Analysis of Maple and TrueFi: Alamenda and Amber borrow the most, with large Maturity concentrated in late July an…

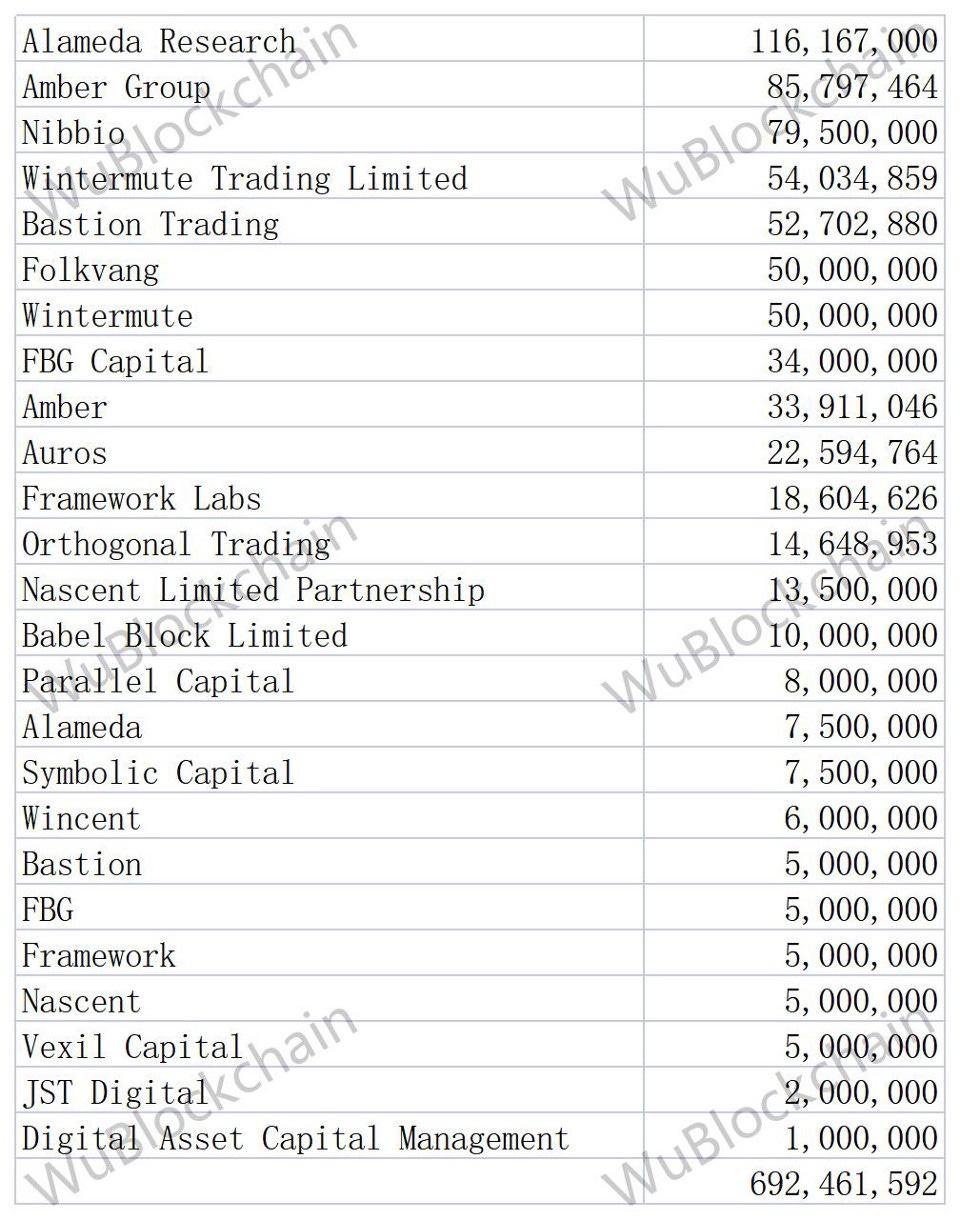

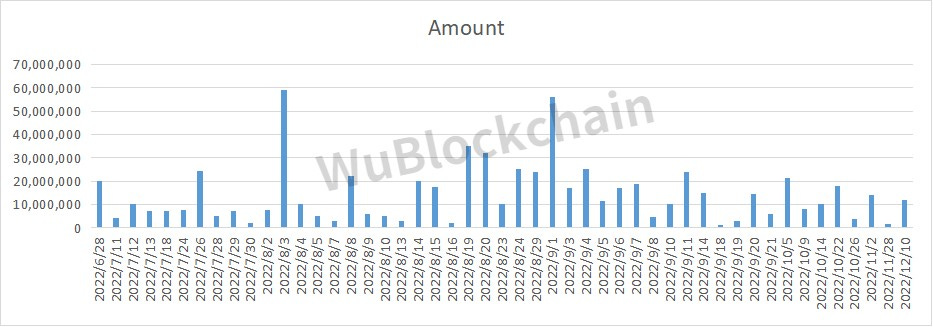

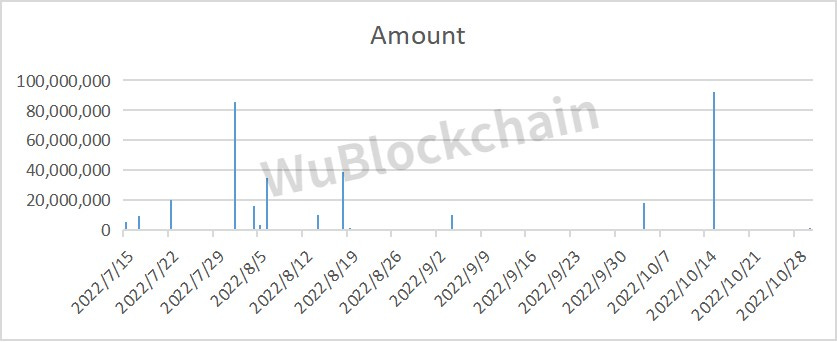

Analysis of Maple and TrueFi: Alamenda and Amber borrow the most, with large Maturity concentrated in late July and early AugustAuthor:Joey Wu From WuBlockchainMaple Finance is a lending protocol built on Ethereum and Solana that provides unsecured credit loan to institutions. Recently, an official release stated that starting the week of June 20, there may be a shortage of funds in the pool and lenders will have to wait for borrowers to repay their loans. Related to the earliest studies from:  This article was inspired by it and was originally written by WuBlockchain. Maple has issued a total of $692 million in loans, with the largest borrower, Alameda Research, having lent $116 million. However, Alameda Research was also a Maple depositor with a total of $89.17m, resulting in a net lending position of $26.37m. In second place was Amber Group, which lent $89.8 million with interest rates ranging from 3.75% to 7.6% and maturity dates ranging from July 19 to December 10. In third place was Nibbio, which lent $79.5 million with interest rates ranging from 7.1% to 9.75% and maturities from August 11 to October 29. The remaining rankings are as follows. The earliest maturity date for all outstanding loans is June 28 and the latest is December 10. In addition, Maple Finance currently has $150 million in cash available for loans, excluding the Alameda Research pool (which is for its own borrowing only) of only $697.5 billion. Also facing deposit dried up is TrueFi, an institutional lending platform where borrowers must be white-listed institutions with $10 million or more in capital. TrueFi has currently disbursed a total of $394 million in loans, with the largest borrower being Alameda Research, which has lent $137 million at 7.05% to 7.15% interest with a maturity date of early August. The second largest borrower is Wintermute Trading, which has lent $92.05 million at 8.73% with a maturity date of October 15. In third place, Amber Group lent $65.86 million with interest rates ranging from 9.23% to 9.35% and a maturity date of August 18. The remaining rankings are as follows. The earliest repayment date for all outstanding loans is July 15 and the latest is October 30. On the deposit side, TrueFi has $407 million in total volume and 96.6% has been borrowed, leaving only $13.59 million in cash available for loans. Both platforms are facing deposit dried up, with large maturity dates concentrated between late July and early August. TrueFi is more at risk of default than the other. However, since both platforms are unsecured lending and only stake platform Tokens to protect depositors’ rights, even if a default occurs, only depositors’ funds, the price of Tokens and borrowers’ credit scores will be affected, and there will be no impact on the crypto market (no liquidation of BTC or ETH). In addition, Maple Finance published an announcement on its website claiming that Orthogonal acknowledges there is a $10M loan to Babel from the Orthogonal USDC pool on Maple, and has been in daily contact with Babel management since Babel halted withdrawals and is focused on protecting the interests of lenders. Follow us If you liked this post from Wu Blockchain, why not share it? |

Older messages

Internal report about StepN: The temptation to wrestle with the death spiral

Tuesday, June 21, 2022

Author: Coral from First.VIP Link: https://mp.weixin.qq.com/s/G-7FwZEBeR5p6sj5-BC7sA The other day, an article compared StepN to that beautiful Sicilian woman, who everyone wants to take advantage of,

TSE Sponsored:Global Crypto Mining News (Jun 13 to Jun 19)

Monday, June 20, 2022

1. Wu Blockchain Exclusive Report: Sources told WuBlockchain that Bitmain, the world's largest bitcoin mining machine company, had a revenue of $8-9 billion in 2021, Whatsminer is about $3 billion,

Investigation: How $2billion lending gaint Babel Finance Was on the Verge of Collapse?

Saturday, June 18, 2022

Colin Wu

WuBlockchain Weekly:3AC、Liquidity Crisis、75bps and Top10 News

Friday, June 17, 2022

Top10 News 1、Three Arrows Capital liquidated by FTX, Deribit and BitMEX link FTX, Deribit and BitMEX have liquidated Three Arrows Capital's positions, sources tell The Block.Three Arrows owes

Analysis: Can MicroStrategy Survive in Bear Market? Will MicroStrategy be liquidated?

Tuesday, June 14, 2022

Currently, MicroStrategy carries the following debt. 1. $650 million of convertible senior notes due December 15, 2025, consisting of $550 million of convertible notes and $100 million of options . The

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏