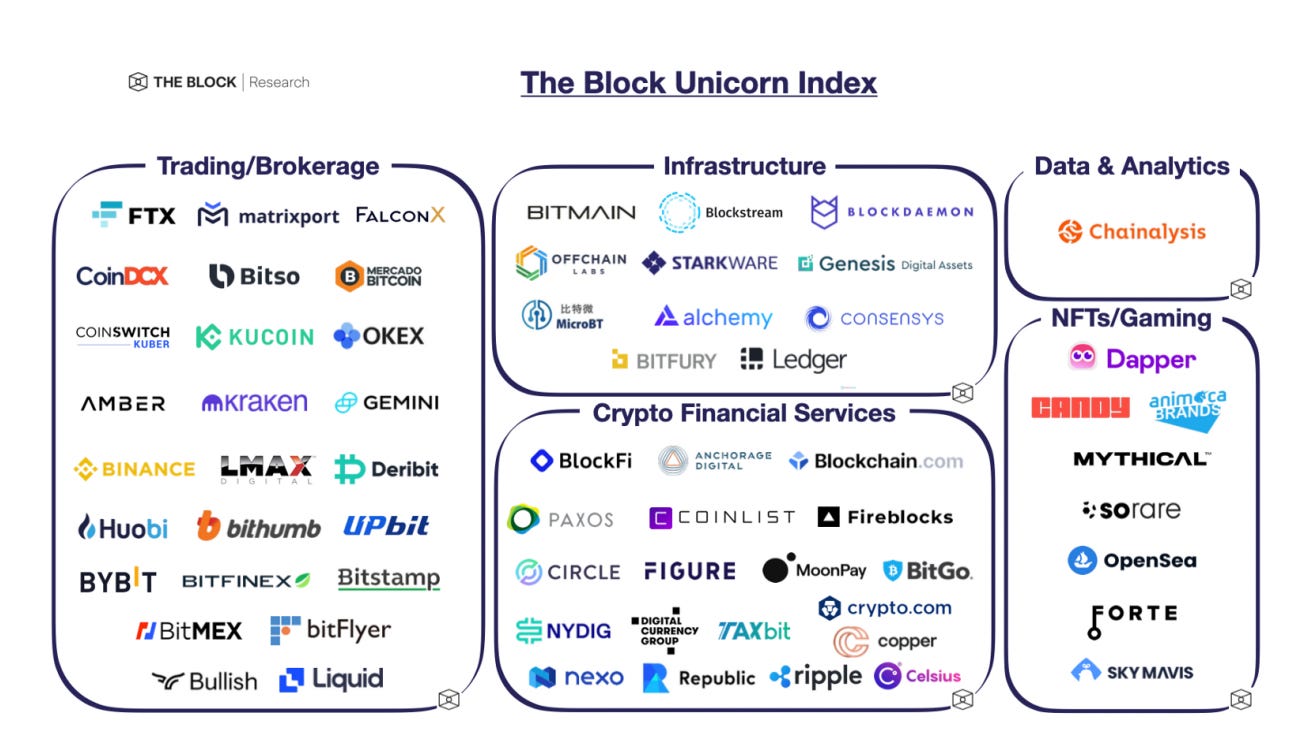

$6B in Mergers & Acquisition Activity2021 was also a big year for crypto mergers and acquisitions. The sector saw over $6B in M&A volume in 2021, which is a 730% year-on-year increase and is approximately 2x the amount of the industry’s previous 8 years combined. “Bridge transactions” — deals between more traditional companies and crypto firms, rapidly accelerated in 2021. Some examples include Nike buying virtual products company KTFKT and Robinhood acquiring cross-exchange crypto trading platform Cove. 65+ companies in the crypto sector have reached unicorn status with a valuation of $1B or moreThe past year created more unicorns than the previous 4 years combined. Entrepreneurs across the globe are taking risks and starting companies to solve real-world problems. In 2021, crypto companies took invested capital and used it to build successful teams. With an increase in funding, crypto companies are now able to go toe-to-toe with top tech companies for talent, often paying equal salaries and offering greater potential upside.

What’s next?We are at an inflection point in history, where a better financial system is being built to replace the antiquated system. Talent is leaving the top companies of today to build the companies of tomorrow. 2021 was a massive year for the Bitcoin and crypto job market, and 2022 looks to be a continuation of the trend. As bitcoin and crypto continue to go mainstream, we can expect more companies to go public, more startups forming, and job openings continuing to grow at an exponential rate.

I hope this report was valuable for each of you. Hope you have a great start to your day. Talk to you tomorrow. - Pomp SPONSORED: Bitwise is one of the largest and fastest-growing crypto asset managers. As of December 31, 2021, the company managed over $1.3 billion across an expanding suite of investment solutions, which include the world's largest crypto index fund and other innovative products spanning Bitcoin, Ethereum, DeFi, and crypto equities. Whether you’re an individual, advisor, or institution, Bitwise provides intelligent access to crypto with your unique circumstances in mind. Visit www.bitwiseinvestments.com to learn more. Certain of the Bitwise investment products may be subject to the extreme risks associated with investing in crypto assets. Visit www.bitwiseinvestments.com/disclosures/ to learn more. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Dylan LeClair is the Senior Market Analyst at UTXO Management, a digital asset fund investing in the analog to digital transformation of money and the emergent financial system. In this conversation, we discuss bitcoin, on-chain metrics, market structure, and what to expect from the rest of the bitcoin bull market. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber. |

Older messages

Long-Term Investors Have Less Stress

Thursday, January 27, 2022

Listen now (5 min) | To investors, Financial markets can be crazy at times. The complexity of an economy makes it nearly impossible to predict what will happen in the short and long-term. Humans are

David Swensen, the Greatest Institutional Investor of All Time

Wednesday, January 19, 2022

To investors, I am constantly trying to learn as much as possible about the best capital allocators in the world. This focus intersected nicely with my wife's recent work on former Yale Chief

Competition Instead Of Conflict

Tuesday, January 18, 2022

Listen now (7 min) | To investors, I was recently listening to a conversation between Joe Rogan and General HR McMaster, a retired United States Army lieutenant general who served as the 26th United

Politicians Don't Want To Ban Bitcoin. They Want To Ban Central Bank Digital Currencies.

Thursday, January 13, 2022

Listen now (5 min) | To investors, Bitcoin critiques have been proposing the idea of a government ban for the digital currency over the last decade. Their argument is that bitcoin threatens the US

Who Owns Web3?

Monday, January 3, 2022

Listen now (6 min) | To investors, The phrase “Web3” has taken the technology world by storm. It is used to describe the next iteration of the internet, which includes the belief of Web3 proponents

You Might Also Like

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But

Startups gear up for EU defense surge

Sunday, March 9, 2025

Also: Female founder face anti-DEI wave, our Global Markets Snapshot wraps up February's action & more Read online | Don't want to receive these emails? Manage your subscription. Log in The

Sunday Thinking ― 3.9.25

Sunday, March 9, 2025

"Whenever honesty is missing, walls slowly start appearing."

🚨 Weekend Wrap-Up: Chatbots Are Stealing 96% Of Your Clicks

Sunday, March 9, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 How to create a unicorn

Sunday, March 9, 2025

Vanta opens up about building a security game-changer. 🔐

Brain Food: Guts Over Brains

Sunday, March 9, 2025

Your reputation isn't just what people say about you—it's the position from which you make every move. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Recruiting Brainfood - Issue 439

Sunday, March 9, 2025

50 Thoughts on DOGE, World Energy Employment Report, a self updating spreadsheet with Real Time TA jobs, the psychological injury of being laid off and why AI Agents need to be KPI'd... ͏ ͏ ͏ ͏ ͏ ͏

+49% increase in cart adds (funny A/B test)

Sunday, March 9, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

🦸🏻#13: Action! How AI Agents Execute Tasks with UI and API Tools

Saturday, March 8, 2025

we explore UI-driven versus API-driven interactions, demystify function calling in LLMs, and compare leading open-source frameworks powering autonomous AI actions