Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #296

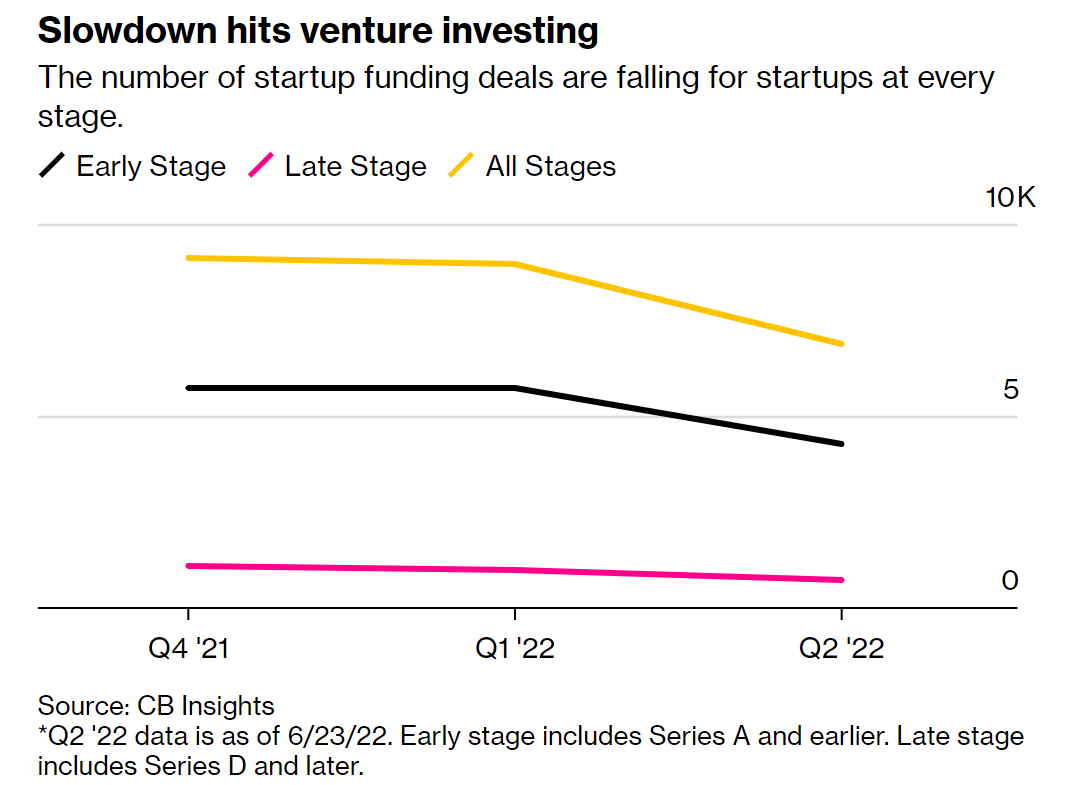

What's 🔥 in Enterprise IT/VC #296Refocusing on relationships vs. transactions, founders who are more 🥩 vs. sizzle 🥓 will rise back to the top🙏🏼 Q2 is finally over. And yes it was quite ugly.

Since this data usually lags a few months, here is my expectation for what Q3 will look like - yes, vaporized like a Thanos snap of the fingers. Since I am 🥛 half full kind of person, here’s the silver lining. Let’s call the last 2 years an aberration or a COVID blip and prior to that while the pace of rounds closing were increasing quickly, founders and investors still had time to be more relational vs. transactional in their approach to fundraising. Relationships have always mattered but that was forgotten during the last 24 months when preemptive round was stacked on top of preemptive round. During turbulent times, a founder’s prior choice of investor is magnified when strategic decisions on burn and value creation are being made. The good news is that due to the slowdown and lack of FOMO, investors and founders are back to basics with more time for relationship building during diligence. What this also means is that those founders who are more 🥩 than 🥓 sizzle will rise to the top again. 🥩 founders are those who are maniacally focused and obsessed about solving a customer pain by building a differentiated product and focused on the basics. They tend to undersell versus oversell. They are the ones who know what the definition of customer is, a paying customer. They can walk you through the customer journey in detail and explain how their product is used by each and every of the first handful of customers and what the deal sizes are. They talk about TAM after first nailing the initial, microscopic wedge of customer pain and talk about the expansion opportunities but don’t lead with it.  🥓Sizzle founders talk about TAM first, are amazing at telling a story but the product and customer obsession is not all there. They tend to oversell and exaggerate where the company is versus where it truly is. When you dive deeper into numbers and diligence and customer use cases, the answers become less clear. During a massive bull market filled with FOMO, the founders who told amazing stories and sold the idea of huge TAMs were the ones who raised the most the quickest especially when credit was given way ahead of actual traction. In today’s funding environment which is more of a reversion to the mean, markets are back to rewarding true value. If you’re a founder and getting ready to fundraise, I’d wait until the Fall when the markets settle. I would spend the summer continuing to iterate on product, landing more customers, and preparing your story with meaningful proof points. Build a believable budget, set clear goals or milestones on what you expect to achieve with the capital, ensure you have a handful of customer references who have been prepped in advance, and create your list of key future hires. Let the results tell your story and you’ll have a fundraise based on 🥩. As always, 🙏🏼 for reading and please share with you friends and colleagues. And for those celebrating, I hope you have a Happy 4th 🇺🇸 of July! Scaling Startups

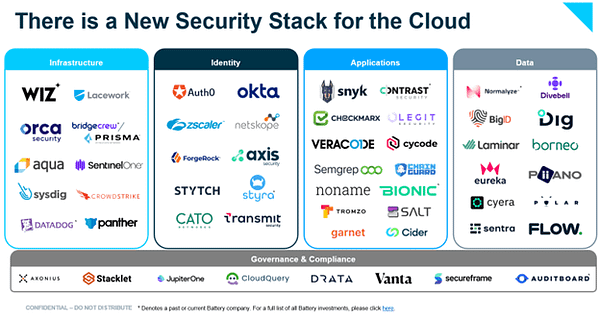

Enterprise Tech

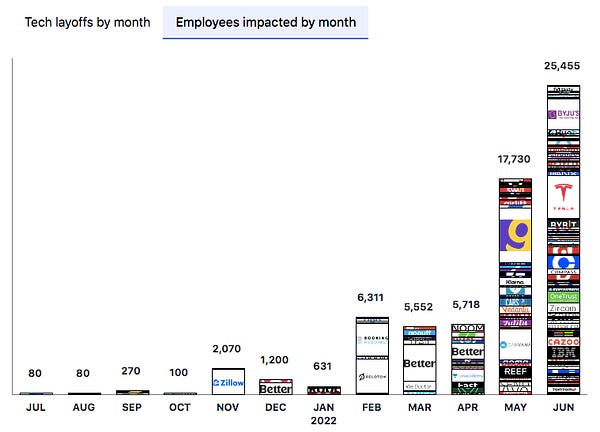

Markets

If you liked this post from What's Hot in Enterprise IT/VC, why not share it? |

Older messages

What's 🔥 in Enterprise IT/VC #295

Saturday, June 25, 2022

Developers, developers, developers - Microsoft's massive developer reach + what's next for enterprise adoption

What's 🔥 in Enterprise IT/VC #294

Saturday, June 18, 2022

Looking for positivity in 📉 - ❄️ Summit + plans for world domination

What's 🔥 in Enterprise IT/VC #293

Saturday, June 11, 2022

The bull 💪🏼 case for DevOps - GitLab's big quarter + what's next on product roadmap

What's 🔥 in Enterprise IT/VC #292

Saturday, June 4, 2022

How we thought about scaling our seed firm from a team of 2 + $1M proof of concept fund to a partnership of 4 & $367M of new funds

What's 🔥 in Enterprise IT/VC #291

Saturday, May 28, 2022

Starting small to go BIG 💪🏼 + the importance of focus

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏