VC Monthly Report:Funding Overview in June

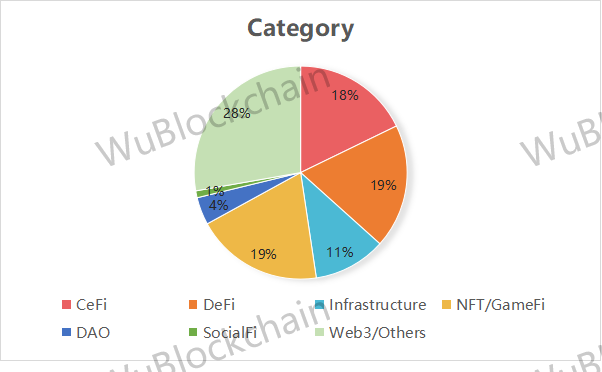

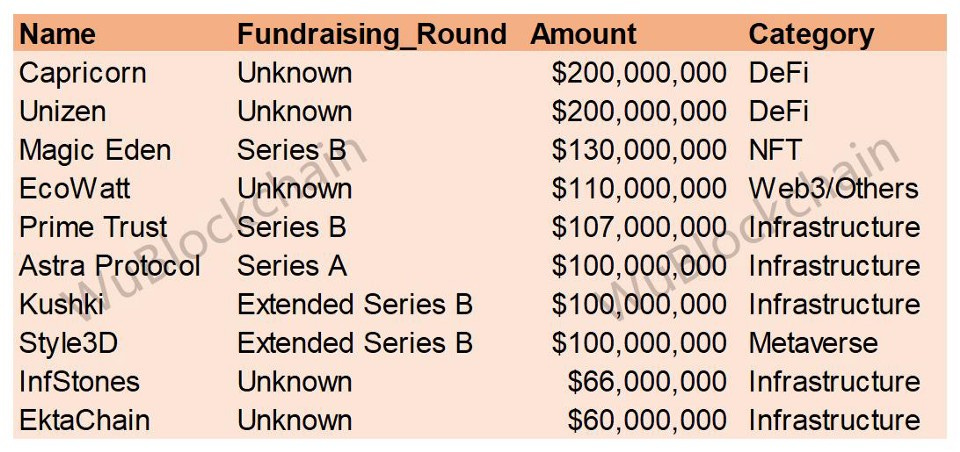

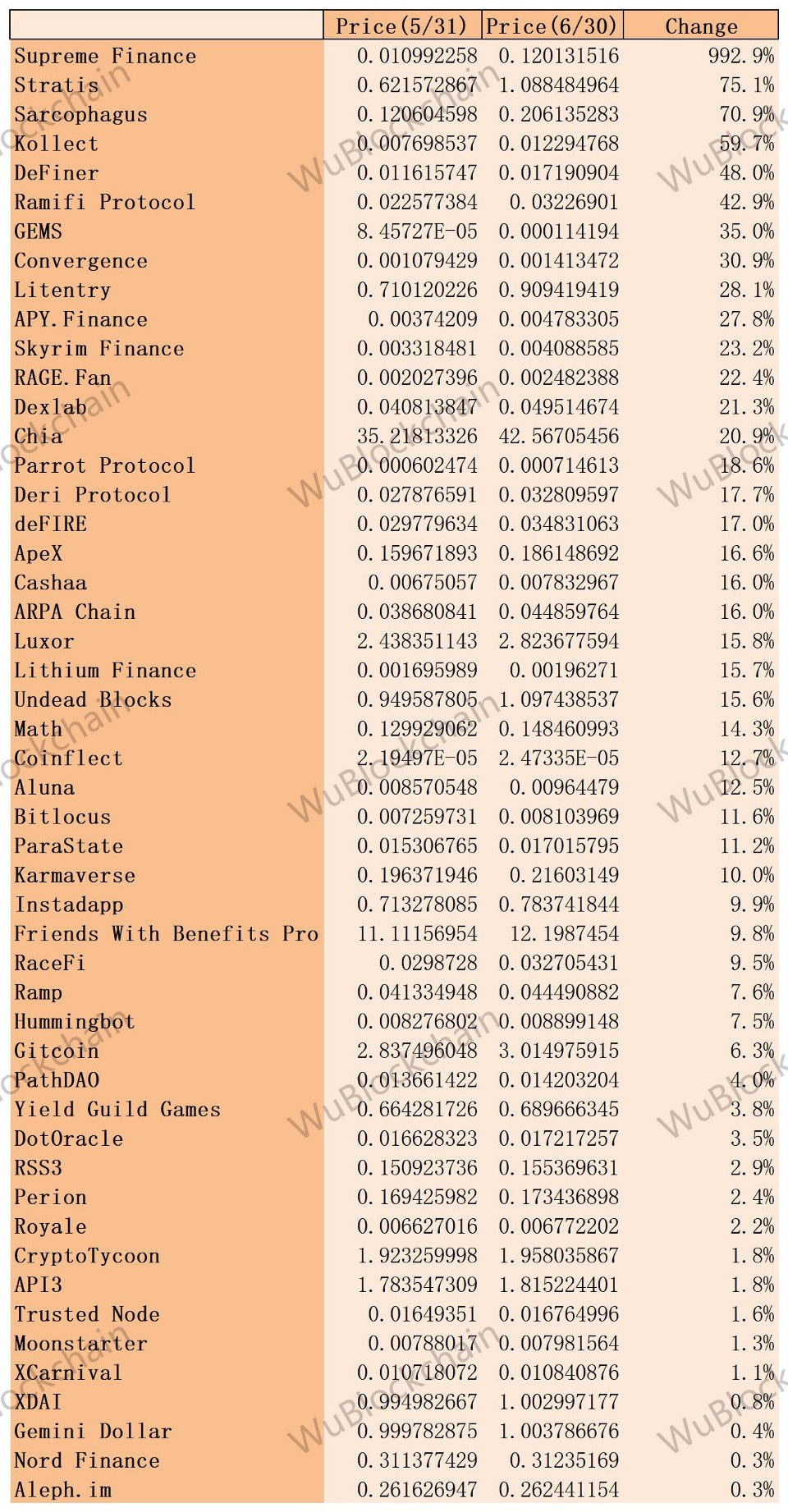

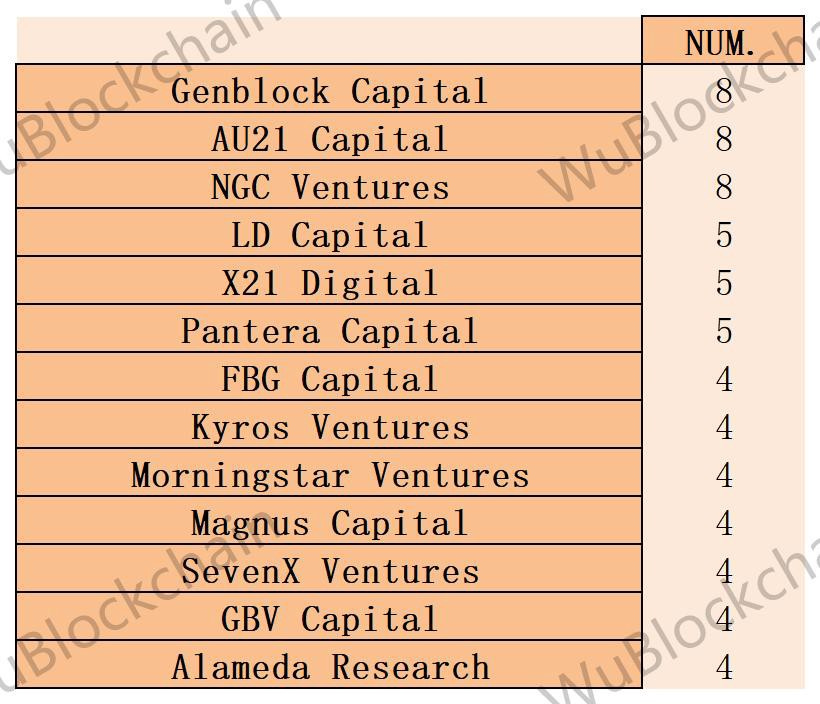

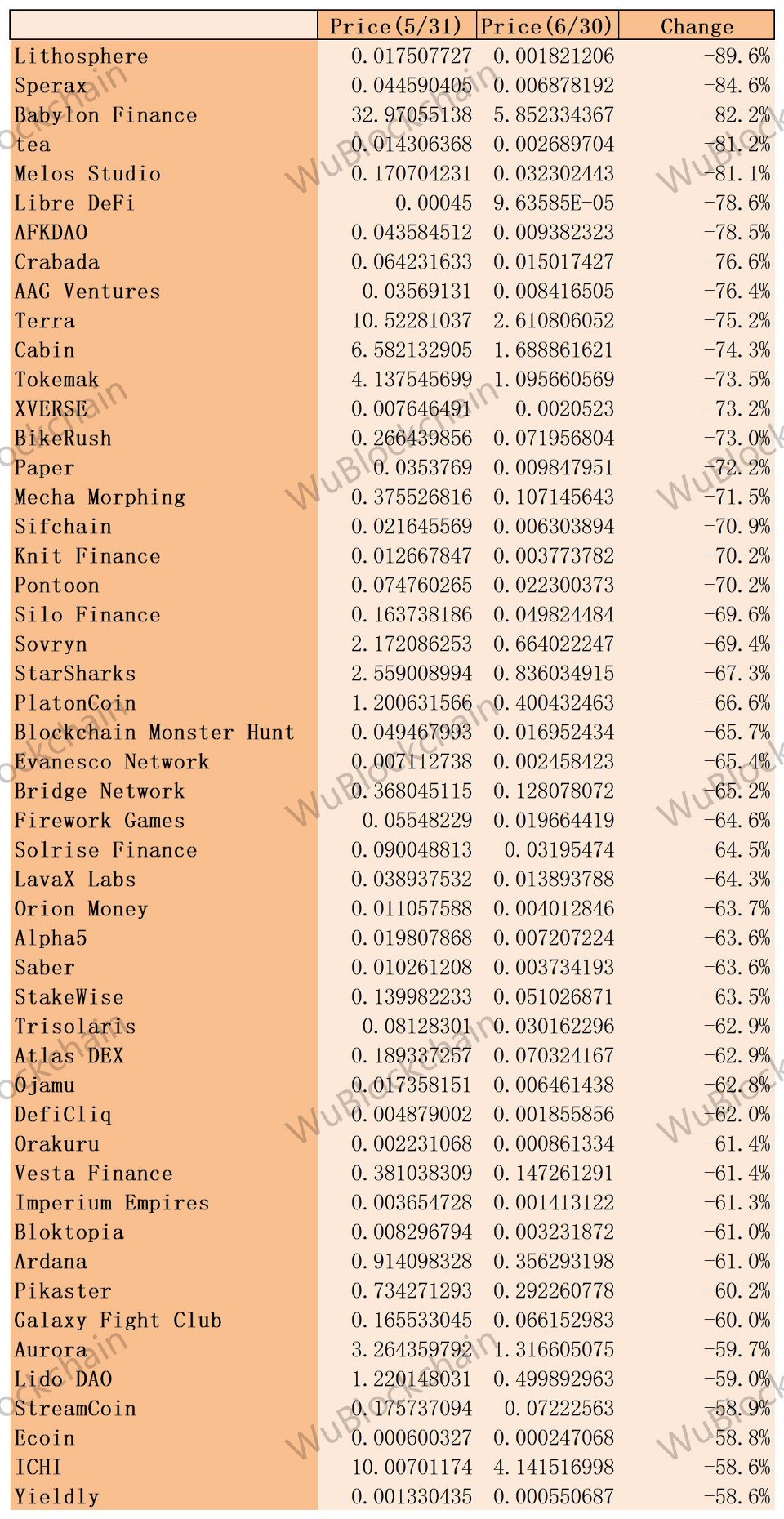

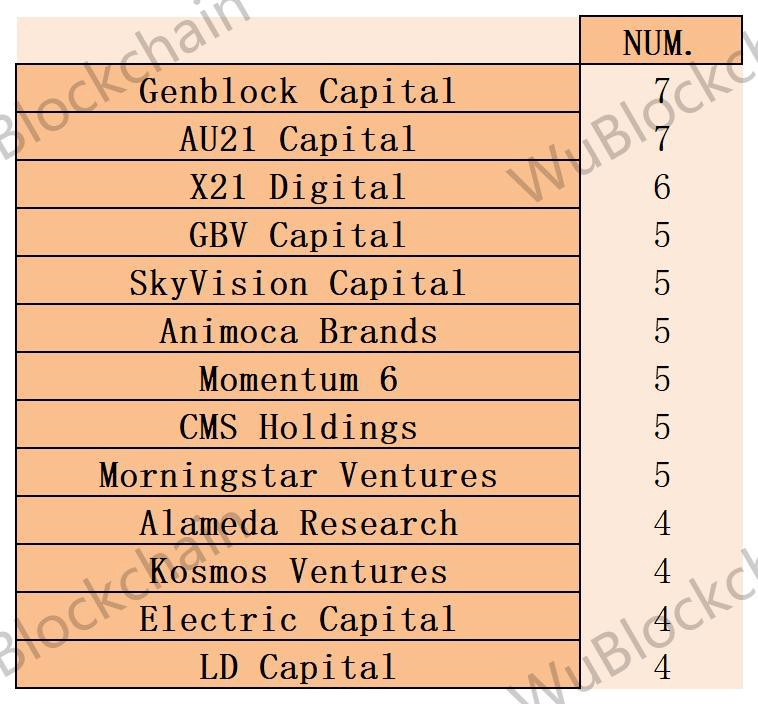

According to Dove Metrics, there were 191 open investment projects of crypto VC this month, down 15% from the previous month (225 rounds in May 2022), and 42.5% from the previous year (134 rounds in June 2021). The secondary industry classification is as follows: The number of rounds raised this month was relatively even across all sectors, with CeFi, DeFi and NFT/GameFi each accounting for about 20% of the total. CeFi raised the most because of the number of institutions that raised debt to avoid liquidation, such as BlockFi, which raised $250m from FTX, and Voyager Digital, which raised $200m from Alameda. Total funding for the month was $3.67 billion, down 18% from May 2022 ($4.45 billion) and up 60% from June 2021 ($2.3 billion). The top 10 financing rounds(excludeCeFi) are as follows: Capricorn is a stablecoin lending agreement backed by multiple assets. The stablecoin CUSD issued by Capricorn will be used to provide users with financial services focused on payments and corporate lending. Unizen is a trading infrastructure built on multi-chain liquidity that allows users to stake various assets for trading on multiple chains, currently backed by Binance Liquidity, and aggregated for decentralized liquidity through the SifChain module. The $200 million is not a direct investment, but will be based on performance to ensure that the use of funds is fully optimized. Magic Eden is the largest NFT trading platform on Solana, with over 430,000 monthly active users. EcoWatt is an enterprise blockchain solution for verifying carbon certificates on the blockchain and making their community and corporate partners carbon neutral as a service. Astra Protocol is a decentralized security and legal assurance protocol that creates a decentralized legal network in partnership with some of the world’s leading business consulting firms, auditing firms and law firms. It provides anti-money laundering (AML) and KYC functionality that ensures funds arrive safely at compliant wallet addresses. Kushki, based in Ecuador, provides payment infrastructure that helps Latin American businesses process digital payments globally. InfStones is a PaaS provider for enterprises and developers that enables users to rapidly deploy nodes and create APIs focused on improving the efficiency and speed of developing and deploying decentralized applications such as Staking, DeFi, NFT, GameFi and others on multiple protocols. Ekta’s businesses include NFT markets, cryptocurrency trading platforms, blockchain-based games and real estate investment, among others. Its Layer 1 blockchain EktaChain was launched in August 2021 and focuses on tokenizing real assets. Price performance in JuneFinally, we have a brief count of the price performance of all projects (issued tokens) that have had a public funding record since July 2020 for this month. The total number of rounds is 2811, containing 615 tokens. Among them, the top 50 tokens in terms of price increase in June. Among the above-mentioned projects, there are 13 VCs with more than 3 investments, listed by number as follows. Tokens in the bottom 50 for June: Among the above-mentioned projects, there are 13 VCs with more than 3 investments, listed by number as follows. Follow us If you liked this post from Wu Blockchain, why not share it? |

Older messages

WuBlockchain Weekly:3AC Aftermath、Huobi Layoffs、Grayscale ETF Rejection and Top10 News

Friday, July 1, 2022

Top10 News 1、3AC aftermath: Court liquidation order, censure of violations, BlockFi acquisition storm, default notice, Celsius Possibility of bankruptcy reorganization The fallout from 3AC insolvency

Analysis: Is the Circle (USDC) collapse and huge bad debts Real?

Friday, July 1, 2022

Recently an insider calling @CryptoInsider23 revealed the inside story of the so-called Circle (USDC). The main points are as follows: 1. Circle suffers long-term losses because it needs to pay huge

Opinion: Why support dYdX leaving ETH to build its own chain

Tuesday, June 28, 2022

The failure of Luna price does not mean the failure of Terra chain. Those who use Terra chain regularly must have experienced the smooth interaction experience brought by Terra. We can even say that

TSE Sponsored:Global Crypto Mining News (Jun 20 to Jun 26)

Monday, June 27, 2022

1. Guizhou Provincial Development and Reform Commission issued on June 20 "Provincial Development and Reform Commission on virtual currency "mining" electricity price difference policy

WuBlockchain Weekly:Withdraw、Credit Facility、Miner Sell and Top10 News

Friday, June 24, 2022

Top10 News 1、 Voyager Digital Secures Loans From Alameda to Safeguard Its Assets link Crypto broker Voyager Digital (VOYG) signed a non-binding term sheet with quant trading shop Alameda Research to

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%