MicroAngel State of the Fund: January 2022

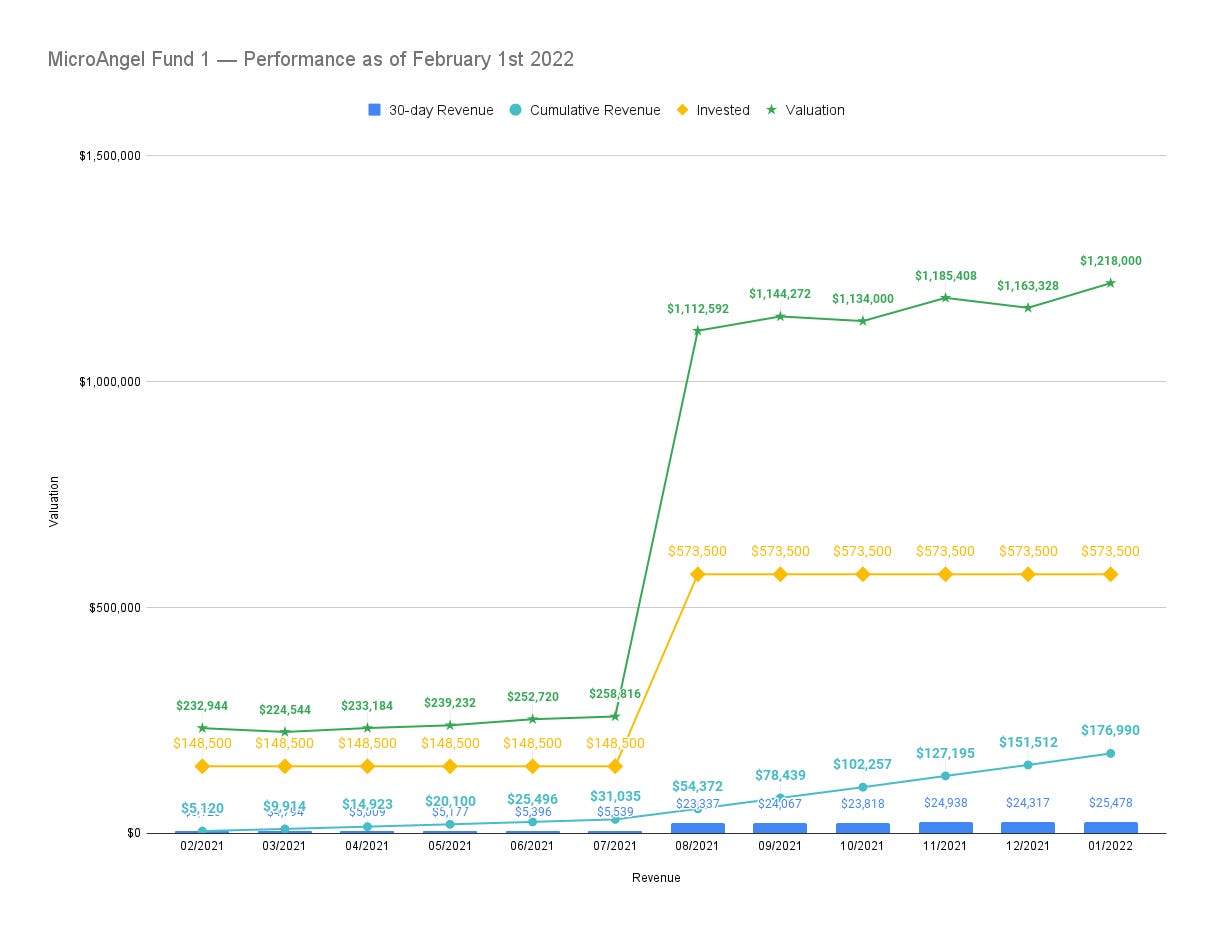

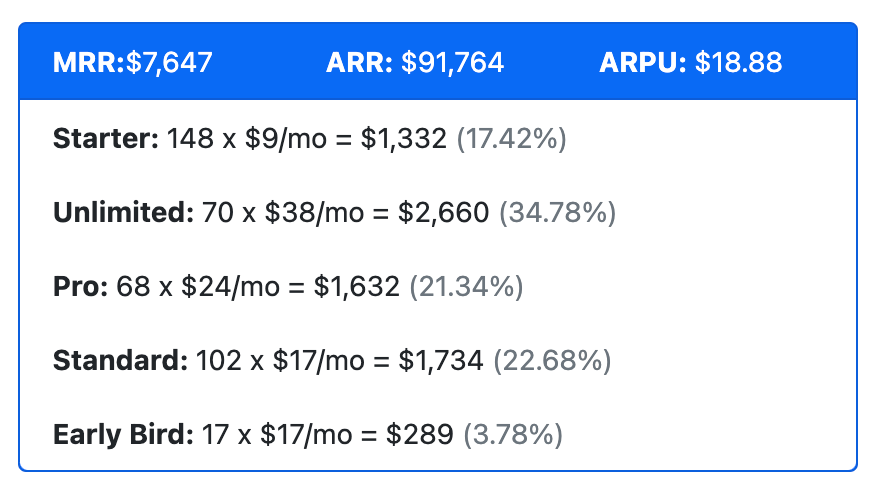

Hey! Eyal from MicroAngel here. Every now and again, I release free deep dives like these to newsletter subscribers. If you get value from them, consider supporting the newsletter so I can continue sharing the journey and my results along the way. Enjoy! MicroAngel State of the Fund: January 2022One year anniversary, $300K ARR and 30% cash-on-cash milestone, and a focus on growth systems. Closing MRR: $25.37kGood morning and evening to you, and thanks for once again checking in on what has just turned into a year old experiment. It’s our birthday!  A year ago (!!), this experiment started when I got sick of having to choose between bootstrapping through an indeterminate amount of pain and time or having to raise venture funds at unfavourable terms before having market/product-fit just so I could build a team, go fast, and break things (my health). While I plan to explore some of the learnings I’ve accumulated over the past 12 months, today’s (shorter than usual) post focuses on the work that was done this month to graduate from Improving the products to Growing them nearly full-time. I managed to tear myself from code and begin building out a variety of growth systems that will play crucial roles as we aim to accelerate the portfolio’s run rate moving forward. My goal this month was to take inventory of our growth systems, their status, and where I ought to spend my energy first. It was very important to put coding pencils down and to begin investing in what really matters: figuring out how to repeatably and consistently sell what we produce. As the days go by and we remain laser-focused on what we’re doing, I didn’t realize it had already been a whole year of working on the MicroAngel project. It took me 6 months to fully field my capital and another 6 months to get the products in a place where I feel comfortable pressing on the gas as it relates to growth. So far, the entire journey has gone in the general direction I was hoping for. We’ve just passed $300k in annual recurring revenue, and the $177k we’ve collected over the past year represent a 31% cash-on-cash return against the funds we’ve invested over the year. To any real-estate folks reading, there’s no typo in the number. I didn’t miss a decimal separator. We returned nearly one-third of our invested capital within 12 months of investing it. If you think that’s insane, so do I. But it proves once again that there exists a third entrepreneurship option between bootstrapping and venture funding that skips the painful 0 to 1 process and foregoes the stress implied by starting to burn a bunch of runway to hopefully reach market-product fit. The entire point of this experiment is to prove there is a better way than to burn your runway down to zero trying to succeed. Instead of burning your nest egg to reach market-product fit with your project, use it to buy a working project that you can hold/grow while working on your side-project. The point is to reset the risk of bootstrapping by getting paid by your investment while its value grows and while you search for market-fit with the project you really care about. Then sell your investment and dump the proceeds into the side project that recently achieved market-product fit. Then go FT on it without any external pressure or worry as it relates to runway, since PMF shows you a clear path to profitability (as you’ve got a working product serving a market that accepts the product). In the meantime, this month created some of the best momentum we’ve managed to get since the experiment kicked off. As Eric took full ownership of the product roadmaps moving forward, I graduated fully to growth & marketing, and set the stage for a variety of initiatives that are sure to raise the tide. Onwards!

Current fund lifecycle stage

Fund Activity

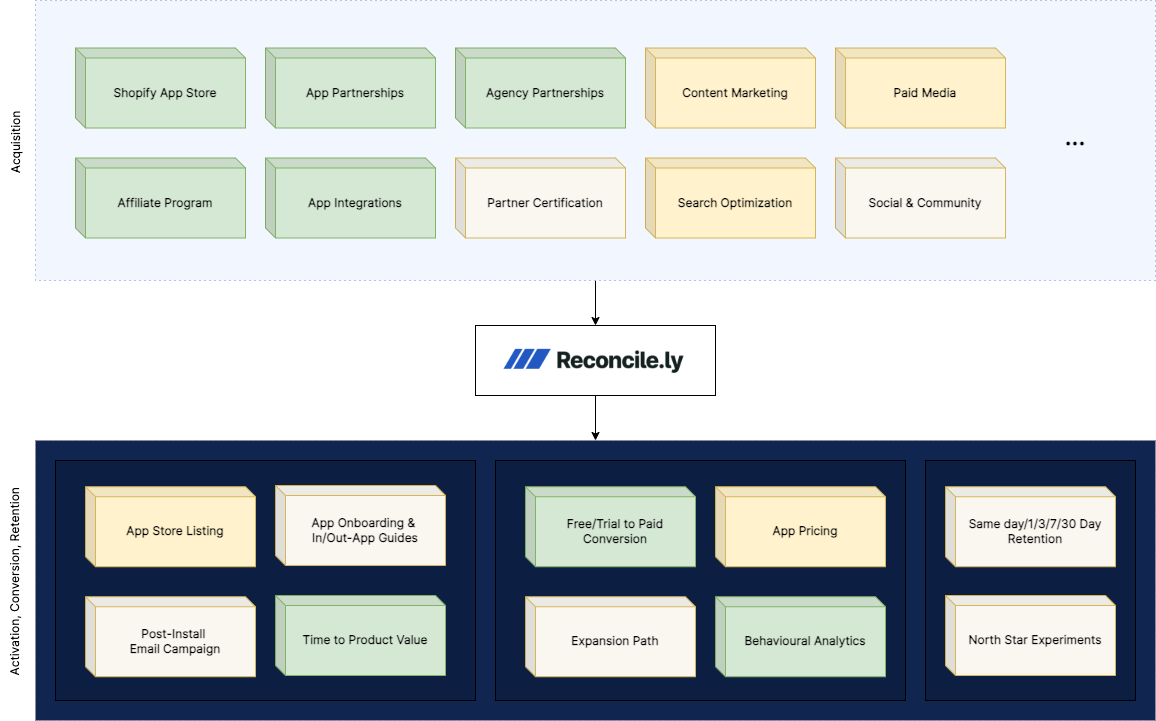

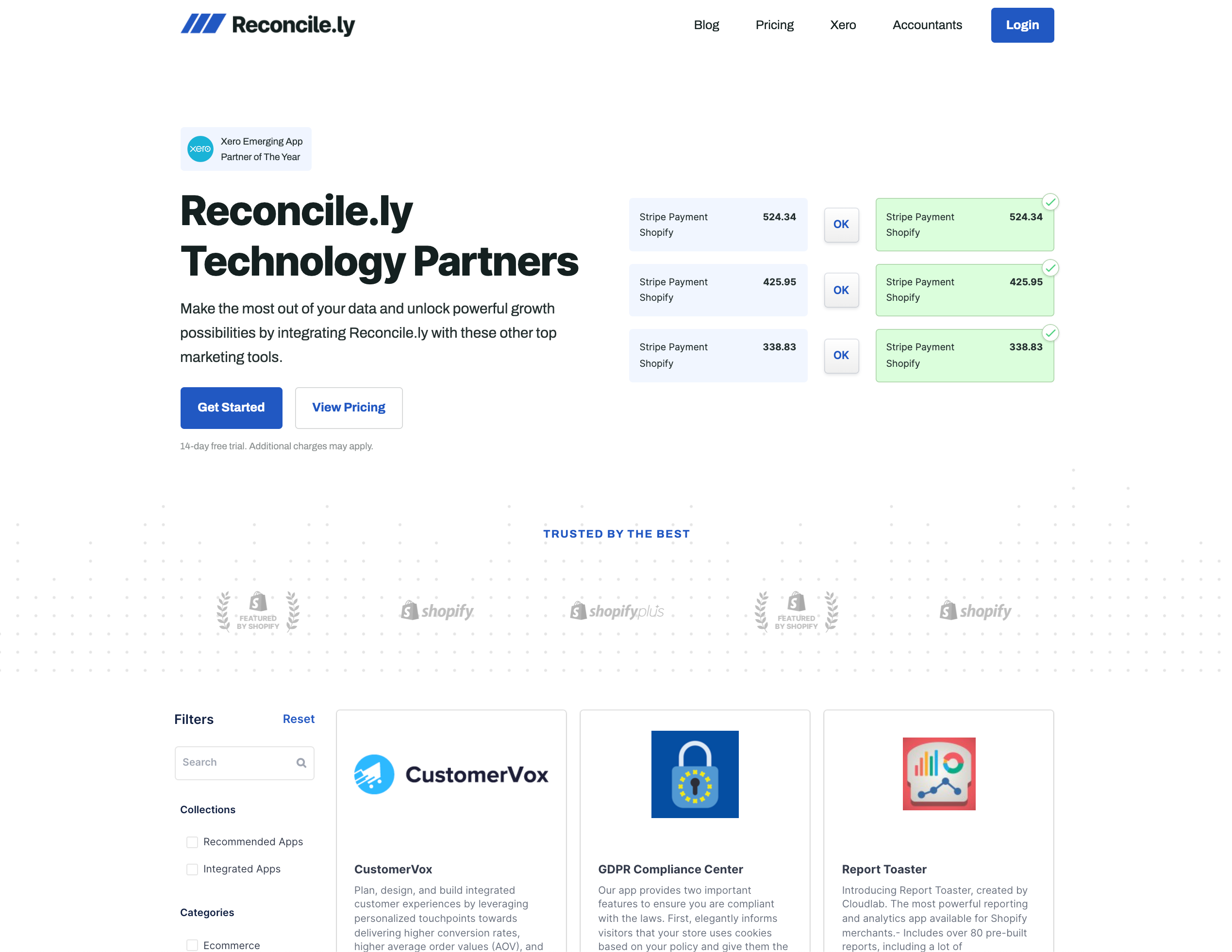

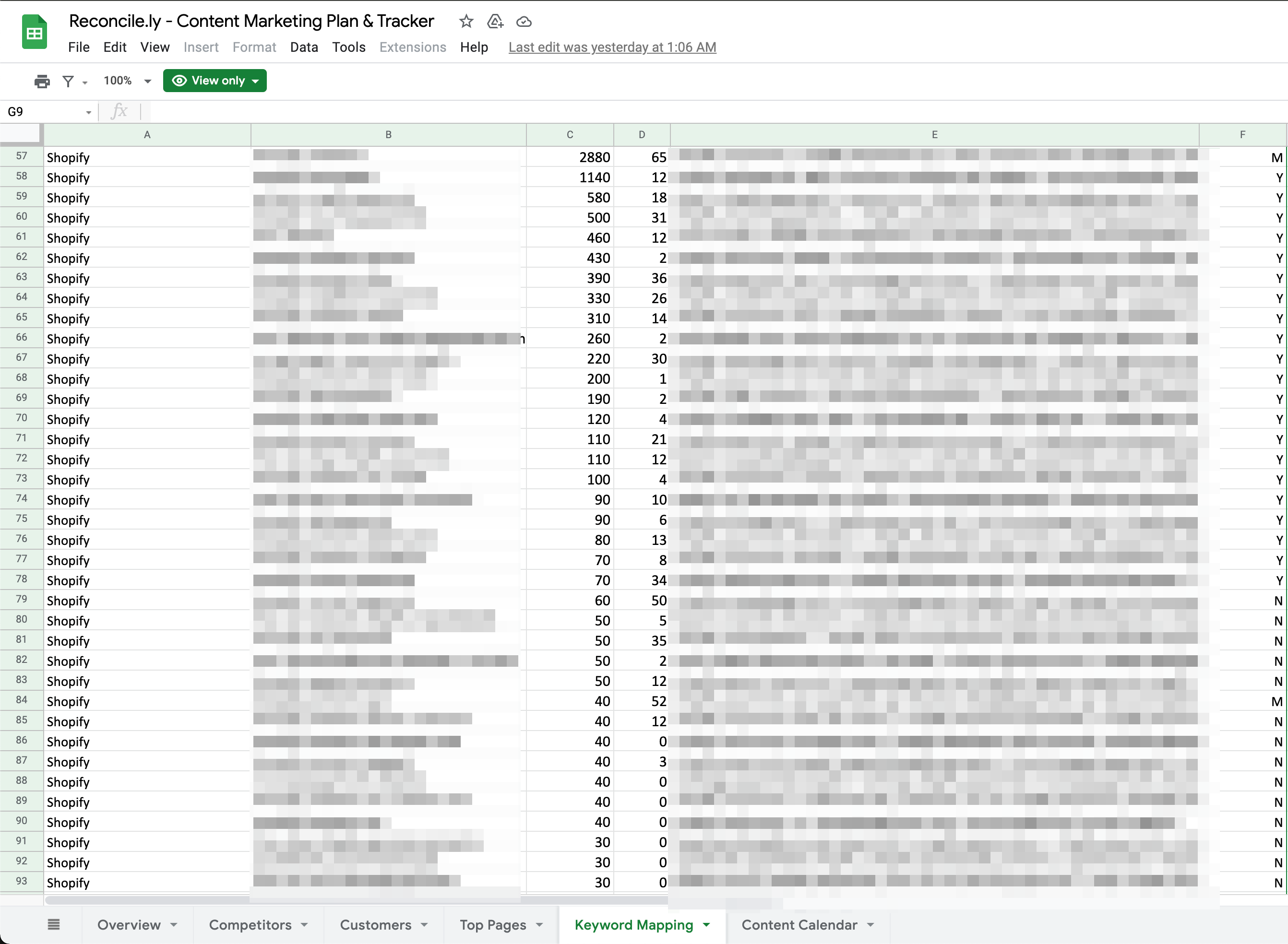

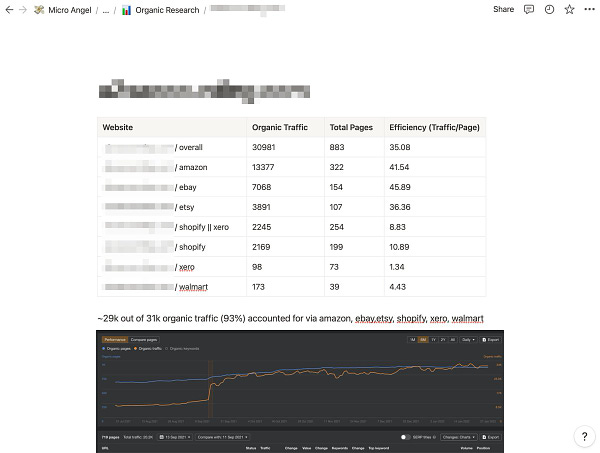

As we kickoff the second year of the experiment, we’re officially entering the Growth phase. And none too soon! Glad to be posting a nearly ~5% growth rate this month despite a reasonably slow start to the year. At this point, most if not all of the activities I’m concerned with have some level of influence on our ability to grow revenue based on new user acquisition or existing customer expansion. In that regard, I kicked off a variety of new growth systems that have a high affinity to create good movement for the apps, and which raise their value on the basis of the future potential they represent. While a future buyer will benefit greatly from buying into the incredible products we operate, their return will amplify thanks to the available channels at their disposal from day zero. This advantage will translate into greater valuation multiples if I can get one or more of our marketing systems to produce a reliable stream of user acquisition, as the future buyer would now have a very clear path to rapidly scaling operations without the need for any additional experimentation. There are opportunities to expand the number of products we own, but I’m unsure if I want to take on anything that might jeopardize the momentum we’ve worked hard to kickoff and accelerate so far. For now, my focus is on executing my growth plan for each of the products by layering systems on both the top and bottom of the funnel one atop the other to ultimately accelerate the run rate. Reconcilely & Postcode ShippingInstalls have started to move a little bit but I’m still pretty unimpressed by the app store in general. It’s important that I review our keyword strategy and give the app listings and app store ads a refresh to reflect some of the new functionality we’ve released in the last few months. But before getting too deep into details, I took stock of the ammunition at the disposal of each product to better understand what systems need to be created, and what the status of future tasks are so I can ignore them in the short-term and focus on what I’m concerned with at a given point in time. Growth strategyI organized everything on a little canvas divided by the moment in the lifecycle when a visitor becomes a user. In the end, I ended up kicking off more than a few systems thanks to different partners in the Shopify ecosystem whose tools made it possible to move fast. If you’ve got a paid membership, take a look at the general approach I’ve chosen to take with Reconcilely growth strategy and how I’ll increase my odds of successfully executing and finding the user acquisition channel that will produce the lion’s share of our future growth. Affiliate & PartnershipsWe kicked off App Partnerships, Agency Partnerships and Affiliate Programs by using PartnerPage and Shoffi to power our partner directories and affiliate tracking. The technology and partner directories will be going live shortly on the new Reconcilely website: That unlocks a whole new layer of interaction with app partners. I’m very excited to be launching with over 10 recommended apps in the directory.   The process of securing partnerships is fairly straightforward if you can clearly communicate the value your can create for the merchants of the apps you intend to partner with. This is the golden area in my eyes: when apps create value in the workflow for the same kinds of merchants, there’s an opportunity to connect the dots for the merchant to unlock further value through the symbiosis of the two apps. Affiliate ManagementSince it will make sense to compensate our preferred partners with a commission anytime they drive installs, I also took the opportunity to set up another acquisition channel through affiliates. That opens up dedicated outreach to other affiliates and publications who reach our target market and would be interested in building a recurring commission profile. We also signed on our first affiliate for Reconcilely, an encouraging result considering the affiliate program isn’t yet live.   Setting up was pretty much a breeze here. Itay and the team behind Shoffi have done an excellent job of creating a two-sided marketplace which reduces the barriers of entry for both sides. I can set up an entire affiliate system without having to build infrastructure. All I needed to do was set up a POST request in the product whenever a new install comes in (so they know when a conversion takes place). Affiliates in turn discover new products that are using Shoffi through the platform itself, which leads to affiliates signing up for your program without you having to lift a finger. These are the kinds of systems that can have a decent impact on the top line without having required a huge up-front energy or money investment. Content MarketingWith the new website going live shortly, it made sense to revisit my organic research and formalize the keyword groups we’ll be looking to go after through content. As recently shared on Twitter, I discovered how frighteningly big the Reconcilely opportunity is with respect to sales channels beyond Shopify.   Though my product cannot serve traffic looking for features my product is unqualified to deliver against, I can still create useful resources for that traffic. The process of doing that crystallizes the needs of that market as the content you create is trying to accurately respond to a search query with the correct content type for the occasion. That and installing Reconcilely for ecommerce accounting automation is a totally different thing. And I can likely afford to kickoff the process of building that infrastructure as I warm my engines to deliver the product features to support them. The obvious low hanging fruit of Shopify<>Xero keyword groups will be Step 1, but we now have a clear path to create valuable content that will attract the exact kind of merchant the products need presently and moving forward in the future. I’m expecting to outsource some of the content creation itself so I can create a large number of pages within a reasonable amount of time. My goal is to simply show up for every single one of these themes, which in every way you slice it, will be a net positive. Then I can optimize. Learnings and adjustmentsNo changes. Just execution. I want to get as many of these systems up and running as quickly as possible so I can spend more time optimizing than building. There’s a familiar feeling involved in any external marketing communications work that you don’t get when you bucker down and start writing code. Things I do to create positive momentum have a reflective capacity to energize me and further motivate me to double-down and increase throughput. Things that I had previously put down for fear of losing focus now take up all of my focus. Because of a methodical culture of disciplined action, I get to really appreciate the actual craft at any given stage, rather than constantly trying to find the time to get things done. In February, the second half of my user acquisition roadmap will complete and usher a new era for the products. I’m excited to push the pedal to the metal, and as always, it’s my honor to have you join along for the ride. Until next time! You’re on the free list for Micro Angel. If you get value from what you read, consider supporting the newsletter. |

Older messages

MicroAngel State of the Fund: December 2021

Tuesday, January 18, 2022

Seasonal MRR and user acquisition fluctuations, Black Friday + Cyber Monday and deep product work. Closing MRR: $24115

MicroAngel State of the Fund: November 2021

Friday, December 10, 2021

Cash-on-cash wins, shipping product improvements, removing zombie accounts and a brand refresh. Closing MRR: $24.7k

How to plan and implement a customer data tracking strategy for your Micro-SaaS

Tuesday, November 16, 2021

From start to finish, learn how I'm tracking customer key events and behaviour across the portfolio

MicroAngel State of the Fund: October 2021

Saturday, November 6, 2021

A spooky month of large refactors, churn & support team tooling. Reached $100k+ Cash on cash. Closing MRR: $24k

MicroAngel State of the Fund: September 2021

Thursday, October 7, 2021

Building/training team, expanding Shopify ad spend, reorganized & improved Reconcilely code & paternity. Closing MRR: $24.8k

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved