Earnings+More - Jul 4: 888’s debt sale hits trouble

Jul 4: 888’s debt sale hits trouble888 debt sale struggle, Las Vegas analyst updates, the shares week, startup focus - Sports Gambling Guides +MoreGood morning. On today’s agenda:

Independence day. Enjoy July 4. 888’s bond woesDr. No: Reports in the FT suggest the banks backing 888’s recent £1bn bond and loan offering are struggling to find buyers for the new debt. JP Morgan and Morgan Stanley initially underwrote the debt but are apparently struggling to find buyers despite the ~10% yield.

No time to die: One unnamed bond fund manager quoted in the piece said “it’s impossible to take a view on this credit before the government white paper is out”. Quantum of solace: The news of the bond sale struggles spoiled the party as 888 officially closed on the William Hill deal on Friday. The company confirmed that Itai Pazner will continue as CEO with Yariv Dafna as CFO, Vaughan Lewis as chief of strategy and Guy Cohen being COO. The world is not enough: 888 will next report in early August with four segments: 888 (including the US), William Hill online UK, William Hill retail UK and William Hill international.

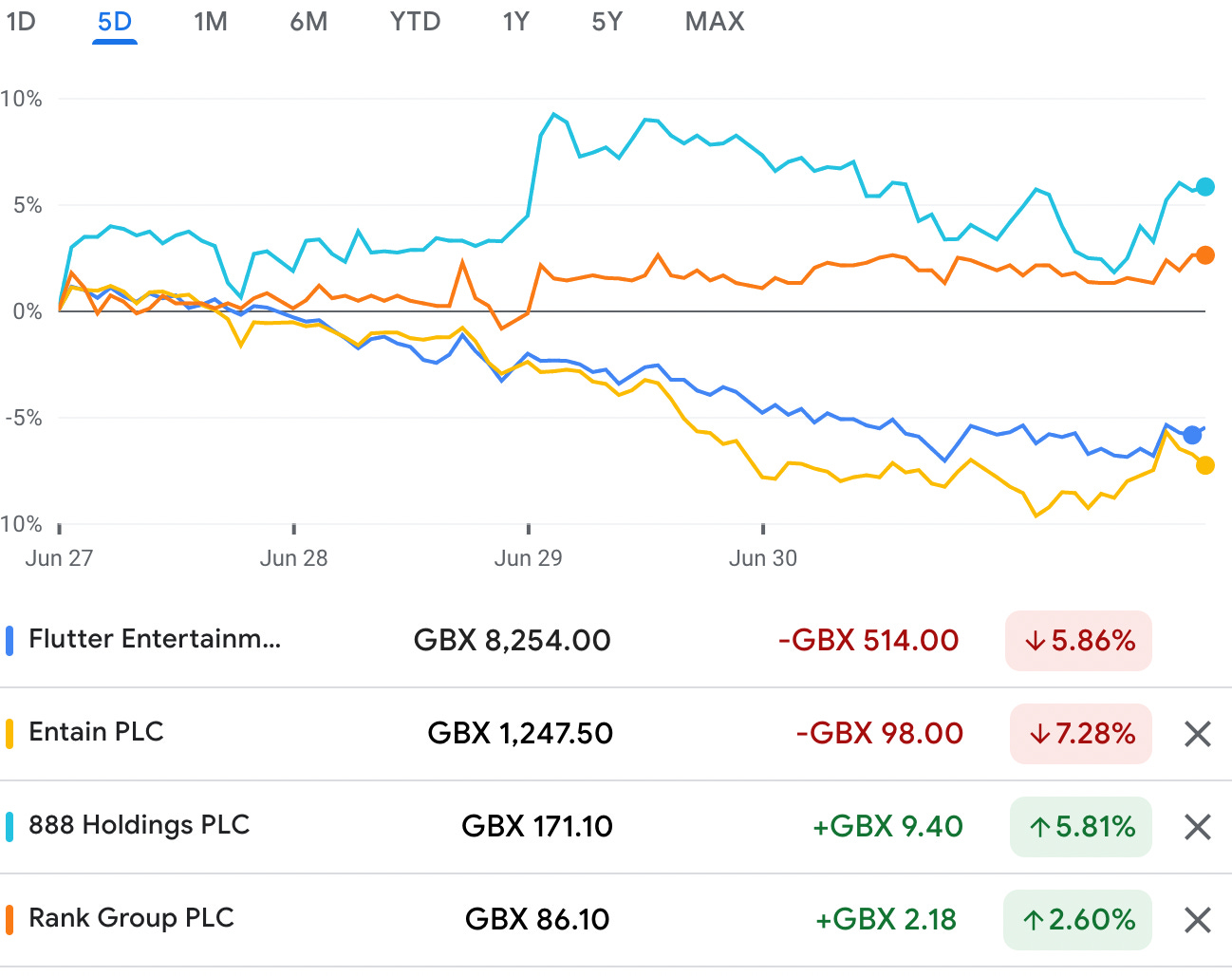

** Sponsor’s message: Venture capital firm Yolo Investments is home to €551m of equity in more than 70 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 29-company, €183m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high roller live casino brand, Bombay Club. As a proud sponsor of Earnings+More, Yolo Investments wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat. The shares weekGlass half full: UK-listed betting and gaming stocks were in the spotlight last week following reports of what was likely to be included with the UK government’s gambling white paper as investors deemed that - at least as far as the rumored proposals were concerned - the sky was’t falling in after all.

The bottom line: Sentiment remains against the UK-listed gaming stocks and it clearly isn’t the white paper overhang but broader fears over where the consumer will be in six months’ time. Las Vegas analyst updatesNot feeling it: On the back of meetings in Las Vegas, the team at Truist report that most managements reported no impact as yet from gas price inflation on Strip visitation and customer spend. The “common theme”, they suggested, was ”gaming’s resiliency to recessionary conditions”.

Caution horses: Responding to last week’s data, the Macquarie team suggested it was appropriate to take a “more cautious outlook” after what appears to be a strong summer.

Pay the piper: Meanwhile, in Atlantic City the possibility of strike action was averted late last week but the team at Regulus there is “no doubt that pay increases will be brutal for some gambling companies”. Opportunity cost: The problem, they suggest, is that for two decades the pace of macro change has “let indifferent companies offering indifferent products staffed by indifferent employees off the hook, absent major regulatory change”.

DraftKings fined for Ontario advertising breachAd breach: The Alcohol and Gaming Commission of Ontario (AGCO) has fined DraftKings CA$100K for breaching its advertising rules on inducements and bonuses.

Unibet Dutch football sponsorship criticizedAjax criticism: Unibet’s recently-announced betting partnership with Holland’s most famous football club Ajax Amsterdam has been criticized by the country’s mental health industry association. The trade body said the sponsorship was “at odds with all efforts to combat gambling addiction”.

Lower league sponsorships: Unibet received its license to operate in the Netherlands in early June and recently signed sponsorship deals with second division football clubs Telstar and De Graafschap. Macau analyst updateBleak house: The news last week that Macau recorded its lowest monthly GGR since Sep20 and the re-imposition of tougher Covid measures “highlights the inherent uncertainty of the Chinese government’s strict zero-tolerance COVID policy,” suggest the team at Macquarie.

Forecasts: Macquarie now forecast 2022 Macau GGR of $8.9bn, down 76% on 2019 levels. For 2023, they expect revenue to reach $23.9bn, or 35% below 2019. Earnings in briefBetfred: The unlisted UK operator has released its figures via Companies House showing turnover for the year to Sep21 static at £525.9m but operating profits tumbled 75% to £24.6m due to a sale of investments resulting in a loss of £22.7m in fair value.

Tab New Zealand May22: Turnover was 3.6% below target at $124.3m, GGR of $32m was 4.4% below target. Gross margins of 15.8% were 0.1% below budget. Monthly profit of $10.8m was $2.4m below expectations. The group said: “Turnover dipped against budget in May, softening economic conditions also played a factor as customers adjusted to the rising cost of living.” DatalinesNew York week ending Jun 26: GGR came in at $15.8m on handle of $218.9m. FanDuel grabbed 49.7% of that while DraftKings was worth 23.2% followed by Caesars (14.2%) and BetMGM (8.1%). Colorado May22: Sports betting handle was down 8.2% MoM at $392.3m, but GGR was up 20% to $27.1m with margins at 7.5%. Promotional credits and deductions came to just above $10.5m, bringing the taxable revenue to $16.6m, the second-highest total since sports betting was regulated in the state. Colorado received nearly $1.7m in taxes in May. Virginia May22: Despite sports betting stakes being down 12% MoM to $351.5m, GGR was up 17.3% to $42.5m and GGR margins were 12.1%. Promotional credits for the month came to just under $10m and a further $5m from other deductions brought adjusted GGR to $27.5m, on which Virginia collected $3.9m in taxes. Startup focus - Sports Gambling GuidesWho, what, where and when: New York-based Sports Gambling Guides was founded by father and son duo Mark and Troy Paul in 2020, hoping to “rewrite the affiliate marketing playbook” by making social media its number one driver. Funding backgrounder: SSG closed its most recent round of funding in May, raising an additional $2m with notable backers including Astralis Capital, a venture capital firm dedicated to identifying transformative businesses in the digital gaming space. So what’s new? In August, SGG will launch a $5m funding round on StartEngine.com, making it the first ever privately-held sports gambling company to open for public investment. The longer pitch: SGG operates one of the largest social media databases in the US with a network of over 800 sports content creators reaching a combined audience of 22 million and includes such names as DraftKings, FanDuel, Fanatics and DFS site PrizePicks among its client base.

NewslinesSportradar has launched ORAKO, its new “all-in-one” sportsbook solution aimed at operators wanting to launch an omnichannel sports betting service regardless of their stage in the business life cycle. Sportradar offers the solution as a full- or part-managed service. Genius Sports has expanded its product offering with Tipsport by increasing the number of features it supplies to the Czech sportsbook. The group will provide extra feeds and pricing on the NFL, Euroleague basketball and English Premier League events. Penn National Gaming closed down theScore Bet’s US operations on Friday and is redirecting stateside players to its Barstool Sports brand. As previously announced, the group will focus theScore Bet’s efforts on Ontario. What we’re readingPaying the price: Jonathan Bierig, co-founder of Ultimate Odds, on whether sportsbook marketing has gone too far: “Sportsbooks have created a crazed bidding war for users and have driven the CAC (Customer Acquisition Cost) through the roof.” Bears savage Robinhood: the listed day-trading app is under pressure. Calendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Jul 1: Weekend Edition #53

Friday, July 1, 2022

OpenBet price cut, Nevada May, Macau June, offshore crackdown call, sector watch - tokens +More

Jun 29: UK set for slot stake limits

Wednesday, June 29, 2022

UK white paper rumors, Bally sells RI casinos, new sector coverage, Web 3 igaming analysis, Entain analyst update +More

Jun 27: Gaming stocks stage a rally

Monday, June 27, 2022

The shares week, New York weekly data, Las Vegas analyst update, startup focus - ParlayBay +More

Jun 24: Weekend Edition #52

Friday, June 24, 2022

Fanatics/Tipico rumors, Bally legal threat, Jackpot.com funding news, sector watch - streaming, US gaming update +More

Jun 23: Earnings+More pod #13

Thursday, June 23, 2022

Watch now (25 min) | Here comes summer...

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏