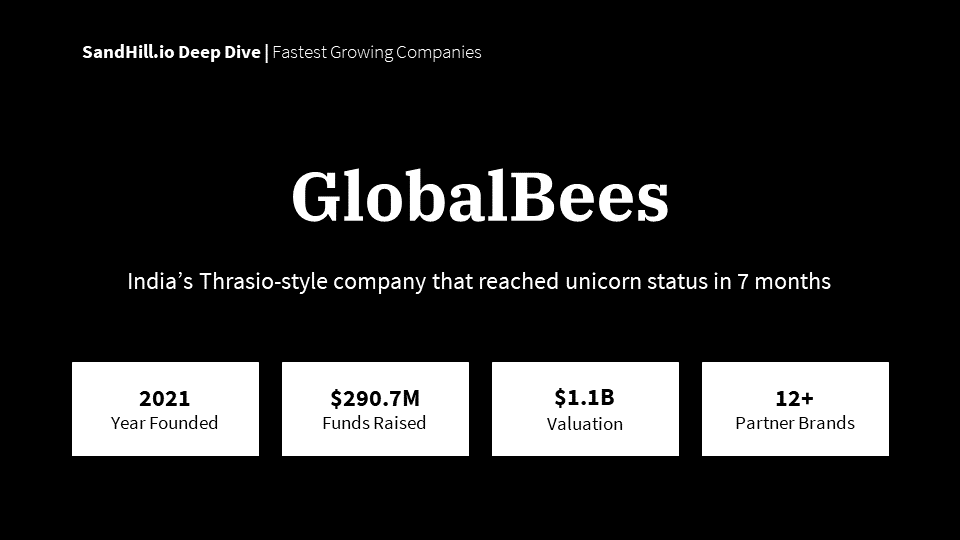

CommerceTech - GlobalBees – Indian House of Brands

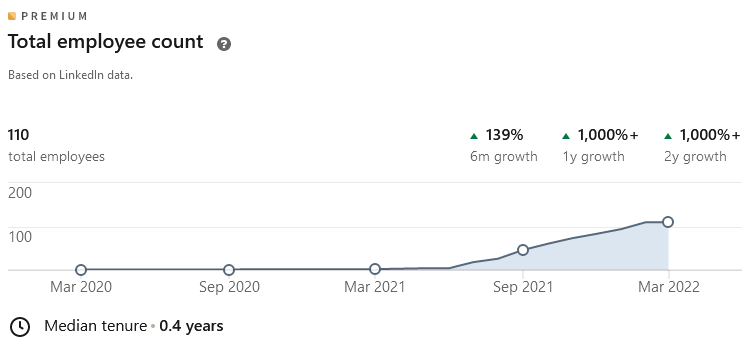

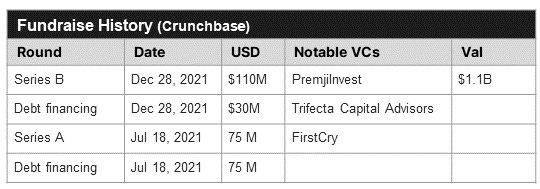

GlobalBees – Indian House of BrandsThe retail company that has scaled to a $1.1B valuation in under a yearThese briefs are produced by leveraging publicly available data sources and information. If you notice a mistake or see an area for improvement, please let us know through this form or via email (team@sandhill.io). SnapshotFounded in May 2021, GlobalBees is an India-based acquirer of digital merchants across a number of retail categories. The company focuses on optimizing sales across markets both local to India (such as Amazon and Flipkart) as well as through channels overseas. The startup has acquired more than a dozen brands in its short operating history and has raised $290.7M in debt & equity from notable investors such as Lightspeed India, Softbank Vision Fund, and Indian eCommerce giant FirstCry. About GlobalBees: Website, LinkedIn Business Overview and ProductsGlobalBees aims to acquire digital brands that have a revenue rate of $1-$20M across categories such as beauty, personal care, home, kitchen, food, lifestyle and others. After the acquisition of select brands, the company helps brands in optimizing marketing, their supply chain, R&D, and other operations. It also helps brands offer their products beyond the South Asian market. The company’s portfolio of acquired brands includes businesses such as Yellow Chimes (Men & Women’s Jewelry), Better Home (Home Care Products) and Prolixr (Millennial skincare brand). How It WorksGlobalBees is building in-house capabilities to take brands that have achieved some scale and turbocharger them for growth nationally and overseas. The company is able to provide financing, tech & marketing expertise, and operational advice to scale acquired businesses. The goal is to build a House of Brands that are fast-growing across categories and that can capitalize on the share infrastructure that GlobalBees is developing. GlobalBees’ model greatly resembles that of US-based Thrasio which is also focused on acquiring and scaling eCommerce merchants. However, there are several key differences. Whereas Thrasio’s focus is primarily on profitable companies they can acquire at relatively low valuations (ex. at 4-5x EBITDA or 1.5x revenue), GlobalBees’ past and upcoming deals indicate a different buyout strategy. It actively scouts for venture-backed consumer brands that have been unable to scale and are hence looking for a buyer. GlobalBees not only goes for profitable companies and helps them grow; it is also open to buying promising loss-making companies and turning around their operations. Business Model and PricingGlobalBees rolls up eCommerce brands with the intention of increasing the profit that each brand can make after it is acquired. Brands are optimized to increase growth and revenue while leveraging the shared infrastructure that GlobalBees develops to reduce costs across brands. TractionSince the beginning of 2021, around half a dozen companies with a similar model as GlobalBees have raised funds. However, GlobalBees with its initial fundraising made its way to the top 3 series A raises ever in India. It intends to deploy the funds over the next 3-4 years, investing $2-$6M per brand acquisition or investment. The company will also leverage the presence of its investor FirstCry in international markets for sourcing and distribution. Moreover, GlobalBees plans to invest in over 20 brands in 2021. In December 2021, the company revealed its plans to invest in over 100 brands during the next 3 years. In January 2022, CEO Nitin shared that the company has already partnered with 12+ digital brands and currently has over 100 employees. Founder(s)Nitin Agarwal:: Co-founder and CEO at GlobalBees. Prior to this, Nitin served as the President and Group CIO, CTO and Chief Digital Officer at Edelweiss Financial Services over a span of 2.5 years. Supam Maheshwari: Co-founder at GlobalBees. Prior to this, Supam co-founded FirstCry.com, where he served as a CEO for about 11 years. History and EvolutionThe model used by GlobalBees was first popularized by Thrasio, an American company focused on purchasing brands on Amazon. Thrasio’s rapid success caught the attention of many founders and investors globally that built similar models, including the GlobalBees team. GlobalBees was founded by FirstCry’s Supam Maheshwari and Edelweiss Financial Service executive Nitin Agarwal in 2021. GlobalBees raised a large amount of capital from the start, raising $150M through a mix of equity and debt, leading to one of the largest Series A rounds raised by an Indian startup. The round was led by FirstCry. The company raised another round in a mixture of debt and equity in December 2021, raising it to a unicorn status and bringing in Softbank as an investor, valuing the company at $1.1B. For the foreseeable future, GlobalBees seeks to go beyond simply making investments in brands. It plans to help the brands scale and diversify their digital footprint through direct-to-consumer channels. It also plans to support product development, branding, and other key activities such as warehousing and logistics. This will be complemented by a focus on improving customer experience and product innovation. Market Snapshot

Suggested Next Readings

If you liked this post from CommerceTech, why not share it? |

You Might Also Like

Building complete rank and rent sites in just minutes

Monday, March 3, 2025

This tool is incredible

🌁#90: Why AI’s Reasoning Tests Keep Failing Us

Monday, March 3, 2025

we discuss benchmark problems, such as benchmark saturation, and explore potential solutions. And as always, we offer a curated list of relevant news and important papers to keep you informed

I interviewed THE largest Amazon Seller [Roundup]

Monday, March 3, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

The state of data-driven decision-making for CPG brands

Monday, March 3, 2025

How marketers use purchase insights to maximize campaign performance

Facebook updates, TikTok ROI, Instagram format matches, and more

Monday, March 3, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo New week, fresh insights, Reader! Stay sharp with the latest updates on AI, social

Are you losing revenue to rivals?

Monday, March 3, 2025

This is a challenge that costs businesses millions every year: Their customers are switching to competitors for various reasons... even though most of them could easily be fixed. On Tuesday, March 4,

DeepSeek’s 545% Profit Claim

Monday, March 3, 2025

PLUS: Siri 2027?!

Insurtech VC resets, readies for growth

Monday, March 3, 2025

Europe's share of regional IPOs sinks; the agtech revolution is now; hope flares for natural gas deals Read online | Don't want to receive these emails? Manage your subscription. Log in The

What I Think About The Crypto Strategic Reserve

Monday, March 3, 2025

Listen now (8 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$92K BTC After Trump’s Crypto Call, MARBLEX Invests $20M—WOOF Ups the Game!

Monday, March 3, 2025

PlayToEarn Newsletter #262 - Your weekly web3 gaming news