Should We Brace For Higher Unemployment?

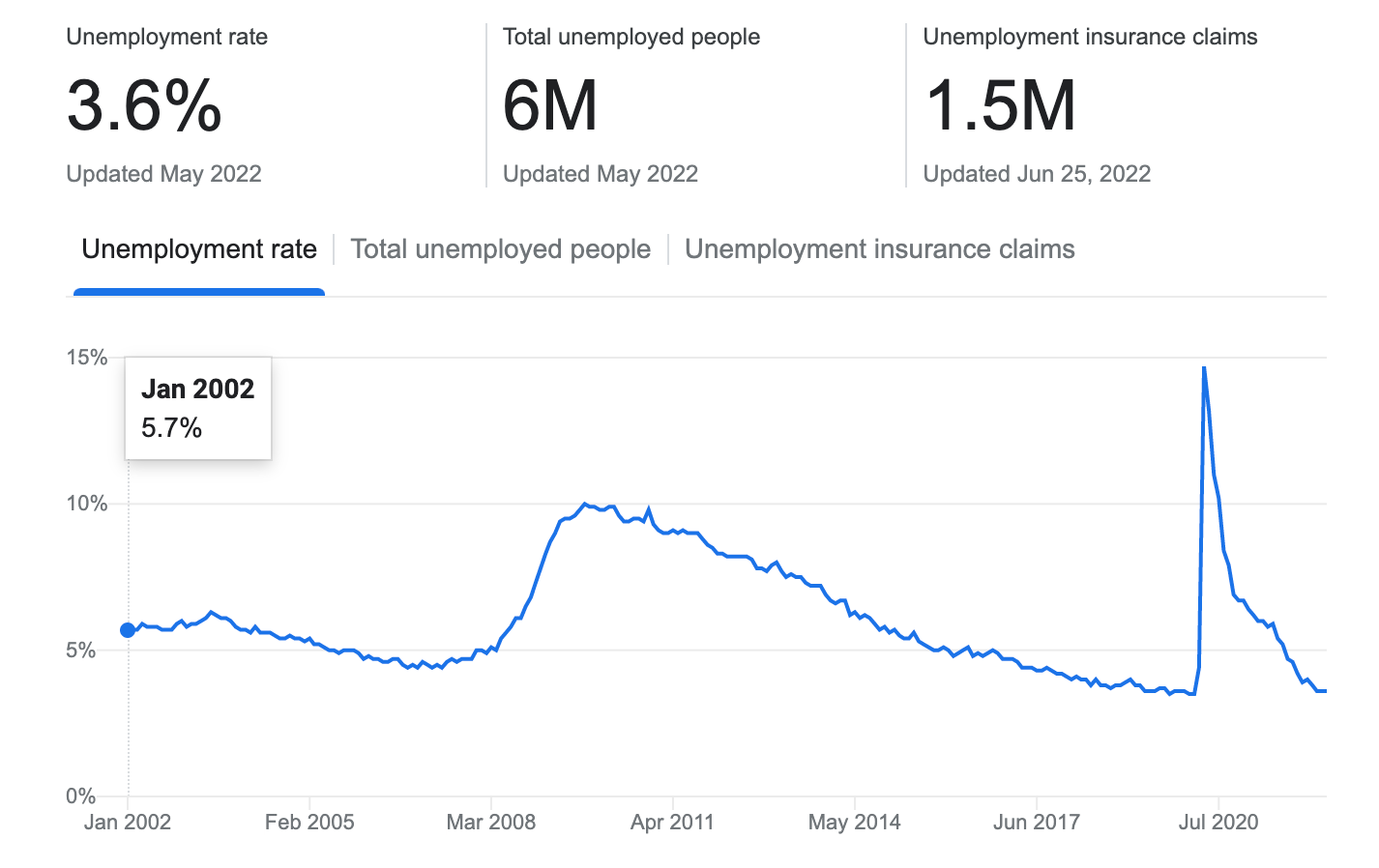

To investors, The unemployment rate in the United States is sitting near historic lows. This is impressive, especially post-COVID chaos, because it took nearly a decade to reach the ~3.5% unemployment rate after the Global Financial Crisis in 2008-2009. My concern at the moment is there is a strong probability that the unemployment rate will push higher over the coming weeks and months. The Federal Reserve is being forced to tighten financial conditions in an attempt to bring down the 40-year high inflation that Americans are experiencing. As they pursue this strategy, the stated goal is to destroy demand from consumers. That demand destruction will ultimately lead to lower revenues for businesses, which will apply financial pressure and likely lead to layoffs. But the market doesn’t always act in a perfect, sequential manner. Many business owners are anticipating the demand destruction, and potential economic downturn, so they are implementing hiring freezes or cutting material percentages of their workforce. Layoffs have been reported across industries, including companies like Tesla, Unity, Coinbase, and Tencent in recent days. This comes at a time where there are more than 11 million open jobs in America. No one said understanding the economy would be easy. But that isn’t even the most interesting part of the labor force analysis in my opinion. There are hundreds of jobs available to job candidates where they can drastically increase their salary. Take Walmart for example — they are now paying truck drivers more than $100,000 in their first year on the job. If you walked down the street and polled the general public, not many people would assume that you could make 6-figures driving for Walmart. Not everyone wants to take the time to get CDL certified and have the life of a truck driver though. It can be long hours, many nights spent away from family, and it doesn’t exactly scream “active lifestyle!” Truck drivers are essential to our economy. Not everyone is cut out for it though. So where will the people flow after they are laid off? In my opinion, many of them will start companies and others will gravitate to the fastest growing industries. We have historically seen an explosion in new business formation during times of economic uncertainty. We saw it around the Global Financial Crisis. We saw it during 2020. And I think we are going to see it again over the next 12-18 months. Not everyone wants to start and operate a business though. A large percentage of the population wants to work at a great company, with great compensation, and an important mission. This is why I anticipate that a material number of people who are laid off, especially from the technology and finance industries, will ultimately transition into the bitcoin and crypto industry. The technology is intellectually stimulating, the mission is important, and the compensation/benefits is attractive. There is one problem though. A good portion of people who will try to transition into the bitcoin and crypto industry are good at their respective roles (marketing, operations, customer service, accounting, etc), but they don’t have the industry-specific knowledge to get through the interview process. Similar to how the truck driver has to acquire the knowledge and skills included in the CDL certification, there is a need for upskilling among the new individuals coming into the bitcoin and crypto industry. This is why my team created a 3-week training program to upskill and place job candidates. We have helped everyone from mortgage loan officers to new college graduates to former public defenders find work in a matter of weeks. The program has more than 60 events packed into the 3 weeks, including lectures, discussion groups, interview prep, resume review, and much more. People who go through the program will leave with a basic understanding of every aspect of the industry, know how to run their own node, successfully execute self-custody, and make memes (no, seriously 😂). If we successfully do our job, we will drastically increase the quality of the workforce across bitcoin and crypto. As we get more and more highly skilled and knowledgable workers, we can accelerate our progress as an industry. If you’ve been laid off or know someone who has been laid off, you can check out the training program here: Get upskilled to work in bitcoin and crypto [Next cohort starts in July] As I continue to look at the macro environment, I am worried that most of the attention has been captured by the inflation conversation. Inflation is out of control in the United States. We should be watching it closely. But if the Federal Reserve is successful in their demand destruction goals, we are about to see many more unemployed individuals. Don’t take my word for it — former Treasury Secretary Larry Summers believes we will need 5 years of unemployment over 5% to quell inflation. If Summers’ diagnosis is remotely accurate, we are going to need all hands on deck. The inflation problem is going to turn into a recession problem, which will turn into an unemployment problem. Brace yourself. Hope for the best, but be prepared for the worst. Hope everyone has a great weekend. I’ll talk to you on Tuesday. -Pomp If you are not a subscriber of The Pomp Letter, join 225,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. SPONSOR:Valour is the first and only publicly traded company built to give investors direct exposure to the rapidly growing space of decentralized finance (DeFi). The company provides simplified, trusted access to crypto, decentralized finance and Web 3.0 investment opportunities. Institutions and investors can gain diversified, secure, compliant, and easily tradable access to a diversified set of industry-leading equity products and protocols, through a single stock purchase on a regulated exchange. Currently listed on U.S. (OTC: DEFTF) and Canadian (NEO:DEFI) exchanges. For more information or to subscribe to receive company updates and financial information, visit https://valour.com/* THE RUNDOWN:VanEck Files New Application for Spot Bitcoin ETF: Investment giant VanEck has filed a new application for a spot bitcoin ETF with the Securities and Exchange Commission. VanEck’s filing for its VanEck Bitcoin Trust comes just eight months after the SEC rejected its previous application and just a day after it denied the spot bitcoin ETF applications of Grayscale Investments and Bitwise. Grayscale Investments is a subsidiary of CoinDesk parent Digital Currency Group. Read more. Biden Official Says US Government Could Pass Stablecoin Rules by End of Year: EmailIcon The U.S. federal government is working on stablecoin legislation with Congress that could become law by the end of the year, an administration official told CoinDesk. The President’s Working Group on Financial Markets, an intergovernmental group composed of the heads of several financial regulators, met Thursday to discuss recent stablecoin activities and future legislation. This legislation would be introduced by the House Financial Services Committee, the official said. Read more. EU Agrees on Landmark Crypto Authorization Law, MiCA: European Union policymakers have struck a deal on landmark legislation to regulate crypto assets and service providers throughout the bloc's 27 member nations. The policymakers, who represent the world’s third-largest economy, have been haggling for nearly two years over the Markets in Crypto Assets (MiCA) framework. As it stood on Thursday, the legislative package sets up requirements for crypto issuers to publish a kind of technical manifesto called a "white paper," to register with the authorities and to keep proper bank-style reserves for stablecoins (cryptocurrencies pegged to the value of an asset such as sovereign currencies like the euro). Read more. Internal Facebook Memo Warns Company Must Be Disciplined, Prioritize Ruthlessly: Facebook-parent Meta has warned employees to expect a tough second half of the year as the company continues to weather challenges related to its core online advertising business amid a weakening economy. Meta chief product officer Chris Cox detailed the company’s financial dilemma in an internal memo that detailed key areas where the social media giant plans to invest, a spokesperson confirmed to CNBC. Read more. Alyse Killeen is a Founding Managing Partner at Stillmark, A Bitcoin focused Venture Capital fund. In this conversation, we discuss investing in Bitcoin, innovation currently being built on top of Bitcoin, Taro, the expansion of the Lightning Network, Stablecoins coming to the Bitcoin network, and how Bitcoin is helping millions of people globally. Listen on iTunes: Click here Listen on Spotify: Click here The US Economy Is Much Worse Than We Thought Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. *Pomp is an advisor to Valour You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber. |

Older messages

Bitcoin is a hedge for loose policy, not inflation?

Wednesday, June 29, 2022

To investors, The number one question I am being asked right now by many of you is related to bitcoin as an inflation hedge asset. I thought it would be interesting to present a nuanced response from

Podcast app setup

Tuesday, June 28, 2022

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Tuesday, June 28, 2022

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Tuesday, June 28, 2022

Open this on your phone and click the button below: Add to podcast app

G7 Bans Gold From Russia - Does It Matter?

Monday, June 27, 2022

Listen now | To investors, Most people's attention has been on the accelerating inflation and reactive monetary policy decisions in the United States. This is the problem that we can see when we go

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these