Earnings+More - Apr 4: Ontario is go

Apr 4: Ontario is goOntario launch, WE+M startup funding quarterly survey, Jefferies digital update, New York and Nevada data, GiG complete Sportnco deal +MoreGood morning. On today’s agenda:

Ready lets go. Click below: Ontario launchesOn the launchpad: Ontario’s OSB and igaming markets launch today with a fully-laden offering of big US names, previously grey market operators and freshly put-together specifically Canadian brands.

Missing in action: However, not featured at the starting gate, it would appear, is DraftKings despite Jason Robins saying on the company’s Q4 earnings call that it was “looking forward to launching there”. Start your engines: Writing in the Toronto Sun this weekend, CGA CEO Paul Burns said the new regime addresses the “inequity” of the existing grey market. He added that it was vital that Ontario’s land-based operators now had the “proper framework”. He also pointed to the investment from online operators to the Ontario economy.

Up against it: Jefferies say the nature of the Ontario “transitioning” from grey market to regulated will provide the former operators with an advantage and will result in “different market share dynamics than the US”. ** SPONSOR’S MESSAGE: Spotlight Sports Group, a world-leading technology, content and media company has released a new white paper detailing the sports betting opportunity for publishers across North America. The paper investigates the size of the market, the revenue models available and the changing behaviors of sports fans. Outlining the keys to success, the research also discusses Racing Post's successful journey from a traditional digital publisher to super affiliate. Click here to download the full white paper. BREAKING NEWS: The CEO of UK-listed affiliate XLMedia Stuart Simms has resigned to “pursue other interests”. He joined the company in Jul19 from Rakuten. He said that in his time at the top he had “de-risked” the core business and moved the company's operational focus towards North American sports betting.

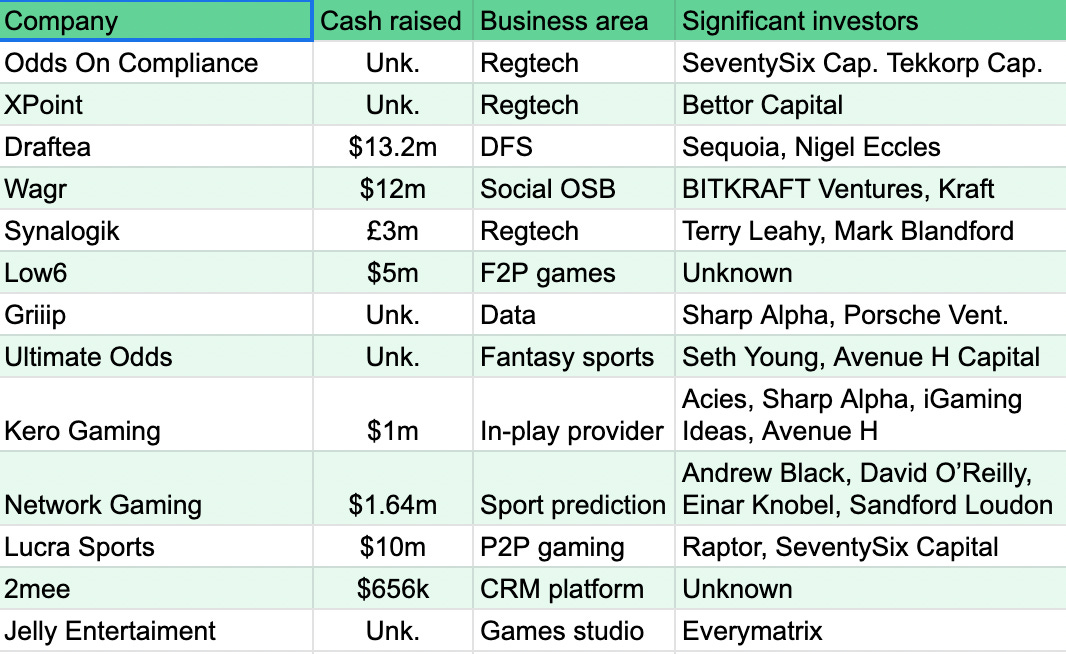

Startup funding - Q1 surveyWE+M has been tracking the funding round announcements for companies in the betting and gaming space. Here are some of the trends from the first quarter.

Q1 fundraising Source: Wagers.com Earnings+More Regtech in focus: The three gaming-related regtech companies are evidence of compliance increasingly being an area of interest for investors. The three companies involved in funding rounds this quarter work in varying fields; regulatory databases and consulting firm OddsOn Compliance, geolocation services for XPoint and automated due diligence platform Synalogik.

Significant names: Sports-betting and gaming specialist investors including SeventySix Capital, Sharp Alpha and Benjie Cherniak’s Avenue H Capital each completed two investments while Accies, Bettor Capital and iGaming Ideas also make appearances.

Note: Also receiving funding this quarter was WSC, the AI-powered highlights provider which raised $100m. Though the funding will go in part to building its capability with regard to betting and NFTs, it is not its main business at present and hence has not been included in the survey. Roundhill ETF closuresNo interest: Roundhill Investments has announced it will be closing two of its ETFs later this week, its MVP pro sports ETF and the SUBZ Streaming ETF, due to a lack of investor interest.

Jefferies digital updateCheap doesn’t cut it: Looking at what they say is “dramatically shortened” market patience with digital gaming stocks, the team at Jefferies suggest a “revised look at the value opportunity is warranted”. Can you feel it? Jefferies sum up the Street’s shift towards a “more conservative stance” on profitability thus:

On the spectrum: Naturally enough, Jefferies believe they can but believe there is a “clear spectrum” of opportunity when it comes to the universe of stocks. One they identify as a clear winner is Gambling.com which they see as benefiting “compelling” fundamentals.

Grow your own: One development in the space which has “evolved in surprisingly important ways” is B2B. The largest players have ownership or control but behind them, the picture becomes “less consistent” with operators using outside providers “with varying results”.

The shares weekSpeaking of GAN, the company’s share price suffered a bad week, down 11% in the past week and 77% down in the last 12 months. Rival Kambi, meanwhile, is off by 55% over the same period. Tekkorp Capital launchTeam building: Tekkorp has launched an advisory arm and has added ex-William Hill Online CEO Crispin Nieboer to the team. Tekkorp is led by Matt Davey, CEO, and Robin Chhabra, president, and has also added Andy Clerkson, former founder of Grand Parade, as a partner.

Deal pending: Tekkorp also managed the Tekkorp Digital Acquisition Corp. SPAC currently seeking a merger with Caliente’s CaliPlay. GiG complete Sportnco dealGig workers: Gaming Innovation Group has completed its €51.4m acquisition of Sportnco announced in Dec21, paying €27.9m in cash and the rest in shares. At the same time, New Zealand’s casino operator Sky City has invested €25m in GiG, largely covering the cash element of the deal, and making it an 11% shareholder. Sweat it out: Sportnco shareholders will also be entitled to a two-year performance-based earnout of up to €11.5m for 2022 and 2023, payable in cash and shares. Hervé Schlosser, Sportnco CEO, will remain in charge of the unit.

Breaking news: GiG has announced that it will supply its sports-betting platform to Betway in Portugal via Sportnco’s sportsbook and player account management (PAM) system. The latest launch is the second one Sportnco has managed for Betway following its entry into the French market last year. NeoGames initiation updateNeo digital: Jefferies has initiated coverage of NeoGames with a positive assessment of the group’s online-lottery platform that it runs as part of the NeoPollard Interactive joint-venture. The analysts said the vertical could enable the group to double its EBITDA figures (FY21 $33.4m) in the long term as more states legalize their digital lottery offerings.

Competing for contracts: NPI’s iLottery programs had been highly successful, producing “sales per capita in MI, VA, and NH over 2x states (those) run by competitors”. Jefferies said the addition of Aspire Global’s sports-betting and gaming platform to the NeoGames product portfolio “could help the company win new iLottery contracts”. Regulatory roundup

The week aheadEntain publishes its Q1 update on Thursday. During the group’s Q4s in January CFO Rob Wood said the business was “up against very strong margins” in H121, but things should improve throughout H122. Analysts will also seek clarity on recent acquisition Unikrn which it said recently it would be relaunching. DatalinesNew York week to March 27: Weekly handle fell 26.%% to $327.8m while OSB GGR was $13.9m, the lowest take since launch.

Further reading: Relations deteriorate between Gov. Hochul and the Seneca tribe. Nevada Feb22: Strip revenues of $599.1m was up 1.2% on Feb19 while locals rose 19.4% to $223m while total GGR was up 10% on Feb19 and 44% YoY to $1.11bn. Strip slot win of $337m was up 25% on Feb19, helping to offset a 20% fall in table GGR vs. Feb19.

Analyst reaction: Wells Fargo pointed to the improved sequential trends as had been predicted by the “gradual” recovery chatter on recent earnings call commentary. For March, Macquarie are predicting further gains (est. 21% up on Mar19). They note that QTD Strip GGR is up 4% on Q119. Virginia Feb22: Online sports betting handle was down 17.2% to $402m as the NFL season closed and $33.1m was wagered on the Super Bowl. Gross revenues were $7.9m and margins 6.8%. Arizona Jan22: Handle rose 13% MoM to a record of $563.7m while revenue was up 13.5% to just over $40m. However, operators gave away ~$20m in free bets. Players wagered $3.9m in DFS entry fees for pre-tax profits of $431k. Rhode Island Feb22: Sports betting handle was down 27.7% to $42.1m, with $23.4m wagered online and $18.8m played at the state’s two retail sportsbooks (Twin River and Tiverton casinos). Revenue was up 125% YoY to $3.6m but down 30.8% MoM. Online revenue was $1.9m, retail $1.7m. Macau Mar22: GGR was down 55.8% YoY and -52.7% MoM to $460m. Looking at visitation and hotel room supply and occupancy data for Feb22, Deutsche Bank said Q122 GGR fell 25% YoY and -77% vs. Q119 to $2.22 bn vs. $27bn forecasts. NewslinesSafe launch: Paysafe has announced that it is also live in Ontario. The group has processed online payments for the Ontario Lottery and Gaming Corporation (OLG) since 2015 and has confirmed PointsBet and theScore Bet as clients in the province. It will be announcing new partners in Ontario in the coming weeks, it added. Plan responsibly: The Parx Casino and BetParx brands have joined the American Gaming Association’s (AGA) ‘Have a Game Plan. Bet Responsibly’ campaign. Both brands will promote responsible gambling messages and consumer education at its retail sportsbooks and throughout all digital channels. Legal eagle: Mohegan Gaming & Entertainment has appointed Raymond Lin as its new chief legal officer. Lin will advise on all legal matters and head the MGE compliance and risk management teams. He will report to chief executive Ray Pineault. Harness operations: WatchandWager.com has extended the lease of its operations at the Cal Expo Harness racetrack until 2030. Its current deal was due to expire in 2025, the extension did not require any further approval from regulators as the group is already approved by the California Horse Racing Board. What we’re readingThe joy of March Madness: America’s weirdest sports ritual. The new wave: With much of European football run by either oligarchs, state-backed wealth funds or major corporates, The Athletic runs the rule over the new sponsors flocking to the beautiful game. On socialLicking his Champions League wounds: PSG President Nasser Al Khelaifi’s says clubs needs to be first on “digital, OTT media, bitcoin, NFTs” to become leaders.   Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Apr 1: Weekend Edition #40

Friday, April 1, 2022

Novibet SPAC listing, Sportradar analyst reaction, Bored analysts NFT, GAN and NeoGames analyst updates, Sector watch - financial trading +More

Earnings+More Podcast #3

Thursday, March 31, 2022

Watch now (27 min) | Managed decline

Mar 30: Nothing compares 2 US, says Sportradar

Wednesday, March 30, 2022

Sportradar Q4, Boyd Gaming, Gaming Realms and IGT analyst notes +More

Boyd agrees $170m Pala deal

Tuesday, March 29, 2022

Boyd Gaming's Pala Interactive buyout, New York data, XLMedia FY, 888's African JV +More

Mar 28: UK gambling’s cost-of-living crisis

Monday, March 28, 2022

Gambling and the cost of living, March madness update, MGM analyst note, Truist online update, Startup Focus - MetaBet +More

You Might Also Like

These are the 14 ways to instantly build trust with visitors

Thursday, January 9, 2025

Some websites sparkle with evidence and reasons to believe. Other websites are really just piles of unsupported marketing claims. Today, we are sharing a guide for building pages that build trust with

PE plugs into data centers

Thursday, January 9, 2025

Doubled valuation follows ditched SPAC; how 10 GPs rule private credit; new look for post-pandemic law firms Read online | Don't want to receive these emails? Manage your subscription. Log in The

Having Fun Yet? 😄

Thursday, January 9, 2025

Enjoyment sells.

Why Saying No Can Be a Good Thing

Thursday, January 9, 2025

Be mindful of your resolutions to help others, ensuring they don't come at the expense of your own well-being.

🔔Opening Bell Daily: $28 trillion red flag

Thursday, January 9, 2025

Long-term bond yields are hovering near the key psychological level of 5% and warning of a Fed error.

Here's what ACTUALLY integrating college sports with academics could look like

Thursday, January 9, 2025

With real world examples and everything!

This week in NatureTech #25

Thursday, January 9, 2025

[4-minute read]

The 2025 State of Email is in the works. 🎉 But first...

Thursday, January 9, 2025

Share your thoughts on how you do email—and we'll bring those insights to life. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The 5 “Must Have” metrics for your SaaS

Thursday, January 9, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack The 5 “Must Have” metrics for your SaaS 1. Monthly RECURRING revenue 2. Churn 3. Cost Per

Is 2025 the year you grow your agency?

Thursday, January 9, 2025

Hi there , No one teaches you how to run an agency. You learn every lesson the hard way. Whether you're stuck on pricing, hiring, or scaling – there's no one else to turn to. No perfect answer