MicroAngel State of the Fund: September 2022

Hey! Eyal from MicroAngel here. Every now and again, I release free deep dives like these to newsletter subscribers. If you get value from them, consider supporting the newsletter so I can continue sharing the journey and my results along the way. Enjoy! MicroAngel State of the Fund: September 2022Team fatigue, exciting MRR & MOIC milestones, high holidays, DAO pivot & a fun web3 project. 30-day Revenue: $29.45k

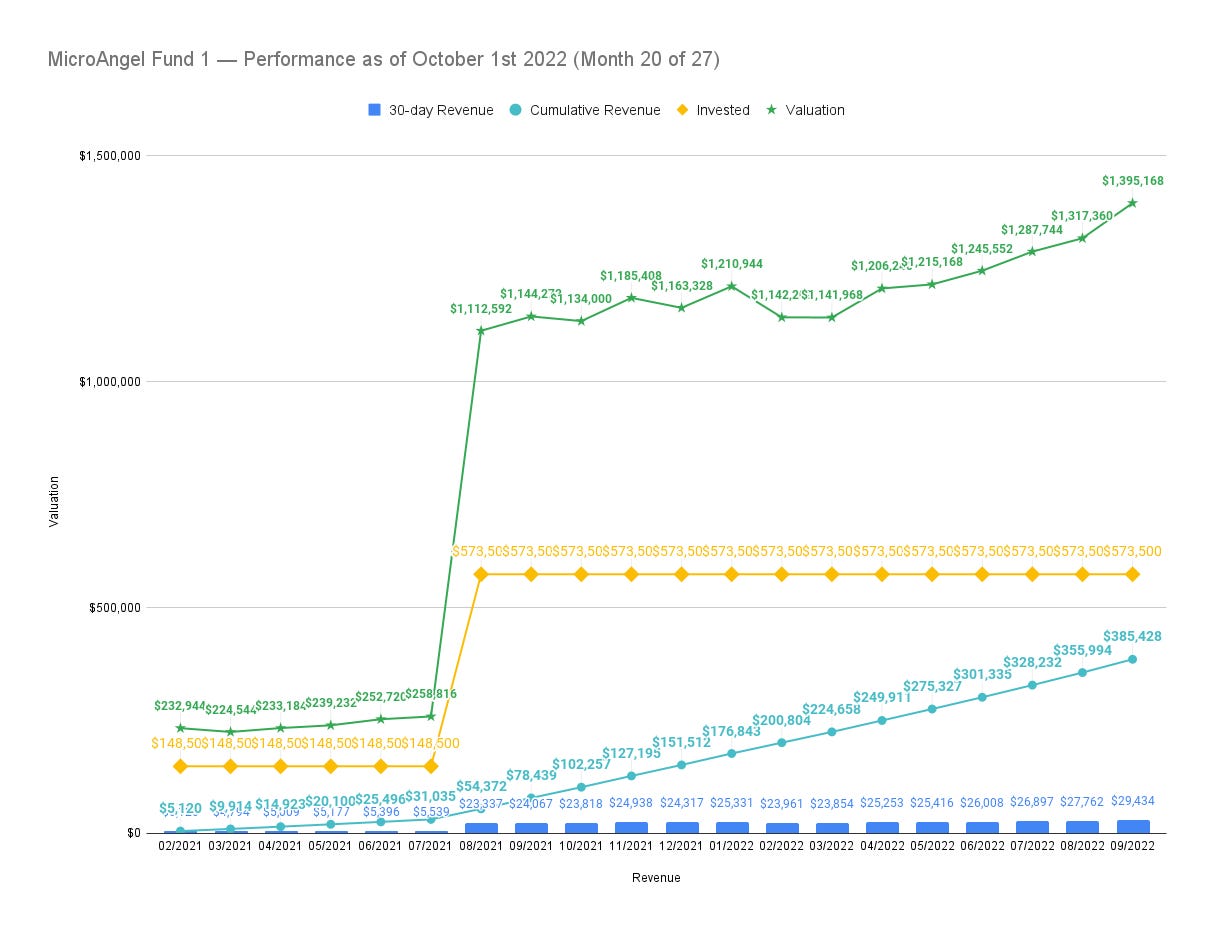

Gooooood morning and evening to you friends. It’s time for the MicroAngel monthly report for September 2022, aka Month 20! As of today, Fund 1 performance breakdown goes as follows:

It’s been a good month overall, though not without its challenges. The team’s been feeling a little tired lately. We’re due for a team retreat sometime, which would sync up well with an exit, to be honest. Eric and I have both been doing a little traveling for a change of scenery and I think the impact has been mostly positive in what felt like a sideways month. But I was once again pleasantly surprised by the performance of our annual plans and the insane cashflow boost they’re producing. Work on product is moving slowly, but that’s alright. There was a similar lull in activity last year. There was Rosh Hashanah and Yom Kippur recently and more holidays coming so it’s important not to try needlessly press on the gas while headed for a pit stop. We parted ways with our team member working on Postode Shipping, which once again opened the question about potentially selling it. Postcode Shipping is a truly incredible piece of software that provides a backbone of revenue that is very stable. Meanwhile, Reconcilely has huge potential and is blooming before our eyes as a result of the work we put in every day. We often wonder whether it would be best to liquidate one of our apps so we could focus on another. And every time, I am reminded of the incredible value delivered by the app we are considering selling, and I decide simply to hold on to it and the cash returns it provides. We’re going to hit 70% in cashflow returns next month and we surpassed 3x total expected on the invested capital back in February 2021. I’m so excited to see this continue to gain steam slowly, surely, and I don’t intend to break that cycle until our planned exit time. When I take a glance at the open listings on microacquisition markets, I notice very little supply in either app range, which is conducive to greater demand, and thus a higher multiple. Gotta stay like water. Current fund lifecycle stage

Fund Activity

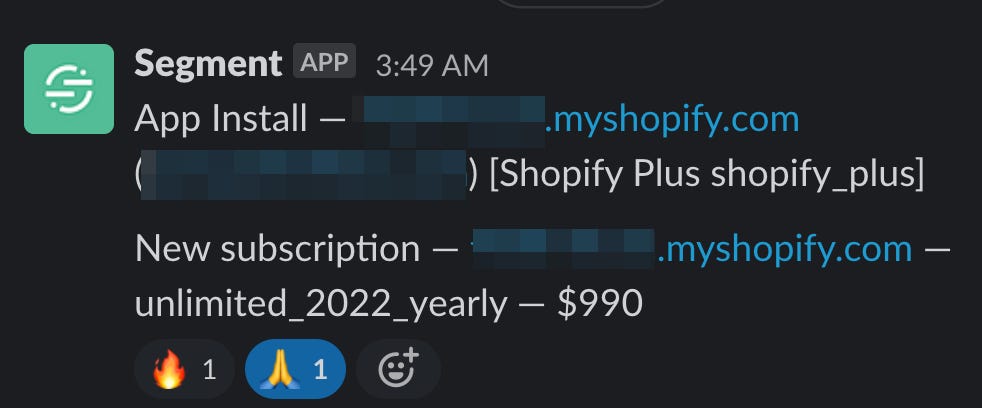

Reconcilely passed $11k in earnings this month and it had its first $2k day. The yearlies are absolutely flying. It doesn’t seem like my outbound sales candidate panned out though. I will be looking for another self-starter soon. We passed 3x+ in total MOIC, which is amazing. I expect to hit 3.5x in 2 years at the current pace, but with the tax credits and any future boost we get from QBO launching, we might potentially hit a total of 4x in 27 months, which would explode my brain instantly. We’re still earning sub $500 per month in overage fees from existing customers who haven’t yet upgraded to new plans. Once the work I’m done with this month goes live, we should see more of them taking the leap to the new plans. It’s clear the yearly approach should have happened way earlier, though I believe it’s working so well today because the value proposition of the product is stronger by many orders of magnitude. Team FatigueI’ve been losing motivation and feel like I’m spending a lot of time projecting myself in the future considering today’s information. It doesn’t translate much to living in the present and I find myself becoming increasingly itchy to move on to the next ignition stage, so to speak. This could be a factor of the way things have been going at the fund paired with the fund’s purpose (which was to hold and/or grow, given the context). It’s like the game has been won, I know where things are realistically headed (or better), and I’m just itching to get there and get going with the next step in this great journey! This might be a testament to the efficiency of this model, granted it contains a dual-edge for ambitious individuals who can get bored in the absence of equally ambitious bets and challenges. I take great joy in the time this fund is providing me so I can experiment either with larger ideas, building relationships, or simply changing sceneries once in awhile. On his end, Eric’s been pulling a considerable weight on the engineering side being pulled on support escalations. I’ve contributed to some of those, namely by introducing the $999/yr plan and in doing so, dramatically increasing the expectations of our larger merchants upon install. Though I will say, nothing beats seeing installs come in and convert less than minute later into $1,000 subscriptions. We needed to consider some new tooling to more efficiently onboard large merchants who, as an example, might need to backdate hundreds of thousands of orders spread across a year or many more. To support him, I’m going to take on the escalations moving forward so he can focus exclusively on product rather than being spread so thin. We mutually decided to part ways with our developer working on postcode shipping. after roughly 3 months, both parties agreed the experiment hadn’t been a success. I have a pretty natural style as it relates to contractors, often opting for larger, flat-based arrangements devoid of hourly billing. The platform to succeed is laid bare on the predication that the contractor will deliver more value than they take, while benefiting from the flexibility and stability offered by a flat retainer, allowing full focus on value creation. This makes it much easier for both parties to quantify whether the gig is working. Otherwise, it’s very difficult to align with contractors as one party wants to minimize billing and the other wants to maximize it. A flat arrangement, especially in a trial gig, enabled me to reach a binary decision by the end of the trial; either more value was created than was spent, or it wasn’t. In our case, this wasn’t due to skill, and much more due to happenstance and context. Things are rough in Pakistan. Moonlighting is much harder to pull off on a consistent basis than you might think. It takes a lot of discipline and sometimes, sacrifice. For many contractors, the math often doesn’t end up working out. For now, Eric will shoulder any work required on postcode, and we may end up bringing on some PT help to do that, but for now no change to headcount. Short & frequent vacationsI ended up going away for a few days on a couples-only trip which helped tremendously. But it made me realize I took the vacation too late, and I need to do it more frequently. It’s difficult to balance taking the kids with us vs leaving them with grandparents since much of our joy comes from our children. But inevitably, you need to recharge your batteries. I admit it’s a balance I’ve yet to strike as a parent of young children and as a lifetime proponent of taking regular time off traveling. The feeling of inevitability accompanied by parental fatigue is very similar to the feeling I had before launching this fund. The point of the fund was to secure cashflow and make an entrepreneurial play rather than falling out of touch and burning through funds. That inevitability of that need came from knowing a second baby was on the way, and that things would again change forever. I didn’t want to lose either my career or a seed round’s worth to a part of my life that I was meant to be able to fully enjoy. Eat the cake and have it too, you already know. Now, I need to solve for a similar inevitability that will last 2 decades…? There’s no way I’m going to make it without regularly recharging. So the time is now to solve for regular travel with and without kids so everyone can stay sane, energized and motivated! Holidays have kicked off. Family has flown in, it’s a time for celebration. I haven’t seen my parents in ages. Which means more time off soon. I’m not complaining. Shopify app store evolutionThere’s a Nov 1 deadline to touch up the app store listings for both Reconcilely and Postcode Shipping since, you know, the app store’s changing again. We have absolutely no idea what the impact on demand, rankings or installs will be. I’ve already made my opinion known on this style. Speed as a developer is everything at this point. Forget building a product in stealth for 6 months to then launch it to the App Store. You’ll need to change your strategy by the time you launch because things change so often. Word to the wise; if you’re planning on building a Shopify app, make sure to skate to where the puck will be:

In our case, the required changes are marketing related; we’ve got to deliver new app store descriptions, collateral and copy to account for the interface changes the app store is about to undergo. I’ll take the opportunity to produce some basic videos for the apps too. As with everything, there is no point in rushing into new changes. The goal is to maintain parity, begin establishing benchmarks, and identifying any drift between previous rankings and new ones, and then create a strategy to adjust and improve if necessary. Let me tell you; I’m not going to be happy if this change destroys our rankings because that would be completely uncalled for. I’m not exactly expecting that to happen, but I’m bracing for something to happen. I just hope it’s positive. I hate hope-based strategies. ProductXero SSU is going to release this month which should allow us to secure a Staff Pick opportunity and put some points on the board. The work for the single signup flow creates a new avenue through which Xero customers can sign up to Reconcilely for the first time. This allows the app to stand independently from Shopify at least on entry; as a completely new customer inbound from Xero’s app store could install the app and then pair their Shopify store to their Reconcilely account. This infrastructure is the nascent foundation upon which every future integration will be built upon, from order sources (i.e. pulling Amazon orders) to invoice destinations (accounting systems). And it’s finally complete. Separately, the Crisp migration took way longer than we expected as we had to push fixes to different parts of our apps which allows customers to reach out to support, but which would not land in Crisp. Similarly, we sanitized some of the data making it through to Crisp, and now marketing automation is ready for development for both apps. Oooo baby. Gonna be time to make some flows. This month, I’m releasing some expansion features to enable users to upgrade more efficiently and I’m focused on the app store listing stuff. We’re mostly focused on QBO polish now. Nothing but forward, it doesn’t matter what the details are anymore; it’s time to get it across the finish line and launched, and we can feel our energies converging in pursuit of that. Exciting times for product and a great result of teamwork and R&D. Speaking of which… R&D tax creditsThe day you plant the seed is not the day you eat the fruit. And things are no different in the case of this little joker card. Last year, I incorporated MicroAngel because it started to make very little sense to take on personal income as most of that income would get taxed and disappear in a high tax bracket. Incorporating allowed me to sell equity to future partners, create a corporate veil shielding us from personal liability, and optimize tax efficiency. Buuuuut it also did one more, really powerful thing: MicroAngel is a Canadian-controlled private corporation, who employs only Canadian-based engineers (Eric and myself), who then conduct a large variety of projects to create value, advance technology and commercialize it, while dealing with the uncertainty implied by such activities — aka R&D. In canada, and in each province, corporations who have qualified R&D spend can claim a (large) percentage of that spend back as part of the Scientific Research & Experimental Development (SRED) federal tax credit. In its hay day, I recall claiming as much as 82 cents on the dollar, effectively cutting my engineering payroll by more than three quarters. It’s a chunky piece returning on the balance sheet which I could then reinvest back into my payroll, and in doing so further the growth of our technology, and indirectly, the Canadian economy. The grants are on a rolling basis once you start claiming regularly every quarter. But in our case, and due to the small size of the company, we needed to wait a year to have enough payroll to make it worthwhile for our partner firm to engage us. Now that this process is under way, we have begun going over all of work that has been pushed to our GitHub repositories in 2021 and constructing a six-figure tax credit claim out of it. I’d be thrilled to get even 30% of our payroll spend back. Wouldn’t you? It would give huge weight to product-heavy microacquisition opportunities as most if not all activities post-acquisition could be R&D qualified, and thus claimable. If this works, it will confirm the last hypothesis I had about this entire fund, which not only would create returns from cashflows and valuation growth, but ultimately also from R&D tax credits which are booked as revenue on a recurring basis, so long as your payroll spend is mostly (Canadian) R&D — which as an app, it ought to be. Will share news when I get some. Web3 fun: Triwizzy TournamentIn my pursuit to develop the DAO early community, I’ve continued to embed into a few large/”blue chip” web3 communities Namely, last month I made a grant proposal to the Doodles community to build a tournament platform. After a dramatic and exciting on-chain vote having received over 1,500 votes, the proposal passed and the core team I put together received a 60 ETH grant from the Doodles community treasury to build the platform. Having tons of fun building that, and it’s a great group of really talented people I’m interacting with almost daily now. I’m excited to see where this goes. Planning on launching the tournament sometime in Q1 2023, assuming everything goes to plan on the product side. DAO PivotA pivot’s probably the wrong word; you pivot when you know what you’re doing is wrong. What we’re doing is not wrong, but it will cost a lot to build. I held dozens of calls in the past month with different legal firms on the topic of the DAO’s legal framework. It's been a few months of exploring and the DAO founding team made the call to shelf the microacquisition DAO considering legal is not getting any clearer.¹ It looks like we could do this, but a grey area leaves us open to liability and risk downstream should the SEC wake up one day and decide we no longer fill the requirements for securities exemption. And that’s simply not a risk we’re willing to take, never mind the costs implied in creating a legal framework intended for a decentralized treasury whose initial seed would be severely reduced by the very legal costs intended to bring it into existence. It’s a bad investment to launch. At least right now. I don’t want to be trailblazing to that extreme. I have a model that works now, there is no point trying to start something from scratch only to walk. We want to run. We want to fly. That said, I’ve received a suspiciously large amount of advice to explore the MCA model considering legal is much simpler and it is a model ready to be disrupted. If you’re unfamiliar with it, merchant cash advances are a pretty old model that allows you to act as a lender without necessarily charging interest as we know it. It’s a simple arrangement to return cost-plus. Much like Pipe.com or Stripe Capital. Considering marketing leaders like Pipe have large institutional investor requirements and an opaque process from the outside in, we’re exploring a pivot to build a DeFi protocol for Web2 and Web3 products which makes non dilutive capital available on a decentralized and trustless basis. But that’s a story for another time. I’ll be releasing a DAO update sometime soon in the Discord going over the learnings and next steps, and I’m happy to say that the new direction is more straightforward, less legally complex, and more conducive to grow very large very fast through institutional partners. In the hopes this found you in good health and spirits. Always happy to hear from you, so don’t hesitate to get in touch. Until next time! 1 We’re shelving the DAO, but still expect to build an NFT community around builders, bootstrappers and microangels operating in the ecosystem. You’re on the free list for Micro Angel. If you get value from what you read, consider supporting the newsletter. |

Older messages

MicroAngel State of the Fund: August 2022

Thursday, September 8, 2022

Pricing update oops, listing requirements, support tool consolidation & expansion mechanisms. Closing MRR: $27.76k

MicroAngel State of the Fund: July 2022

Tuesday, August 2, 2022

Yearly pricing boost, new team member, support platform migration & cash-on-cash acceleration. Closing MRR: $26.6k

MicroAngel State of the Fund: June 2022

Saturday, July 2, 2022

Fund success! Passed 2.7x total return & 50%+ cash/cash, annual experiment successes & growth optimization. Closing MRR: $26k

MicroAngel State of the Fund: May 2022

Thursday, June 2, 2022

Planning the next great adventure, growth experiment wins, pricing research, strategy & roll out. Closing MRR: $25.32k

Productizing MicroAngel Returns: Part Two

Monday, May 16, 2022

Exploring game theory components to give life to a two-sided marketplace & designing a Decentralized Autonomous Organization

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved