Earnings+More - Feb 9: Kindred loosens ties with Kambi

Feb 9: Kindred loosens ties with KambiKindred, Evolution Q4, Gambling.com trading update, Super Bowl betting forecasts, Wells Fargo sector update +MoreGood morning. In the newsletter today:

Push the button… Kindred Q4

Packing up, shacking up is all you want to do: The big news broke last night when Kindred and Kambi each put out press releases announcing the split. Kindred said the in-house sportsbook stack would be developed from its existing racing platform. Henrik Tjärnström, CEO said on the call with analysts the company wanted to “take the next step”.

Take back control: Tjärnström emphasized that Kindred would gain differentiation, the ability to scale, security of supply and agility and control of the sportsbook roadmap. “The KRP is the perfect launchpad,” he added, noting that it already accounted for 10% of group revenues.

Antidote: Kambi’s press release made mention of now being able to pay back the ‘poison pill’ convertible bond taken out when it first split away from Kindred. “The current agreement remains in place with the convertible still there,” said Tjärnström. ”In addition, there are security-of-supply conditions.” Blame game: Kindred had previously warned on Q4 revenues and EBITDA and today Tjärnström laid out a smörgåsbord of excuses for the hit across all major metrics, variously blaming the Netherlands exit, the sporting schedule (the occurrence of French open and, perhaps bizarrely, the US presidential election in Q420), the Q4 Omicron outbreak and currency movements.

Sidestep: Tjärnström noted Kindred had dialed back on its U.S. efforts in the face of the recent promotional and marketing onslaught. U.S. revenue suffered as a result, down 5% QoQ.

On social  Kambi @KambiSports Kambi signs contract extension with Kindred Group, taking the partnership up until at least the end of 2026. In addition, Kambi earns option to prepay the convertible bond Kambi issued to Kindred in 2014, which will provide Kambi will full independence. https://t.co/KfvwJjUP9CNOTE: Kambi is set to release its own Q4 earnings on Friday. ** Sponsor’s message: Venture capital firm Yolo Investments is home to €350m of equity in more than 50 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 28-company, €135m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high-roller live casino brand, Bombay Club. As a proud sponsor of Earnings+More from Wagers.com, Yolo Investments wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat. Evolution Q4

Heavy load: Management stressed the group’s revenue growth had happened at the same time as it had nearly doubled staff numbers to 13,000 over the past 18 months to increase capacity, integrate 30% of its clients to its ‘One-Stop-Shop’ (from current 10%) and launch new games. CFO Jacob Kaplan acknowledged U.S. capacity was underserved currently, but with U.S. staff numbers up to 1,500 he said it was expanding as fast as it could. Gradual ramp: Kaplan added that the markets should take a longer-term view of the issues. Once “seamless integration” to the OSS is ready, “customers will connect in one place” and go live much quicker, “but we don’t expect in one go, it will be a more gradual impact”. What they say:

Asia not so minor: Carlesund said nothing had changed in response to allegations of regulatory breaches published at the end of last year and the group continued to be in regular contact with the New Jersey DGE.

The allegations had little impact on revenues, he added, and Evolution was “still small in Asia”. Revenues from regulated markets had gone up 3% to 41% in Q4, even if nearly a third (€91m) originated from Asia. Paranoid Android: Evolution has €421m in cash but CFO Kaplan said the focus would remain on paying out ~€300m earmarked for dividends. On the possibility of carrying out M&A, he said Evolution would “listen and look, but the main strategy is organic growth”. The group's Great 88 project will see 88 new games launched in 2022. “We’re always on our toes, paranoid as ever,” added Carlesund. Gambling.com trading update

Driving the news: CEO Charles Gillespie said 2022 had got off to an “incredibly strong start,” before consolidating revenues from its recent acquisitions RotoWire and NDC Media (BonusFunder.com). The statement said Jan22 was the group’s single biggest monthly revenue performance. Missing the mark: Analysts noted, however, the revenue guidance was below Street estimates at midpoint of 3% while the forecast adj. EBITDA was off by up to 7%. Worse, they noted free cash flow of between $8m-$8.5m was “well below” Street estimates of $31m.

Tuck shop: Analysts at Jefferies said the RotoWire and NDC deals were consistent with previous commentary about one or two “tuck-in acquisitions’ per year in the range of $20m-$50m.

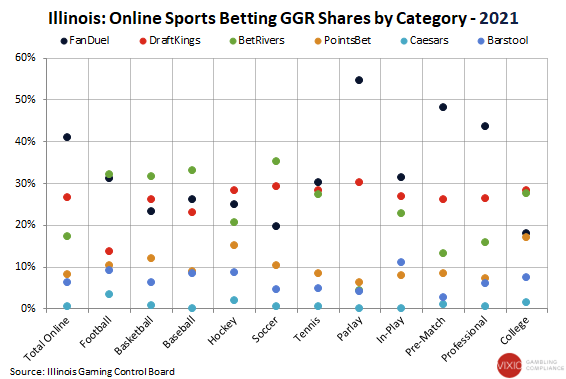

Super Bowl betting forecastsCoin toss: Ahead of kickoff on Sunday, the AGA said yesterday total wagering across legal retail and online sports-betting as well as casual betting and squares contests would hit $7.6bn, up 78% from last year. Note: Wells Fargo earlier this week predicted total regulated sports-betting wagers would be $800m+, up from $486m in 2021. It suggests the casual betting element of the AGA’s forecast is doing a lot of the heavy lifting. Wells Fargo sector updateFour things to note: Looking at Q4 and the FY21 trends in U.S. sports-betting, the team at Wells Fargo come up with key takeaways:

US OSB app downloads - Jan22The numbers:

App download market share - Jan22 ⬆️ FanDuel up 39% vs. 33% (MoM) ⬆️ Caesars up to 24% vs. 14% ⬇️ DraftKings down to 22% vs. 26% ⬇️ BetMGM down to 9% vs. 12% Earnings in briefSportech said FY21 group Adj. EBITDA would be in line with expectations, although the contribution from its Dominican Republic lottery contract (Leidsa) would be removed following its sale to Inspired Entertainment in January. Cash on the balance sheet at year-end stands at ~£21.75m. DatalinesRhode Island Dec21: Handle came to $31m and GGR fell 82.1% to $1.2m, a five-month low. Casino revenues for the state’s Twin River Lincoln Casino Resort and Tiverton Casino was $6.1m for both establishments, revenues came to $326K and $275K respectively. NewslinesAccess point: Fubo Gaming has secured market access to Ohio via a deal with the Cleveland Cavaliers. The deal was prefigured by the official marketing partnership signed in October. The Fubo Sportsbook will launch pending regulatory approvals. Northern exposure: Canadian sports-betting content provider Parleh Media Group has announced an exclusive partnership with NorthStar Gaming ahead of the launch of the Ontario market in April. Content will be syndicated across NorthStar parent Torstar’s media assets including the Toronto Star. Hunger games: Hungary is set to regulate its online-betting sector and will be putting forward a bill that would enable commercial operators to apply for a license in the country and compete with the state monopoly Szerencsejáték Zrt. A €1.7m licensing fee will apply. Makers mark: BetMakers will supply its sports-betting solutions to CrossBet for the sportsbook’s upcoming Ontario market launch. The two groups are already partners in their home market of Australia. What we’re readingBonzo dogs: “Bonham was Led Zeppelin, in this ability to land heavily and lightly at once.” What we’re listening to: Is crypto trading creating a new generation of addicts? On social  Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Feb 8: Entain strikes an Avid deal

Tuesday, February 8, 2022

Entain buys Avid, Aristocrat debt rating, Everi ecash acquisition, Maryland Jan22 +More

Feb 6: Boyd could be bolder, say analysts

Monday, February 7, 2022

Boyd analyst review, New York & Illinois data, PointsBet's good week, Madison Square Gardens Sports earnings call, startup focus - Low6 +More

Feb 4: Weekend Edition no.32

Friday, February 4, 2022

Penn National analyst reaction, Boyd Gaming Q4, sector watch - streaming, TMX webinar +More

Feb 3: Penn reports ‘in shadow of sideshow’

Thursday, February 3, 2022

Penn National Gaming Q4, Red Rock Resorts Q4, Playtech takeover saga, boom in sports betting TMX webinar, Macau update +More

Feb 2: Playtech decision day

Wednesday, February 2, 2022

Playtech decision day, Gamblng.com acquires BonusFinder, XLMedia trading update, Entain/Ennovate launch, Penn National analyst update +More

You Might Also Like

A strategy to help customers choose you

Monday, December 30, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's Still Need to Do Day, Reader... Do any of us need this pressure in our

Suing Amazon? Not legally possible [Roundup]

Monday, December 30, 2024

Here's your chance to win our best-selling "How to Find a Product to Sell on Amazon" course for FREE by answering our Amazon Software Poll. Hey Reader, Got your Amazon account suspended?

Make SEO great again

Monday, December 30, 2024

More than 45 billion searches take place on the internet each day. 8.5 billion of them are on Google – which means a lot of your potential traffic is hanging out on other platforms. One of the key SEO

Models, Pizza & Synergy (Prizes Still Available)

Monday, December 30, 2024

The EXACT business model he used to ditch the “9-to-5” life and become a full-time online business owner View in browser ClickBank Steven Clayton and Aidan Booth, two of ClickBank's top vendors,

Just be Average

Monday, December 30, 2024

It's not about timing the market; it's about time IN the market.

Business Sellers – What are Qualified Buyers?

Monday, December 30, 2024

THE EXIT STRATEGIST Business Sellers - What are Qualified Buyers? If you are a business owner considering selling your business most likely you will interview several business brokers or merger and

Happy Q5 😘

Monday, December 30, 2024

The end is just the beginning.

Be Where Your Feet Are: A Championship Season Marked by Courage and Presence

Monday, December 30, 2024

Adversity is not the final act—it is the beginning of something greater, something far bigger than ourselves.

AI model prompts record funding

Monday, December 30, 2024

A 'Goldilocks year' for private credit; discounts on startup secondaries fade; cybersecurity VC funding returns to growth Read online | Don't want to receive these emails? Manage your

🔔Opening Bell Daily: No bad days in 2025

Monday, December 30, 2024

Optimism is soaring as every major forecaster expects the stock market to climb again next year.