Creator Economy - The 2022 Crypto Credit Crisis Explained

The 2022 Crypto Credit Crisis ExplainedA sordid tale of how a few greedy players screwed millions of retail investorsDear subscribers, The global crypto market has lost $1.2 trillion dollars since April 2022 and multiple crypto companies are facing bankruptcy. Just WTF happened? Yes, inflation is at a 40-year high and the stock market has also declined. But this isn’t a post about macroeconomics. No, I want to write about how a few greedy players screwed millions of retail investors. Let’s explain like I’m five:

Today’s post is brought to you by…Hello Metaverse Hello Metaverse is a podcast hosted by my friend Annie Zhang that seeks to demystify the metaverse and explore its implications on society. Past guests include David Finzer (CEO of OpenSea), Yat Siu (Co-founder of Animoca Brands), Morgan Tucker (Head of Social Product at Roblox), and yours truly. Check out the latest episodes below. Terra UST and LUNA’s $59 billion collapseTerra is a blockchain protocol led by Do Kwon, a South Korean entrepreneur. The chain had two main tokens:

How UST and LUNA workThere are many types of stablecoins. USDC, for example, is a stablecoin that’s backed by actual US dollars in its treasury. But UST was different. You see, UST was an “algorithmic” stablecoin that would magically maintain its $1 peg using its sister token, LUNA:

To get people to invest in UST and LUNA, Terra heavily promoted Anchor, a “savings” protocol that offered 20% APY.

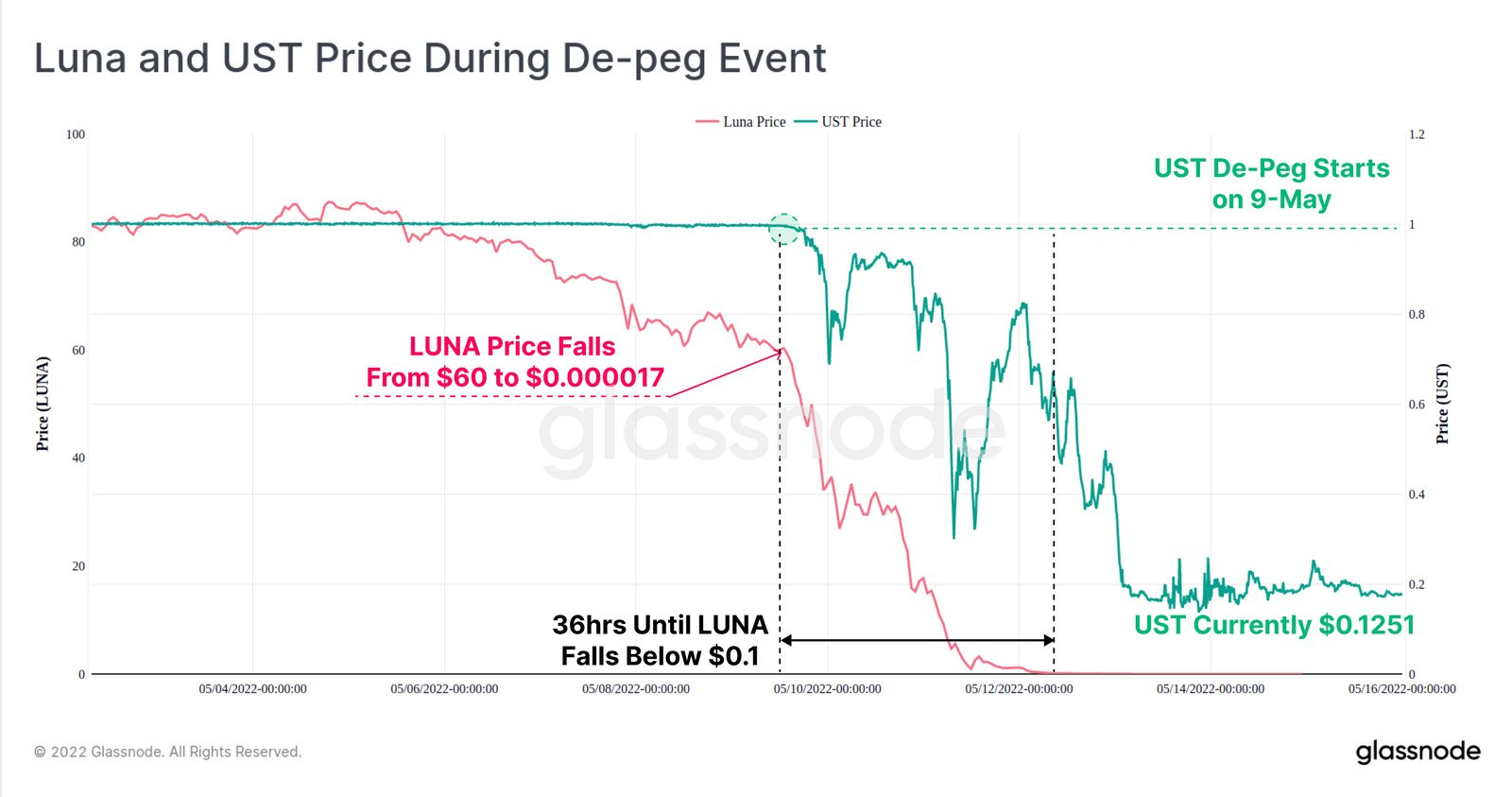

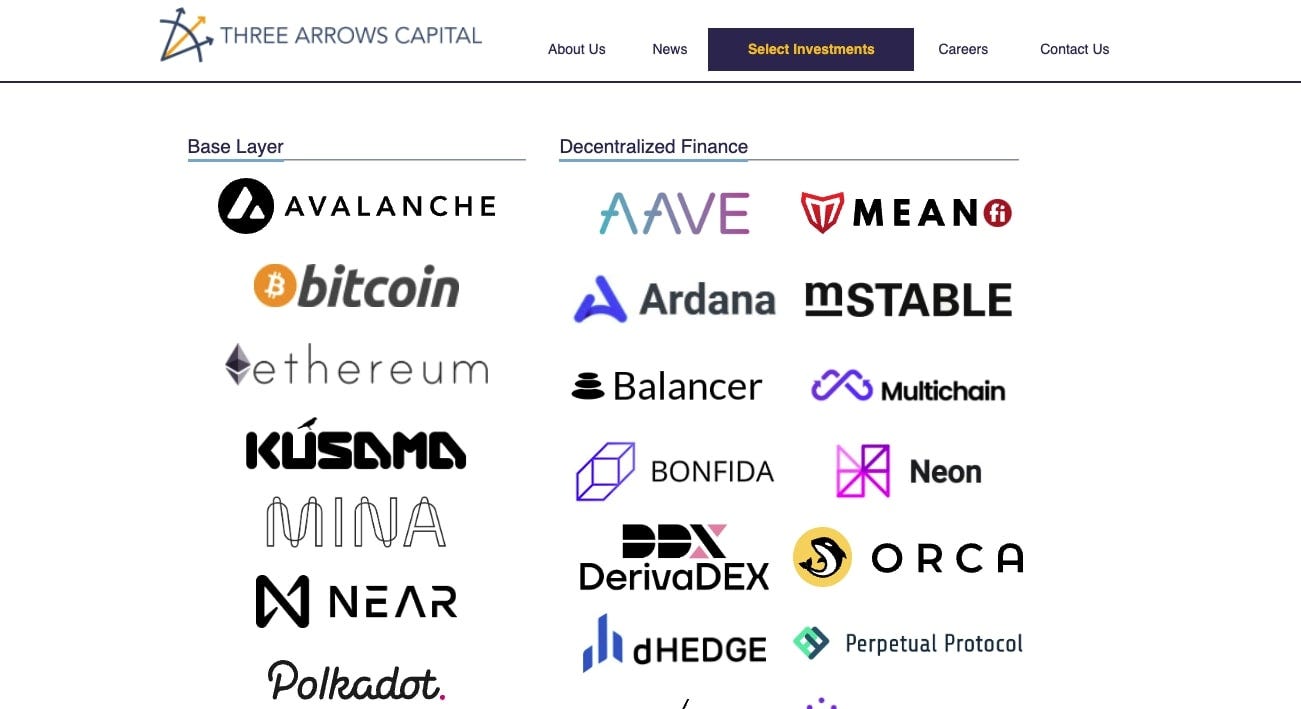

Some people did ask these questions only to get mocked by Do Kwon for being poor:  Behind the scenes, Do knew that UST could depeg if demand dried up. That’s why he raised $1B Bitcoin in early 2022 to back the price of UST. Many institutional investors participated in this fundraise, exchanging real money for large amounts of LUNA. UST and LUNA’s collapseThe chickens came home to roost in May 2022: UST depegged and its price dropped 95% from $1 to less than 5 cents in a few days. Terra tried to maintain the peg by printing more LUNA and using its bitcoin reserve. But the death spiral continued until both UST and LUNA became worthless. $59B evaporated into thin air over a few weeks, including $18B from UST "stablecoin." This was just the beginning, however:  How Three Arrows Capital went from $10B to bankruptcyThree Arrows Capital (3AC) is a crypto fund led by Zhu Su and Kyle Davies. At its peak, 3AC had $10B+ in assets under management. Its investments include a “who’s who” list of leading blockchains and DeFi protocols: All this success made 3AC cocky. The fund started borrowing money from lenders and investors based on its reputation alone instead of putting up any collateral. Like Do Kwon, Zhu Su had incredible confidence that crypto was going to the moon: From 2021 onwards, 3AC made three terrible bets:

Let’s dive into #3 in more detail. What is GBTC?Grayscale Bitcoin Trust (GBTC) is a publicly-traded security that’s meant to track the price of Bitcoin. Basically, GBTC bought a lot of Bitcoin and issued shares that reflected the net asset value of its treasury. Here’s some more history:

Zhu thought this was a massive arbitrage opportunity. 3AC could buy GBTC shares at a discount and make a profit when the price went up after the ETF got approved:  But the SEC still hasn’t approved GBTC as an ETF as of this writing. Meanwhile, GBTC’s price vs. its net asset value kept declining (now at -30% as of July 2022). 3AC was eventually forced to close their GBTC position at a massive loss. 3AC’s collapseWhen the overall crypto market soured, lenders started asking 3AC for their money back. For example, 3AC borrowed 15,250 in Bitcoin and $350M in USDC from Voyager, a leading crypto lender. However, due to its terrible investments in LUNA, GBTC, and God knows what else, 3AC no longer had money to repay its loans. The firm had no choice but to declare bankruptcy. Su Zhu and Kyle Davies’ whereabouts are currently unknown. How Celsius and other crypto lending firms froze $20B in customer assetsCelsius is a crypto lending company led by Alex Mashinsky. At its peak, the company had $20B in assets under management from 1.7M customers. Many of these customers were retail investors attracted to the 10%+ APYs that Celsius offered on stablecoins. After all, why wouldn’t you want to earn 10x the yield of your local bank from a platform that has “ military-grade security and next-level transparency”? Of course, the real question is:

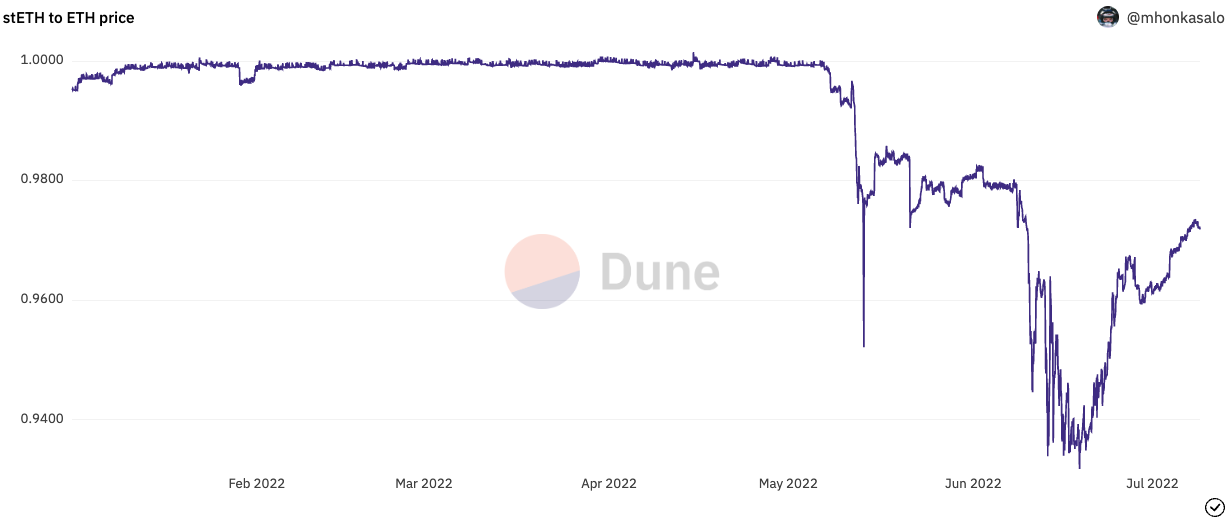

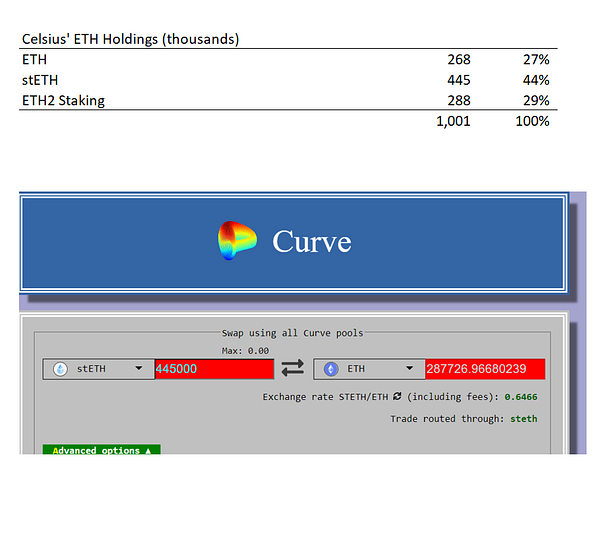

Let’s look at one of Celsius’ biggest plays - a $400M investment in stETH. What is stETH?stETH, or “staked ETH,” represents a unit of ether that’s been deposited on Ethereum’s new proof of stake beacon chain. Let me explain:

So here’s what happened:

At the same time, Celsius’ depositors started asking for their money back - money that Celsius didn’t have. People shared concerns, but Alex Mashinsky was defiant:  Just one day after the above tweet, Celsius announced that it was pausing withdrawals for all 1.7M customers:   A company that built its reputation on “banks are not your friends” turned out to be much riskier than a bank. The fallout of the 2022 crypto credit crisisSo this is wtf happened:

This sordid series of events is due to greed and recklessness from a few key crypto players - figureheads in a space that’s supposed to be decentralized. The silver lining is that actual decentralized finance platforms (e.g., Aave) were largely shielded from this collapse. Unfortunately, that’s little solace for the millions of retail investors that got screwed: Let’s conclude this rant by listing a few takeaways:

I hope more people learn these lessons because losing your money is the worst way to onboard to this space. If you liked this post from Creator Economy by Peter Yang, why not share it? |

Older messages

Is Play to Earn Gaming a Ponzi Scheme?

Wednesday, June 29, 2022

Is play to earn gaming a ponzi scheme? In this post, I dive into what play to earn is, case studies on Axie Infinity and STEPN, and how web3 gaming might become sustainable.

Nouns: How One NFT Every Day Forever Built a $34M Brand

Friday, June 17, 2022

Let's talk about Nouns DAO, one of the most interesting NFT projects out there. In this post, we'll cover how Nouns DAO works, the wacky world of Nouns projects, and if Nouns DAO is actually

Practical Lessons from Building a DAO

Wednesday, June 1, 2022

Dear subscribers, Let's talk about what it's actually like to build a DAO (decentralized autonomous organization) from scratch. I've been building Odyssey DAO over the past six months with

How to Build a Thriving NFT Membership Community

Wednesday, May 18, 2022

I believe that NFT memberships are how 1000 true fans will be realized. Let's take a look at how you can build a thriving NFT membership community by examining three of the best: VeeFriends,

Are NFTs the Future of Subscriptions?

Wednesday, May 4, 2022

I believe that creators and brands will rapidly shift to NFT memberships that they can own. This shift is a massive opportunity for web3 companies. Let's explore why NFT memberships are better,

You Might Also Like

🌎 Make international sourcing and shipping easier

Tuesday, March 4, 2025

How to prep your business for changing trade regulations. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 How was the masterclass with Arvid Kahl?

Tuesday, March 4, 2025

Your feedback matters + Access the recording ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Letter from the Editor: Why this year's Digiday Publishing Summit matters

Tuesday, March 4, 2025

It's a new era for the media industry. Eras, actually: There's the AI era, the streaming era, the podcast era, the post-cookie era. In other words, media companies are being forced to evolve,

11 social media skills to master (and how AI can help)

Tuesday, March 4, 2025

Perfect these skills now to stay ahead in 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 The masterclass with Arvid Kahl starts in 15 minutes

Tuesday, March 4, 2025

Build In Public Without Giving Away Your Business Secrets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The next level of content marketing

Tuesday, March 4, 2025

Content marketing isn't just about creating blog posts. If you're still stuck in that mindset, you're leaving money on the table. The best marketers go beyond traditional content and

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a

🦅 Masterclass with Arvid Kahl: watch the live stream

Tuesday, March 4, 2025

At 10:00 AM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏