Coin Metrics' State of the Network: Issue 164

Get the best data-driven crypto insights and analysis every week: The Ethereum Crowdsale 8 Years LaterBy Kyle Waters, Nate Maddrey, and Matías Andrade After years of testing, research, and development, excitement is building around the potential timeline for Ethereum’s planned move to proof-of-stake (PoS) through The Merge. The Merge arguably represents the single largest protocol-level change in Ethereum’s history, eliminating mining and introducing a system of validators that stake their ETH to earn rewards from creating and attesting to new blocks. Tracking ETH supply continues to attract attention as ETH holdings directly dictate a user’s ability to participate in PoS. At the same time, the move to PoS will also introduce a new ETH issuance model and impact ETH’s monetary policy. To best understand Ethereum’s current supply, however, observers need to step back a year before the network even launched to the pivotal period of July 22, 2014 to September 2, 2014: the ETH crowdsale. In this week’s State of the Network, we take a data-driven retrospective look at the ETH crowdsale using data from Coin Metrics’ ATLAS. We review the data behind the sale and also examine the current set of genesis accounts (those who participated in the crowdfund). BackgroundHow should a cryptocurrency be initially allocated? Over the years this question has been the source of constant debate. There have now been many initial issuance models with varying amounts of rewards for early adopters and contributors – leading to stark differences in supply distributions. For Bitcoin, Satoshi addressed this question when releasing the first version of Bitcoin’s code in 2009:

Anyone could download the open source software for Bitcoin and contribute compute power to secure the network in exchange for freshly minted BTC. Per Bitcoin’s supply schedule, the first 50 BTC were generated in the genesis block, the same amount as any other block until the first halving in 2012 when the block reward dropped to 25 BTC (interestingly, these 50 genesis coins are not spendable and are provably lost). But with the proliferation of alternative cryptocurrencies to BTC, new models were tested. In 2013, Mastercoin (MSC), the precursor to the Omni layer for Bitcoin, launched a fundraising campaign using Bitcoin as the crowdfunding platform. Anyone could send BTC to a specified address and receive an amount of MSC at a predetermined rate. The project raised just over 5,000 BTC worth ~$500,000 at the time. The success of this model would pave the way for Ethereum’s high-stakes 2014 crowdsale of ETH. ethereum.org as it looked during the ETH crowdsale in summer 2014 (source) Like Mastercoin, the Ethereum crowdsale raised BTC in exchange for ETH. Participants in the crowdsale were promised an allocation of ETH when Ethereum launched in the following year. By using Bitcoin as a crowdfunding platform, anyone in the world could in theory participate. Author and Defiant News founder Camila Russo summarized just how profound the ETH crowdsale was in her book The Infinite Machine, an exciting account of Ethereum’s roots:

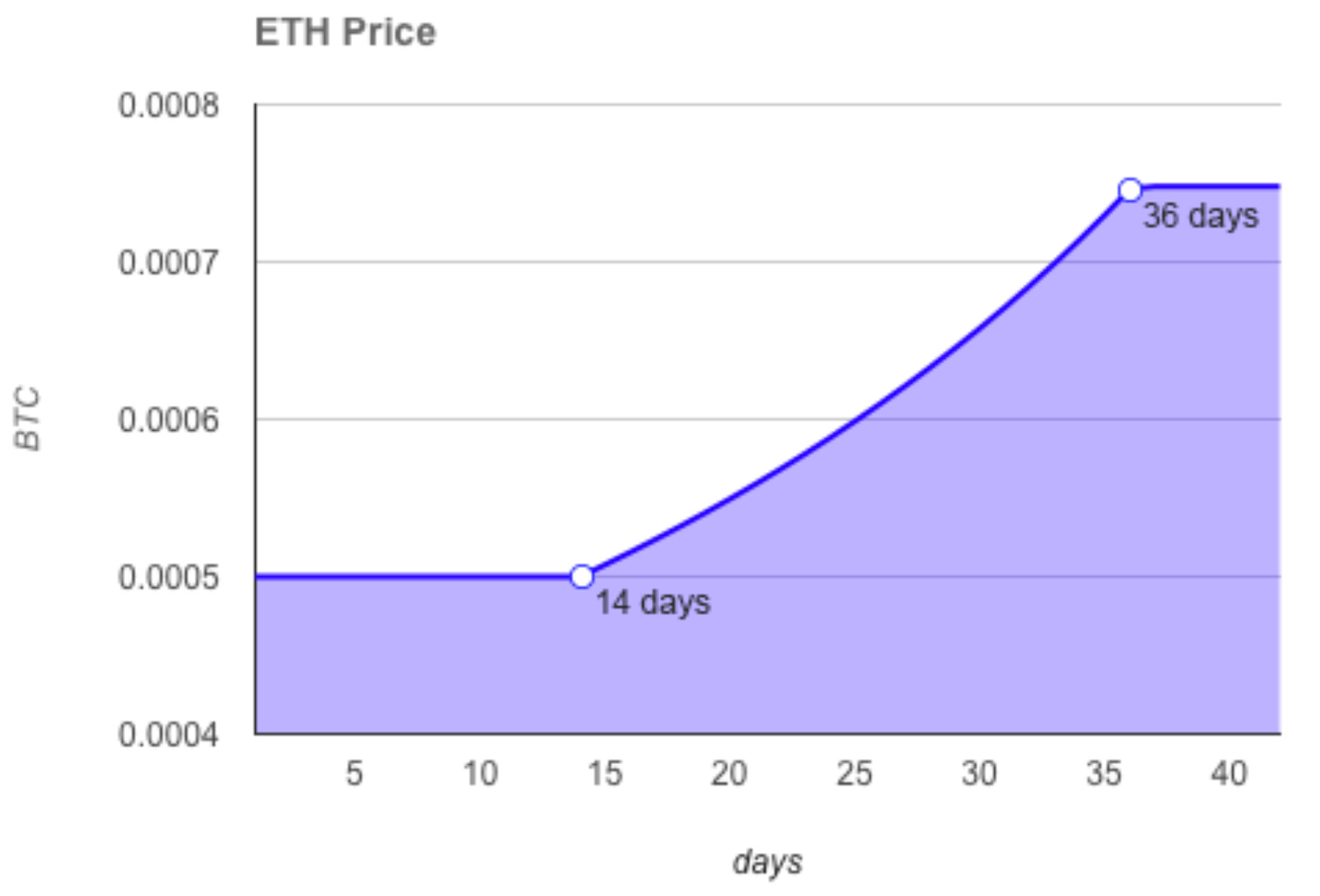

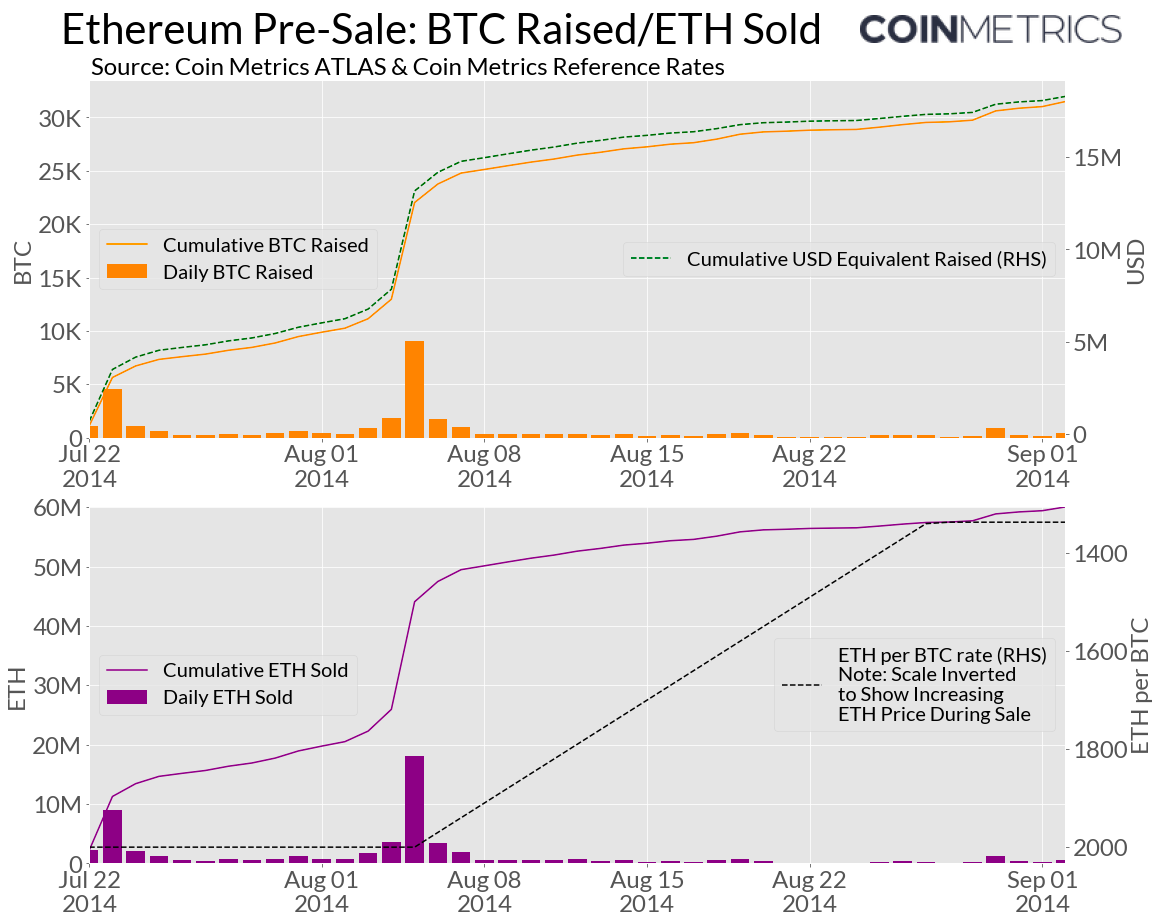

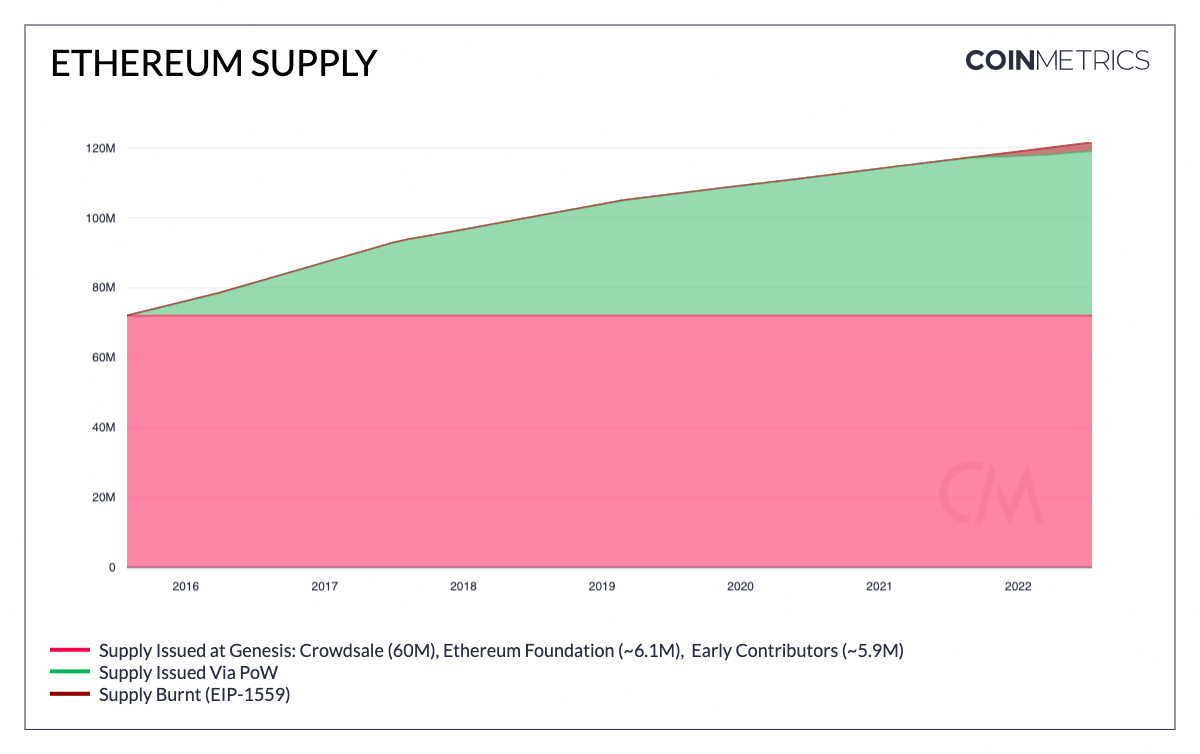

The crowdsale launched on July 22, 2014 and was scheduled to run for 42 days. By this point, Vitalik and other early contributors had revealed Ethereum’s vision to the world, most notably with the 2013 Ethereum whitepaper and a presentation at Bitcoin Miami 2014 in January of that year. The crowdsale had an interesting set of incentives to encourage those privy and willing to participate to do so early. For the first two weeks of the sale, 1 BTC could purchase 2,000 ETH, with the price changing linearly thereafter to a final 1,337 ETH per BTC. The chart below shows the price for ETH in BTC terms to show the discounted price of ETH in the early days of the crowdsale and rising price from day 14 to 36 of the sale. Source: Terms and Conditions of the Ethereum Genesis Sale Using Bitcoin as a crowdfunding mechanism was a novel experiment at many levels. But one consequence of conducting the crowdsale on a public ledger is that we can easily access this rich dataset of contributions years on. Unsurprisingly, this data has been the subject of a lot of scrutiny to-date — most intensely with Preston Byrnes’ 2018 remarks and independent crypto researcher Hasu’s data-driven follow-up analysis. Bitcoin “Exodus” Address StatsThe chart below shows the total amount of BTC sent to the Bitcoin address ( The chart below shows the total BTC and USD equivalent raised during the crowdsale and total ETH sold. Over 31K BTC was raised worth ~$18.3M for a total of 60M ETH sold (this placed Ethereum as the 2nd largest crowdfunding campaign ever at the time). Sources: Coin Metrics ATLAS & Coin Metrics Reference Rates Of the 60M ETH sold, around 50M were sold within the first two weeks when the price was greatly discounted – with significant volume spikes at the beginning of the sale and the last day of the 2,000 ETH per BTC rate. A total of 8,437 purchases were made between the minimum purchase amount of 0.01 BTC and maximum amount of 500 BTC (though there was in theory no way to cap contributors from splitting up larger amounts into multiple addresses). The three largest purchases were 500, 466 and 330 BTC. The average purchase was 3.65 BTC or about 7,000 ETH. Ultimately, it’s hard to say much more about the participants given the pseudo-anonymity of Bitcoin addresses, yet these results nevertheless offer valuable insights into one of the most important events in the history of crypto thus far. The Crowdfund in Context to Current SupplyAlong with the 60M ETH sold in the crowdfund, ETH early contributors received an additional amount equivalent to roughly 10% of the total ETH sold while another ~10% was set aside for the Ethereum Foundation. This meant that the total supply of Ethereum at network launch was just around 72M ETH, split across 8,893 addresses. But with additional ETH being distributed via mining, over time the crowdfund participants and early contributors have controlled a smaller and smaller percentage of total supply. With total ETH supply today near 120M, nearly 50M new ETH has been issued since genesis. Source: Coin Metrics Formula Builder Note that the chart above is merely presented for comparison to proof-of-work issuance over time, and doesn’t reflect genesis accounts distributing their coins through time. In other words, the set of accounts controlling the 72M ETH from genesis continues to change and grow in size. Over 92% of genesis accounts have touched their ETH by now, with only 693 accounts having never moved their ETH to-date (the largest being But all told, Ethereum accounts created at genesis control just 2.66M ETH today, representing around 2% of total ETH supply, declining from 7M ETH in 2018 (of course some holders may have simply moved their ETH to custodians/exchanges or to new accounts). While often debated for its lasting effects on supply distribution, the ETH crowdsale was undeniably an ambitious project with its success reflecting the excitement around a new era of programmable blockchains to support smart contracts and decentralized applications. With yet another ambitious project on the horizon with The Merge, many eyes are focused on Ethereum as it enters a critical stage in its still less than a decade long history. To keep up to date on Ethereum data and other on-chain data across the entire crypto ecosystem, explore the rest of our metrics on our free charting tool, formula builder, correlation tool, and Python API client. Also check out these other resources covering ETH supply and its pre-sale.

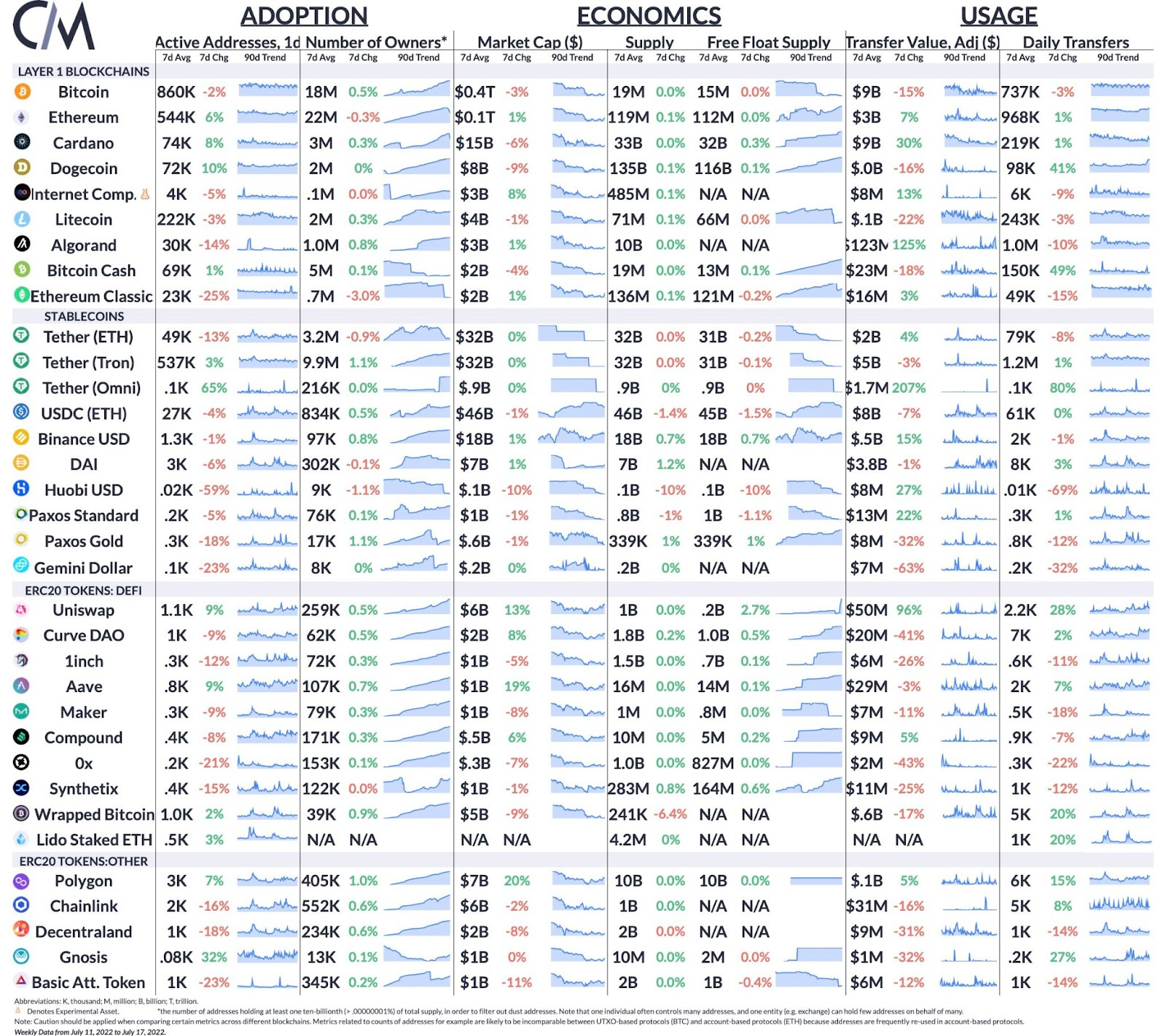

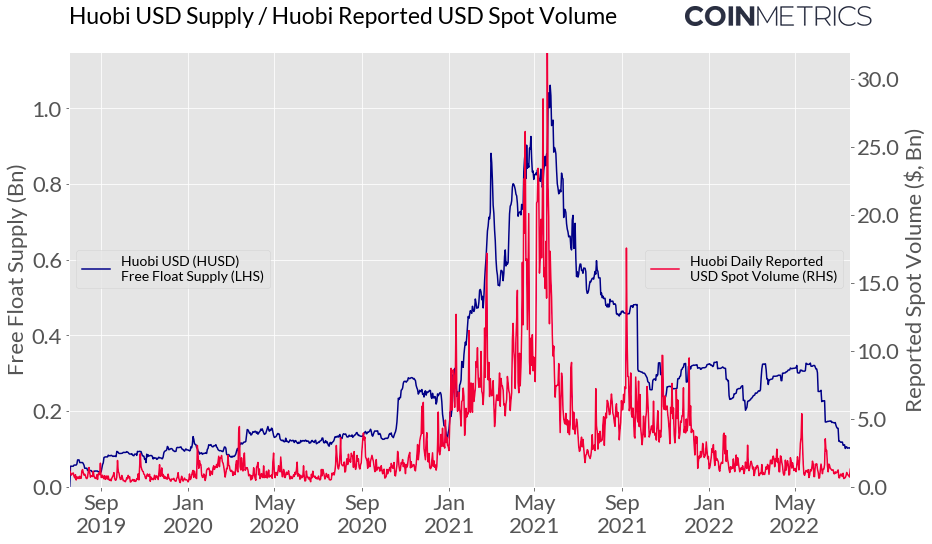

Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro The supply of wrapped bitcoin (WBTC) – the Ethereum token backed by BTC often used within DeFi – has fallen to 241K from a peak of 285K in May. With the unwinding and pullback in crypto lending markets, WBTC activity has weakened. But at 241K, about 1.2% of all BTC are still wrapped on Ethereum today. Meanwhile, the number of BTC held in public Lightning Network channels has continued to rise this year, standing at 4.3K BTC today. Network HighlightsMany stablecoins have experienced drawdowns in supply this year following the collapse of TerraUSD and broader crypto market contagion. The decline in the circulating supply of Huobi USD (HUSD) however – the crypto exchange Huobi’s US-dollar stablecoin – shows how stablecoins that are popular for trading on centralized exchanges closely track observed spot volume. As daily spot trading volume on the exchange has fallen since 2021 from over $20B/day to under $1B/day, HUSD supply has contracted from over $1B on Ethereum to just $100M today. Sources: Coin Metrics Network Data & Market Data Feed Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. To learn more, acquire our data, or contact Coin Metrics reach out here. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 163

Tuesday, July 12, 2022

Tuesday, July 12th, 2022

Coin Metrics' State of the Network: Issue 162

Wednesday, July 6, 2022

Wednesday, July 6th, 2022

Coin Metrics' State of the Network: Issue 161

Tuesday, June 28, 2022

Tuesday, June 28th, 2022

Coin Metrics' State of the Network: Issue 160

Wednesday, June 22, 2022

Wednesday, June 22nd, 2022

Coin Metrics' State of the Network: Issue 159

Tuesday, June 14, 2022

Tuesday, June 14th, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏