The Commerce Tech - Udaan - India's leading B2B Marketplace

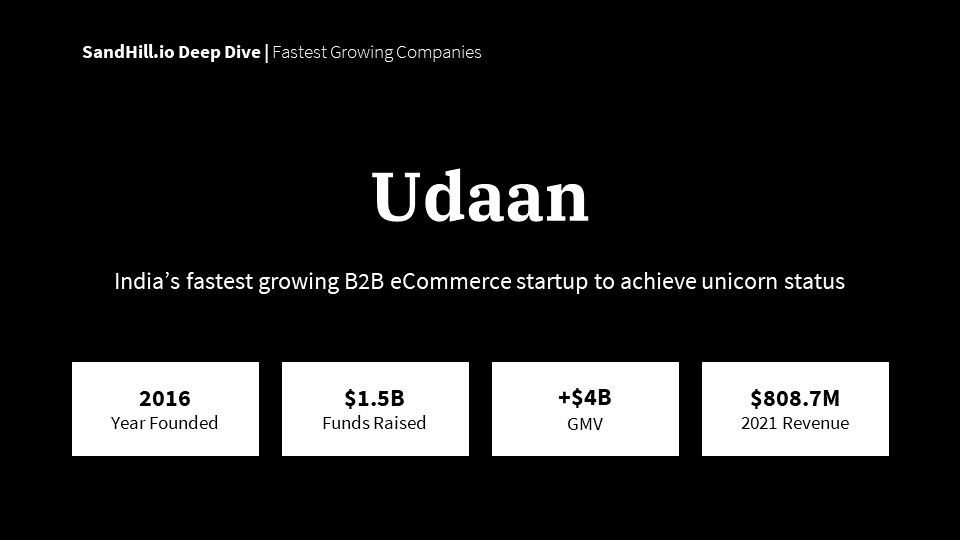

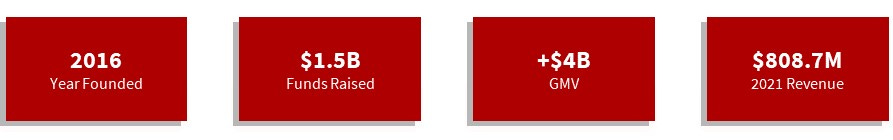

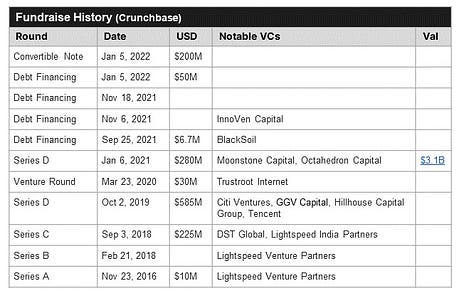

Udaan - India's leading B2B MarketplaceFounded in 2016, Udaan grew to become one of the fastest unicorns in India.These briefs are produced by leveraging publicly available data sources and information. If you notice a mistake or see an area for improvement, please let us know through this typeform. Snapshot

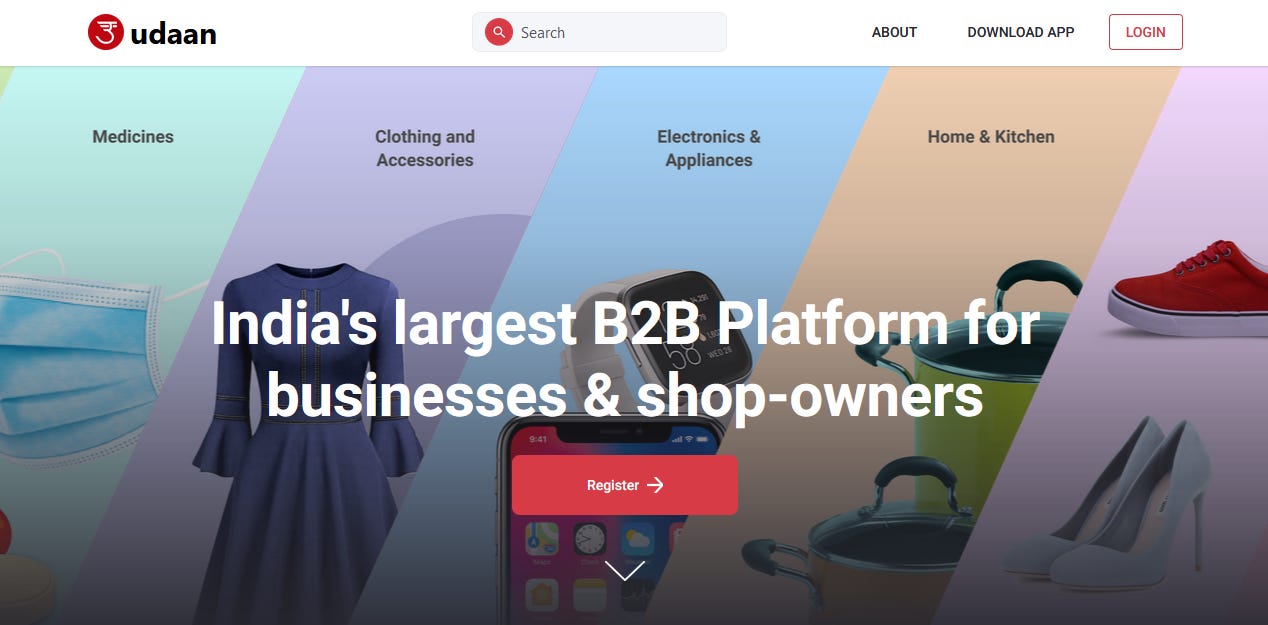

Business Overview and ProductsUdaan’s core offering is its B2B marketplace, which is a one-stop solution for conducting transactions. The platform provides access to all members of a supply chain, from manufacturers to end-user retailers, to transact across an expansive range of high-quality, competitively-priced products. The company boasts over 500,000 products across a range of verticals such as electronics, FMCG, pharmaceuticals, and more. Udaan also provides a slew of other services such as a product delivery service called udaanExpress, and udaanCapital, which provides trade financing to users of Udaan’s B2B platform. Through the use of finance, technology, and logistics, the company aims to mainly empower smaller traders to compete with larger corporates in the retail world. How It WorksRetailers on Udaan’s platform can browse through various categories of products and place orders for their desired needs. The seller – generally a manufacturer or wholesaler – books the order, packs it, and gets it ready for delivery. Udaan’s logistics team then assists the seller with the pick-up and delivery of the shipment. Once the shipment is delivered to the retailer, payment is collected and settled into the seller's account on Udaan. By directly connecting manufacturers with retailers, Udaan allows business buyers to bypass intermediaries and get products more affordably. The company operates over 200 warehouses totaling 10 million square feet to facilitate logistics. Udaan’s users can connect with other parties via its online platform or a mobile application. Udaan also currently owns an NBFC (non-banking financial company) license to provide financing in the form of loans to small retailers, which saves them from the high-interest rates charged by local lenders. Business Model and PricingUdaan earns revenue through several streams. The company charges a commission on all transactions which is been reported to be in the range of 15-18%. The company also generates revenue through several additional streams including:

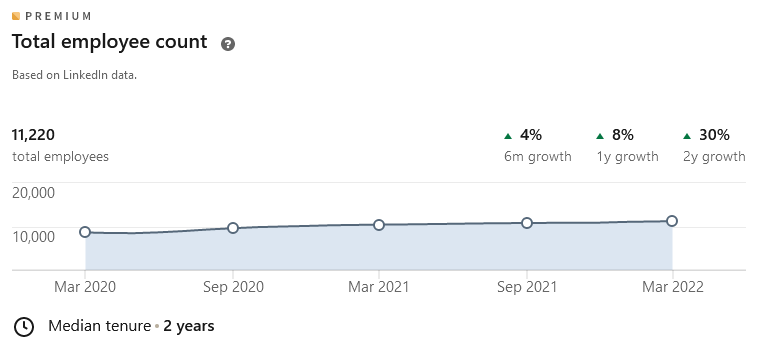

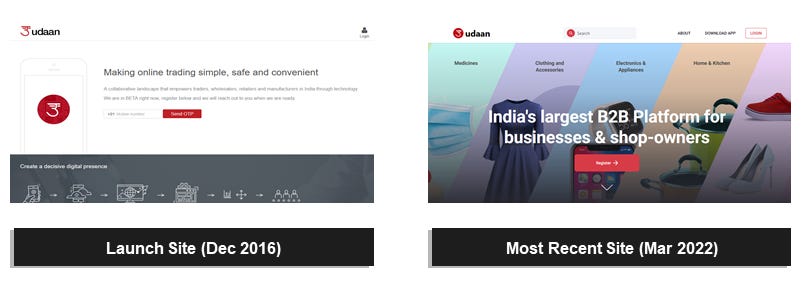

TractionAs of March 2022, Udaan claimed to have over 1.7M retailers and over 25K sellers across 900+ cities in India. The company reported doing over 4.5M transactions each month. The company boasts a repeat purchase rate of over 94%. In an article by Business Mavericks, Udaan’s revenue was reported to have increased from $6.69M in 2019 to $129.2M in 2020. This was a 21x surge within a year. Udaan’s revenue again increased by 6 times from $129.2M in 2020 to $808.7M in 2021. Udaan’s annualized GMV was reported to be over $4B in July 2021, up from $3B in 2020. At the time Udaan was reported to have disbursed over $1B in loans, and over 200,000 businesses had utilized this credit. Founder(s) & TeamVaibhav Gupta: Co-founder and CEO at Udaan. Before setting up Udaan, Vaibhav worked with his co-founders at Flipkart as SVP of Finance and Analytics. Amod Malviya: Co-founder and engineer at Udaan. Prior to Udaan, Amod was CTO at Flipkart. Sujeet Kumar: Co-founder at Udaan. Before this venture, Sujeet was the President of Operations at Flipkart for 3 years. History and EvolutionPrior to coming up with this idea of Udaan, all three co-founders were working together at Flipkart in executive roles. The company originally established itself as a logistics business, and for the first 10 months of operations catered to small customers or dealers working in electronics or apparel categories. After gaining popularity, the company formed its database of customers and dealers and began venturing into the delivery and lending business for merchants. The company was reported to have onboarded over 180,000 buyers & sellers within the first 2 years of its operations. In September 2018, the company raised a round at a $1B valuation, becoming one of the fastest companies to become a Unicorn in India. During the coronavirus pandemic, Udaan was severely impacted between April and November 2020. Several merchants on its platform shut down their businesses and Udaan was forced to lay off thousands of its contractual staff. However, in February 2021, the company claimed it had surpassed its losses in the peak covid period. In September 2021, the company announced a decision to appoint founder Vaibhav Gupta as a CEO, after having run the company under a decentralized joint leadership of all 3 founders. The other co-founders meanwhile became board members. There is speculation that Udaan may go for an IPO by 2023. Additional Learnings

Market Snapshot

Suggested Next Reads

If you liked this post from The Commerce Tech Newsletter, why not share it? |

You Might Also Like

Building complete rank and rent sites in just minutes

Monday, March 3, 2025

This tool is incredible

🌁#90: Why AI’s Reasoning Tests Keep Failing Us

Monday, March 3, 2025

we discuss benchmark problems, such as benchmark saturation, and explore potential solutions. And as always, we offer a curated list of relevant news and important papers to keep you informed

I interviewed THE largest Amazon Seller [Roundup]

Monday, March 3, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

The state of data-driven decision-making for CPG brands

Monday, March 3, 2025

How marketers use purchase insights to maximize campaign performance

Facebook updates, TikTok ROI, Instagram format matches, and more

Monday, March 3, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo New week, fresh insights, Reader! Stay sharp with the latest updates on AI, social

Are you losing revenue to rivals?

Monday, March 3, 2025

This is a challenge that costs businesses millions every year: Their customers are switching to competitors for various reasons... even though most of them could easily be fixed. On Tuesday, March 4,

DeepSeek’s 545% Profit Claim

Monday, March 3, 2025

PLUS: Siri 2027?!

Insurtech VC resets, readies for growth

Monday, March 3, 2025

Europe's share of regional IPOs sinks; the agtech revolution is now; hope flares for natural gas deals Read online | Don't want to receive these emails? Manage your subscription. Log in The

What I Think About The Crypto Strategic Reserve

Monday, March 3, 2025

Listen now (8 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$92K BTC After Trump’s Crypto Call, MARBLEX Invests $20M—WOOF Ups the Game!

Monday, March 3, 2025

PlayToEarn Newsletter #262 - Your weekly web3 gaming news