The Daily StockTips Newsletter 05.11.2022

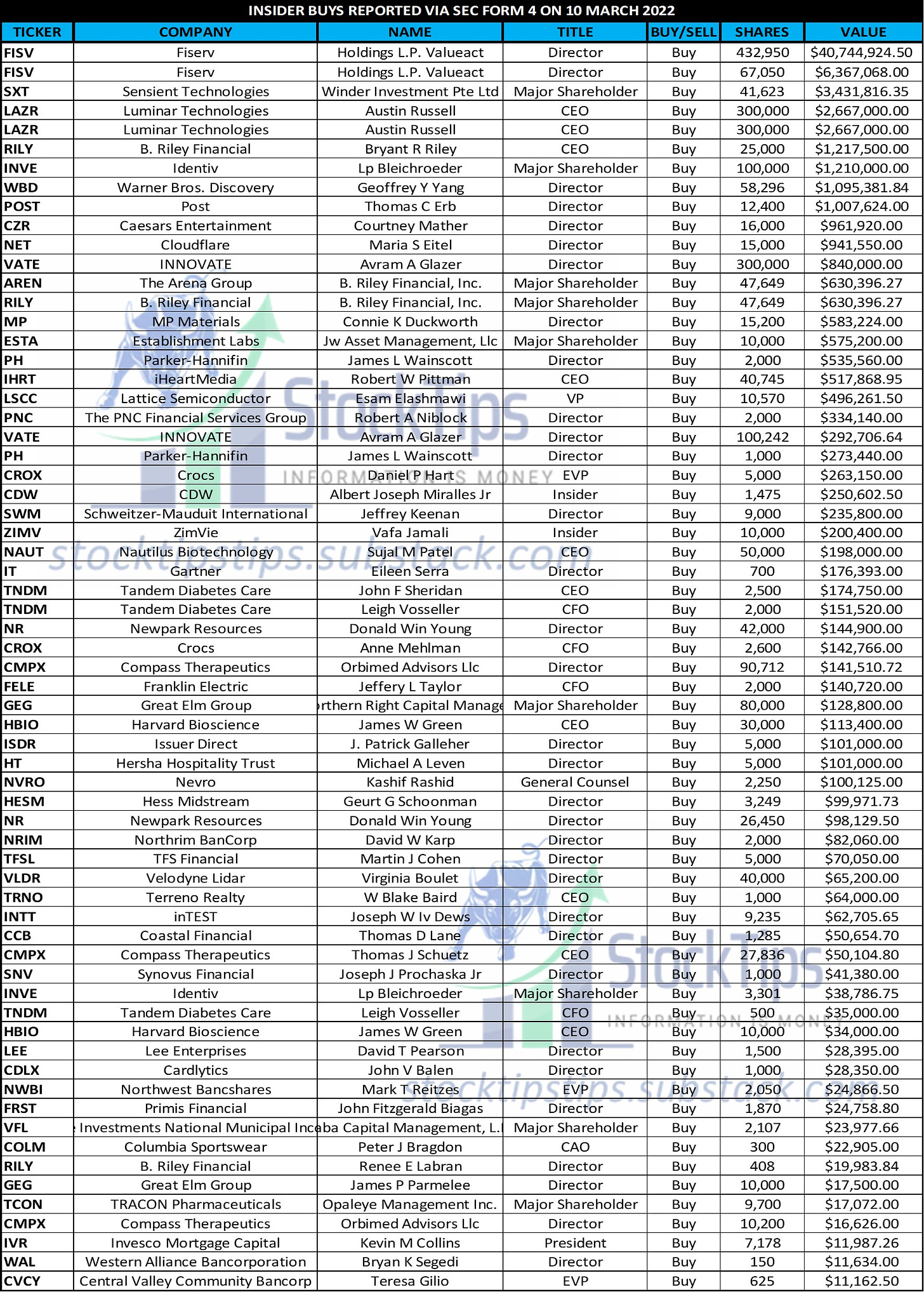

The Daily StockTips Newsletter 05.11.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red on the Earnings Calendar Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. MOST RECENT INSIDER BUYING TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. INFLATION REPORTED TODAY: April YoY CPI is expected to come in at 8.1%. March was 8.5% YoY. The only reason this month is expected to come in lower YoY is simply because the increase in inflation from April to May this year is expected to be lower than the same period last year. Even so, an 8.1% increase YoY in April still represents quite a large unsustainable jump. Last years March to April jump was 1.6% leading to a CPI of 4.2%. The 8.1% estimate represents a YoY increase of 8.1% higher than prices were AFTER the 4.2% a year ago (That’s roughly 12.5% price increases over a 24 month period). In order to hit the Feds target rate of inflation of 2% YoY, we should expect an average jump of 0.17 month to month. So, in order for inflation to be increasing at sustainable rates, we should look for 8.5%+0.17%-1.6%= roughly 7.07% (I say “roughly” because when we’re talking about a rate of increase we should factor in the compounding nature of inflation) . Therefore the consensus of 8.1% actually represents a jump of 1.03% month to month higher than sustainable levels. What we want is inflation to be increasing at a rate lower on average than experienced in the trailing 12 months. Last months 8.5% increase in YoY inflation assumes an 0.71% increase on average month to month while this month is expected to be an increase of 1.03% month to month. So what I would like to see is the CPI coming in lower than 7.61% for April 2022, although current April consensus is 0.49% higher. So to get the true feel of how bad inflation is, look at the MoM numbers … not the YoY numbers. Now … I don’t know how the hell analyst came up with that 8.1% consensus. I was expecting much lower given the 1.6% month to month jump last year. But understanding these numbers is important. We don’t want to get lost in the assumption that YoY inflation coming in lower in the latter month than the previous represents a decline in the rate inflation is actually increasing month to month. THE MARKETS MAY PUMP WITH THE BAD NEWS OUT OF THE WAY: We’ve all seen it before, … the markets price in bad news days or weeks prior, & once released its almost as if folks say “OK, we have another month before the next bad news release, lets swing this.” It’s happened in most months where inflation was supposed to be bad, save those months where inflation surprised much higher than expected. THE WORST IS NOT BEHIND US: Summer is coming, & with summer comes vacations & road trips. Historically energy prices increase over the summer which is especially bad news when energy is among the highest drivers of inflation. $5gal unleaded would not surprise me in June/July time frame. And given how oil/gas futures function it also would not surprise me if $4gal gas would be a price we would long for moving forward. An increase in energy prices, raises the prices of everything! NEXT BIG ECONOMIC NUMBERS: We have the Producers Price Index coming tomorrow at 0830ET. The month to month increase is expected to come in at 0.5% (consensus estimate). Remember the PPI is the firms version of the CPI. Whereas the CPI measures inflation from the consumers point of view, the PPI measures inflation from the producers point of view. A NOTE ON WAGES: Wages are increasing as a result of the scarcity in the labor market. Remember, raw wages only tell half the story. Not only are people paying more for the increase in consumer prices than they receive in wage increases, but they also pay more in taxes both on income & sales tax. Also firms must contribute their half of social security & Medicare taxes paid by employees. So lets not assume that a 3% increase in wages means firms are paying merely 3% more for labor. When we account for taxes & benefits (Like social security, Medicare, 401K’s, healthcare, life insurance, unemployment insurance, paid time off & more), its much more. Therefore the hotter the labor market, the higher inflation becomes. Significant News Heading into 05.11.2022:

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 05.12.2022

Thursday, May 12, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.10.2022

Tuesday, May 10, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.09.2022

Monday, May 9, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.06.2022

Friday, May 6, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.05.2022

Thursday, May 5, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏