Earnings+More - Apr 8: Weekend Edition #41

Apr 8: Weekend Edition #41888 completes cash raise, Entain analyst reaction, MGM Resorts analyst update, WE+M quarterly awards +MoreGood morning. As one well-known Gambling Twitter commentator said this week (in a tweet that we cannot, unfortunately, link to), 888 pulled the equivalent of suggesting the property it had already made an offer on was more of a fixer-upper than was previously believed. The company cited macroeconomic uncertainty in the UK as a key reason, an issue which on the same day the CEO of Entain somewhat dismissed. Gambling spend was “not the first thing that impacts households,” said Jette Nygaard-Andersen when asked about the cost-of-living crisis. We’ll see whether that turns out to be true in the coming months. Do you remember the good old days before the ghost town? Click below:  888 cash raise

Bargain hunt: Investors clearly liked the news yesterday that 888 had negotiated a £250m discount, sending the shares up 24% in early trading yesterday before giving back some of their gains to close at 224p.

Hard times: Analysts at Regulus said the UK market has become ”much tougher” since the deal was originally announced. They noted that William Hill had enjoyed 56% growth in H121 but that H2 revenues of £277m were down 21% half-on-half. Downsizing: CBRE analysts noted that the news yesterday squashed speculation that the deal might fall apart due to the collapsing 888 share price. Before yesterday’s rise had fallen more than 50% since the deal was originally announced seven months ago.

A win for Caesars: Jefferies said the price adjustment should “alleviate concerns” among investors. CBRE noted that a revision of the deal to get it over the line was the “right call”.

Refocus: The team added that focus will now shift to the prospect of a sale of a Las Vegas Strip property.

A wider worry: Jefferies noted the revised terms of the deal have implications across the sector.

**Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. Its industry-leading Superfeed is used by the biggest betting brands in the world including bet365, Flutter and Entain. The content engine powers on-site engagement by delivering impartial expert betting insight for 20 sports in 70 languages. For more information visit: spotlightsportsgroup.com Entain analyst reactionCommendable: Analysts at Regulus suggested the 8% decline in online GGR (6% in constant currency terms) was commendable given the outperformance this time last year and the disruption caused by the ongoing German and Netherlands disruption. (PO QUOTE) “Entain continues to demonstrate the value of a diversified and increasingly localized geographic and product portfolio, with strong momentum in emerging markets offsetting more challenging trading and regulatory conditions in more mature jurisdictions.” The one in ten: Noting the commentary on the macro front, CBRE pointed to Nygaard-Andersen’s comment on the average bet size of £10, “highlighting the potential resilience of its consumer in inflationary and/or recessionary environments”.

WE+M quarterly awards🥊🍿The Will Smith prizefight of the quarter - Jason Robins vs Jim Chanos: Robins got righteously mad at Chanos after he took the opportunity of a further CNBC appearance to admit he made a mistake in his calculations over DraftKings - but said he was still short.

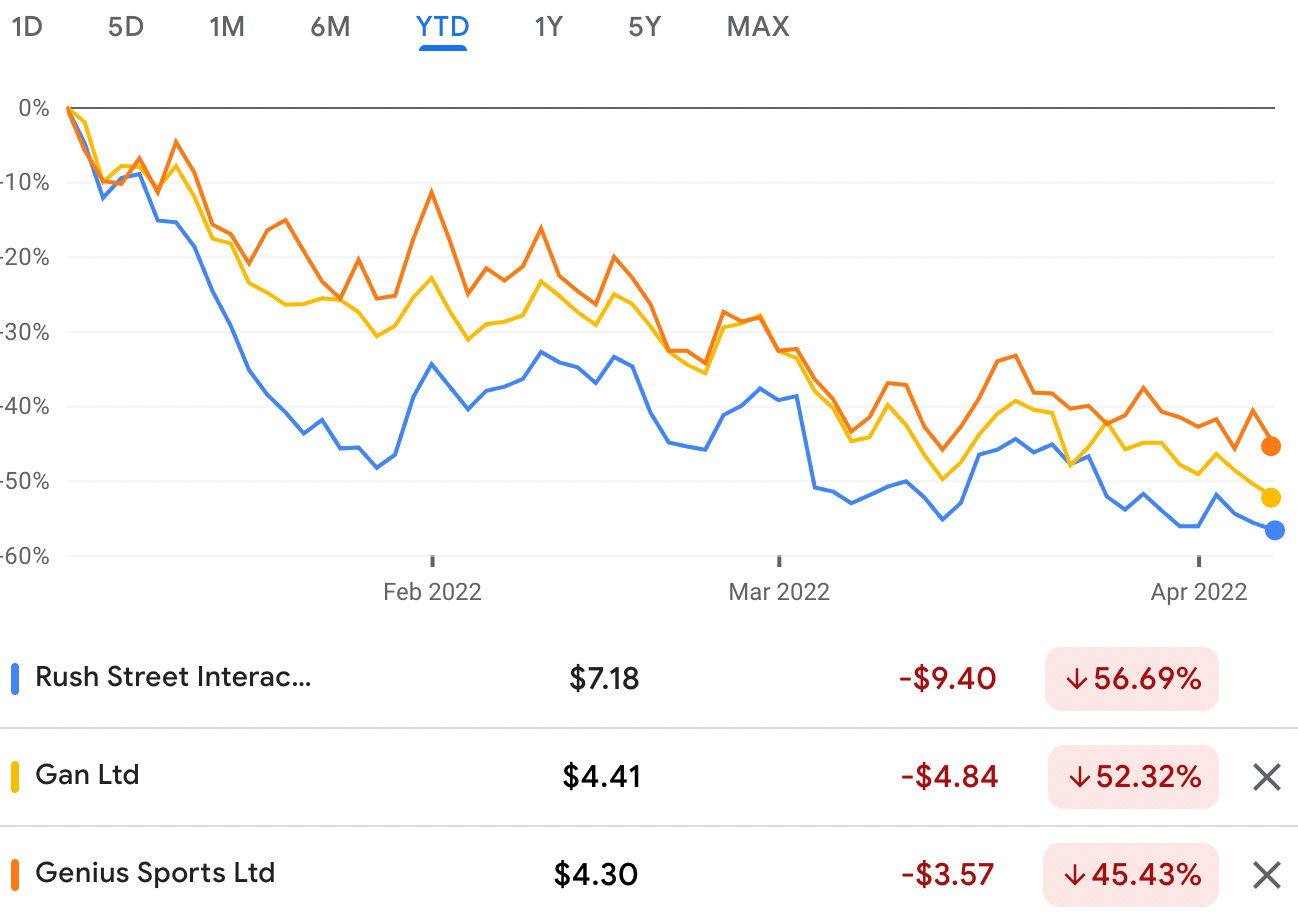

The worst stock performance of the quarter: Robins’ defense of his ailing stock has done little to help - the shares are down over 39% in the quarter. However, that is only enough for even a podium position in this competition.

Related data point of the quarter: DraftKings and Genius Sports led the way in the stock-based compensation totals for the year at $683.3m and $489.9m respectively. Fair criticism of the quarter: The ever-entertaining Daniel Lee at Full House Resorts gave his opinion on Churchill Downs;’ decision to quit sports-betting.

🧇Look out Gordon Ramsey: Sticking with Lee, he gave the best reason for why a diner won out over fine-dining at the upcoming Temporary American Place.

The ‘Little Lord Fuckleroy’ Has Joined The Call’ statuette to: Lachlan Murdoch, CEO, Fox Corp. “Our only frustration is that we've only been launched in four betting markets or four states, and obviously, we'd like to see that increase significantly as we roll out FOX Bet.” Humble pie of the quarter: 888’s Itai Pazner for his apology for its recent fine £7.8m

Oh boy: According to the revised takeout terms of 888’s purchase of William Hill, next up in the dock at the UKGC is… William Hill.

Skeptics of the quarter: The analysts at Deutsche Bank (again) for their verdict, among others, on DraftKings news TAM estimate.

Feeling it: “Drop was strong, handle was strong, RevPAR was strong. I could go on and on.” Craig Billings at Wynn Resorts. He didn’t by the way. Go on and on, that is. MGM resorts analyst updateJust rewards: The team at Deutsche Bank have reiterated their buy on MGM suggesting their bullish stance with “the unheralded transition to a stronger rewards system” among the potential profit drivers.

M&A linesRaw iGaming has acquired games producer and aggregator Leander Games for an undisclosed sum. Tom Wood, Raw CEO, said Leander was “one of the best distribution platforms in the industry”, adding that after meeting the management team “we felt the immediate cultural connection”. Earnings in brief

PartnershipsPenn National's theScore Bet is now the exclusive official gaming partner of the MLB Toronto Blue Jays under a 10-year contract. Rush Street interactive’s BetRivers has entered an exclusive brand and content contract with Canadian sports broadcaster Dan O’Toole. Datalines

NewlinesSafer parking: Paysafe has expanded its partnership with betPARX in Pennsylvania and New Jersey. It already provides payment support for the Play Gun Lake brand in Michigan, which is powered by betPARX. Casino with no name: Fifth Street Gaming and Latino sports bar operator Ojos Locos will renovate and rebrand the Lucky Club in North Las Vegas to the Latino casino which is yet to be named. No Ain, no gain: Ainsworth has agreed to supply online spots to Cordish casinos in Pennsylvania though GAN’s SuperRGS iGaming platform. Clic and collect: Bragg Gaming has agreed a deal with Betclic for the supply of online games though its Oryx platform. Hölle lotta love: German igaming provider Hölle Games has concluded a deal for online casino games and Bonus Spin function with Kindred’s Relax Gaming in Germany. What we’re sayingA reminder that the WE+M podcast #4 was released yesterday. Available via YouTube, Spotify and Apple and yesterday’s newsletter. On socialA word from our sponsor. Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Earnings+More podcast #4

Thursday, April 7, 2022

Watch now (30 min) | I've got a feeling we're not in Kansas anymore

Apr 7: 888 knocks £250m off William Hill pricetag

Thursday, April 7, 2022

888 revises William Hill buyout terms, Entain Q1 trading update, NFL Fanatics investment, affiliates in Ontario, Gaming Society seed finding +More

Apr 4: Ontario is go

Monday, April 4, 2022

Ontario launch, WE+M startup funding quarterly survey, Jefferies digital update, New York and Nevada data, GiG complete Sportnco deal +More

Apr 1: Weekend Edition #40

Friday, April 1, 2022

Novibet SPAC listing, Sportradar analyst reaction, Bored analysts NFT, GAN and NeoGames analyst updates, Sector watch - financial trading +More

Earnings+More Podcast #3

Thursday, March 31, 2022

Watch now (27 min) | Managed decline

You Might Also Like

Betting on AI to transform healthcare

Wednesday, January 8, 2025

Whatnot nears $5B valuation; Sixth Street will manage $13 billion of Northwestern Mutual's assets; funding for Europe's female founders falls Read online | Don't want to receive these

Turn those Big Ideas of yours into reality

Wednesday, January 8, 2025

A founder's guide to realising the vision for your business in 2025. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Am I Devoted to My Calling or Distracted by My Device?

Wednesday, January 8, 2025

The question isn't whether technology can enhance our lives; it's whether we will use it as a tool or allow it to use us.

Started From The Bottom

Wednesday, January 8, 2025

Brand growing pains.

🔔Opening Bell Daily: Trump vs. Powell heats up

Wednesday, January 8, 2025

The president-elect said his team is preparing to inherit a difficult economic situation.

Fourth down

Wednesday, January 8, 2025

Flutter warns after 'historically bad' NFL season ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Skyrocket your audience growth

Wednesday, January 8, 2025

One Time Promo ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Disrupt the cost of YouTube video marketing

Wednesday, January 8, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack Disrupt the cost of YouTube video marketing Turn your blog into a video blog. Turn your plain-

🆕 New Year, New Biz: Your entrepreneurial resolution

Wednesday, January 8, 2025

How to bring your business goals to life in 2025. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Tuesday, January 7, 2025

Open this on your phone and click the button below: Add to podcast app