Silicon Valley Outsider - How to break into Venture Capital

How to break into Venture CapitalIt depends: do you want to be a Partner, or an Associate?

Despite having outsized influence, venture capital firms are usually small companies — with a few Partners at the top, and even fewer junior Associates and Analysts who support them. Venture capital Partners are senior decision-makers.It’s their job to decide in which companies they want to invest, and to “win deals” (convince founders to take their money) once they’ve made their decisions. Partners often have successful careers in something other than venture capital.

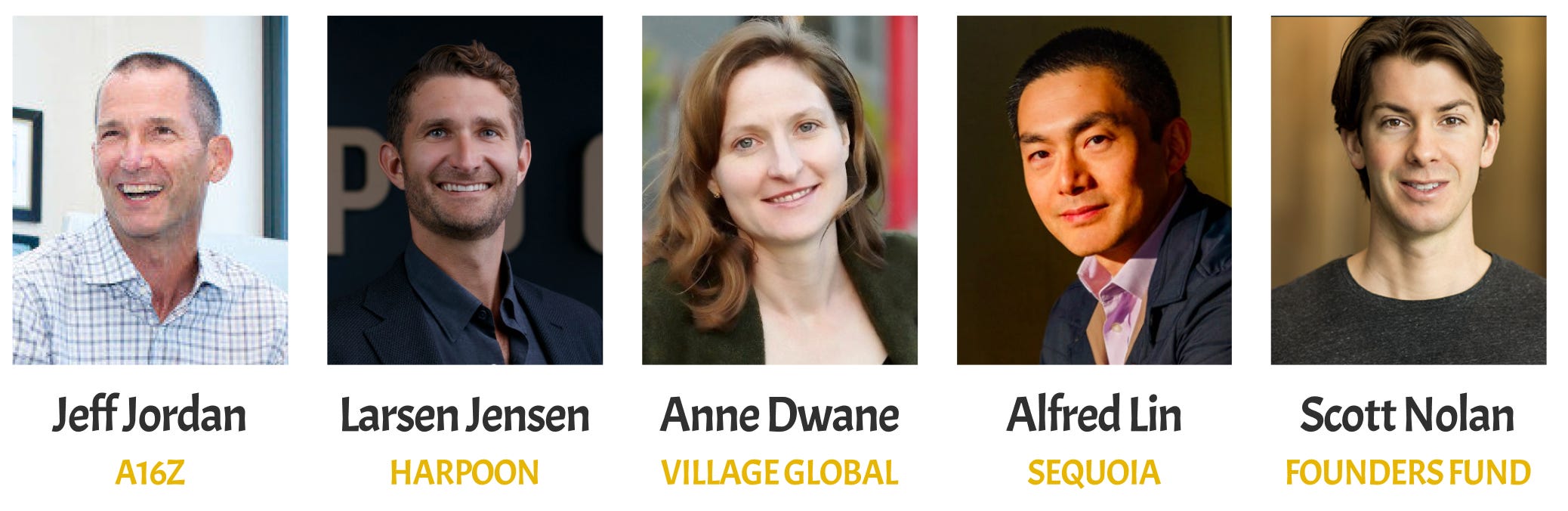

If you notice some trends — yes, there are lots of dudes. Of all VC firms, 65% have no female Partners. And yes, there are lots of Harvard and Stanford MBAs. Of all VC Partners, 40% went to one of those two schools. Associates and Analysts are junior folks who support the Partners.A traditional VC firm is an inverted pyramid, with more Partners at the top and fewer support folks at the bottom. As a result, it’s a seller’s market for the VC firms offering up these roles, and the competition out of undergrad (for Analysts) and MBA programs (for Associates) is fierce. (Perhaps as a result, most junior VC people are not offered carry in the fund. If the firm’s startups succeed or fail, Associates and Analysts get paid their salaries and their salaries alone.) Traditionally, the role of a junior person at a VC fund was just to find deals and bring them to the Partnership for consideration. More recently, we’ve seen a new class of junior venture person emerge thanks to the example of Andreessen Horowitz (a16z).

Long story short, Marc Andreessen and Ben Horowitz went up a mountaintop, met a wise man (Michael Ovitz), and came back to town calling literally everyone that worked at their firm a “Partner.” Their team is way, way larger than those of most other firms, because they need lots of people to support their new service-based model that offers in-kind support to their founders (to go along with their investment dollars, of course). Those services are things like recruiting support and intros to the C-suites of big companies, and they’re offered by folks that would be called Analysts or Associates at other firms — like Zach Dicker, an a16z Partner who recently hosted me and Astranis at an executive briefing in a16z’s Menlo Park office: There are new VC jobs emerging — great news! — and I’d hazard a guess that that’s why you’re still reading: you know, and you want one of them. 🏁 Venture Capital partnership is not a career path, it’s a career destination.There is a wide gulf between the Associates and the Partners at a normal VC fund. You probably cannot just work really hard as an Associate and hope to get promoted all the way to the top. If you want to be a VC Partner, I only have one piece of advice: go have a successful career elsewhere.There really isn’t an alternative. You can prove your mettle in startups, of course, but could also be a great investment banker, or Big Tech executive, or crypto nerd, or engineer, or Navy SEAL. One mental model: if you were a Limited Partner (a huge, institutional investor who puts money into VC funds), who would you trust with your money? Go prove that you can do something, anything, at an extremely high level, then start a fund of your own. If you want to be a VC associate, you’re competing against lots of MBAs from fancy business schools.If you go to a fancy school yourself, you can compete on equal footing; if not, you’re facing an uphill battle. That’s just the reality. But you can still secure a great role by putting in more effort than anyone else. Here are three ways to stand out: 1️⃣ Network your brains outStop thinking about VC firms as firms, and focus on Partners instead. Learn the specific sectors and companies that belong to those individual Partners. Find ways to offer those Partners things that they value and that you can uniquely provide. If you’re a student, you can introduce a Partner to a professor or a startup on campus, or organize a speaking event for them. You absolutely should not reach out to VCs to ask to “get coffee” and “pick their brain.” That’s you asking a stranger to do you a favor. You absolutely should offer to give those strangers something of value for free — there’s a huge difference. The latter will work; the former will fail. 2️⃣ Meet every founder in a new verticalIn business school, I interned at two different VC firms. Both asked me the same question in my interviews: “tell me about an industry you know well, and which startups are going to succeed in it.” So you need to find an industry and become an expert not only with its technology, but also with its people. Go to industry events. Meet founders. build relationships with them. (And stay off the beaten path. Don’t choose crypto.) 3️⃣ Make a mock investment portfolio, and write about itI’ve been meaning to build Fantasy VC, an app where you commit, publicly, to choosing a portfolio of startups and watch them succeed or fail over the course of the fund. If I were a VC Partner interviewing a prospective associate, I would love to see a timestamped list of startups that they saw coming before the rest of the world. Anyone can claim to have seen big tech movements coming, but few can prove it. In lieu of my app, you can just start your own Substack or Medium, and write up memos about companies that other people don’t know yet but will soon know. It’s an easy way to stand out — not because you’re writing a blog, but because you’ve done work that there’s no way to fake or shortcut. In an industry as competitive as VC, you have to find a way to develop an asymmetric advantage. Assume that everyone you’re applying against has also read this article, or others like it. What can you do to stand out? You can work hard. Put in more work than anyone else. And prove it. It’s that simple, and that hard. You’re a free subscriber to Silicon Valley Outsider. For the full experience, become a paid subscriber. |

Older messages

It's okay to work hard.

Monday, August 29, 2022

And it's okay to take it easy -- but you have to choose.

How to found a Silicon Valley startup

Monday, August 8, 2022

And avoid the mistakes I made as a founder

Startups 101: What Business School Teaches You

Monday, July 25, 2022

And what you can only learn from experiencing startup life yourself

How Silicon Valley makes billionaires

Monday, July 11, 2022

Venture Capital 101 (MBA 80/20: Silicon Valley Startups)

🇺🇸 The life, death, and re-birth of Silicon Valley patriotism

Monday, July 4, 2022

Anduril, Astranis, ABL, Palantir, Hermeus, Shield AI, and more

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved