With crypto, wait for greed and you’ll get it

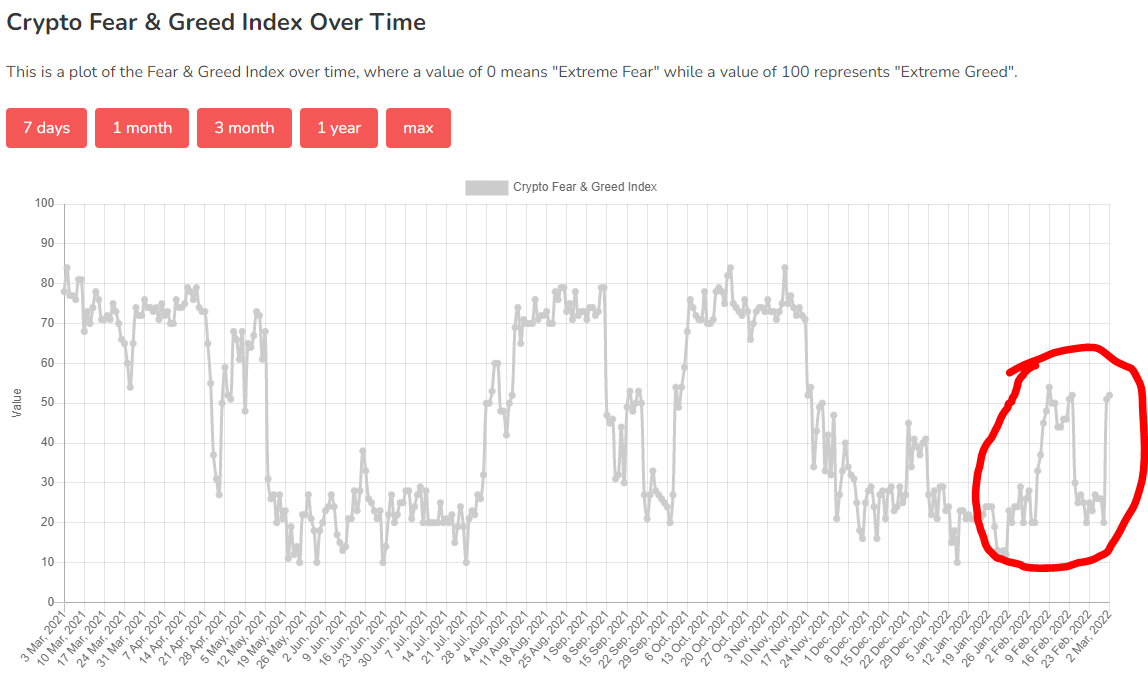

What happened to bitcoin? We didn’t get supercycle in 2021. Bitcoin’s price didn’t even reach $100,000! And many altcoins only gave you gains of 500% or less. Some are even lower now than last year. What happened to laser eyes? Where is my 100x altcoin? Now, bitcoin’s price has gone up 33% since the end of January, just had a 15% pump, and people think it’s about to fall off a cliff. I want my money back. All things come, in timeNo worries if you bought in October or November. You’ll be fine, possibly sooner than you might think. Try to push through the terror of the moment. Eventually, you will find the ecstasy you seek. In November and December, we shed some institutions and summer tourists. In December and January, we shed some whales and leveraged traders. Last month, we shed defensive profit-takers and got rid of some panic-sellers while institutions trickled back in, some peak sellers re-entered, small wallets got bigger, and diamond hands gobbled up whatever bitcoins remained. I covered this for paid subscribers of my Crypto is Easy newsletter. After almost two months of fear, bitcoin’s Fear and Greed Index has started poking its head into “greed” territory. Delayed FOMOficationWhile it may take a while to get back to a new all-time high, the market cut a lot of dead weight over the past few months. What do you think will happen once the market turns bullish again? Now that the smart money and true believers dominate the market? As always, once prices go up long enough for people to think they’ll keep going up, you’ll see the money pour in. Except unlike the people buying now, these new people will not care about bitcoin. They plan to use it to make more of their government’s money. At that point, you’ll see the greed come out. All those bearish charts and disparaging tweets will turn bullish. Laser eyes will return. You’ll hear about supercycles, flippenings, and data models again. So-called maximalists will talk less about freedom, more about wealth. Greed will return. The question is, what will you do when it does? Will you sell to somebody trying to flip bitcoin for some fast cash? HODL on the way up, at the risk of sitting through the multiyear bear market that comes after? Buy a little more with each new all-time high? Dollar-cost average into a rising market? Think about this now. It may still feel like a bear market, but bitcoin’s been known to explode to the upside faster than you can say “bull trap.” The FOMO is inevitable, it’s only a question of when. Plan now for what you’ll do when it comes. This market may not let you wait. Mark Helfman publishes the Crypto is Easy newsletter. He is also the author of three books and a top bitcoin writer on Medium and Hacker Noon. Learn more about him in his bio. Follow Me on Twitter.Learn how to earn…Become part of our community.Follow our socials.Subscribe to our podcast.Subscribe to this publication.

Comment & Earn!Share your thoughts and opinions on the topics covered within this blog in the comments below for your chance to win yourself an NFT. Click here for more information on our engagement rewards. If you liked this post from Cryptowriter, why not share it? |

Older messages

Round 31 Cryptowriter NFT Engagement Winners!

Tuesday, March 1, 2022

Top 10 Most Engaged Users Our analytics consider the total amount of likes, comments, and shares to determine the top 10 most engaged users across our entire publication. Most engaged winners receive 1

EOSweekly: Fractally Whitepaper, Earn EOS with Feedback on Blue Papers, and more

Saturday, February 26, 2022

TOP HEADLINES Fractally Whitepaper Released Here's (video) the much awaited TWOSDAY presentation of the Fractally whitepaper. You can read the document in full here. Maybe you'd rather get

You Are Missing the Point if You Think Bitcoin Technology Is Outdated and Will Be Replaced

Friday, February 25, 2022

Bitcoin's superiority lies in its currency, network, and infrastructure.

Charlie Munger Calls Bitcoin a “Venereal Disease” – Elon Musk Gives Him the Best Answer

Wednesday, February 23, 2022

Sorry, Charlie, the venereal disease is not Bitcoin, but the debt-based system you worship.

EOSweekly: Pomelo, Upland, ENF vs. B1, Dan, Pomelo, GenPool Spotlights Core+

Monday, February 21, 2022

ENF eases community concerns. Dan guides community brainstorming. Is Pomelo taking EOS mainstream? GenPool looks deeper into the motivation behind the Core+ blue paper. Upland introduced P2P

You Might Also Like

CryptoQuant CEO says US could feasibly cut debt by embracing strategic Bitcoin reserve

Thursday, December 26, 2024

Analysts see US Bitcoin reserve as symbolic step toward debt reduction, amid challenges and speculation. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Shen Yu's "Four Wallets" Strategy: A Guide to Crypto Investment Management

Thursday, December 26, 2024

This content summarizes an AMA hosted by E2M Research on Twitter Spaces, featuring Shen Yu (Twitter @bitfish1), Odyssey (Twitter @OdysseyETH), Zhen Dong (Twitter @zhendong2020), and Peicai Li (Twitter

Reminder: Bitcoin Hits A New ATH Once Again After Touching $108K

Thursday, December 26, 2024

Monday Dec 23, 2024 Sign Up Your Weekly Update On All Things Crypto TL;DR In this issue, we dive into: Bitcoin Hits A New ATH Once Again After Touching $108K Avery Ching To Become New Aptos Labs CEO As

Bitcoin sees brief rebound to $99,000 on Christmas day

Wednesday, December 25, 2024

Holiday excitement lifted Bitcoin past $99000, but it quickly corrected to $98000 where it still holds strong support. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Opinion: Market Panic After FOMC Shows Some Overreaction

Wednesday, December 25, 2024

Last night, the market experienced a significant pullback, primarily due to investor concerns over the Federal Reserve possibly shifting towards a more “hawkish” policy stance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s pro-crypto pledge could see day-one executive orders, industry players hope

Tuesday, December 24, 2024

A Bitcoin strategic reserve, access to banking services, and the creation of a crypto council are among the items on the industry's 'wishlist.' ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s 2024 Year in Review

Tuesday, December 24, 2024

A data-driven overview of events that shaped crypto in 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

OKExChain: Will the Federal Reserve and Jerome Powell Prevent the U.S. from Creating a National Bitcoin Reserve?

Tuesday, December 24, 2024

In the early hours of today, Federal Reserve Chairman Jerome Powell made it clear during a press conference following the monetary policy meeting that the Fed has no intention of participating in any

Crypto community cheers as Trump names pro-crypto advisors Stephen Miran and Bo Hines for economic and digital ass…

Monday, December 23, 2024

Trump fosters economic expansion and digital innovation with Miran and Hines at the helm of economic and crypto councils. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 BTC-to-Gold ratio hit a historical peak on 17 Dec; Crypto.com renewed its partnership with Formula 1 until 2030

Monday, December 23, 2024

BTC-to-Gold ratio hit a historical peak on 17 Dec; Crypto.com renewed its partnership with Formula 1 until 2030; Crypto.com and the Philadelphia 76ers unveiled Web3 mobile game 'Spectrum Sprint