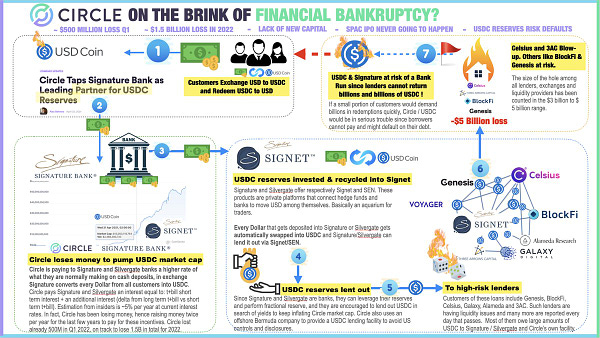

Analysis: Is the Circle (USDC) collapse and huge bad debts Real?

Recently an insider calling @CryptoInsider23 revealed the inside story of the so-called Circle (USDC).   The main points are as follows: 1. Circle suffers long-term losses because it needs to pay huge interest to the bank. 2. The bank will lend out Circle’s reserves. 3. Circle lending to high-risk lenders such as Genesis, BlockFi, Celsius, Galaxy, Alameda and 3AC to generate “billions” of dollars in bad debts. At the heart of this is the third point, but it is certainly wrong. Circle has always been overcollateralized, not an unsecured loan like the one Voyager lent to 3AC. The choice of collateral will also be conservative (the website shows only BTC). So even if there is a loss due to the liquidation of collateral, the amount is not too big. But not at all. On the Circle website, there is a deposit business called Circle Yield, which lends money after receiving deposit, emphasizing “Overcollateralized”. But the page also says Genesis Global Capital is a core partner. https://www.circle.com/en/products/yield CoinDesk, whose parent company is also owned by DCG, reports that Genesis lost “several hundred million dollars” due to exposure to Three Arrows Capital and Babel Finance. Circle officials say they only accept bitcoin as collateral, but 3AC and others often use GBTC or SETH as collateral, which is theoretically not in line with Circle’s rules. Secondly, Circle is rising rapidly at present, and its total market value tends to surpass Tether. They are also pursuing a U.S. stock listing, so they will be very cautious about risk control. Circle has already lost $500 million in the first quarter of 2022 and is expected to lose a total of $1.5 billion in 2022, the so-called insider said. Circle previously disclosed data showing that it will generate $115 million in revenue in 2021, with a loss of about $76 million, with projected revenue of $40 million from USDC, $65 million from TTS and $10 million from SeedInvest. It’s also not credible that a company that was doing well in 2021 would suddenly lose $500 million in one quarter of 2022 due to the bizarre 5% interest rate charged by its partner banks. All in all, given the strict regulation of stablecoins and Circle’s traditionally cautious approach to compliance, rumors of a collapse should not be believed. But better disclosure of the relationship with Genesis and whether it suffered losses as a result would have been desirable. Follow us If you liked this post from Wu Blockchain, why not share it? |

Older messages

Opinion: Why support dYdX leaving ETH to build its own chain

Tuesday, June 28, 2022

The failure of Luna price does not mean the failure of Terra chain. Those who use Terra chain regularly must have experienced the smooth interaction experience brought by Terra. We can even say that

TSE Sponsored:Global Crypto Mining News (Jun 20 to Jun 26)

Monday, June 27, 2022

1. Guizhou Provincial Development and Reform Commission issued on June 20 "Provincial Development and Reform Commission on virtual currency "mining" electricity price difference policy

WuBlockchain Weekly:Withdraw、Credit Facility、Miner Sell and Top10 News

Friday, June 24, 2022

Top10 News 1、 Voyager Digital Secures Loans From Alameda to Safeguard Its Assets link Crypto broker Voyager Digital (VOYG) signed a non-binding term sheet with quant trading shop Alameda Research to

Reveal the secrets of 3AC' 1 billion big creditor Voyager

Friday, June 24, 2022

Foreword: Voyager, 3AC's sudden revelation of a $1 billion creditor, is a mystery. Its assets are huge, reaching $6.2 billion as of last year, largely from customer deposits. Voyager added 115, 000

Analysis of Maple and TrueFi: Alamenda and Amber borrow the most, with large Maturity concentrated in late July an…

Wednesday, June 22, 2022

Author:Joey Wu From WuBlockchain

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏