The Bitcoin Espresso☕#15 — The Russo-Ukrainian War, Buying Your First Satoshis

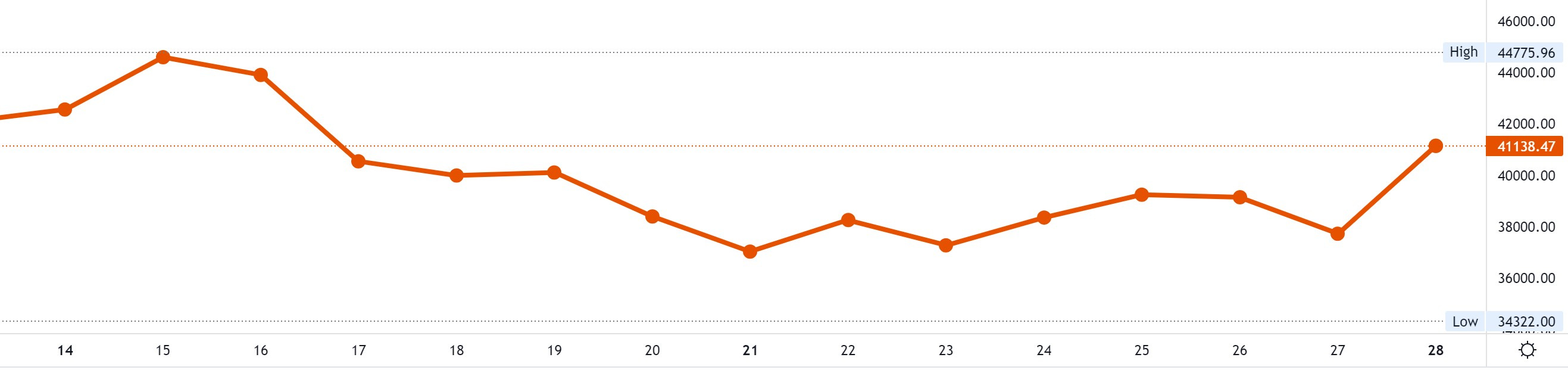

Welcome to this week’s The Bitcoin Espresso! Whether you’re interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is for you. Find out more about the motivation behind this newsletter in the introduction post. Want more news? Follow @thebitcoinespresso on Twitter to stay on top of things between newsletters. Weekly Summary: Bitcoin’s price is currently firmly in the grip of macroeconomic forces like the Russo-Ukrainian War. Today’s topics include a Bitcoin perspective on the topic, as well as Bitpanda acquiring Trustology, and the Coinbase SuperBowl ad. This week’s focus topic is about buying Bitcoin/your first satoshis. 📰 Essential NewsThe Russo-Ukrainian War: I firmly believe that I am neither the right person nor is this newsletter the right place to write about this topic from a general perspective. Furthermore, I will not engage in investment speculations for such critical global events. Nevertheless, I can point out some technological properties specific to Bitcoin that can be worthwhile for you to consider. Mykhailo Fedorov, the vice prime minister of Ukraine and minister of digital transformation, tweeted that parliament has adopted a new law on virtual assets, legalizing exchanges and cryptocurrencies. Kuna, a Ukrainian cryptocurrency exchange, has seen a 3x increase in trading volume since then. Allowing Ukrainians to own an asset like Bitcoin that they can have self-custody over (owning it without any third party controlling it) seems prudent given the current crisis. The most minimalistic way to store and transport your Bitcoin is by remembering a word phrase — the “seed phrase.” Accessing your Bitcoin can be done with just a smartphone and an internet connection. Please take a moment to consider how crucial this low barrier of (re-)entry is for adverse scenarios. Bitcoin is independent of other monetary networks. It works even when international payments are blocked or when accessing ATMs means standing in long lines (if they even have any money left). For more content in line with this reasoning, I can refer to this 2-minute video from Alex Gladstein on why Bitcoin matters for human rights. Bitpanda acquired Custodian Trustology: Bitpanda, an Austrian investment platform offering a cryptocurrency exchange amongst other services, has acquired Trustology. Trustology, now rebranded as Bitpanda Custody offers custodial wallet services useful for cases where transacting, holding, and securing cryptocurrencies would carry too much risk or costs, such as for institutions. Coinbase Superbowl QR Code Ad: Coinbase ran an ad during the recent Superbowl with a color-changing QR code bouncing around the screen, reminiscent of when this was a DVD screen saver. The ad was highly successful, sending the Coinbase app to #2 on the iOS app store and overloading their website. 🎯Focus: How to buy Bitcoin/Your First SatoshisIf you’re new to Bitcoin, one of the first questions you will ask yourself is how to buy some. I’ve been hesitant to write about this much-requested topic because I didn’t want to nudge people to make an impulsive choice at a time of considerable hype and, therefore, a higher chance of making irrational decisions leading to loss. Now that we are on the “extreme fear” side of the fear and greed index, and the people buying right now are the most likely to have given their decision proper thought, I feel comfortable sharing how to get started. This is not a clickbaity “fastest way to buy Bitcoin in 5 steps” article, but one that gives you context for what you will experience. Enjoy! The first thing to know is that you can buy fractals of a Bitcoin (BTC). The smallest possible division of Bitcoin is called a Satoshi (sat) and represents 1⁄100000000 (one hundred millionth) BTC. This means you can buy BTC at any budget — you don’t need to buy a whole Bitcoin. But where do you actually buy Bitcoin? The first place most people get started is at a cryptocurrency exchange with a so-called broker. Brokers make it easy to buy and sell Bitcoin without having to learn about market orders — you can “Buy” and “Sell” at any time for the given $/€/… price. You register at the exchange and buy Bitcoin at the current price (with some fees) using money from your bank account, credit card, or other options. During registration, you will likely go through KYC/AML checks. These Know-Your-Customer and Anti-Money-Laundering procedures are required by most exchanges to comply with local laws and regulations. They allow exchanges to identify you and answer requests by universally beloved tax collectors. While this might give you pause, consider counterparty risks. Adherence to regulations is a sign that the company running the exchange has gone through considerable effort to comply with local laws, making it less likely that the exchange is going to disappear with your money (“get hacked”). After all, you don’t want the tools you use for trading to be a considerable risk factor. I urge you to make these choices consciously instead of hunting for the lowest fees and best offers as there is still high fraud potential in the scene. You know that I love to draw parallels between the 1990s Internet and Bitcoin, so here’s today’s: It’s like ordering on the Internet back then, where fraudulent online shops delivered bricks instead of what you wanted or straight up took your money but delivered nothing. It’s worth your time to identify legitimate exchanges to reduce counterparty risks. So, what makes for a good cryptocurrency exchange for people to buy their very first Satoshis? I would consider the following categories:

So, given these categories, what exchange is a good choice for buying your first BTC? I considered giving you a recommendation right here, but I believe the best path for you is to do your own research with this guide as a reference. You will need this skill of applying a healthy dose of skepticism to your possible choices for the cryptocurrency space. In one of the future editions, I’ll be back with an analysis of a cryptocurrency exchange for you to compare your findings with on the way to buying your first satoshis. Are you still looking for more to read? Subscribe to Refind and get 7 new links tailored to your interests every day, curated from 10k+ sources. Did you like this edition? Share it with someone! And if you haven’t yet, sign up for The Bitcoin Espresso now! 💡 Fundamentals GlossaryAltcoins … Alternative cryptocurrencies to Bitcoin are called altcoins. Crypto … Common abbreviation of the whole cryptocurrency space, which goes beyond digital currencies and also spans across decentralized finance (DeFi), non-fungible tokens (NFTs), and many other innovations. Cryptocurrency … A digital currency that uses cryptography to prevent counterfeiting and fraudulent transactions. There are other cryptocurrencies besides Bitcoin. Satoshis (sats) … smallest possible division of Bitcoin: 1⁄100000000 (one hundred millionth) BTC Do you want me to tackle a particular topic? Or do you want to tell me how The Bitcoin Espresso is doing? Give feedback or comment on this post to make this the best newsletter possible. The Bitcoin Espresso does not constitute financial-, tax- or investment- advice, nor is it an offer or invitation to purchase any digital assets. You are solely responsible for your own investment decisions. The Bitcoin Espresso is for general purposes of information only and no representation or warranty, either expressed or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness, or correctness of this article or opinions contained herein. Some statements contained in this article may be of future expectations that are based on our current views and assumptions and involve uncertainties that could cause actual results, performance, or events that differ from those statements. |

Older messages

The Bitcoin Espresso ☕#14 — KPMG Purchased Bitcoin, The Lightning Network⚡

Friday, February 11, 2022

Welcome to this week's The Bitcoin Espresso! Whether you're interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is

The Bitcoin Espresso ☕#13 — India Announcing 30% Crypto Tax, Biden Administration Crypto Strategy & NFT Intro

Wednesday, February 2, 2022

Welcome to this week's The Bitcoin Espresso! Whether you're interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is

The Bitcoin Espresso ☕#12 — Rio Investing in Bitcoin, Intel entering Mining Business & Bitcoin’s Energy Use and th…

Saturday, January 22, 2022

Welcome to this week's The Bitcoin Espresso! Whether you're interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is

The Bitcoin Espresso ☕ #10 — EU Crypto Regulations & What happens when all 21 million Bitcoin have been mined?

Friday, January 21, 2022

Welcome to this week's The Bitcoin Espresso! Whether you're interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is

The Bitcoin Espresso ☕ #11 — Lightning, Paypal, JPMorgan & Reporting Tax with Accointing

Friday, January 21, 2022

Welcome to this week's The Bitcoin Espresso! Whether you're interested in Bitcoin, have just bought your first fractions of Bitcoin, or want to dive deeper into the space — this newsletter is

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%