Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #292

What's 🔥 in Enterprise IT/VC #292How we thought about scaling our seed firm from a team of 2 + $1M proof of concept fund to a partnership of 4 & $367M of new funds

So we announced this…   For solo GPs and others running small firms like Eliot and I, let me share with you some of our thought process around growing our team. The first question Eliot and I were faced with was how do we keep supporting our founders from day one and continue to be the first call until exit. Along those lines, we mapped out how much time we spent in various areas from meeting new founders, supporting existing ones, raising capital and all else we needed to do to grow a firm. Ultimately we landed on an operating partner model and given that we have often written about capital being more of a commodity, than people, enter Natalie Ledbetter. Natalie came referred to us from Dipti Salopek who was VP People at Snyk, a portfolio co, and has an operating background having helped scale Stash in the fintech space from 7 to over 300. She’s taken a huge load off us and helped implement a best-in-class framework to think about hiring, put systems in place, and also attract and find talent. Over the years we added Ab Gupta, formerly VP Ops & Strategy at Kustomer, another portfolio co to help founders with team dynamics, ops, and all of the other things technical and product driven founders are experiencing for the first time on the business side. Finally, Eliot and I were faced with the question of getting bigger and if so, how big. One thing we did know based on experience is that we never wanted to get so big that we would leave our swim lane of finding founders and leading rounds at company formation. We know that in venture you can either go big, go niche, or go home. We know our niche, partnering with highly technical founders from day one and having the capital to back them through exit. Once we decided we wanted to get bigger then naturally it came down to adding future partner level talent. Taking a step back, Eliot and I had a hard time raising capital until the middle of 2019 so our first 9 years of existence was quite rough. I remember the many discussions with Eliot on who the right partner could be and many a potential LP suggested adding an established partner to our firm who already had significant LP relationships and could jumpstart our fundraising process. As much as we were tempted by the notion and shortcutting our fundraising process, we decided to stick to our focus and our unusual way of partnering with founders and thought best to build from within. Fortunately, we got to know Shomik Ghosh from our LP Top Tier Capital. While not on the LP side, we collaborated with Shomik over a couple of years as he was leading direct investments in enterprise startups like CircleCi, Shape Security and Anaplan. We first met Ellen many years ago as we were an investor in her startup Dark where she was also CEO. She brings an incredible product and engineering mentality to the team and always offers the founder perspective. Fast forward and we couldn’t be more thrilled to have them both as Partners. What I ❤️ most is how both Shomik and Ellen encapsulated their learnings during the last two years which shows the true boldstart culture of being a true believer for founders from day one but also done with their own flair and creative twist.     As always, 🙏🏼 for reading and please share with your friends and colleagues! Scaling Startups

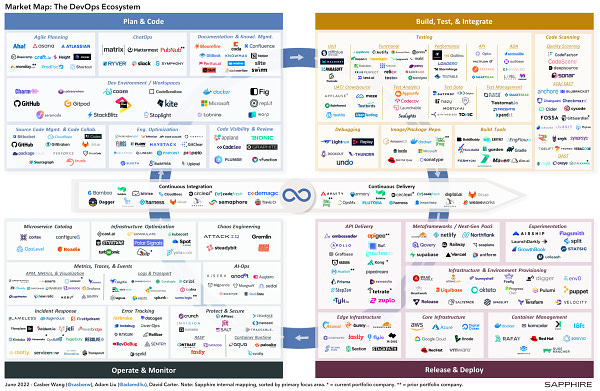

Enterprise Tech

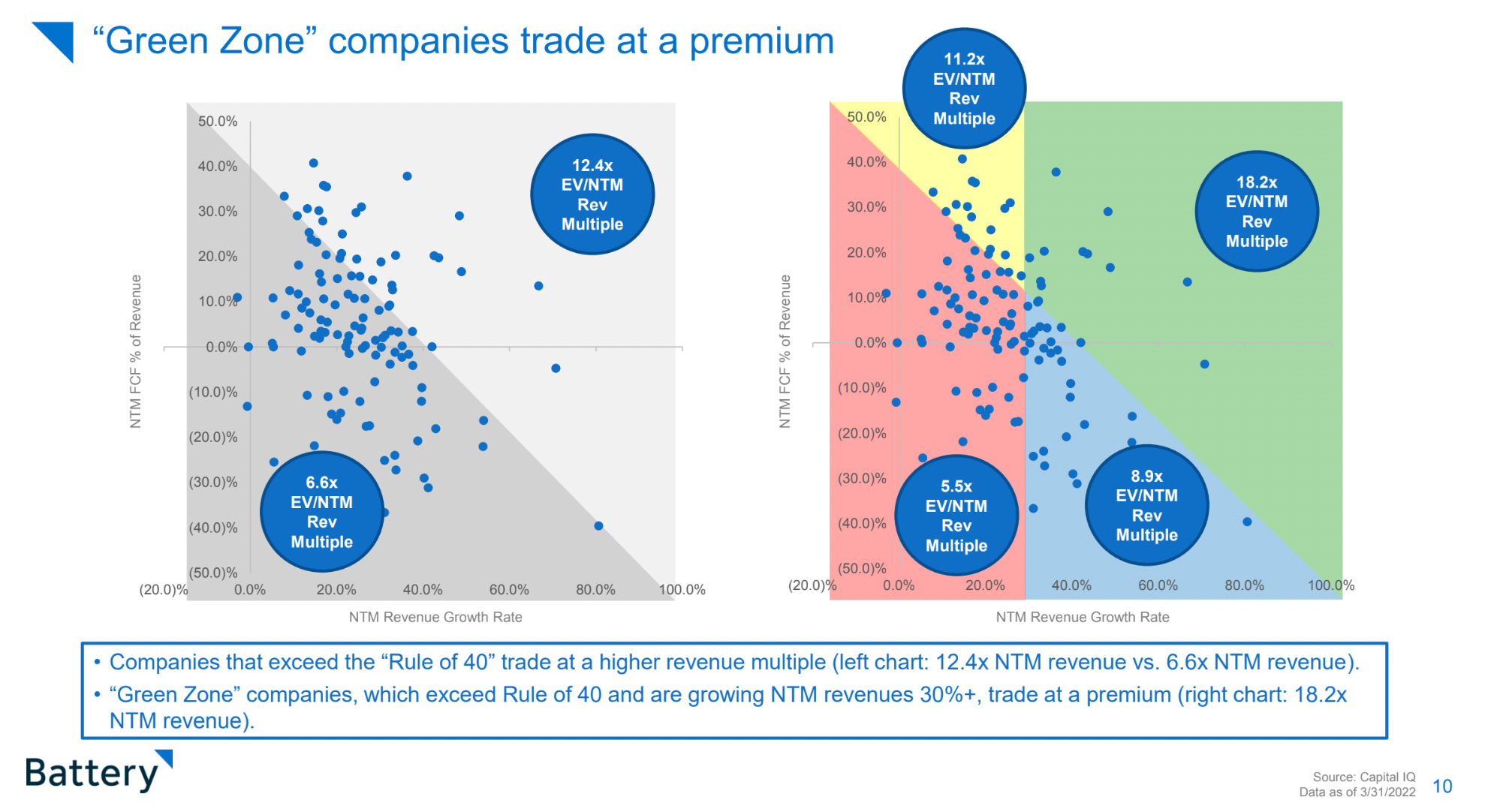

Markets

If you liked this post from What's Hot in Enterprise IT/VC, why not share it? |

Older messages

What's 🔥 in Enterprise IT/VC #291

Saturday, May 28, 2022

Starting small to go BIG 💪🏼 + the importance of focus

What's 🔥 in Enterprise IT/VC #290

Saturday, May 21, 2022

Story of survival + success from the Dotcom crash - how Greenplum sold to EMC + eventually IPOed as Pivotal

What's 🔥 in Enterprise IT/VC #289

Saturday, May 14, 2022

Why lead investors matter + simple portfolio triage for seed investors

What's 🔥 in Enterprise IT/VC #288

Saturday, May 7, 2022

Stay calm and carry on, growth at all costs is over, the prudent ones can keep building 🏗️

What's 🔥 in Enterprise IT/VC #287

Saturday, April 30, 2022

Building in a 🐻 market and getting ahead while you have the 💰

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏