The Pomp Letter - The Age of Economic Chaos

To investors, We have entered the Age of Economic Chaos. It seems like each day brings a new announcement, a new decision, or a new action. Rather than a simple, predictable plan being executed, President Trump and his administration are moving fast and breaking things. His critics see this strategy as detrimental to the US economy and America’s position globally. His supporters are applauding the President for following through on what he promised while on the campaign trail. They want the swamp drained of the bureaucracy, government waste ended, and an America First strategy that rolls back the globalist agenda from the last 50 years. Let’s look at the last 24 hours as an example of how this is playing out. The White House confirmed last night that President Trump has suspended all military aid to Ukraine amid the disagreement with Ukraine’s Zelenskiy. The United States is seeking a mineral rights deal that will ensure repayment for the hundreds of billions of dollars that is being sent to support Ukraine, while the European country continues to demand security agreements and other onerous terms. This decision to pause military aid was a surprise to the market and created another news cycle filled with fear, which doesn’t help to calm investors. According to Perplexity, investors are worried because freezing aid “could potentially escalate the conflict and increase geopolitical instability, which often leads to market volatility and economic uncertainty. Additionally, this move might signal a shift in US foreign policy that could have broader implications for international trade relationships and global security alliances, factors that significantly influence investor confidence and financial markets worldwide.” As if that wasn’t enough, Trump confirmed he will impose the 25% tariffs on all imports from Canada and Mexico, along with an additional 10% tariff on China, starting at midnight last night. These penalties had been threatened for weeks, but many were holding out hope for a last minute deal — instead of getting that deal, the US government is moving forward with the tariffs as a way to exert pain on our largest trading partners. Stocks immediately fell after Trump confirmed the tariffs would be implemented and the S&P 500 is now negative year-to-date. You can actually watch the stock market fall while Trump is speaking about tariffs in this video: Just these two developments would be enough news for weeks of analysis in any other administration. Add in the fact that the stock market is crashing and you can understand why hysteria has started to take over. But we were just warming up yesterday. And not all the news was bad. Taiwan Semiconductor Manufacturing Company held a press conference with President Trump, AI czar David Sacks, and Commerce Secretary Howard Lutnick. The company announced plans to invest an additional $100 billion in the United States by building 5 new manufacturing facilities and creating at least 20,000 American jobs. Trump’s supporters will argue this investment from TSMC is a result of the tariff threat, while his detractors will point to Biden’s CHIPS Act as the main driver. The truth is that both Presidents are likely to be partially responsible. Regardless of who gets the credit, American citizens should be excited about the prospect of more investment, more domestic manufacturing, and more jobs. So what is going on here? It feels like every 24 hour period brings a flurry of good and bad news. It seems to the untrained eye that action is the goal, rather than results. But I want to make a different argument — I want to lay out a scenario where the President and his team are intentionally cratering the economy and the stock market to reset the foundation on which to build upon. Kyla Scanlon pointed out that one user on X named Fischer King posted in October of last year the following:

This innocuous post got a reply from Elon Musk who said “sounds about right.” This begs the question — why would a President and his team intentionally hurt the economy or the stock market? The answer is a little more complicated. Cem Karsan had the best breakdown of anyone:

This is a highly complex strategy that may or may not work. But one thing is becoming clear — the Trump administration is going to take a run at implementing the plan regardless of what anyone else thinks. The thing about these policies is that receptivity and enthusiasm really boils down to whether someone is a fan of Donald Trump or not. Ben Carlson had a great meme that explained the different viewpoints perfectly — critics call it crashing the economy, while supporters call it lowering mortgage rates. The truth is that both can be true at the same time. And you may think that everyone will be upset if the economy collapses, but I don’t agree. Spencer Hakimian said it well when he described the working class cheering for a market downturn:

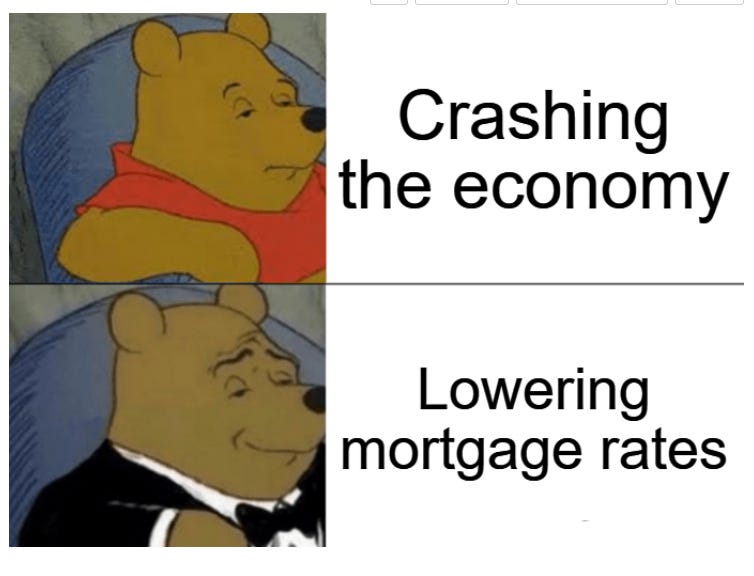

So you can think of Trump’s policies as a way to play to his newfound working class base in a weird way. Get stocks and mortgage rates lower. Give these people access to financial assets or primary homes that were previously unavailable to them from an affordability standpoint. I am not arguing that these are good ideas, but merely commenting on what seems to be playing out. The market downturn is being promised as short-term pain in exchange for long-term benefit. Treasury Secretary Scott Bessent was on television this morning explaining how the focus is on Main Street and consumers rather than Wall Street: We will see if that is actually what happens. But one thing is guaranteed — change is happening and chaos is an intended outcome. I liked X user Goodstructure’s explanation of the pain — “always a little pain when daddy takes the credit card away.” With this as the backdrop, it makes sense that odds on prediction market Kalshi currently sit at 40% for a recession this year. You may not expect the President of the United States to crash the US economy on purpose, but that is what appears to happen. Hopefully this is a healthy correction that allows us to rebuild on a stronger base, but either way — put your seatbelt on. We are in for a bumpy ride. Hope everyone has a great day. I’ll talk to you all tomorrow. - Anthony Pompliano Founder & CEO, Professional Capital Management Darius Dale Explains Why The Government May Be Crashing The Market On Purpose Darius Dale is the Founder & CEO of 42Macro. In this conversation we talk about global liquidity, what’s going on with inflation expectations, why the government may be tanking the market for a foundation of strength, and how this impacts asset prices. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

What I Think About The Crypto Strategic Reserve

Monday, March 3, 2025

Listen now (8 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin industry insiders aren’t worried about the price correction

Friday, February 28, 2025

Today's letter features a guest post from Phil Rosen, the co-founder of Opening Bell Daily, an independent financial media company. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

From the Desk of Anthony Pompliano

Thursday, February 27, 2025

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Can The US Eliminate Federal Income Tax?

Thursday, February 27, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

American Consumers Are In Financial Pain

Thursday, February 27, 2025

Listen now (3 mins) | READER NOTE: I have spent the last few years mostly managing balance sheet capital. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

🦅 How was the masterclass with Arvid Kahl?

Tuesday, March 4, 2025

Your feedback matters + Access the recording ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Letter from the Editor: Why this year's Digiday Publishing Summit matters

Tuesday, March 4, 2025

It's a new era for the media industry. Eras, actually: There's the AI era, the streaming era, the podcast era, the post-cookie era. In other words, media companies are being forced to evolve,

11 social media skills to master (and how AI can help)

Tuesday, March 4, 2025

Perfect these skills now to stay ahead in 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 The masterclass with Arvid Kahl starts in 15 minutes

Tuesday, March 4, 2025

Build In Public Without Giving Away Your Business Secrets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The next level of content marketing

Tuesday, March 4, 2025

Content marketing isn't just about creating blog posts. If you're still stuck in that mindset, you're leaving money on the table. The best marketers go beyond traditional content and

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a

🦅 Masterclass with Arvid Kahl: watch the live stream

Tuesday, March 4, 2025

At 10:00 AM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Where Are The 2021 Unicorns Today?

Tuesday, March 4, 2025

60% Are Stuck In Limbo To view this email as a web page, click here saastr daily newsletter Where Are The 2021 Unicorns Today? 60% Are Stuck In Limbo, Per Carta By Jason Lemkin Sunday, February 2, 2025