Coin Metrics' State of the Network: Issue 171

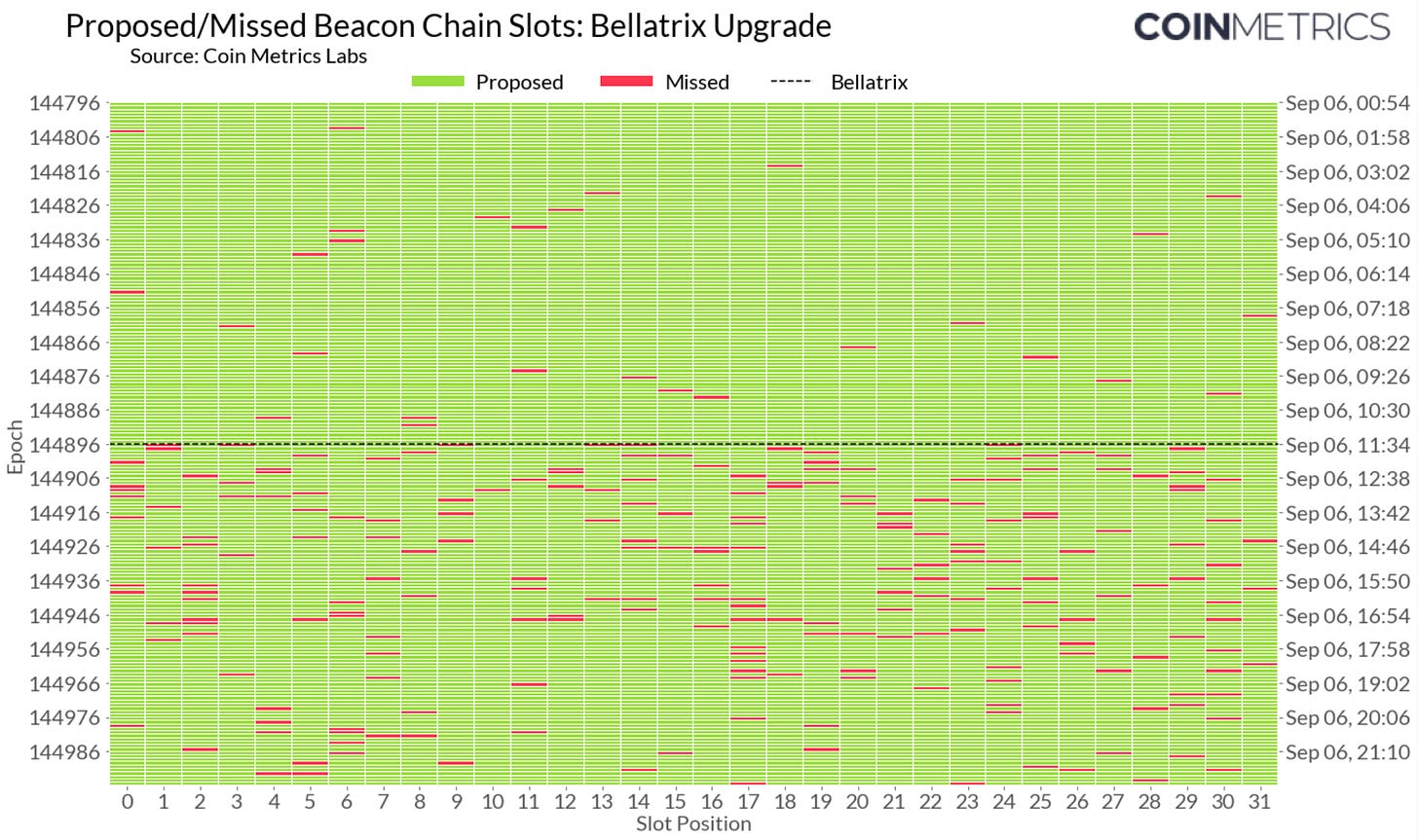

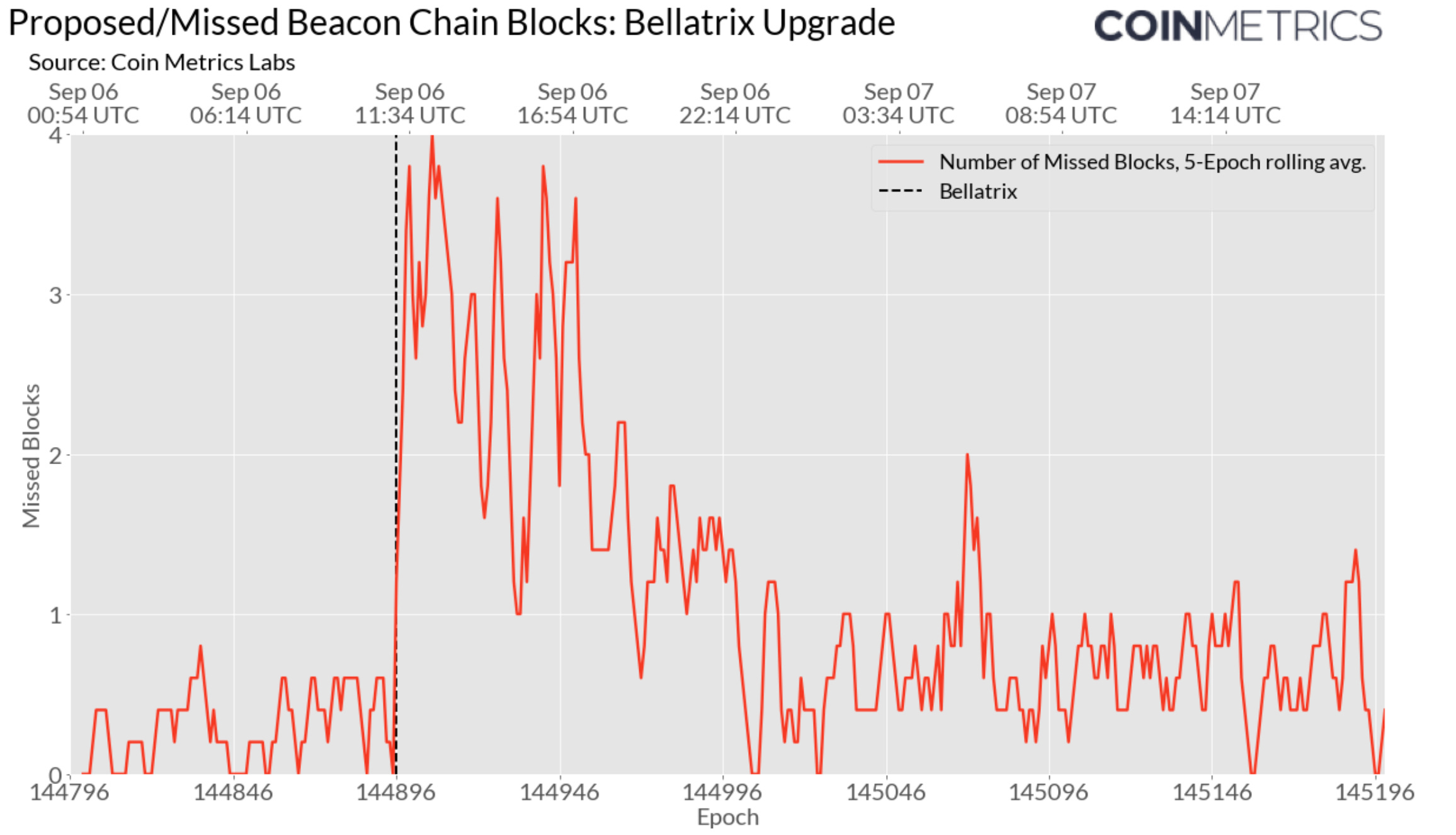

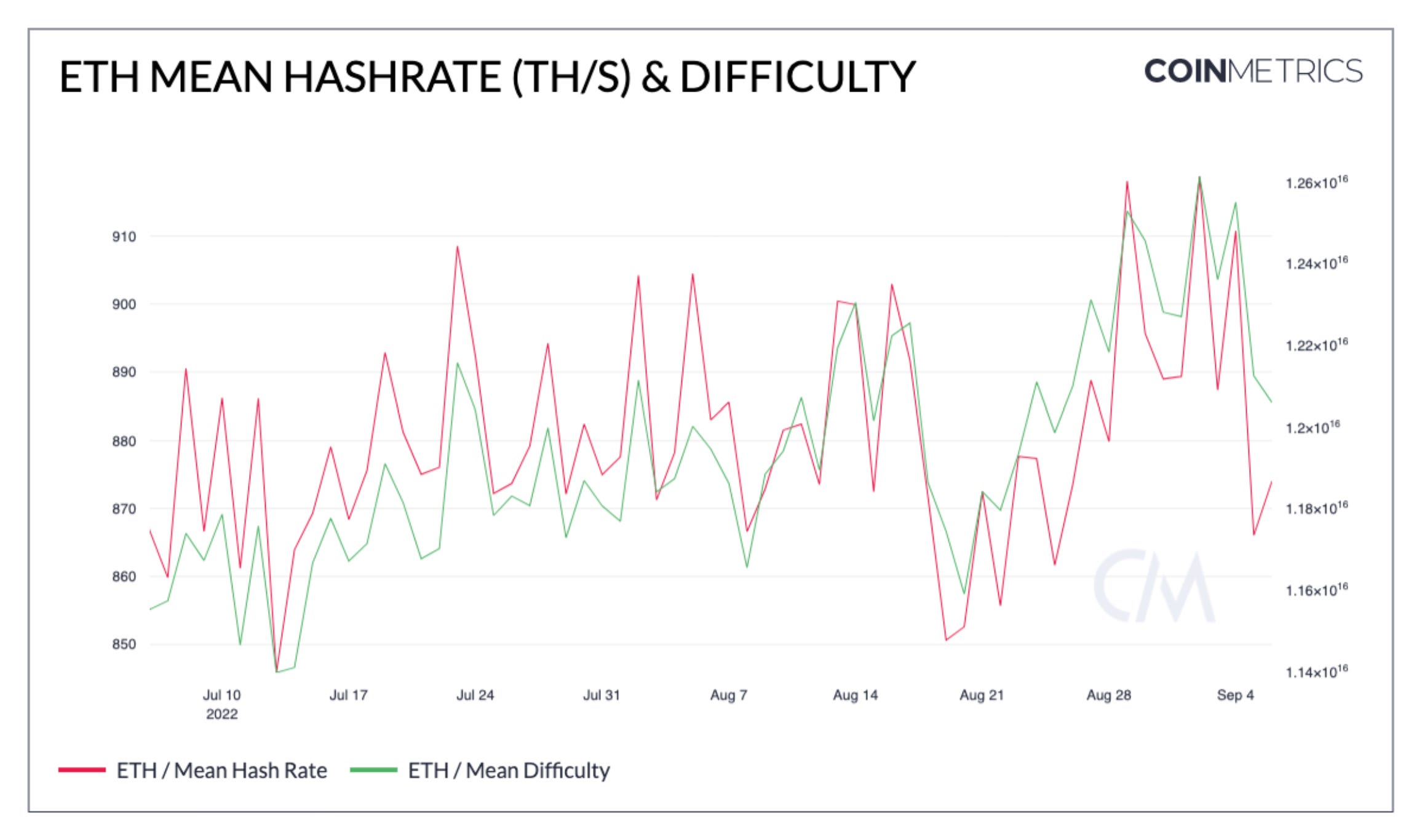

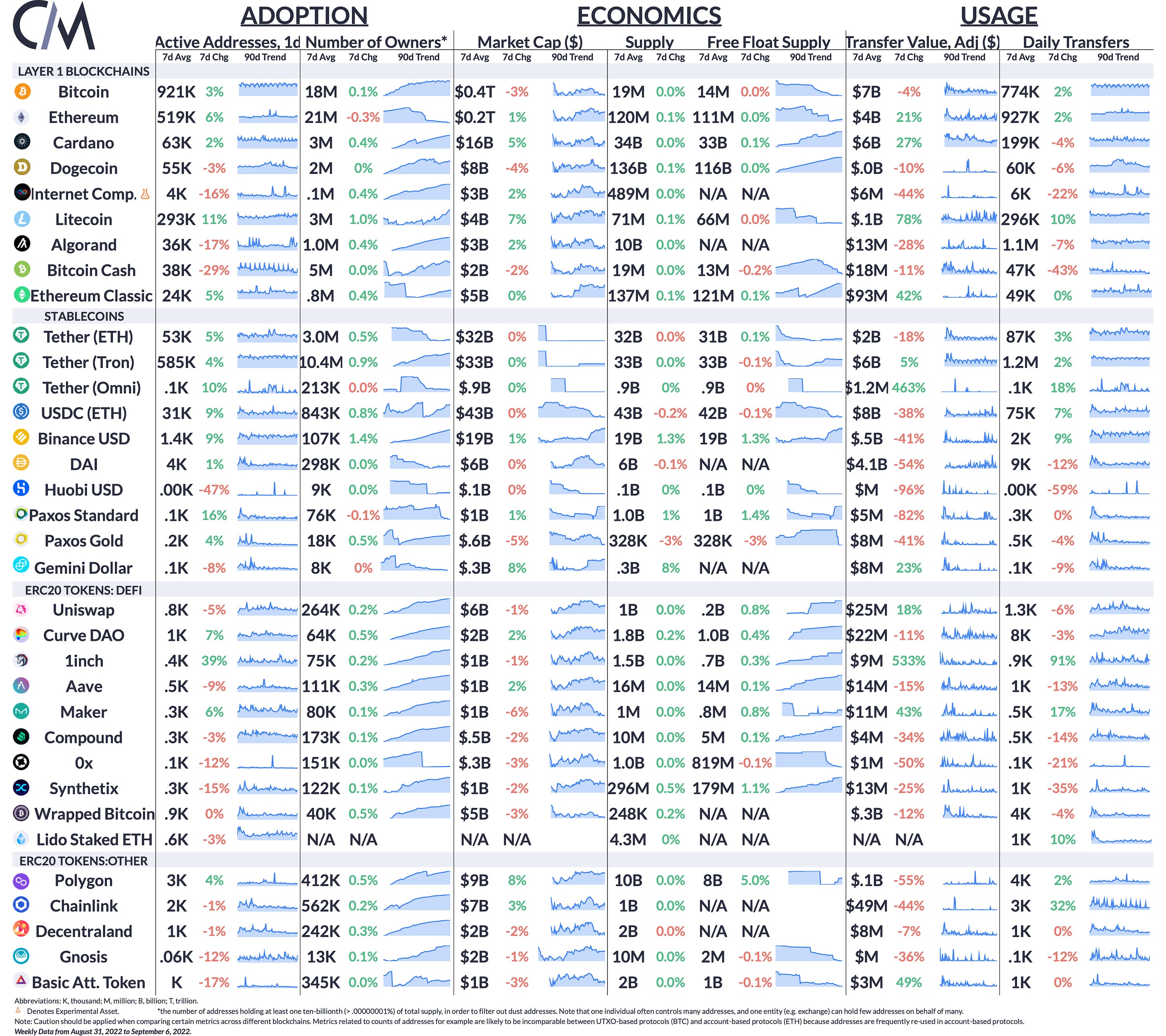

Get the best data-driven crypto insights and analysis every week: Ethereum’s Bellatrix Upgrade Goes Live in Final Preparation for The MergeBy Kyle Waters and Matías Andrade All eyes in the crypto ecosystem are turned to Ethereum as the network approaches its long-awaited transition from Proof-of-Work to Proof-of-Stake. With The Merge fast approaching, final preparations are underway for the network to complete this momentous upgrade. In this week’s State of the Network, we analyze Ethereum’s recent Bellatrix upgrade, the last brushstroke before The Merge itself, and offer some insight into the estimated timing of The Merge and why it is not so straightforward. Bellatrix ForkEthereum moved one step closer to The Merge Tuesday with the activation of Bellatrix, a network upgrade to Ethereum’s Consensus Layer (CL), also known as the Beacon Chain. This upgrade prepares the CL to include Ethereum users’ transactions from the Execution Layer (EL) once the total terminal difficulty (TTD) is reached on the EL. The Bellatrix upgrade was completed via a hard fork of the CL, meaning that all nodes on the network needed to upgrade their client software to support the fork ahead of its scheduled activation at epoch 144,896 (September 6th at 11:34 am UTC). The upgrade was completed successfully on Tuesday morning. However, we found some evidence that not all validators were fully prepared for Bellatrix. One measurement of this is the rate of missed blocks on the CL. In each CL epoch, there are exactly 32 slots where a randomly selected validator proposes a block. Although pre-Merge CL blocks do not yet contain EL transaction payloads (and the subsequent user transaction fees), it is still costly to miss out on an opportunity to propose a block and validators are incentivized to be online. While it is still possible a validator might just happen to be offline or have a bad connection when selected, the jump in the rate of missed blocks signaled some trouble — likely stemming from validators failing to upgrade their nodes or some EL-CL client pairs having issues. The chart below shows the status of each slot 100 epochs before and after Bellatrix, pulled from Coin Metrics’ Lighthouse CL node. Slots in green are proposed blocks as expected, while slots in red are missed blocks. The rate of missed blocks picked up right after the Bellatrix fork—most epochs had 3-5 missed blocks, noticeably higher than before the Bellatrix upgrade. While the upgrade was ultimately successful and network uptime was easily maintained with the level of observed participation, it is not ideal to have a high rate of missed blocks.  Post-Merge, too many missed blocks can be a nuisance because they can impact transaction time-to-finality and potentially increase fees as pending transactions accumulate. They can also impact DeFi applications’ efficiency as on-chain prices move out of sync with off-chain markets. However, by Wednesday morning, the network was on its way to recovering to pre-Bellatrix participation rates, likely as more node operators upgraded their client software. With the CL now ready to include EL transaction data in blocks, the Bellatrix upgrade sets the stage for the Paris upgrade on the EL, which triggers The Merge. However, it is crucial to understand that the timing for The Merge is not as simple as a clock ticking down second by second on New Year’s Eve. Understanding The Merge’s TimingPast Ethereum upgrades have been set to occur at specified block numbers, which are fairly easy to predict in the future given a known average time between blocks. However, due to the possibility of miners acting maliciously as they are ousted from the network, Ethereum developers and participants had to think of a different way to agree on when The Merge would happen. The solution was to set a threshold called Total Terminal Difficulty (TTD) that is harder to tamper with. Crucially, TTD is not a set point in time and involves more variables when attempting to predict it. TTD is the cumulative measure of difficulty for the entire Ethereum blockchain. A particular block’s difficulty is determined by the Ethereum protocol, which targets an average 13.5-second block time. If the network hashrate (a measure of the total computational resources allocated to mining) increases and blocks are produced more quickly, difficulty will increase as well to maintain consistent block times (Ethereum’s difficulty adjusts each block, unlike Bitcoin’s 2-week difficulty adjustment interval). This means that network hashrate is a key variable in predicting the timing of The Merge. The Paris upgrade from PoW to PoS targets a TTD of 58,750,000,000,000,000,000,000, at which point the last PoW block is mined and validators take over block production. Source: Coin Metrics Network Data In practice, estimating hashrate is very difficult for a number of reasons. First, miners will only operate if it is profitable to do so. If ETH price increases, this can encourage more miners to join the network pushing hashrate up, and vice versa for price decreases. Quick changes to miner input costs (electricity, hardware) can also impact an operation’s profitability. On top of these persistent and hard-to-predict systematic factors, there is also the idiosyncrasy of The Merge itself. Ethereum’s GPU miners have to grapple with the options of joining other existing, but less lucrative GPU PoW networks like Ethereum Classic, sell their hardware, or wait and see if a PoW fork of Ethereum will persist after The Merge. It’s tough to know how many ETH miners use ASICs (hardware specifically meant for mining ETH), but for the small number of them that do, they should be incentivized to continue mining until The Merge. Finally, like an employee collecting their last paycheck, there are logistical details miners and mining pools need to address in miners taking their final pool payouts. In summary, it is simply hard to know how hashrate will progress in the days leading up to The Merge, impacting our estimates of its timing. But since we know the target TTD for The Merge, we can naively estimate its exact moment by finding the difference between the target TTD and current total difficulty, divided by the average block difficulty. This expression gives us the expected number of blocks until The Merge. We can then multiply by the average block time (13.5s) to estimate the time left until The Merge. However, this is just an estimate; in reality, block difficulty and hashrate can experience significant variation day-to-day (as observed in the chart above), particularly as miners close their operations in expectation of the switch to PoS. Using the total difficulty as of block 15492777 and an average difficulty from blocks mined on September 6th, this comes out to an estimated timing of next Wednesday evening (ET), September 14th. Plugging in recent values: Some other practitioners have applied statistical models to predict TTD and add more context to the spread of possible times when The Merge will occur. One such example is the site bordel, which many in the Ethereum community have looked to in recent weeks and also points to a similar estimated timing for The Merge. Source: Bordel.wtf Ultimately, as total difficulty keeps increasing, the confidence interval is tightening on the exact timing. Even if difficulty were to suddenly drop 20%, the naive model above would only push back The Merge’s estimated time by about 42 hours . Should conditions stay roughly the same, The Merge will likely have occurred by this time next week. Coin Metrics Research will be closely monitoring all of the most relevant data in the coming days ahead of Ethereum’s big shift. To learn more about The Merge, how Coin Metrics is preparing for this event, and other helpful resources check out our dedicated page here. Network HighlightsSummary MetricsSource: Coin Metrics Network Data Pro Adjusted transfer value on Ethereum Classic (ETC) picked up over the week as The Merge nears. Hashrate on ETC has increased as some ETH miners have likely moved operations to ETC ahead of The Merge. However, the prospect of mining ETC is far less lucrative compared to ETH. ETC miners make ~$500K in revenue today, while ETH miners earn 40x more, around $20M per day. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 170

Tuesday, August 30, 2022

Tuesday, August 30th, 2022

Coin Metrics' State of the Network: Issue 169

Tuesday, August 23, 2022

Tuesday, August 23rd, 2022

Coin Metrics' State of the Network: Issue 168

Tuesday, August 16, 2022

Tuesday, August 16th, 2022

Coin Metrics' State of the Network: Issue 167

Tuesday, August 9, 2022

Tuesday, August 9th, 2022

Coin Metrics' State of the Network: Issue 166

Tuesday, August 2, 2022

Tuesday, August 2nd, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏