DeFi Rate - This Week In DeFi – July 1

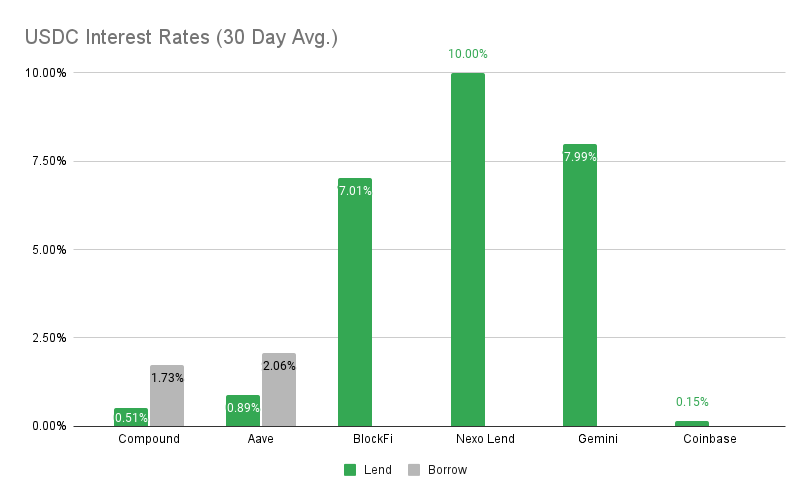

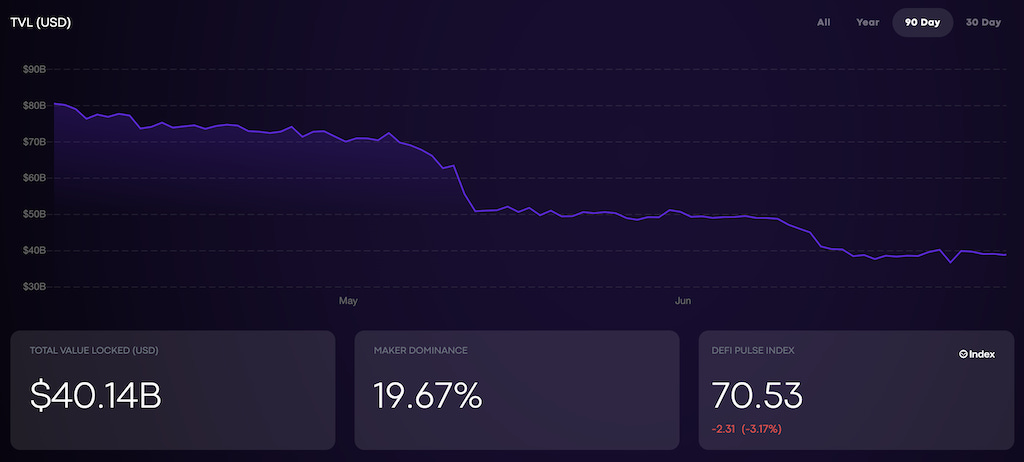

This Week In DeFi – July 1This week, FTX looks to acquire a distressed BlockFi, Compound goes multi-chain and ConsenSys partners with StarkWare.To the DeFi community, This week, crypto exchange FTX is reportedly looking to acquire centralized lending platform BlockFi for a sum between $25 million and $50 million. Sources believe the deal is expected to complete by the end of this week, however BlockFi CEO Zac Prince has denied the $25 million figure and FTX has refused to comment on the deal. FTX had already recently provided the distressed company with a $250 million loan to keep it afloat.  Code has been released for Compound III, a new and improved multi-chain version of the Compound lending protocol. There are several major changes in Compound III when compared to previous versions of the platform, including a single interest-earning base asset with all other assets collateralized. The platform is designed to be portable to all Ethereum virtual machine (EVM) compatible chains.   ConsenSys has partnered with StarkWare, the company behind Ethereum Layer 2 scaling solution StarkNet. ConsenSys intends to integrate StarkNet into its products MetaMask and Infura – the well-known web3 wallet and infrastructure service. StarkNet is a ZK-rollup platform which increases transaction throughput and decreases transaction costs. The MetaMask integration is already open to developers for building and testing.   Ethereum Layer 2 scaling platform Arbirtum has paused its “Odyssey” introduction program, after transaction fees on the platform spiked past those of the main Ethereum chain (oops!). The overall transaction load surged as users flooded Arbitrum to claim reward NFTs for completing tasks on the network. The development team says that Odyssey will resume once throttle limits are removed from the network – expected soon with the release of an update called Nitro.  The rebuilding phase appears to be taking place before the destruction has even subsided, as industry giants sweep in to pick up the pieces of centralized crypto lending platforms in hopes of turning them around. FTX appears to be closing in on acquiring a distressed BlockFi after passing on Celsius, while Celsius also reportedly had interest from Goldman Sachs. The centralized lending space isn't the only area seeing this action, with DeFi lending platforms also on the move, development-wise; Compound Finance is going multi-chain with its new Compound III protocol, while Maker continues to explore new territory by going into Treasury bills. Layer-2 scaling is moving quickly too, with a flurry of activity that has flown somewhat under the radar; Arbitrum with its (temporarily paused) Odyssey program, Optimism doubling its total value locked (TVL) and StarkWare partnering with ConsenSys. These platforms are sending Ethereum scaling full-speed into real-world testing on mainnet, which will eventually result in a brand new DeFi user experience – faster, cheaper and more usable than ever. Combined with new and improved DeFi protocols, we may be in for an exciting new wave of DeFi just a matter of months down the road. Market prices may be down, poorly-designed protocols may be falling apart, but DeFi is bouncing back – and it may be better than ever. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Gemini at 6.43% APY Cheapest Loans: Aave at 2.85% APY, Compound at 2.89% MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Gemini at 7.99% APY Cheapest Loans: Compound at 1.73% APY, Aave at 2.06% APY Top StoriesGoldman Sachs said to be raising investor funds to buy Celsius assets: CoinDeskKPMG enters the metaverse, invests $30M in Web3 employee trainingCrypto fund Three Arrows has reportedly been ordered to liquidateEthereum finishes Gray Glacier hard fork to push the 'difficulty bomb' to SeptemberStat BoxTotal Value Locked: $40.14B (up 1.6% since last week) DeFi Market Cap: $36.0B (down 6.3%) DEX Weekly Volume: $12B (down 37%) Bonus Reads[Samuel Haig – The Defiant] – Optimism’s TVL Doubles as Trading Activity Surges on Layer 2s [Chris Williams – Crypto Briefing] – OpenSea NFT Marketplace Suffers Email Address Data Breach [Osato Avan-Nomayo– The Block] – Maker governance is voting to invest $500 million in US Treasury bills [Timothy Craig – Crypto Briefing] – Polkadot Unveils New On-Chain Governance Model If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – June 24

Friday, June 24, 2022

This week, dYdX decides to ditch Ethereum scaling for its own chain on Cosmos, Solend stirs up governance drama and Uniswap steps into NFTs.

This Week In DeFi – June 17

Friday, June 17, 2022

This week, Circle announces a new euro-pegged stablecoin, while Celsius and Three Arrows battle solvency issues – also involving stETH.

This Week In DeFi – June 10

Friday, June 10, 2022

This week, Ethereum completed its Ropsten testnet merge, Wintermute unveiled its DEX aggregator and TronDAO decides to overcollateralize USDD

This Week In DeFi - June 3

Saturday, June 4, 2022

This week, Binance Labs raises $500M for a new web3 fund, Ethereum prepares for its testnet merge and the Lightning Network sets a new record.

This Week In DeFi - May 27

Friday, May 27, 2022

This week, a16z raises a record $4.5B for its fourth crypto fund, Terra 2.0 is on the way and StarkWare reaches an $8B valuation.

You Might Also Like

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask