Removing Ammo Inc (POWW) From the BUY LIST

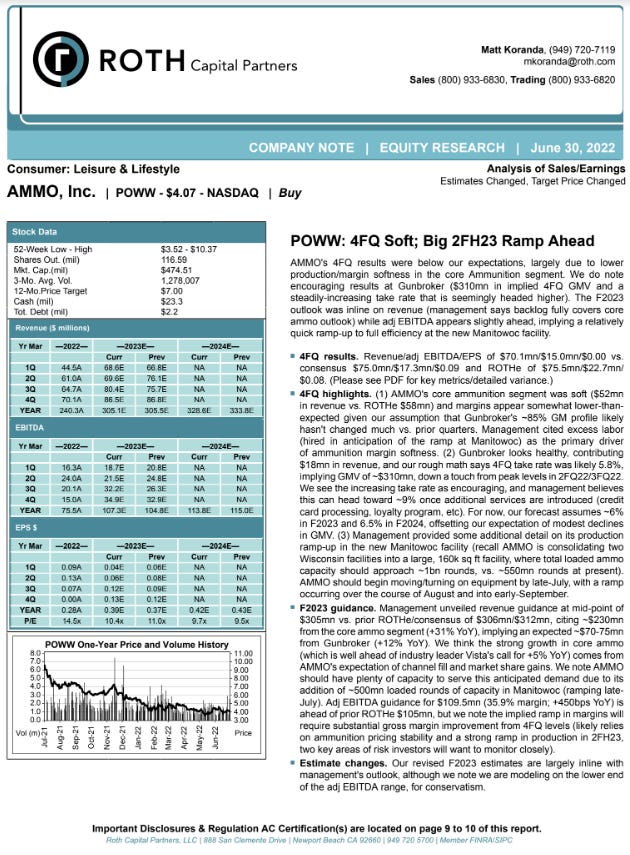

IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. Past performance does not guarantee future results. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.One of my public plays I’ve had since I began this newsletter was POWW. I still like the company but I’m closing the position. The reason is due to new information as a result of the last earnings report. I noticed during earnings the company did not release a quarterly EPS. They released annual numbers, but not quarterly. As a result, each & every single quarterly EPS announcement for AMMO Inc this quarter, as posted by various outlets, had a different earnings result. A TOTALLY self inflicted wound by AMMO Inc! I saw some reporting an EPS of $0.14 per share, others reporting $0.09 per share, I saw one report alleging $0.07 per share, another reporting $0.01 per share, & even in the range of 0.00 & -$0.01 per share. I knew something was wrong! So in yesterdays newsletter, prior to market open, (the paid section) I said I was mulling selling $2.50 calls against my position right as the market opened. This in effect locked in my gains & protected me from downside risk. The more I looked at various sources reporting POWW earnings, the more I knew things were uncertain. And this strategy effectively locked my position in place. I’m glad I did it! With the knowledge that I was not going to lose money no matter how the stock traded, I set myself at attempting to figure out how Ammo Inc truly performed last quarter. So I looked at their overall 2022 annual earnings & deducted their last three earnings from the past three quarters. I came up with a diluted EPS of $0.01 & an adjusted EPS of $0.09 for Q4. I had one more tool at my disposal … call investor relations & ask. So I did! They OUTRIGHT REFUSED to give me the quarterly EPS figures!!! I was told that they can’t give me beyond what the company gave them to work with. WOW!!! However, they were kind enough to send me an analyst report on the quarter from Roth Capital Partners. The Roth assessment was the following. You’re reading that right … $0.00 adjusted EPS. Comment below if you want me to send you a copy of the report. Nothing made sense! And when shit doesn’t make sense I start looking for answers. And when I’m looking for answers, I first look for anomalies. I then attempt to fill those anomalies, based on my understanding of the underlying conditions, with the most plausible explanation. Here are my findings.

So here is my theory. The number one cost of any firm is labor. They needed to hire additional workers & train them for the new facility. That cost them a great deal of money. This explains the low EPS for the quarter. There may be other factors, but this is likely the largest contributor. I don’t think this issue will be resolved when next quarter is reported in roughly 30 trading days or so. Else they would have announced, as they usually do, a projection for the following quarter. The ad firm was to help them generate business … because when they expand operations with the new facility, they will be capable of producing a lot more in a shorter amount of time. With such increased scale, they will need more orders to fill. In the near term I’m predicting continuation of lower than historic latter pandemic era earnings ... at least for the next two reporting periods (quarters). A full quarter of new facility earnings WILL NOT be reported until February 2023. (Q1 APR-JUN No facility, Q2 JULY-SEP Partial facility, Q3 OCT-DEC Full facility… Q3 Reported in February). That’s 8 months out!!! By the time they’re up & running with the new facility for a full quarter, who knows what the ammo market will look like? I can’t project that far out. I think it’s bullish, but I can’t project 6 months out on specialty discretionary retail amid a likely recession after 2x quarters where people & businesses stocked up on ammo ... which may come out of future sales. There are bullish factors … the Supreme Court did just expand open carry by 30% of the US … so Ammo Inc has that going for them. And while I can’t predict their ability to gain & acquire future government contracts, I’m somewhat certain they will. And recessions are often bullish for self defense. And who knows what the heck President Biden is going to attempt to do with respect to guns & ammo? So there are plenty of reasons to remain bullish despite this assessment. Nevertheless, I think there is time to step away from this stock for a bit. I see at least 6-8 months of sideways trading here (I could always be wrong folks!). Sure, I could continue to sell calls as I have been, letting them expire worthless for some options income, but I’ve taken my licks on this stock. When companies abruptly change from behaviors they’ve had for the last year, that’s when I sit up & take notice. COMPANIES DO NOT CHANGE BEHAVIOR FOR NO REASON! And whenever you see them change behavior, ensure you make an attempt to figure out why! Now, I could have left this on the BUY LIST longer … tying up capital …. for another 8 months or so. But that would be unethical, as I myself have closed out this position ( announced on twitter.) What kind of integrity would I have if I sold the position but kept it on the buy list? I promised that I would never put anything on the BUY LIST that I would not throw my own money at. How then could I leave it up? I simply cannot. All this said, I like the company, I like the stock! There is ample opportunity to sell covered calls until the cows come home! So don’t take this as me bashing the stock. I have a feeling we have not heard the last of Ammo Inc here at StockTips! But for now, I will remove it & add the slaughter to the StockTips record. This one is going to hurt! Good news is now I have to burn brain cells attempting to find something to replace it with amid a bear market & likely recession. And I have a three day weekend to do it! … though market conditions are really really rough for both long & short plays right now. I’m going to TUCK POWW AWAY for later. IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. Past performance does not guarantee future results. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.You’re a free subscriber to StockTips Newsletter. For the full experience, become a paid subscriber. |

Older messages

The Daily StockTips Newsletter 06.30.2022

Thursday, June 30, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.29.2022

Wednesday, June 29, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.28.2022

Tuesday, June 28, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.27.2022

Monday, June 27, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

Sign in to StockTips Newsletter

Saturday, June 25, 2022

. Here's a link to sign in to StockTips Newsletter. This link can only be used once and expires after 24 hours. Sign in now © 2022 StockTips 109 .

You Might Also Like

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Issue #275: You're preapproved… to spend a bunch of money

Wednesday, March 5, 2025

plus Soup Watch 2025 + snacking cakes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 3-5-25 Economy Suddenly Weakens: Recession Coming Soon?

Wednesday, March 5, 2025

Harry's Take March 5, 2025 Economy Suddenly Weakens: Recession Coming Soon? I've been seeing the economy as the most stretched in history after the longest $27T US stimulus program, by far.

💀 RIP, world's biggest dividend

Tuesday, March 4, 2025

Aramco slashed its billion-dollar handouts, the US faced retaliation, and bitcoin went up against organs | Finimize Hi Reader, here's what you need to know for March 5th in 3:14 minutes. Aramco –

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🇺🇸 The president's crypto fund

Monday, March 3, 2025

Crypto's back in favor and European defense stocks got an, uh, arm up | Finimize Hi Reader, here's what you need to know for March 4th in 3:15 minutes. The US president announced plans for a

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏