The Pomp Letter - Is A Soft Landing Possible Anymore?

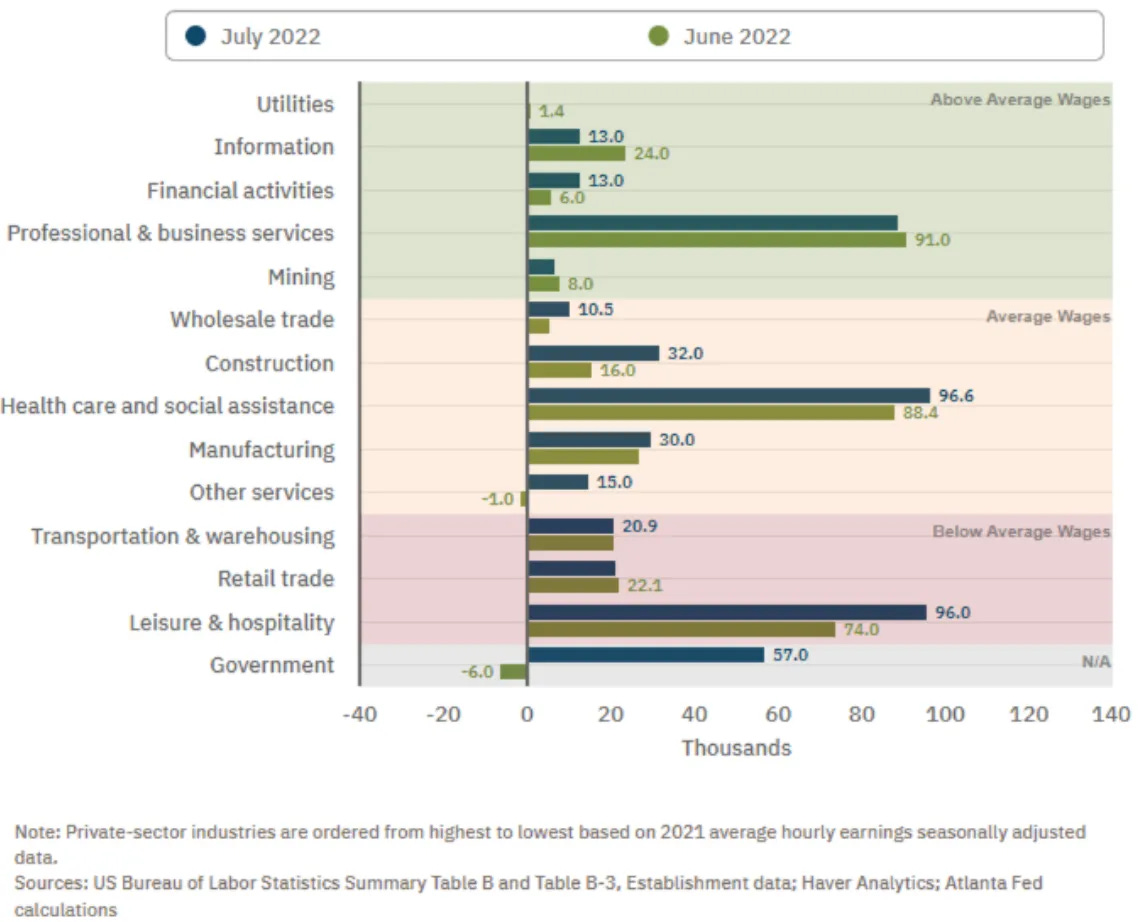

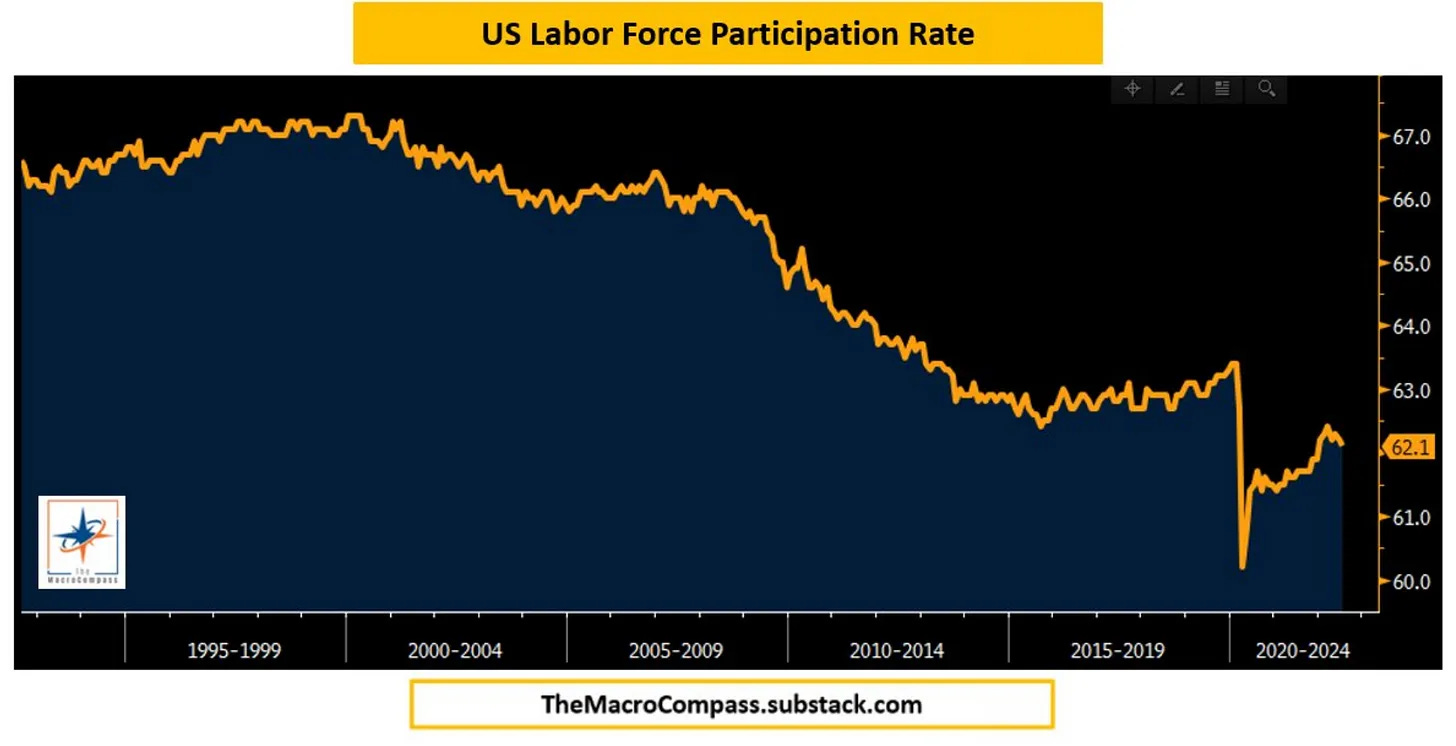

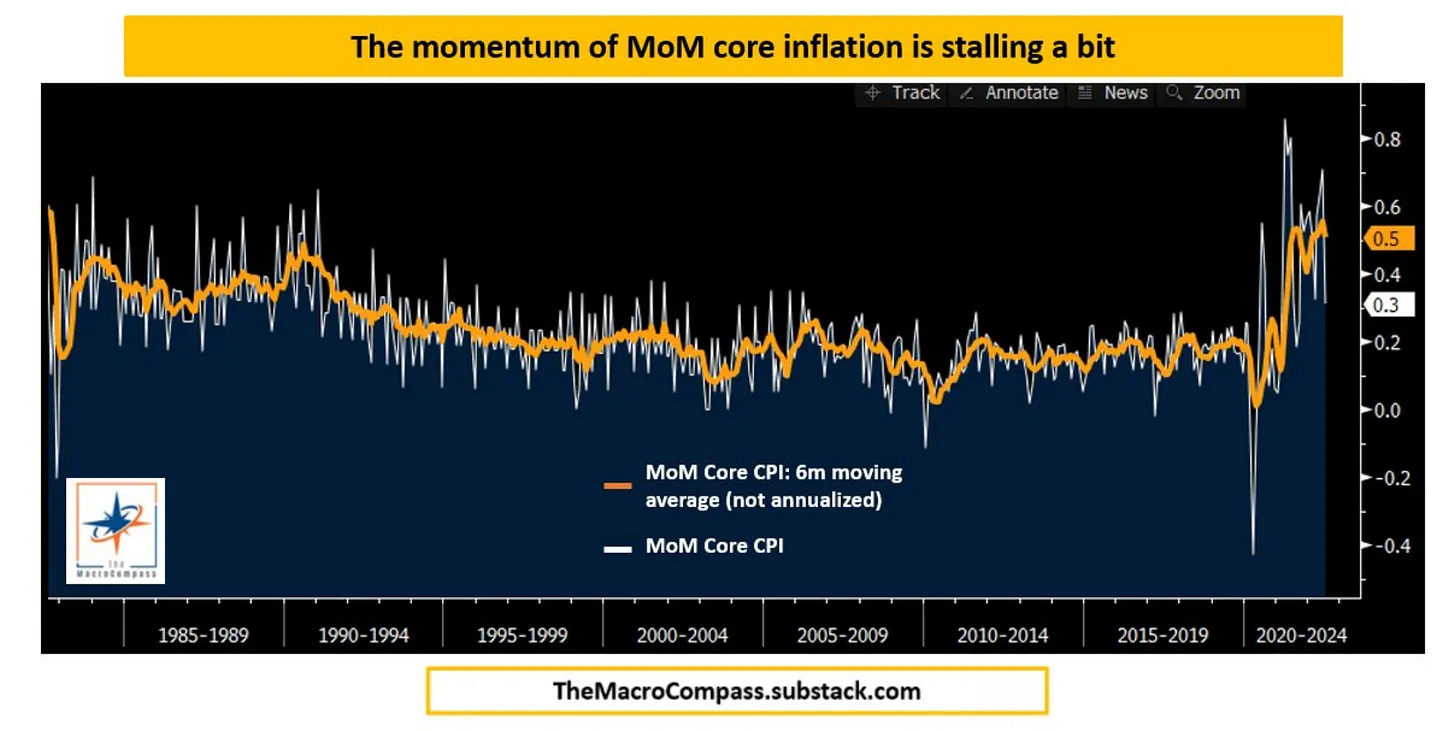

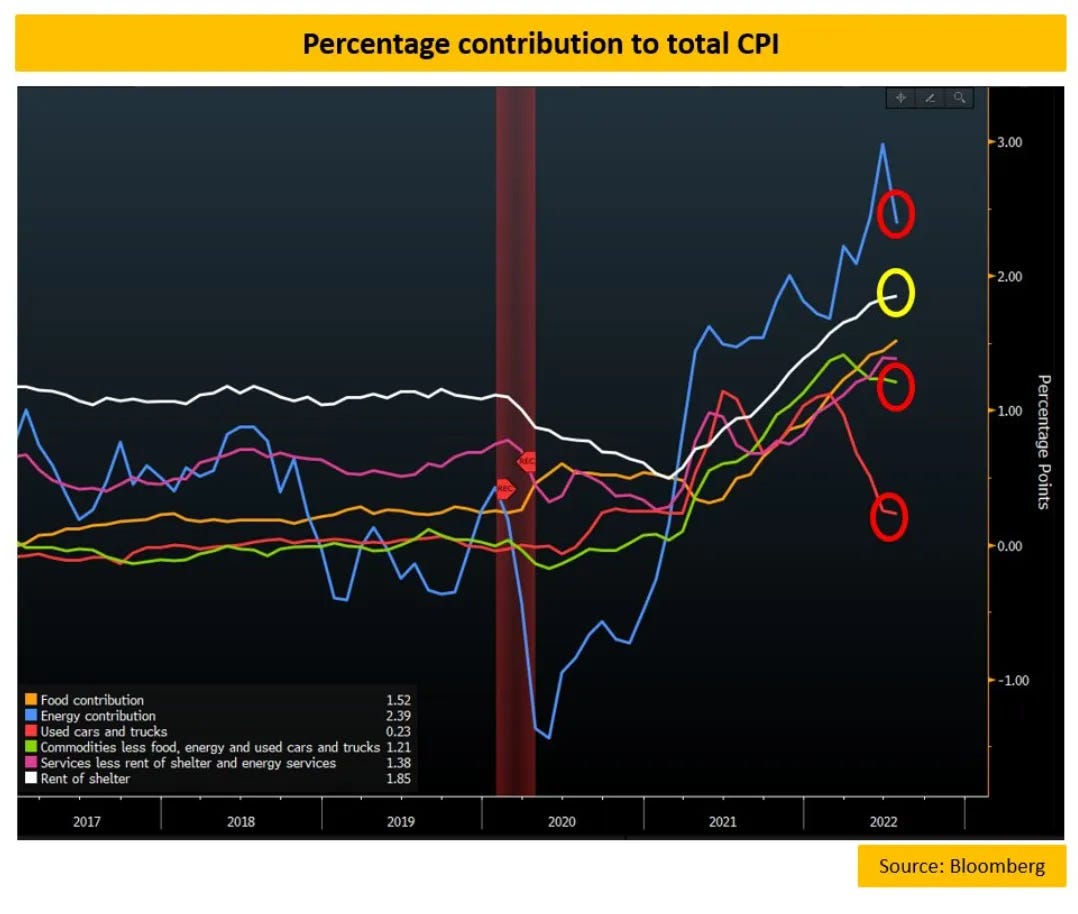

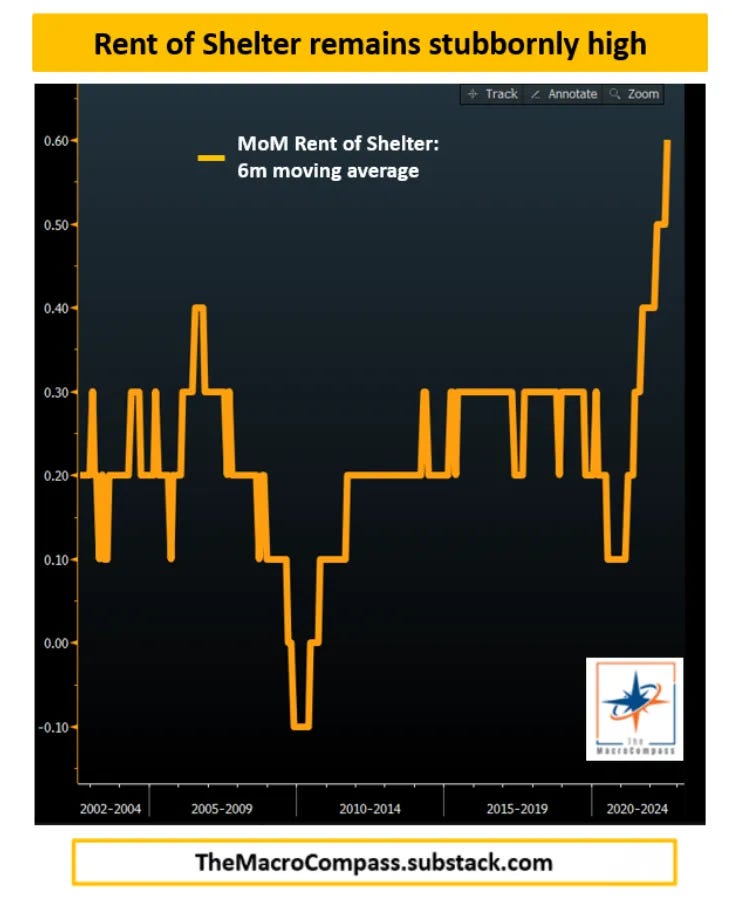

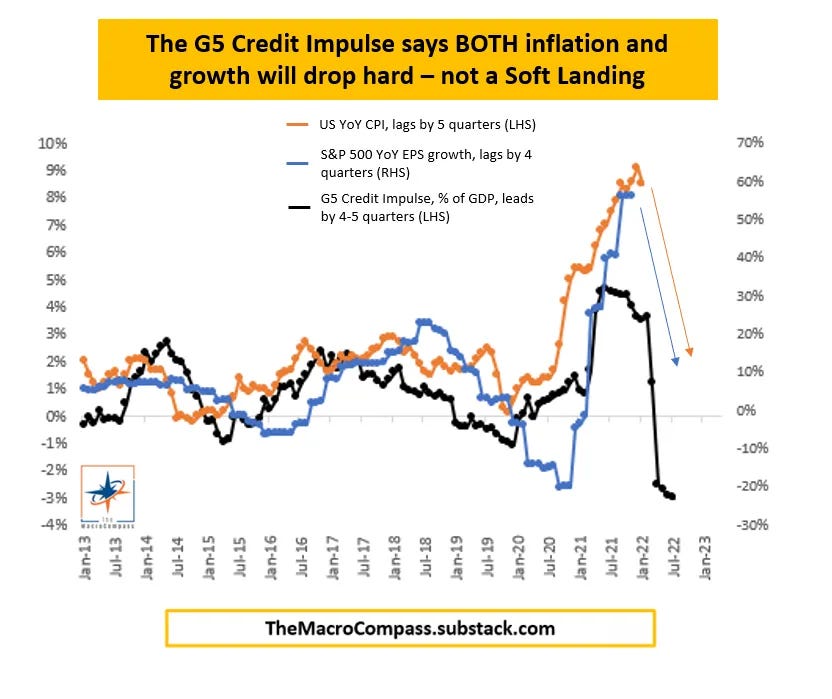

To investors, Below is a guest post from Alfonso Peccatiello (@MacroAlf), author of The Macro Compass, providing analysis on the latest CPI and labor market reports, and showing how they do not necessarily imply high odds of a Soft Landing. Before starting The Macro Compass, Alfonso was the Head of Investments, managing a $20 billion portfolio for ING Germany. For more unique macroeconomic insights, I recommend subscribing to The Macro Compass, which is free. Is the Fed achieving the famous Soft Landing after all? A deep look at the latest job market and CPI reports reveals how the extent of aggregate demand weakness the Fed engineered through tight financial conditions is not consistent with a Soft Landing - it will help in slowing down inflation, but it will also come at a big cost for economic growth. 1. ‘‘The job market is very strong!’’ Hold your horses, cowboy…The good news first: all jobs lost during the pandemic have now been recovered (and more on top!). Interestingly, estimates of the pace of job creation necessary to keep unemployment rate stable given US demographics sit in the 100k per month. A. Compared to June, the sector which added most jobs was…the government?! In a very strong economy where growth is robust, you would expect private (and not public) sector job creation to lead the way. B. Even more interestingly, the Household Survey data was much (!) weaker than the Bureau of Labor Statistics job report (NFP). This matters a lot because the BLS survey has two interesting (and very relevant) features: multiple jobholders are counted as if multiple jobs were created, and the statistical methodology for the net number of opened/closed businesses was changed after the pandemic and this can lead to very volatile outcomes. The household survey instead correctly accounts for multiple jobholders, and it shows how since March we have less (!) full-time and part-time workers while the number of multiple jobholders continues to increase. Additionally, the BLS survey reported an estimated +309k net new business openings (!) in July - a very large number that contributed to the positive NFP report, and likely the result of a new statistical methodology (here for more details) rather than underlying business openings. C. Participation rate is not picking up at all We are still almost 1.5pp away from the pre-pandemic participation rate and by now it seems clear that people who decided to leave the labor force…well, they left for good. 2. Good news on the inflation front! But why did CPI slow down?Finally, inflation is showing signs of a slowdown. As we know, the Fed cares about the momentum and composition of inflationary pressures going forward: to ease their policy stance they need to see progress from both fronts. The 0.3% MoM Core CPI print stabilized the momentum a bit, but the 6m moving average of monthly core inflation remains historically high at 0.5% - a good step, but obviously more is needed. When it comes to the composition, the big drivers behind the move down in CPI where energy and other commodities (blue and green) together with the most cyclical components of the CPI basket like used cars & trucks (red). The weaker demand theory is also backed by another evidence: while the cyclical components of the CPI basket are experiencing drawdowns, the stickier and more lagging core services price (e.g. shelter) remain stubbornly high for now. In Short: The Soft Landing Narrative Seems Misplaced.A Soft Landing implies a marked slowdown in inflation while growth remains robust. Grim forward-looking economic indicators, negative real wage growth for 1.5 years and the reach for credit card debt to bridge the purchasing power gap, multiple jobholders accounting for most ‘‘job creation’’ since March and our G5 Credit Impulse metric all suggest this is not going to be a Soft Landing. Hopefully this made you think more deeply about the current market and what is likely to come in the following months. -Pomp (I recommend subscribing to The Macro Compass) 🚨 SPONSORED: The most anticipated crypto event of the year is back. Don’t miss Mainnet 2022, September 21-23rd in New York City. Connect with 4000+ crypto builders and thought leaders for 3-days of can't-be-missed keynotes, fireside chats, demos, networking, and more. Mainnet brings together a stellar cast of crypto pioneers to speak about the industry's current state and provide projections on the future of web3. Don't miss programming like the fireside chat between Messari’s Ryan Selkis and Ripple's Brad Garlinghouse and keynotes from speakers like crypto entrepreneur Balaji Srinivasan and OpenSea's Devin Finzer. Click here to see our 150+ speaker lineup and purchase your pass. Plus, get $300 off of your pass today by visiting and entering promo code "POMPLETTER" at check out. 🚨 You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber. |

Older messages

Podcast app setup

Sunday, August 7, 2022

Open this on your phone and click the button below: Add to podcast app

Institutions Aren't Running From The Bear Market

Thursday, August 4, 2022

Listen now (4 min) | To investors, There has been anticipation of Wall Street institutions joining the bitcoin and crypto industry for years. Fidelity started mining bitcoin back in 2014, which was

Podcast app setup

Thursday, July 21, 2022

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Sunday, July 17, 2022

Open this on your phone and click the button below: Add to podcast app

3 certainties in life: Death, taxes, and ever-increasing monetary intervention

Friday, July 15, 2022

To investors, Below is a guest post from Jan Wüstenfeld analyzing consumer price inflation, monetary inflation, and whether bitcoin is a hedge against one or both. Jan is pursuing a Ph.D. in Economics

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these