Explanation: Sudoswap Token Allocation Controversy

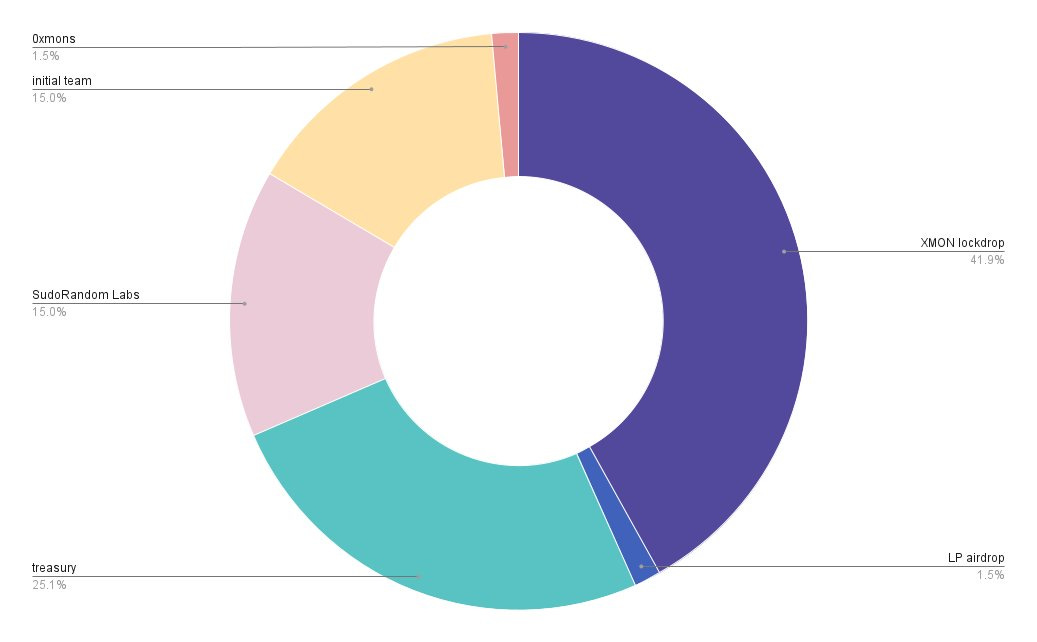

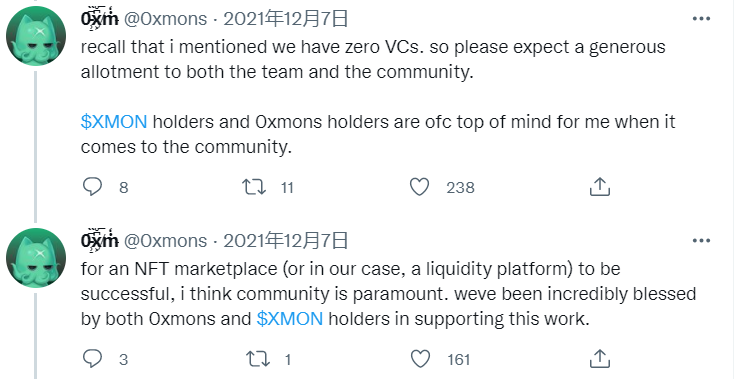

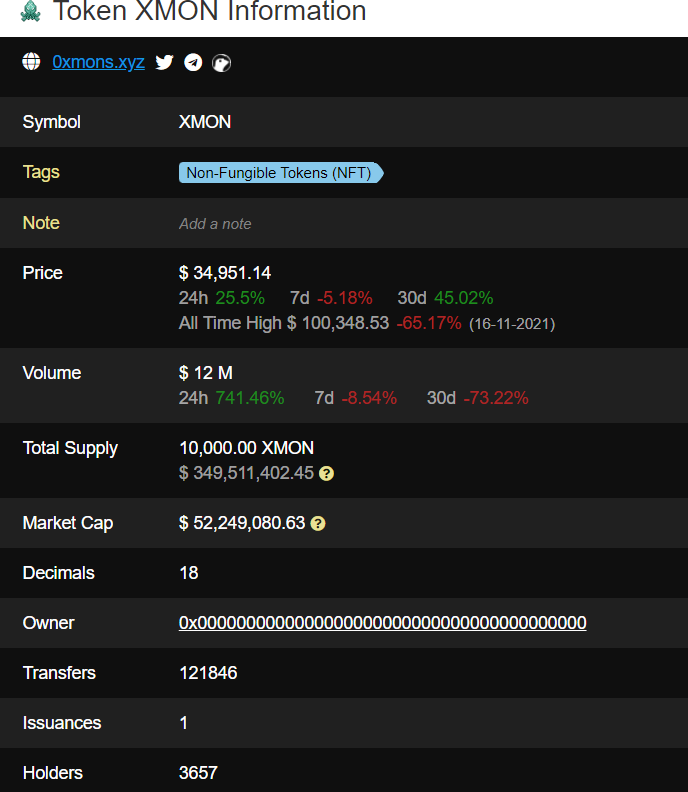

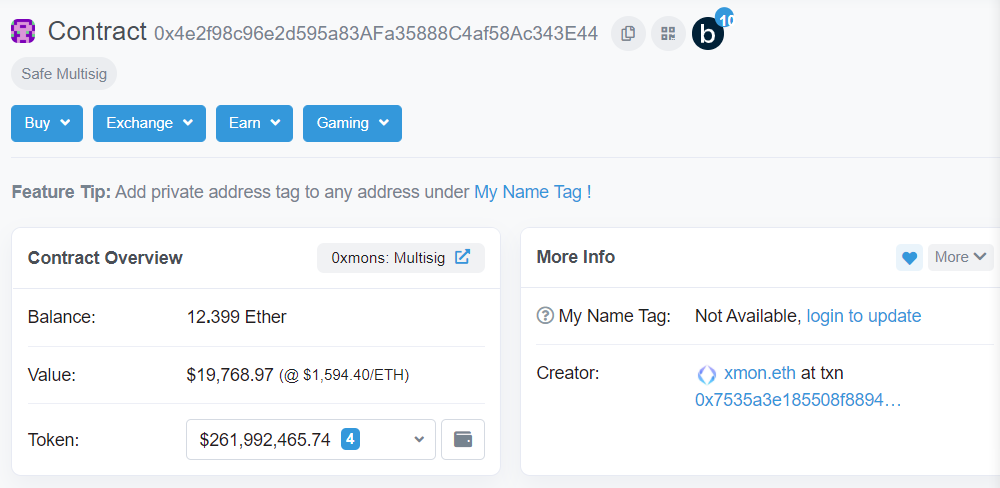

Author:@w_goldminer Today, Sudoswap posted outlines the distribution of SUDO, the governance token of the sudoAMM protocol. The allocation ratio is as follows. XMON holders: 25.12M, 41.9%;0xmons NFT holders: 0.9M, 1.5%;Retroactive LP airdrop: 0.9M, 1.5%;Treasury: 15.08M, 25.1%;Initial team members: 9M, 15%, vested over 3 years with a 1 year cliff;SudoRandom Labs: 9M, 15%, vested over 3 years with a 1 year cliff. However, the percentage of tokens allocated to Sudoswap is unusual. Underneath the tweet about "SUDO token allocation", many users said: "41.9% for xmon, the world's big joke." Cause up to 41.9% of SUDO tokens were allocated to $XMON holders. Sudoswap is known to have been started by anonymous developers 0xmons, zefram.eth and 0xhamachi. The Oxmons team posted a tweet in December 2021 that,   explained that the team launched the Oxmons project in late 2020, the project ecosystem includes XMON tokens and Oxmons NFT, and has no VC involvement in the investment. In 2021 the team began building the NFT AMM protocol——sudoswap, which was created so that users could trade their Oxmons NFT. The tweet also discuss Sudoswap's future and its native token $SUDO. Indicating that after sudoswap's release, the subsequent goal is to move to a DAO model and start raising funds. The tweet specifically mentions that because the Oxmons project was launched without VC investment, early backers will be rewarded with a subsequent sudoswap release. When making future token allocations, $XMON holders and Oxmons NFT holders will be the primary consideration. It seems plausible to assume that this time $XMON holders are getting 41.9% of SUDO tokens as the team is fulfilling the 2021 engagement, even if 41.9% is unreasonably high. However, the initial supply of $XMON tokens was 10k and the current number of addresses held is only 3657. Of the $XMON holding addresses, the address starting with 0x4e2f98c holds 7488.28 tokens, worth about $260 million, or 74.88%, which in fact belongs to the Oxmons team. 41.9% of the SUDO tokens are distributed to XMON token holding addresses, while 74.88% of the XMON tokens are held by the team, which multiplies to 31.37% of the SUDO tokens. of the SUDO tokens were allocated to the Oxmons team. Besides, the founding team and the Sudorandom Labs team may be from the same team or most of them overlap. And 15% of SUDO tokens are allocated to the founding team and 15% to sudorandom labs, meaning 30% of SUDO tokens are allocated to their own team. So at least 60% of the tokens were actually allocated to the Oxmons team, plus 25.1% to the treasury and 1.5% to Oxmons NFT holders, these accounted for 98.5% of the SUDO tokens, while only 1.5% of SUDO was allocated to LP users. Some time ago sudoswap was hot, attracting about 22,000 users to interact and add liquidity to sudoAMM, while LP users ended up with only 1.5% of the SUDO tokens and most users did not receive one token. This highly controlled distribution system by the team seems to have completely abandoned the community users. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish If you liked this post from Wu Blockchain, why not share it? |

Older messages

VC Monthly Report:Funding Overview in August

Friday, September 2, 2022

Author: Joey Wu WuBlockchain According to Messari, there were 104 public investments by crypto VCs this month, down 35% MoM (160 projects in July 2022) and up 22% YoY (85 rounds in August 2021). The

Opinion: Aptos came at the wrong time

Thursday, September 1, 2022

Author: Joey Wu WuBlockchain Aptos makes an impressive entrance, and like Solana, it uses a new consensus protocol and pursuits high TPS. In fact, in terms of programming language alone, Move does have

TSE Sponsored:Global Crypto Mining News (Aug 22 to Aug 28)

Monday, August 29, 2022

1. As reported by rferl.org, Iranian authorities have announced the seizure of 9404 illegal cryptocurrency mining devices in Tehran since the end of March.Kambiz Nazerian, head of Tehran Electricity

Weekly Project Update:BendDAO's liquidity crisis, Synthetix、MakerDao、Ethereum's new proposals, and Top 11 Projects…

Saturday, August 27, 2022

Author:Mingyao Editor:Colin Wu 1、BendDAO faced a liquidity crisis and proposed BIP#10 to amend the Liquidation Threshold implementation schedule. Link Summary:Due to the depressed NFT market, BendDAO

WuBlockchain Weekly:Account Freeze、BendDAO、OFAC's Sanction Related、Mainnet Merge and Top10 News

Friday, August 26, 2022

Top10 News 1、FTX advises users not to use mixing service FTX recently froze the account of a user who sent money to Aztec's zkmoney. The official customer service replied that Aztec Connect-Aztec

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%