3 Reasons Why Russia Accepting Bitcoin for Oil and Gas Is Not a Game-Changer in the Short Term.

3 Reasons Why Russia Accepting Bitcoin for Oil and Gas Is Not a Game-Changer in the Short Term.Let's be Bullish, but let's be Bullish for the right reasons.The news has been a bombshell in recent hours. Pavel Zavalniy, Chairman of the State Duma Committee on Energy, has suggested that Russia could accept Bitcoin as a means of payment for its oil and gas exports in order to escape American and European sanctions. Indeed, America has blocked the Russian central bank from accessing its U.S. dollar reserves. To continue to accept payments in US dollars when it cannot use them is de facto nonsense. Some even imagine that this war in Ukraine will be remembered in the future as the beginning of the end of the petrodollar era. During the video in which Zavalniy hinted at this possibility, it was also said that it would concern countries friendly to Russia. By friendly countries, you must understand countries that do not follow the American and European sanctions against Russia. In the video, Zavalniy explained that he had already offered China a payment in rubles and yuan:

To Turkey, which if it finds Putin's Russian-led war in Ukraine unacceptable continues to trade with it, payment in lira and rubles was proposed. And finally, Zavalniy said that Bitcoin was an alternative option that remained on the table:

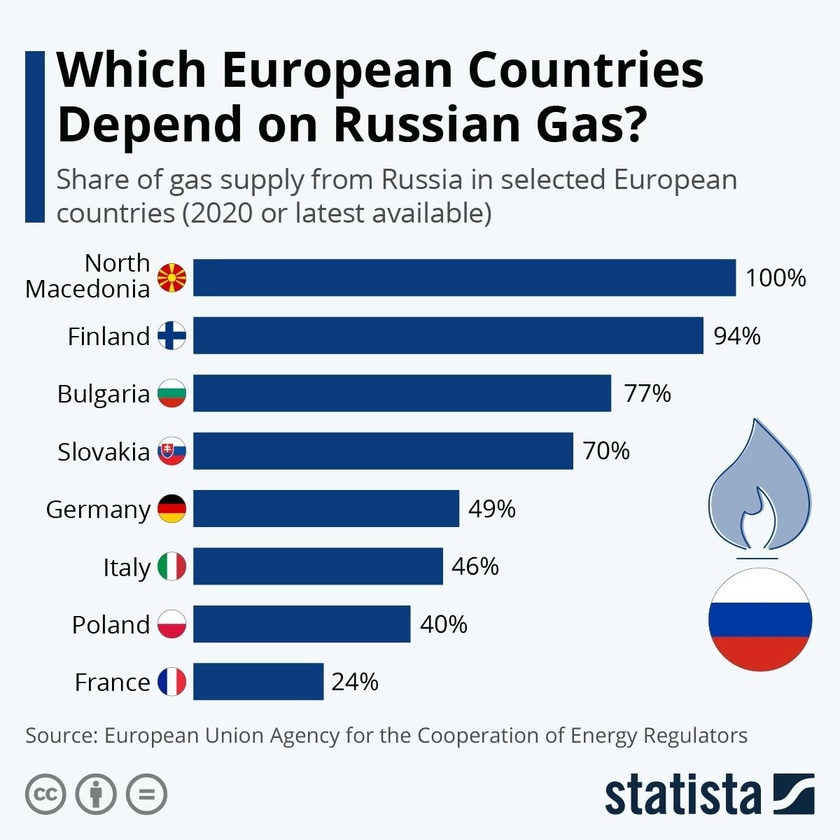

If Russia can do this, it is also because a law was passed in February 2022 to make Bitcoin and cryptocurrencies the equivalent of foreign currencies in Russia. So payment in Bitcoin is totally legal. This was enough for all Bitcoiners to think that this would totally change the Bitcoin market in the short term. And this, while Zavalniy also clarified that for “unfriendly” countries, payment will be required in rubles. This is obviously aimed at all the countries of the European Union which are ultra dependent on Russian gas. However, I don't think that this will have as much of an impact on the price of Bitcoin as some people think. At least in the short term, because in the medium to long term it could be different. None of Russia's largest oil importers will be offered the Bitcoin option as a payment methodTo better analyze the situation, here is an infographic detailing the countries that were buying the most oil from Russia during 2020: I have not yet found such an infographic with 2021 figures, but I guess the ranking should not have changed much. Here we can clearly see that China is the biggest importer of Russian oil in the world. Behind it, we have two European Union countries, with the Netherlands and Germany. For these three countries, whose cumulative oil purchases from Russia reached almost $40 billion, payment in Bitcoin is already excluded. China has banned Bitcoin in 2021, and Russia is offering payments in rubles and yuan. As for the Netherlands and Germany, they are among the countries qualified as “unfriendly” by Russia. For them, Russia seems to want to demand payment in rubles from now on. South Korea has started to apply sanctions to Russia but is still looking for a way to better protect itself from its dependence on Russian oil. Qualifying as an “unfriendly” country in the sense that Vladimir Putin's Russia understands it, South Korea should also have to pay in rubles for its Russian oil imports. Going further, you can see that only Belarus is a Russian-friendly country in the top 10 of Russian oil importers. But Belarus will pay in rubles and not in Bitcoin probably. In short, we are far from a game-changer here in terms of oil. Russia's biggest gas importers won't be offered payment in Bitcoin eitherLet's move on to Russian gas. Europe is clearly ultra dependent on Russian gas: A country like Finland is more than 90% dependent on Russian gas. Germany is almost 50%. In short, it is difficult to do without the gas of the world's largest exporter in this area. However, Zavalaniy's last message is unambiguous. The “unfriendly” countries, like those of the European Union, will have to pay for their Russian gas imports in rubles. So there is no question of having the Bitcoin alternative. There will be nothing revolutionary here. We can look at the BRICS, which have preferred not to align themselves with Western sanctions except for South Korea. China will not pay in Bitcoin as seen before. India has already started paying in rupees and rubles for Russian oil. Bitcoin will probably not be used either. I imagine that Brazil and South Africa will also be wary of being the first to pay for Russian oil in Bitcoin. At least 3 reasons why this announcement by Russia will not change anything for Bitcoin in the short termZavalniy's statement should therefore be taken for what it is: a way to retaliate against Western sanctions against Russia. A way to put pressure on the West by brandishing the Bitcoin threat. A threat that is very real, insofar as the Bitcoin system would be perfect as a means of P2P payment whose transactions cannot be censored. However, it may be a bit early for Bitcoin to be used in this way. It will surely be in the future, but I see it more in the medium term. So, here are the 3 big reasons why we shouldn't get too excited about this announcement from Russia:

However, there are plenty of other reasons to be Bullish on Bitcoin. I've explained this to you recently, and I still maintain that Bitcoin will reach $100K by the end of 2022. This is just an opinion, but I think you'll find it interesting to understand what makes me believe in $100K for Bitcoin by 2022: Let's be Bullish, but let's be Bullish for the right reasons so that newcomers avoid disillusionment later. In Bitcoin We TrustComment & Earn!Share your thoughts and opinions on the topics covered within this blog in the comments below for your chance to win yourself an NFT. Click here for more information on our engagement rewards. If you liked this post from Cryptowriter, why not share it? |

Older messages

Art of the Chart - TAking Requests!

Friday, March 25, 2022

Art of the Chart is BACK, baby! We're all moved into our new place, and I've got the new office all set up. I'm digging back in on charts, and I see it's a great time to fire up TAking

There’s No Such Thing As Bitcoin’s Fair Value. There’s Just the Price You Are Willing To Pay for What Bitcoin Offe…

Wednesday, March 23, 2022

Ask yourself the right question with Bitcoin.

Round 34 Cryptowriter NFT Engagement Winners!

Tuesday, March 22, 2022

Our analytics consider the total amount of likes, comments, and shares to determine the top 10 most engaged users across our entire publication. Most engaged winners receive 1 Genesis Finney Coin.

Bitcoin Price Evolution When the Fed Rates Hike – The Past Shows Us That There Is No Reason To Panic

Saturday, March 19, 2022

History Doesn't Repeat Itself, but It Often Rhymes.

EOSweekly: Wallet+, Fractally, Pomelo, EVM+, Edenia

Saturday, March 19, 2022

TOP HEADLINES Wallet+ BluePaper No one argued the community's choice in its first EdenOnEOS Head Chief Delegate Aaron Cox. Sure, he's among the most personable and engaging developers within

You Might Also Like

Bitcoin sees brief rebound to $99,000 on Christmas day

Wednesday, December 25, 2024

Holiday excitement lifted Bitcoin past $99000, but it quickly corrected to $98000 where it still holds strong support. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Opinion: Market Panic After FOMC Shows Some Overreaction

Wednesday, December 25, 2024

Last night, the market experienced a significant pullback, primarily due to investor concerns over the Federal Reserve possibly shifting towards a more “hawkish” policy stance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s pro-crypto pledge could see day-one executive orders, industry players hope

Tuesday, December 24, 2024

A Bitcoin strategic reserve, access to banking services, and the creation of a crypto council are among the items on the industry's 'wishlist.' ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s 2024 Year in Review

Tuesday, December 24, 2024

A data-driven overview of events that shaped crypto in 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

OKExChain: Will the Federal Reserve and Jerome Powell Prevent the U.S. from Creating a National Bitcoin Reserve?

Tuesday, December 24, 2024

In the early hours of today, Federal Reserve Chairman Jerome Powell made it clear during a press conference following the monetary policy meeting that the Fed has no intention of participating in any

Crypto community cheers as Trump names pro-crypto advisors Stephen Miran and Bo Hines for economic and digital ass…

Monday, December 23, 2024

Trump fosters economic expansion and digital innovation with Miran and Hines at the helm of economic and crypto councils. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 BTC-to-Gold ratio hit a historical peak on 17 Dec; Crypto.com renewed its partnership with Formula 1 until 2030

Monday, December 23, 2024

BTC-to-Gold ratio hit a historical peak on 17 Dec; Crypto.com renewed its partnership with Formula 1 until 2030; Crypto.com and the Philadelphia 76ers unveiled Web3 mobile game 'Spectrum Sprint

Bitcoin Hits A New ATH Once Again After Touching $108K

Monday, December 23, 2024

Monday Dec 23, 2024 Sign Up Your Weekly Update On All Things Crypto TL;DR In this issue, we dive into: Bitcoin Hits A New ATH Once Again After Touching $108K Avery Ching To Become New Aptos Labs CEO As

Yi He on Binance Alpha and Wallet: Most Projects Are Air, Facing Talent Shortage in Web3, and Wallet as an Airdrop…

Monday, December 23, 2024

This article is a summary of a recent AMA hosted on Binance's official Twitter, focused on the relaunch of Binance Wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Finish signing in to Crypto.com DeFi Research

Monday, December 23, 2024

Here's a link to sign in to Crypto.com DeFi Research. This link can only be used once and expires in one hour. If expired, please try signing in again here. Sign in now © 2024 Crypto.com 1