Integral Resistance - Integral SIZE Is Now on Mainnet

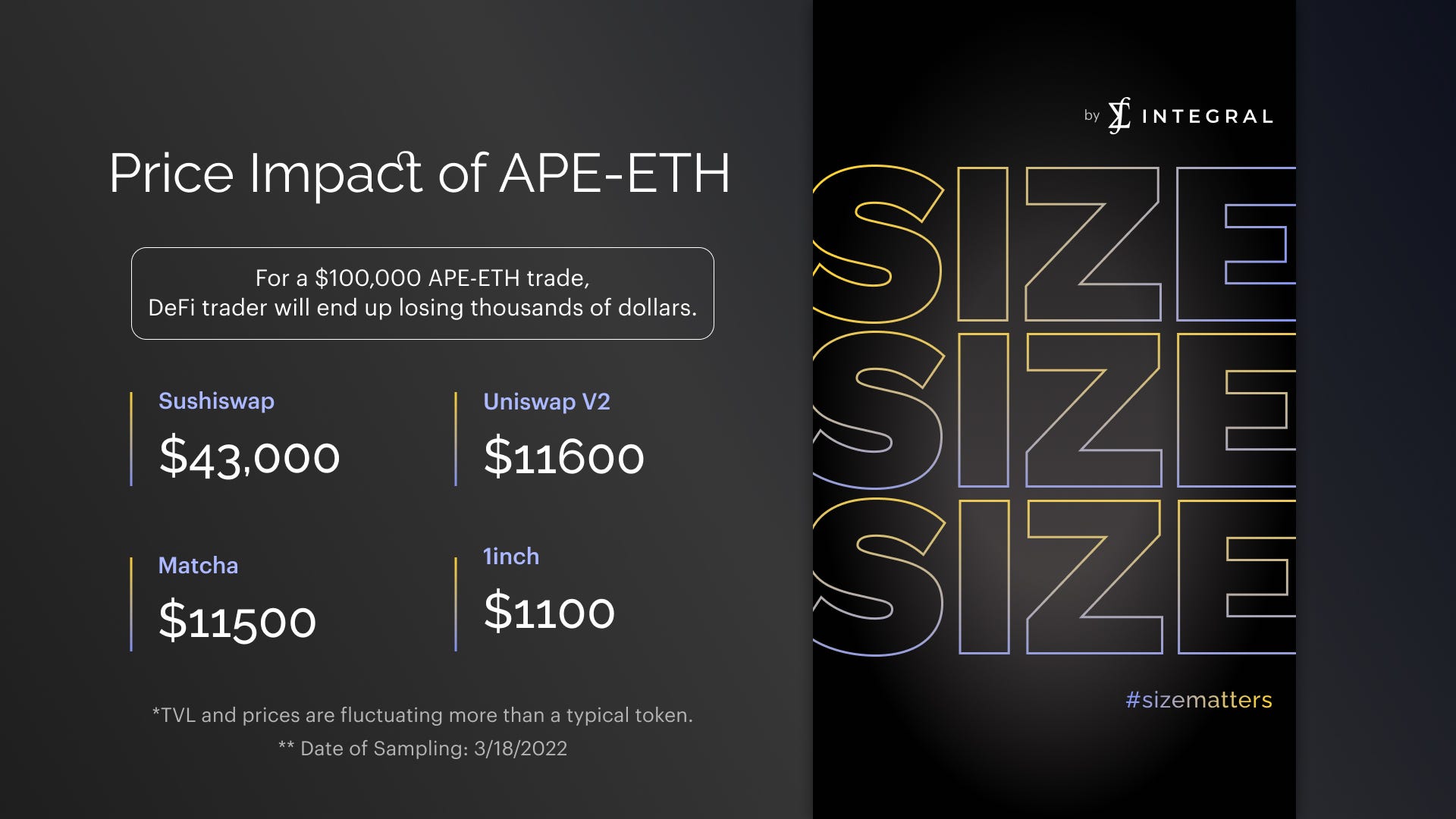

Integral SIZE Is Now on MainnetToday we are excited to launch SIZE, a new decentralized exchange specifically designed to execute large orders on chain.Today we are excited to launch SIZE, a new decentralized exchange specifically designed to execute large orders on chain. SIZE lets traders execute orders at 30-minute TWAP, giving trades zero-price impact. What is SIZE?SIZE is a new DEX and DeFi primitive that executes time-weighted average price (TWAP) trades on-chain. While other on-chain exchanges are not optimized for large-volume traders, SIZE is built with whales in mind to provide a better trading experience with zero price impact. Why SIZE?In the last year since we launched Integral FIVE we've had the privilege to work with a great community. To date, FIVE has executed nearly $500m in trading volume. However, one of the most common pain points we have heard from whales and other DeFi traders is that it is still difficult to execute large orders on chain. Especially when trading less liquid tokens, on-chain trades are subject to high price impact and front-running. To combat this, whales may split orders up in to smaller ones or move off-chain to a centralized exchange. A study by Integral showed that trading for $100,000 worth of $APE would incur an average price impact of over 13%. Trading for $1,000,000 pushes price impact past 30%. We have made SIZE to open up a new area of opportunity for DeFi traders: on-chain, high-volume trading of less liquid tokens. How does SIZE work?Instead of a traditional swap, Integral SIZE uses Uniswap v2 as a price oracle. Once an order is submitted, the protocol queries Uniswap to get spot prices over the next 30 minutes. By calculating the arithmetic-mean of these prices, the protocol uses this time-weighted average price to execute your order. All of this is done on-chain, and without needing a custom price curve. As a result, SIZE will be able to execute trades with zero price impact. You can read more about the specifics in the SIZE documentation and whitepaper. We will launch SIZE with an initial TWAP duration of 30 minutes, but it is possible to customize the duration and change it in the future. Who is SIZE for?Even though the large volume orders will see the most benefit, SIZE is for everyone. You can use SIZE whether you are a long-term investor, a HODLer, a day trader, or a farmer. No need to write custom code to split large orders into small ones, execute smaller orders across venues, or worry about sandwich attacks. With one click, get a 30 minute TWAP execution for all your orders. Even better, Integral SIZE returns all of the positive slippage incurred from the trade to you. What can be traded with SIZE?We are launching SIZE with a 30 minute TWAP on the ETH-USDC pair with a 10 bps fee. We will be monitoring the launch and expect to make other altcoin pairs available soon. We will gradually launch pools for other tokens. We would love to hear community inputs on which tokens to you want to trade on SIZE next. To do so, simply join our Discord server and leave your opinions in the #feedback channel under the “Support Desk”. Where can SIZE be accessed?To begin trading on SIZE, please visit: https://size.integral.link/. Currently, SIZE is deployed on Ethereum mainnet, but we are looking at expansion on other chains and Layer 2s based on feedback from the community. How to Earn $ITGR as a Liquidity Provider or TraderAs part of the SIZE launch, we will be starting a rewards program for both liquidity providers and traders. SIZE launch program rewards will go to both LPs and traders. LP Farming will start on March 24, 2022. Trading Mining program will start March 27, 2022 and continues on a weekly basis. You can read more about the rewards program here. The Future of Large Orders in DeFiWe're excited to see SIZE bring large order with better execution to DeFi. Moving forward, the broader vision of SIZE is three-fold:

We see SIZE as the last missing piece to this puzzle of on-chain execution of large orders. With FIVE we brought 5-min TWAP for highly liquid token and minimal price impact. With SIZE traders now have access to a 30-min TWAP for less liquid token and can trade with zero price impact. Start using SIZE today at https://size.integral.link. You can provide any questions, comments, or feedback in our Discord or on Twitter. If you would like to help Integral grow faster, the most important thing you can do is refer to us great builders. Currently we’re looking to hire Smart Contract Engineers. Any assistance on sourcing the best possible candidates for this position would be greatly appreciated. |

Older messages

Introducing The DeFi Whale Squad NFT Collection by Integral

Tuesday, March 22, 2022

The DeFi Whale Squad is a commemorative NFT collection and community represented by 8888 unique, randomly generated digital whale avatars.

Integral Stakeholder Letter | 2021 Annual Review

Monday, January 3, 2022

At Integral, we built a DEX to eliminate price impact, and make sure all primitive-defining trades are executed in a permissionless way, 100% decentralized and on-chain.

Recap of Professor's Office Hour (Weeks 11 & 12)

Thursday, December 30, 2021

Integral now has the highest average order size compared to any other DEX in the space.

Recap of the Professors' Office Hour (Week 9&10)

Tuesday, November 30, 2021

Please find below our recap of week 9 & 10, survey question results and the live community Q&A session that followed.

A Data-driven Farming Approach, Updated

Monday, November 15, 2021

40% of the weekly farming rewards will now applied to USDC-ETH pool.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏