Why the Crypto Market Always Seems to Let You Down

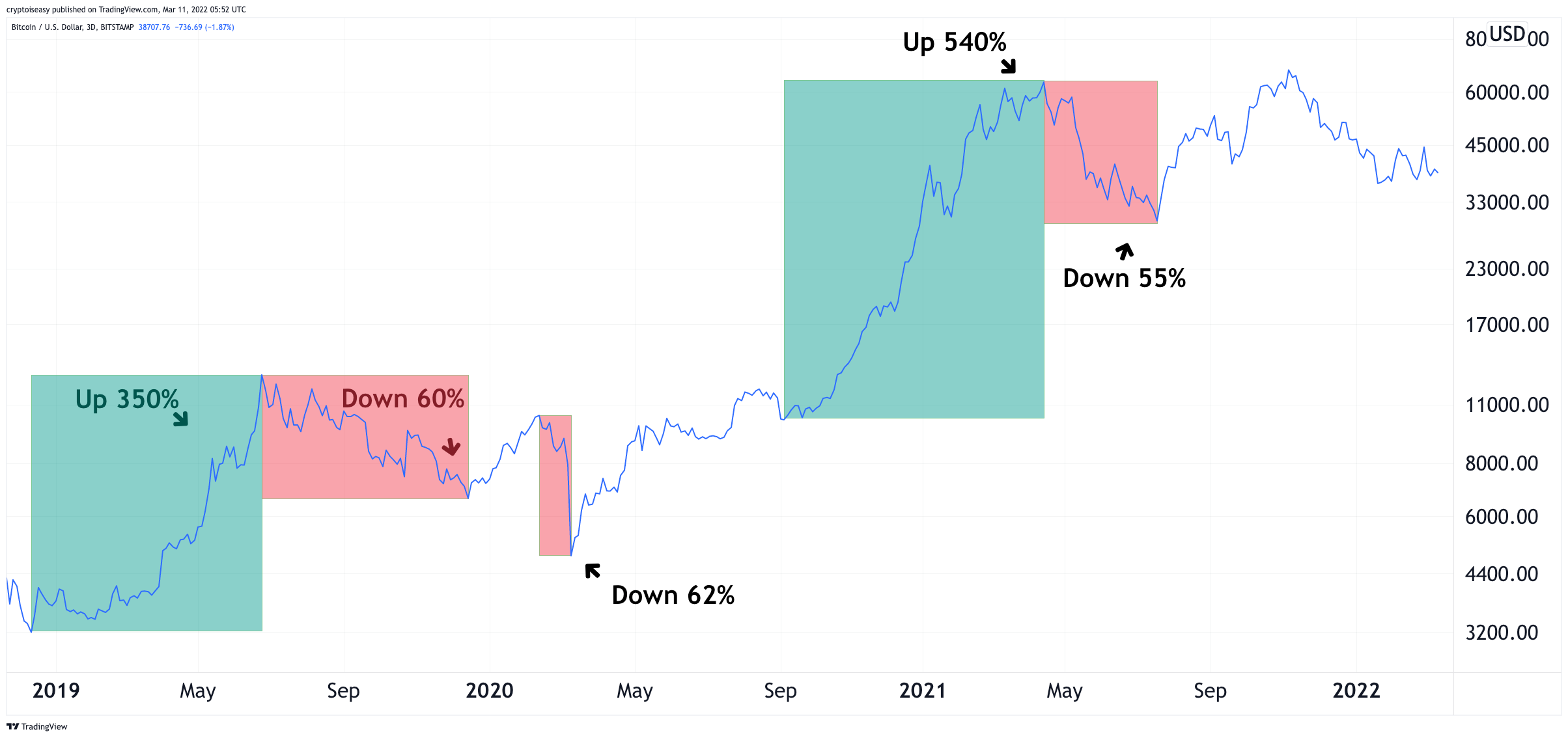

When you entered the crypto market, you found a lot of excitement. Data models predicted riches. YouTube and Twitter told you the market would explode to the upside. It doesn’t feel that way today, but it should. Since last summer, you’ve stood on the ground floor of the next leg up, and it’s a whole different experience. Scary. Exciting. Frustrating. Terrifying. Stressful. Hopeful. A mix of emotions. Big upswings, big downswings. Supercycles and bear markets. Laser eyes and death crosses. Big players moving on. Little players moving up. Crypto remains a wealth-creation machine, a generational opportunity to build lasting, durable wealth from owning a stake in the financial networks of the future. It is also a cruel and vicious market. Only the most courageous and persistent survive. To paraphrase a US general, you may have thought crypto is all glory, but I assure you, it is all hell. We’ve been here beforeIn 2019, the market did 4x in six months to kick-start a three-year parabolic run, with upswings of +500% and downswings of +60% along the way. Do the swings of the past six months seem any more extreme? When the market zooms for three months, you feel a sense of ecstasy and excitement. You can’t help but put money in—and everybody’s telling you to do just that. When the market drops for three months, you feel a sense of terror and loss. You can’t help but take money out—and everybody’s telling you to do just that. Both times, it feels like the right decision. Traders will insist it is. And if you act on those instincts, you will never get ahead in this market. In other markets, maybe, but not crypto. Empty promisesPerhaps the traders have something else in mind? Last year, they told you that you’d get a repeat of 2017. Then, they said you’d get a repeat of 2013. Now, they’re saying you might end up with a repeat of 2012 or 2019. What happened to $288,000 bitcoin by the end of 2021? Stock to flow says we should be above $100,000 now. How could so many people say so many things that never came true? How could so many people who were so wrong so many times in the past, now be right? Maybe it’s impossible to be right or wrong about the future. If nobody knows what’s going to happen, how can anybody be right or wrong? And even if somebody is right or wrong, how do you know it’s anything more than a coincidence or a lucky guess? Priya in the park yells “bear market” every time the price dips 5% or more and begs you to sell every upswing. Tony on the TV yells “supercycle” every time the price pumps 5% or more and begs you to buy every downswing. Eventually, they’re going to be right. What will you do about it?Does it even matter? In 2019, bitcoin’s price ended more than 100% higher than it started. In 2020, its price tripled from start to end. And most people finished down on their investment. They chased the market. Meanwhile, people who bought in 2018 sold to these newcomers after the price went up.  In January, I published an article begging people to stop dollar-cost averaging blindly. While there’s never a bad time to buy bitcoin, some times are better than others. Just make the most of those opportunities and chill when the opportunities pass. Buy low and HODL. Judging from the comments, people didn’t like that advice. Frankly, they hated it and called it terrible and stupid. But it’s worked for me and it’s baked into my plan for bitcoin’s bull market. With that plan, you’re down as much as 25% but probably closer to even on your investment, possibly up 600% or more. (For altcoins, you may have a far wider range of returns. I’m down +99% on some altcoins and up more than 5,000% on others. Most pace or slightly beat the overall market.) Over the long run, gamblers and competent traders might do better. Dollar-cost averagers will probably do worse. Mark, you still call it a bull market. Why?Like Richard Nixon did with his dog, I just want to say this right now, that regardless of what they say about my plan’s name, I’m going to keep it. You can call it whatever you want—I’m sure you can think of some choice words to describe it. (Some with only four letters.) Bitcoin’s price goes up 100% in bear markets and drops 50% in bull markets. That gives me the latitude to say “bull” and “bear” about pretty much anything I want. In any event, it doesn’t matter. With my plan, you will never have to think about bull or bear, right or wrong, short or long. You won’t have to time the market, take profits, or buy the peaks. Ideally, you will never sell (though you probably will have to at some point). You will simply take advantage of opportunities as they come and let the market do its thing. That way, this market will never let you down. Mark Helfman publishes the Crypto is Easy newsletter. He is also the author of three books and a top bitcoin writer on Medium and Hacker Noon. Learn more about him in his bio. Follow Me on Twitter.Learn how to earn…Become part of our community.Follow our socials.Subscribe to our podcast.Subscribe to this publication.

Comment & Earn!Share your thoughts and opinions on the topics covered within this blog in the comments below for your chance to win yourself an NFT. Click here for more information on our engagement rewards. If you liked this post from Cryptowriter, why not share it? |

Older messages

What Does the Russian Invasion of Ukraine Mean for Bitcoin?

Thursday, March 10, 2022

The crypto-economics of a misguided move

Unpopular Opinion: Giving Bitcoin Away Doesn't Help Adoption.

Thursday, March 10, 2022

Giving the solution before people discover the problem is even counterproductive.

Where Is Bitcoin Legal (And illegal?)

Thursday, March 10, 2022

And which way are we trending?

Round 32 Cryptowriter NFT Engagement Winners!

Tuesday, March 8, 2022

Top 10 Most Engaged Users Our analytics consider the total amount of likes, comments, and shares to determine the top 10 most engaged users across our entire publication. Most engaged winners receive 1

With Bitcoin, Embrace Uncertainty

Tuesday, March 8, 2022

At least you'll know what to expect

You Might Also Like

CryptoQuant CEO says US could feasibly cut debt by embracing strategic Bitcoin reserve

Thursday, December 26, 2024

Analysts see US Bitcoin reserve as symbolic step toward debt reduction, amid challenges and speculation. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Shen Yu's "Four Wallets" Strategy: A Guide to Crypto Investment Management

Thursday, December 26, 2024

This content summarizes an AMA hosted by E2M Research on Twitter Spaces, featuring Shen Yu (Twitter @bitfish1), Odyssey (Twitter @OdysseyETH), Zhen Dong (Twitter @zhendong2020), and Peicai Li (Twitter

Reminder: Bitcoin Hits A New ATH Once Again After Touching $108K

Thursday, December 26, 2024

Monday Dec 23, 2024 Sign Up Your Weekly Update On All Things Crypto TL;DR In this issue, we dive into: Bitcoin Hits A New ATH Once Again After Touching $108K Avery Ching To Become New Aptos Labs CEO As

Bitcoin sees brief rebound to $99,000 on Christmas day

Wednesday, December 25, 2024

Holiday excitement lifted Bitcoin past $99000, but it quickly corrected to $98000 where it still holds strong support. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Opinion: Market Panic After FOMC Shows Some Overreaction

Wednesday, December 25, 2024

Last night, the market experienced a significant pullback, primarily due to investor concerns over the Federal Reserve possibly shifting towards a more “hawkish” policy stance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s pro-crypto pledge could see day-one executive orders, industry players hope

Tuesday, December 24, 2024

A Bitcoin strategic reserve, access to banking services, and the creation of a crypto council are among the items on the industry's 'wishlist.' ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s 2024 Year in Review

Tuesday, December 24, 2024

A data-driven overview of events that shaped crypto in 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

OKExChain: Will the Federal Reserve and Jerome Powell Prevent the U.S. from Creating a National Bitcoin Reserve?

Tuesday, December 24, 2024

In the early hours of today, Federal Reserve Chairman Jerome Powell made it clear during a press conference following the monetary policy meeting that the Fed has no intention of participating in any

Crypto community cheers as Trump names pro-crypto advisors Stephen Miran and Bo Hines for economic and digital ass…

Monday, December 23, 2024

Trump fosters economic expansion and digital innovation with Miran and Hines at the helm of economic and crypto councils. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 BTC-to-Gold ratio hit a historical peak on 17 Dec; Crypto.com renewed its partnership with Formula 1 until 2030

Monday, December 23, 2024

BTC-to-Gold ratio hit a historical peak on 17 Dec; Crypto.com renewed its partnership with Formula 1 until 2030; Crypto.com and the Philadelphia 76ers unveiled Web3 mobile game 'Spectrum Sprint