Micro Angel - MicroAngel State of the Fund: June 2022

Hey! Eyal from MicroAngel here. Every now and again, I release free deep dives like these to newsletter subscribers. If you get value from them, consider supporting the newsletter so I can continue sharing the journey and my results along the way. Enjoy! MicroAngel State of the Fund: June 2022Fund success! Passed 2.7x total return & 50%+ cash/cash, annual experiment successes & growth optimization. Closing MRR: $26kGood morning and evening to you, fellow microangels. We did it! As of today, we’re posting a 2.7x total multiple on invested capital from Fund 1, which was my goal launching this business model more than 17 months ago, on this very newsletter. The breakdown as of today goes something like this:

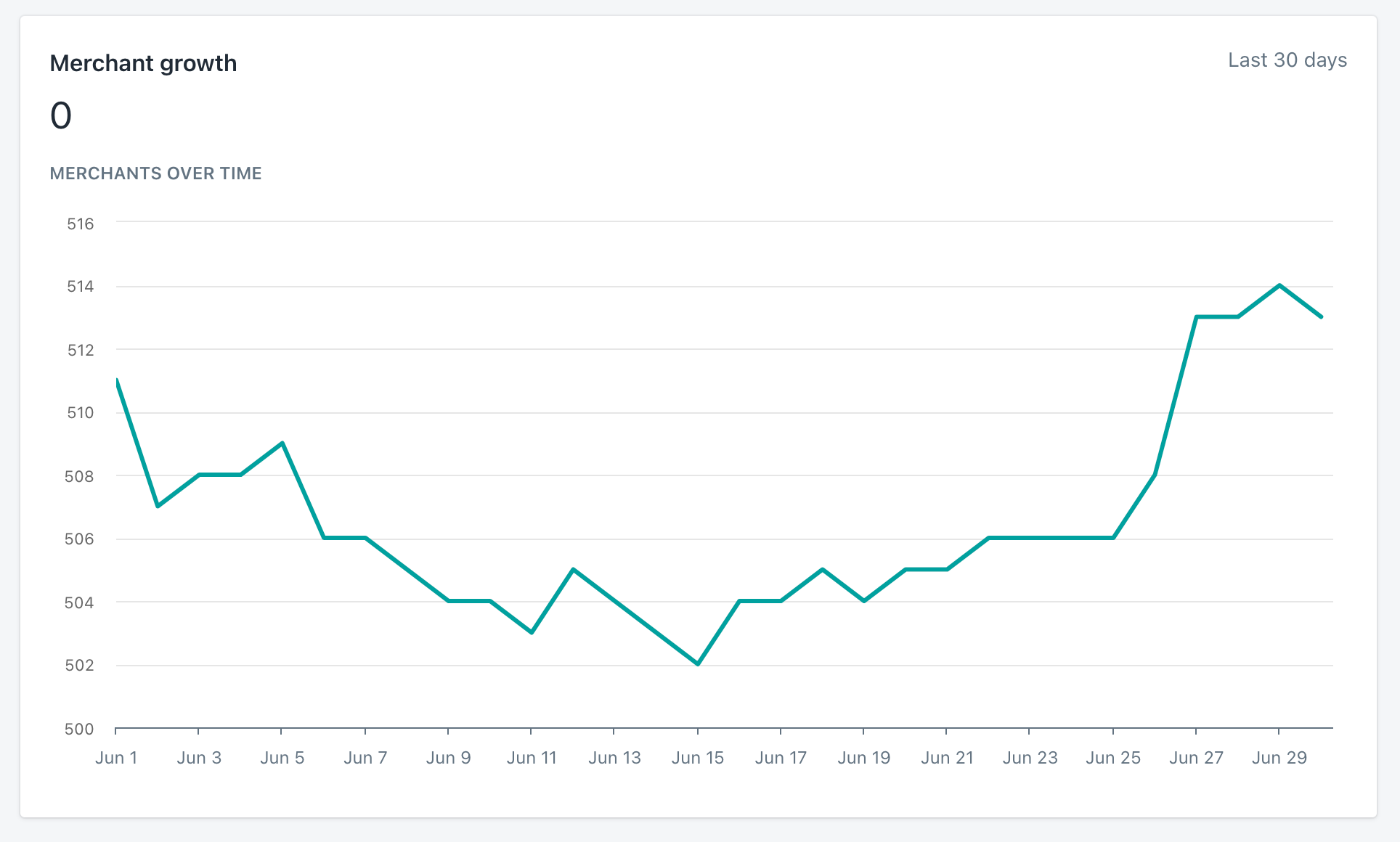

And the show goes on. Because the run rate is currently in excess of $26k MRR, we’re now enjoying a monthly cash-on-cash rate of 4.5%, or approximately 54% per anum at the current run rate. And… growing! Provided we don’t sell for the next year, we’ll finish collecting all of our original investment over the next 9-10 months. Absolutely wild! Of course, that’s not necessarily the case. We’re starting to think seriously about closing at least one of our positions so we can swing all of our weight into the other before making a choice about the more distant future. This month was once again replete with progress on all fronts, and I’m excited to share some of the results from last month’s pricing project that kicked off. All in all, net positive merchant growth, we’re past the success threshold for Fund 1 and above all else, things mostly still feel like play. Read on!

PS. This post is image-heavy and Substack complains about posts being too large for email. If the content cuts off for you, you may prefer reading directly from the site or Substack app. Current fund lifecycle stage

Fund Activity

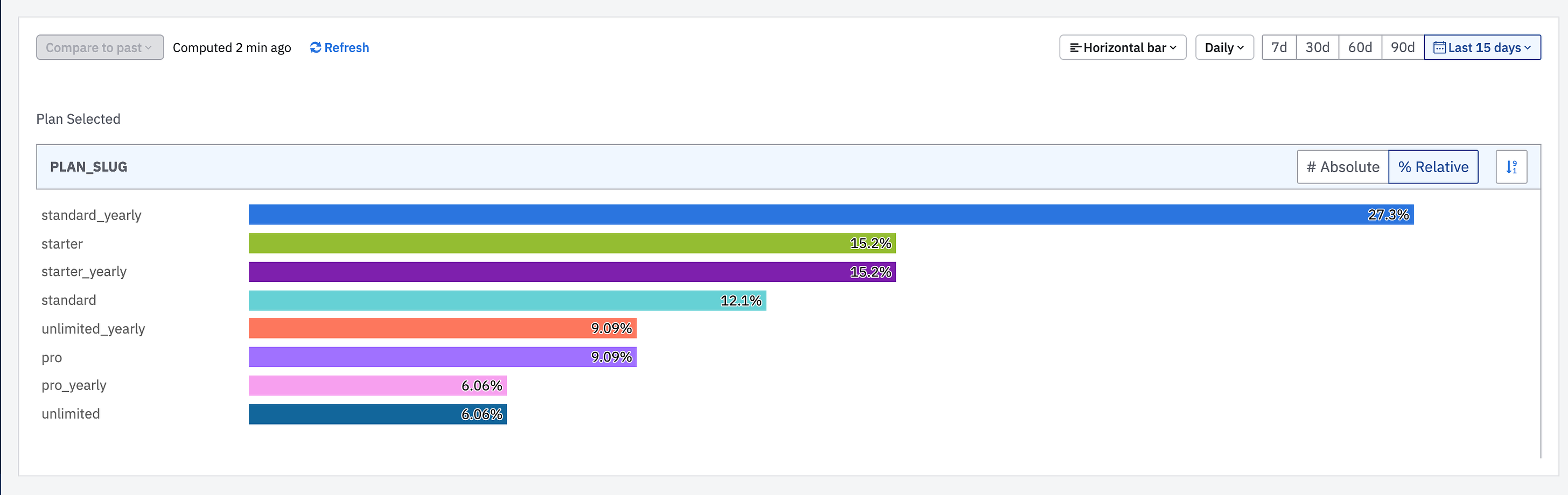

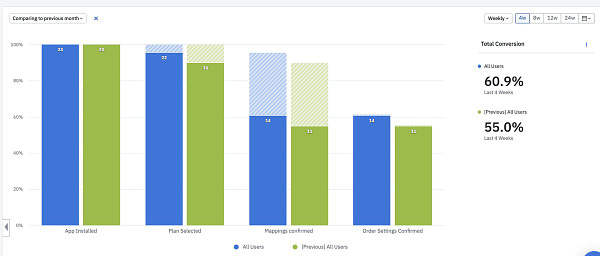

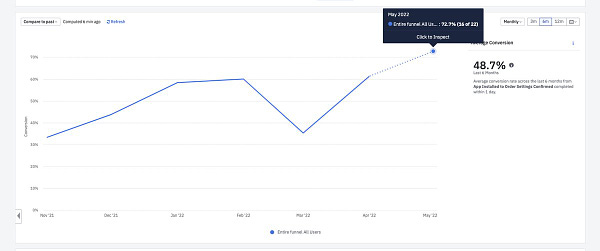

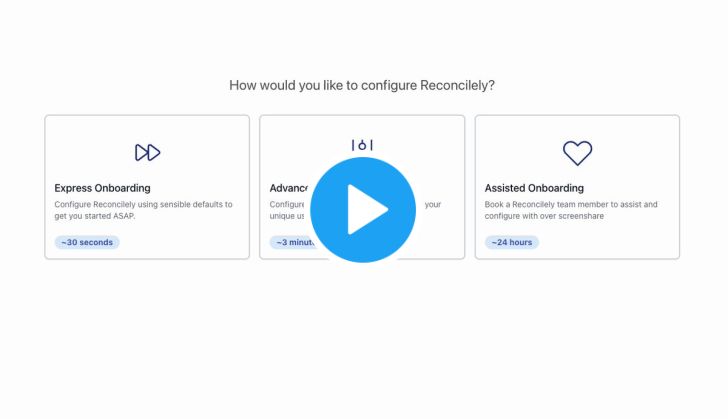

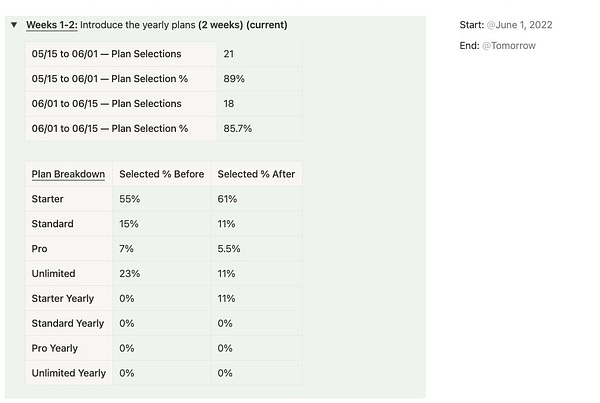

ProductReconcilely had an overall really good month, especially considering the progress made on the pricing front. There was a moment of tension as some of the huge refactors that were made to accommodate our new QBO integration caused a few merchants to experience unacceptable outcomes with regards to the value the app is meant to deliver. The high-level overview of why this happened is quite simple. Reconcilely requires an active Xero connection to send orders over to Xero. Sometimes, the Xero API goes down so orders are delayed until it goes back up. However, the Xero outage we experienced this month caused access tokens to expire on top of disconnections, which itself cascaded the problem. If you choose to fully sever the Xero connection (to connect with another organization), Reconcilely deletes all of the mappings and settings associated with the Xero organization fully disconnecting. Unfortunately, that happened for several of the newly onboarded merchants as their tokens expired, and their (newly configured) settings were completely removed. Big issue. Unacceptable. We remedied this so it never happens again, but the fact is we needlessly sacrificed about a month’s worth of merchant growth due to this issue we hadn’t foreseen. Quickbooks OnlineOn the bright side, lots of great progress on the QBO side. We’re very close! Eric completed the QBO integration, which was the result of some awesome work pulling pretty much every piece of functionality in our app up one level so we could create a generic AccountingSystem layer that would house and expose the QBO endpoints in a generic manner. This approach enables us to offer the exact same app regardless of which accounting system is connected, and is absolutely key to rapidly increase the number of accounting systems we integrate with and support — itself a large contributor to increasing market share and run rate. While Eric focused on this backend work required, I doubled-down on growth optimization by refactoring the Reconcilely onboarding from top to bottom and finally solving a critical issue that was preventing it from being a zero-friction experience. Refactored OnboardingSpecifically, I discovered awhile ago that the main drop-off in the app onboarding happened at the most confusing point, where you’re supposed to assign general ledger accounts to different transaction types. To a non-accountant, this page is literal rocket science. By removing a few steps, I managed to get a bit more juice out of the onboarding, but that still fell short of solving the main issue in the flow.     Eyal Toledano | sh0wie.eth 🧙♂️ @EyalToledano Broke down the @Reconcilely onboarding key events to try and improve the success rate from ~60% to the 90% range and decrease time to value as much as possible Can you guess which step I'm focusing on? https://t.co/VbfFDFNty4Importantly, I found out that most of the drop-off happened with smaller-scale users. Which was logical considering they could be one-person shops with no direct accounting pedigree. In the end, I swallowed the frog and approached the issue as the consumer I’d be were I to rely on Reconcilely for reconciliation. Simply, I didn’t want to deal with any of it. I’d want a button that lets me use recommended accounts and sensible defaults that will just work both on the app and within the scope of Xero’s features. And I imagine the users dropping out of the flow feel the same way. I created a short video for to communicate the change to my support team but it’s a good enough overview to share with you here too. You can check out out the video for that here. I also implemented a neat change at the top of the onboarding flow. Now you can choose to onboarding with sensible defaults as your settings (and skip all of the configuration), or you can go through advanced onboarding — which would still include sensible defaults — and override any settings to your heart’s content. Lastly, there’s an assisted onboarding option which opens up a Calendly form to book a demo, where I’ll set things up with the customer on the call and make any upsell offers myself.   With these changes now in, I’m done with the onboarding — it’s in a great place and extensible vis-a-vis any new integrations we release. I can now focus exclusively on growth experiments and new features as far as product work goes. PricingOh man. Oooooooh man. Oh man oh man oh man. This went really well. After the first two weeks of the experiment, I noticed we were seeing a nice take rate on the annual plans and the revenues they represented was showing we’d collect a 10% increase to cashflow.   Eyal Toledano | sh0wie.eth 🧙♂️ @EyalToledano Boy have I been busy with @Reconcilely Features highlighted in green have been released in the past 3 months. Lots of new value coming out of beta for larger merchants Introducing a yearly plan to give loyal customers a great deal + boost cashflow Then increasing prices https://t.co/nplkggLF0SNice! That was my goal, so I got excited. However, we had observed a small decrease in installs at the start of the month, and the second half of the month tends to be stronger, so I decided to let the experiment run uninterrupted for another 2 weeks to gather more data. That’s the issue with playing with low volume — but I’m not going to complain. I’ll take a low number of customers with high ARPU and LTV over thousands of tiny customers sucking me and my support team dry. The results are shocking. For the better. I added annual plans that are pre-selected at the plan selection and I expected a 10-11% take rate. Instead… Over 57% of plan selections were for annual payments! That is earth-shatteringly good. This product has insane potential. For reference, the value of an annual plan is 10 * monthly cost as we give two months free. For a $9 plan, that means we’d collect $90 up-front rather than $9 twelve times over the year (assuming they stick around that long). For our $38 plan, that would be $380. Which will soon be increased to $99/mo and $990/year. The cashflow increase of the past 15 days looks something like this:

On a previous 2 week cohort, the 19 plan selections above would have produced $336 of new MRR, and thus of immediate cashflow. We would then have to wait about a year to collect the annual run rate expected of that MRR, and of course there can be pickles causing customers to leave before the year is over. In our case, the lifetime of a customer is a little over 18 months, so that doesn’t happen often. Actually, that lifetime is the reason I chose annual plans because we’d be able to collect an additional 6 months of LTV from customers choosing annual plans as they’d pay for the year forward on their second year of subscription. Instead, we’re going to book up to $3,360 of revenue next month from the annual payments clearing after the trial period, depending on trial conversion and any uninstalls inbetween. At the current MRR levels, that represents up to a. 44% increase in monthly cashflows. Why monthly? Because we get new customers every month. And moving forward, it looks like 50%+ of customers will be choosing annual plans, which will drive up the subsequent month’s billings. Considerably. And that will happen every month. On top of it all, these are annual payments, which means one year from now, not only will we book up to $3,360 of revenues from that month’s annual plan selections, but we’ll also book another $3,360 from the customers having signed up this month. That’s where things will get mega interesting for whoever is running the portfolio a year from now. It’s a cashflow bonanza just waiting to happen and you can expect it will happen with great confidence because Reconcilely’s customer lifetime is 18 months, which means customers on the annual plans will pay the annual fee twice — and thus represent a 24 month lifetime, minimum. It’s also an important illustration of the buying intent of Reconcilely’s customer. Like me, our customer wants a solution they can set and forget, and they’d be more than happy to collect a 2 month discount on a service they know they’ll need year-round, and for many years ahead. Hopefully this is as exciting to you as it is to me, because the cashflow increase means a lot of things for different microangels. I could hire a developer if we wanted to improve product faster. Or I could take advantage of the fact that my customer payback period will have radically shorted from the current ~6 months down to less than 3, allowing me to be far more aggressive on the customer acquisition front. Moving forward, the next step is to adjust the overage fees and to increase them to the point where the cost of an additional plan would represent a cost savings against overage fees incurred. Soon though. I unfortunately have to deal with a few fires this upcoming month. Shopify App Store ListingMan, seriously, this is a bit much. We’ve once again received a priority notice from Shopify asking us to adjust our app store listing. We’ve receive no less than 7 requirements, including changing our name from Reconcile.ly to Reconcilely. I’m not quite sure how I feel about Shopify right now. There isn’t much patience left in the tank for me. I just don’t have any appreciation for the kind of partner activities that go against a good Brand<>Developer relationship. Between this app listing and Xero’s, we’re going to be spending most of next month dealing with things that don’t add any new value simply to keep us in the game. Xero’s New App Store ListingFolks at Xero got in touch with me to discuss the upcoming changes to the Xero Marketplace, the current iteration of their app store. In fact, they specifically wanted to get in touch because the marketplace is evolving into a fully-fledged App Store, and things are going to be changing around there. I must admit I was really surprised by the approach, and I gave them scathing feedback in return. Hopefully they can iterate and come back with something stronger really soon. Since the changes are technically opt-in, it’s worth going through the pros and cons. I say ‘technically’ because in my view, Xero partners are being strong-armed into signing the new App Store agreement. The deadline for the change is August 4th, so it’s just a short month away. We barely found out about this last month, so in total Xero has given approximately 60 days to make a decision and implement changes to stay operational. Specifically, they’re going to be requesting a 15% revenue share from any leads they send to apps from their app store. Worse, to enable this commission, it’s now required to bill customers referred by Xero through Xero integrated billing. Which insinuates we need to implement an entirely new billing system side-by-side with Shopify’s billing. That’s going to work just wonderfully, right? Even worse, the consequence for opting out of the new agreement is basically suicide: partners who don’t agree to the new terms by August 4th will get severely API throttled, and no new API connections will be possible. In other words, if we don’t sign this new agreement, Reconcilely won’t be able to sign on any new customers as of next month. This was really not the right approach, and I let them have my unfiltered feedback. I have some really good intentions to build a strong relationship with Xero, since the bulk of our efforts have been towards Shopify for the past long while. I’ve already seen firsthand in previous projects both the stability and returns that can come to bear from a successful Xero relationship. I’m all for it — we deserve it, too. Thing is, we barely get any leads from Xero, so this felt like a net-negative for us either way, unless Xero could help us create some traction from their marketplace. I imagine there’s a direct line of sight to a staff pick and introduction to their sales team, which would be a massive win considering the bulk of our competition’s early traction came from these very channels, still untapped to Reconcilely. In the end, this is likely going to be worth it in the long-run, and as I said, it’s not like we really have a choice anyway. The danger of working in closed ecosystems like Shopify and Xero isn’t so much that they could kill you by putting you out of business. If you are small, keeping up with the insane number of changes they introduce over time becomes a real problem with regards to building momentum and working on revenue generating deliverables. Support Stack MigrationTo better support our support team which we value very much, it’s time to make good on a long-time request of theirs to migrate the support for both products into a single stack, rather than Helpscout + Intercom as it is today. They’ve expressed some significant operational distress from having to deal with both platforms, and I plan to immediately rectify this so they can run at their most efficient as soon as possible. I haven’t yet made a decision as it relates to which platform I’ll use, but considering we spend like $500/mo between Helpscout and Intercom, I think I may end up going with something like Crisp, which bills $99/mo flat and offers both live chat and help desk functionality. I know the support team needs a ticketing solution since Postcode Shipping users have become used to that (much better) workflow. The only time I’d like to offer live chat is to premium customers who pay for that additional layer of real-time support. In the end, my goals with the migration are to move both products to a support product that offers:

If you have any recommendations, I’d appreciate them very much! Quick DAO NewsPreparations for the DAO are moving along well. I now have clarity on legal structure and it's nice and kosher. There are no unknowns and we’ll be using a proven model already used by market leaders like Opensea. I’ve also been carefully observing other models, such as the recent Doodles Bucket Auction, which allowed the Doodles team to raise nearly 12,000 ETH with just 23 ETH of gas spend. Contrasting that smart contract with the Otherside Deeds mintwhich saw gas expenditures explode resulting in huge wasted capital to the tune of $180M. The reason I’m interested by it is because the nature of the bucket auction is to (1) raise an unspecified amount of capital from a fixed supply of NFTs and (2) completely surrender the value of each sold token to market demand, without incurring wastage or loss of funds. It could be an interesting means of raising, say, a year’s worth of acquisition funds from 365 individuals in a fixed supply situation. And those people would become the DAO members. Haven’t really changed my mind with regards to the daily auction model since that provides so many advantages, but it’s important to educate and consider the bucket auction as a viable solution. For now, our next steps are to start documenting how the product and smart contracts should specifically work, and to kickoff the formation of the founding team to begin building the DAO itself. Learnings & AdjustmentsIt’s been a good month overall. I’m starting to feel a little tired, especially as I start to get more deliberate about the DAO and laying the foundation there. It’s a lot of nights and weekends, and frankly I’m due for a vacation that I’m hoping to take sometime in July or August. We’re reaching a real inflection point with Reconcilely between the launch of the new pricing, the QBO launch, and the prospect of increasing traction from Xero as well — all at once. I’m really excited to start reaping the benefits of our efforts. It took a lot more to get here than I expected, and that’s likely a factor of having purchased the product rather than having built it from scratch. There’s a slew of emotions that exist as a buyer than don’t exist as a builder, and that is the case for just about every other variable you interact with as a microangel trying to build value this way. There is a huge feeling of gratitude for having managed to succeed with the plan so far, and I look forward to writing the final chapters of this first fund so I can really think about the future and all it will bring. As usual, thank you so much for reading, and I look forward to your counter-thoughts! Until next time.

You’re on the free list for Micro Angel. If you get value from what you read, consider supporting the newsletter. |

Older messages

MicroAngel State of the Fund: May 2022

Thursday, June 2, 2022

Planning the next great adventure, growth experiment wins, pricing research, strategy & roll out. Closing MRR: $25.32k

Productizing MicroAngel Returns: Part Two

Monday, May 16, 2022

Exploring game theory components to give life to a two-sided marketplace & designing a Decentralized Autonomous Organization

MicroAngel State of the Fund: April 2022

Thursday, May 5, 2022

A quarter million in cash returns, new product improvements, pricing model redesign and a BizDev win. Closing MRR: $25.25k

Productizing MicroAngel Returns: Part One

Wednesday, April 20, 2022

Where do we go from here? Exploring how to elicit the maximum potential out of the MicroAngel model

MicroAngel State of the Fund: March 2022

Wednesday, April 6, 2022

Doubling down on content, SEO momentum, Shopify billing investigation & COVID time-sink. Closing MRR: $23.80k

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved