The Commerce Tech - Teardown | Facily

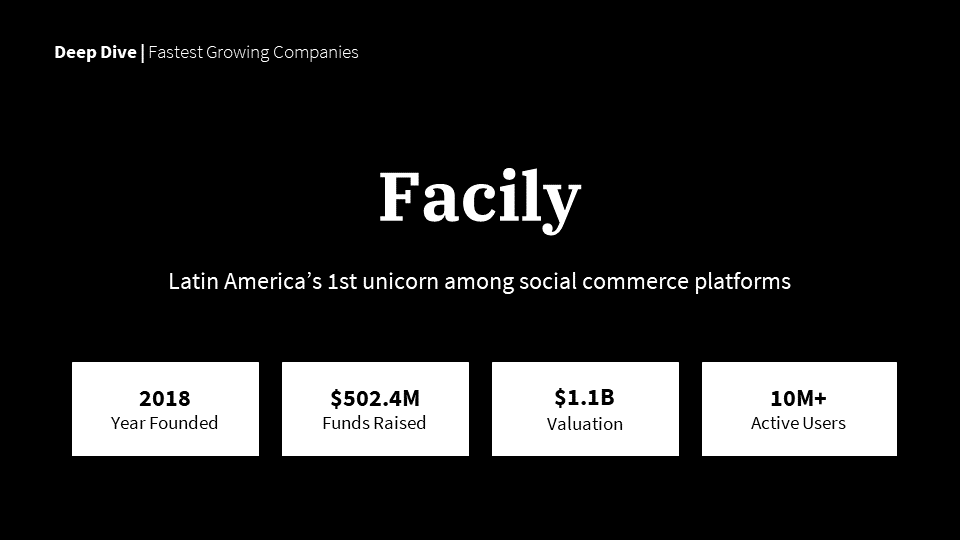

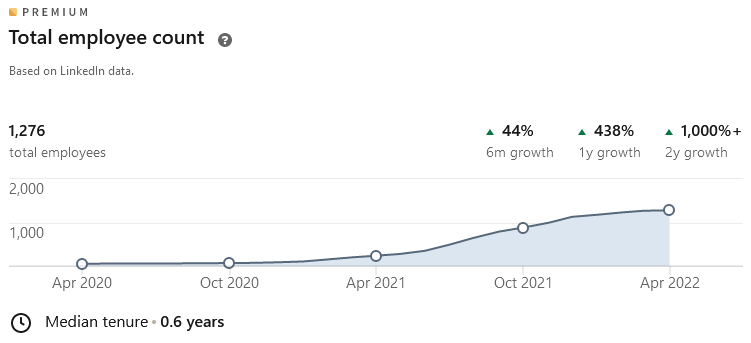

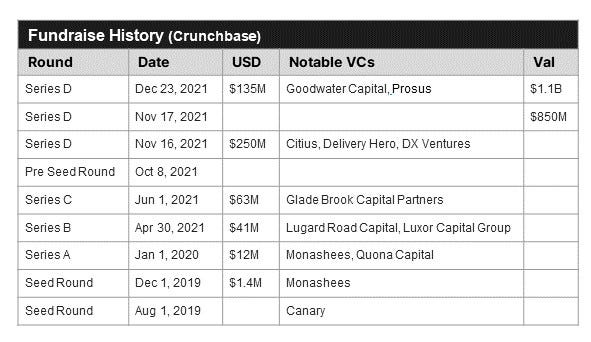

Teardown | FacilyFounded in 2018, Facily has scaled rapidly to become a leading social e-commerce platform committed to helping Brazil's low-income population.Brief by Sarah Pariwush. These briefs are produced by leveraging publicly available data sources and information. If you notice a mistake or see an area for improvement, please let us know through this typeform. SnapshotFounded in 2018, Facily is the first social commerce platform in Latin America. It is on a mission to provide everyday goods to the low-income population in Brazil at affordable prices. The company leverages a community group buying model and combines it with the convenience of online shopping, catering to millions of Brazilian families. The company is headquartered in São Paulo, Brazil, and currently operates in 9 more states. It has raised $502.4M in funds, and reached the unicorn club after its latest funding round of $135M brought it to a valuation of $1.1B. Business Overview and ProductsAs a social commerce platform, Facily seeks to provide access to high-quality goods to low-income populations at affordable prices. It offers fresh fruits and produce at 40% of the cost at supermarkets. The goods it supplies overall consist of food, beverages and other products at wholesale prices. It encourages group shopping to ensure consumers get the best prices on a vast category of products. Whatsapp plays a key role in the business. The company is enabling convenient online shopping through the multiple pickup points it provides across the cities it operates in, and also through the variety of payment options on its platform. These include cash payments and bank transfers. How It WorksThe company provides a marketplace for buyers to purchase everyday items at low prices. It connects SMEs to larger audiences and aims to ensure producers get paid more, while buyers have to pay less through its platform. It offers a gamified app, which enables consumers to access the best prices via group purchases. Facily works directly with suppliers and manufacturers which allows it to maintain low prices. Most of its customer base belongs to the low-income segment and are first-time e-commerce users. Shopping is done through the use of Whatsapp. Through Facily’s app, interested buyers can make group purchases and obtain discounts through Whatsapp groups. Customers can create new groups or join existing ones, and share purchase links with their friends and family members. The app also has built in games to increase user engagement and popularity of the platform. Once an order is placed, it is delivered to a nearby pick-up point for collection by the customer. Facily owns a vast distribution network which uniquely consists of pickup points for collection by customer. These collection points make delivery cost zero for customer, lowering logistics costs for Facily. Moreover, the company makes several payment options available to customers and they are not required to use credit cards. This includes paying through cash, through PIX (a central bank platform for digital payments), or through Boletos (a voucher-based payment system). Business Model and PricingThe company uses an asset-light community-group-buying model, along with its logistics network and technology to conduct its operations. The company does not charge a shipping fee to its consumers. Facily uses technology to disrupt supply chains and in the process, eliminates the role of middle agents. The difference in prices offered by Facily can therefore be drastic, for example, a banana which costs BRL 8.40 ($1.79) in a traditional supermarket, will be available in the app for BRL 1.99 ($0.42) with no delivery fee. The company has a network or pickup points, which primarily comprise of small businesses. These small businesses earn 5% of the price of every item that they deliver to customers, which amounts to BRL 1 ($0.21) per item at max. In larger order volumes, this becomes a significant amount. Facily itself charges a commission of 15% per sale on average from these sellers. TractionIn a period of rising inflation in Brazil, the company’s model has resonated well with the Brazilian population. From September 2019 to February 2020, the company reported a 20% growth in users per week. Moreover, Facily raised multiple funding rounds in 2021 alone, and experienced a 43x growth in sales volume from January to September 2021, a span of 9 months. The no.of orders delivered by Facily grew by 46 times in 2021, and in October 2021, the company made 7M+ product deliveries. By November, its distribution network had grown to 11,000+ pickup points. By December 2021, the company’s app had 17.5M downloads and around 10M active users, and it was among the fastest growing shopping apps around the world. Its pickup points numbered at 12000+. Facily’s app is now among the top 3 most downloaded apps in Brazil. It is also among the fastest growing apps in the country, and among the fastest-growing e-commerce food apps around the world. The company has withheld information about its revenue numbers. Founder(s)Diego Dzodan: Co-founder and CEO at Facily. Previously, he has served as Vice-President for Facebook Latin America for more than 3 years, and was also co-founder and CEO of Certant. Luciano Freitas: Co-founder and ex-CMO at Facily. Prior to Facily, he co-founded Nuveo and worked as a marketing manager at Uber. Currently he is CMO at Bxblue. Vitor Zaninotto: Co-founder and IT Director at Facily. Previously, he has worked as an SAP consultant at Infosys and ESS Brazil. History and EvolutionFacily was founded in 2018 with a sharp focus on the low-income population of Brazil and Latin America in General. When Founder Diego Dzodan traveled to China, he witnessed impressive social e-commerce models in place. Soon after, the company was directly inspired from the Chinese Pinduoduo, a platform that connects farmers and consumers in China. Once the company took off, it focused on bringing onboard talented teams and hired on key roles such as Head of Strategy, who helped the company scale rapidly. The group purchase model worked well in Brazil due to the innate connectedness and shared goodwill of the Brazilian community. They did not hesitate to share good offers in their social circles. The company experienced a sharp growth during the coronavirus pandemic (refer to “Traction” section). In 2020, it launched a full scale internship program. In November 2021, the company achieved a $850M valuation and within a month, following another funding round, reached a $1.1B valuation. This funding round of $135M will allow the company to focus more on expanding its technology and logistics going forward. In March 2022, the company announced its plans to enter the financial services industry. It revealed that payment processing may be the starting point, but the portfolio will later be expanded to include access to the typical services provided by large banks and insurance companies. The company may consider integrating 3rd-party solutions with its platform. Currently Facily operates in Brazilian cities of Sao Paulo, Rio de Janeiro, Belo Horizonte, Curitiba, Fortaleza, Goiania, Brasilia, Recife, Porto Alegre and Salvador. The company has shared plans to expand to 7 more cities in 2022, along with launching pilot projects in Colombia and Mexico. According to the founder, the company is still in the initial stages of overcoming traditional e-commerce barriers and tapping the vast market. Even so, it has managed to disrupt existing supply chains with its social commerce approach. It is backed by leading investors in Latin America and outside of it, which has undoubtedly enabled it to scale rapidly in a short period of time. Moreover, the company praises its asset-light model and extensive logistics for contributing massively to its success. Additional Learnings

Market Snapshot

Suggested Next Reads

Company Reviews & Competitive IntelIf you liked this post from The Commerce Tech Newsletter, why not share it? |

Older messages

Teardown | Ankorstore

Sunday, May 1, 2022

In under 3 years Ankorstore has achieved a $2B valuation building a B2B marketplace in Europe

Udaan - India's leading B2B Marketplace

Monday, April 4, 2022

Founded in 2016, Udaan grew to become one of the fastest unicorns in India.

You Might Also Like

Building complete rank and rent sites in just minutes

Monday, March 3, 2025

This tool is incredible

🌁#90: Why AI’s Reasoning Tests Keep Failing Us

Monday, March 3, 2025

we discuss benchmark problems, such as benchmark saturation, and explore potential solutions. And as always, we offer a curated list of relevant news and important papers to keep you informed

I interviewed THE largest Amazon Seller [Roundup]

Monday, March 3, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

The state of data-driven decision-making for CPG brands

Monday, March 3, 2025

How marketers use purchase insights to maximize campaign performance

Facebook updates, TikTok ROI, Instagram format matches, and more

Monday, March 3, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo New week, fresh insights, Reader! Stay sharp with the latest updates on AI, social

Are you losing revenue to rivals?

Monday, March 3, 2025

This is a challenge that costs businesses millions every year: Their customers are switching to competitors for various reasons... even though most of them could easily be fixed. On Tuesday, March 4,

DeepSeek’s 545% Profit Claim

Monday, March 3, 2025

PLUS: Siri 2027?!

Insurtech VC resets, readies for growth

Monday, March 3, 2025

Europe's share of regional IPOs sinks; the agtech revolution is now; hope flares for natural gas deals Read online | Don't want to receive these emails? Manage your subscription. Log in The

What I Think About The Crypto Strategic Reserve

Monday, March 3, 2025

Listen now (8 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$92K BTC After Trump’s Crypto Call, MARBLEX Invests $20M—WOOF Ups the Game!

Monday, March 3, 2025

PlayToEarn Newsletter #262 - Your weekly web3 gaming news