The Daily StockTips Newsletter 05.05.2022

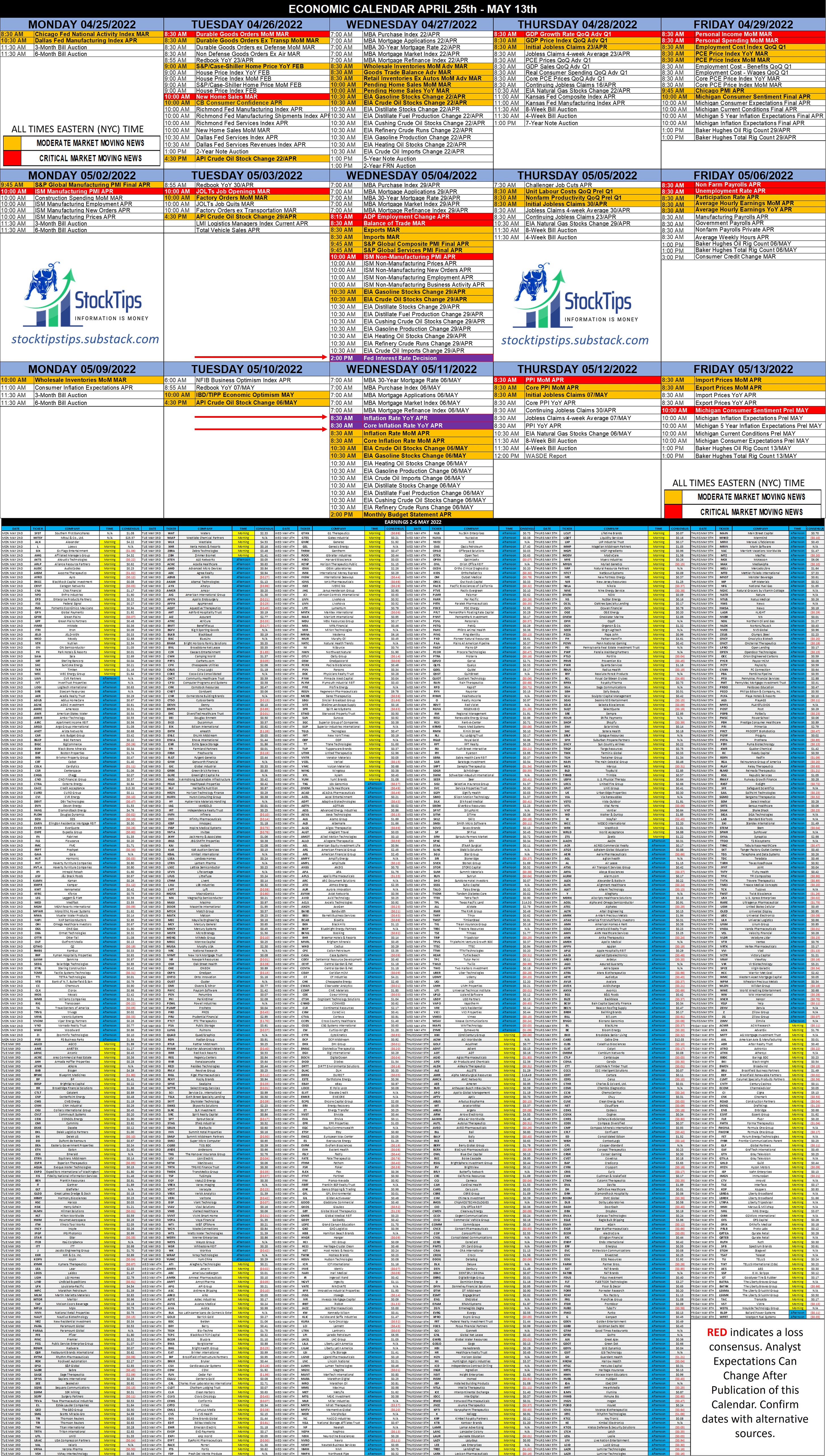

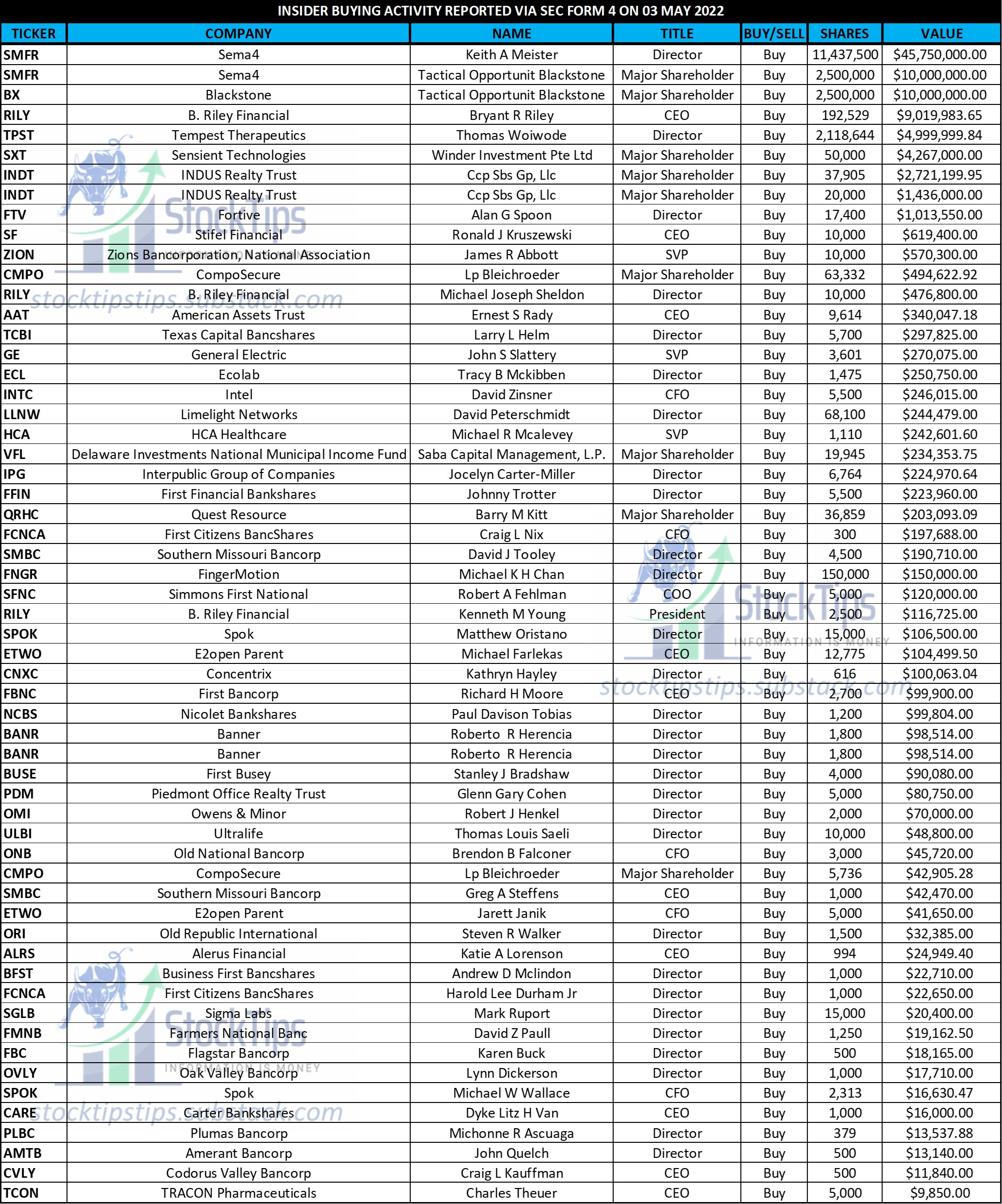

The Daily StockTips Newsletter 05.05.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red on the Earnings Calendar Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. MOST RECENT INSIDER BUYING TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. SPECIAL NOTE: Substack glitched again yesterday & did not send my newsletter out to all subscribers. Therefore I am recycling some very important info I pushed out yesterday. Yeah, its that important. PLEASE READ BELOW, I’M LIKELY GOING TO SAVE YOU A SHIT TON OF MONEY. BUY LIST UPDATE: The first two sets of earnings reports from companies on the BUY LIST did exceptionally well. EMKR didnt do well at all. They blamed the fact that they are locked into their contracts (no pricing power), & their former exposure to the Chinese semiconductor market & more. I don’t like such excuses & lack of pricing foresight. Anyway I removed three companies from the Buy List this morning; VSH, PLAB, & EMKR. Why PLAB? Because of their exposure to China amid lockdowns. And despite this years down trend, I’m certainly holding on to POWW. I have also added unusual options activity from the day prior to the paid subscriber section. MARKET OBSERVATIONS: As many of my paid subscribers are aware, I have been keeping meticulous records of earnings this season. One big takeaway is the number of companies missing analyst EPS estimates despite beating analyst revenue estimates. In some cases companies are absolutely smashing revenue estimates, & yet just hitting analyst EPS estimates, or, coming in well below analyst EPS estimates. Ladies & Gents, this is the corrosive power of inflation. Sure, companies are largely getting more revenue. But the cost of inputs, wages, & operating costs, are increasing higher than revenue. The result is a lower than expected EPS. Should this trend continue combined with an eventual reduction in economic activity, the result would be declining earnings & an eventual recession. I believe this is what the market is pricing in & in part why even outstanding earnings aren’t being respected by the street. MARKET EARNINGS OUTLOOK: This quarter is justifiably a bearish quarter. Not because of how companies performed January-March, but because only a part of the effects of the war in Ukraine & China Lockdowns, if any effects at all, are represented in these earnings. I will repeat that statement, because it’s important: ONLY A (PART) OF THE EFFECTS OF THE WAR IN UKRAINE & CHINA LOCKDOWNS, IF ANY AT ALL, ARE REPRESENTED IN THESE EARNINGS. It will not be until next quarter until we see the true results of these items. Items like increased energy costs, supply chain issues out of China, increasing input/food prices, etc. PLEASE KEEP THIS IN MIND BEFORE YOU BUY ANYTHING PRIOR TO NEXT EARNINGS! And this doesn’t even account for current inflation & Fed rate hikes. MARKET OVERVIEW: Lockdowns in China (Wrecking Supply Chains), the Fed is increasing interest rates (De-stimulating the Economy), the Fed is reducing balance sheet (De-stimulating the Economy), War continues in Ukraine (Wrecking Supply Chains / Increasing Commodity Prices / Not Fully Priced in to Todays Earnings), negative GDP growth, 40 year record inflation, skyrocketing rent & housing prices ….. folks ….. ignore yesterdays rally. It was short covering amid fear that Powell’s assessment would squeeze the bears. NEXT BIG ECONOMIC NUMBERS: Unemployment Data on Friday, INFLATION REPORTED ON WEDNESDAY NEXT WEEK. YESTERDAY: After the Fed raised interest rates by 50 bps (0.5%), the market rallied. Why did the market rally? Because Powell said two things. He noted, & I’m summarizing here, that 1) The Fed isn’t considering a 0.75 bps hike, 2) He sees no indicator of a recession. Evidently he must have been asleep when the negative GDP numbers were released last week. Significant News Heading into 05.05.2022:

YESTERDAYS EARNINGS: CWBC AGCO AME ARNC ACRE ATKR BIIB BPMC BRSP BR CTLT CNP CERN CMS CNHI CIGI CVLT DSKE DKL DK DLA DD DEA ETN ETRN ESPR EXPD FIS BEN IT GLT GTE GLDD HSC HSIC HLMN HLT HWM ITW INCY IPGP ITT J KNSA KKR KYMR LEA LDOS LGIH LIND LPX MPC MLM MTOR TAP MPLX NNN NRZ PARA PFE PINC PEG RDWR QSR RYTM ROK SPGI SABR SAGE SPNS SEE SQNS SMP SGRY TEVA EL GEO SMG TRI TWI TRTN UTL USAC VAL VSH WAT WLKP WLK XHR ZBRA ZBH ACHC AMD ABNB AKAM AYX AMCR AIG APEN AQST ATRC BGFV BLKB BFAM BNL CZR CWH PRTS CRUS COKE CHCT CPSI CRK CNDT CTSO DENN DEI DCO EIX ENLC ENVA EXR FRSH FLGT GRBK HLF HURN HY INFN INFI IOSP INSP NVTA JKHY KAI KAR KBAL LTRN LSCC LFVN LFUS LTHM LYFT MGNX MX MNDT MASI DOOR MTCH MATX MEC MRCY MSTR MDXG MG MUSA NYMT OSH OKE OSPN ONTO OUST OMI PAYC PEN PKI PUMP PRO PRU PTCT LUNG RDN RRR RNR REZI RVLV RIGL RCKY SPNE SCI SWKS SRC SPT SBUX INN SMCI THG MTW TMDX TSP EGY VREX VRSK VERI DSP VIAV VOYA WTI WCN WTS WERN WSR WK WRAP YUMCPAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 05.03.2022

Tuesday, May 3, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.02.2022

Monday, May 2, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.28.2022

Thursday, April 28, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.27.2022

Wednesday, April 27, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.26.2022

Tuesday, April 26, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏