Opinion: XEN doomed to failure and why benefits to Ethereum

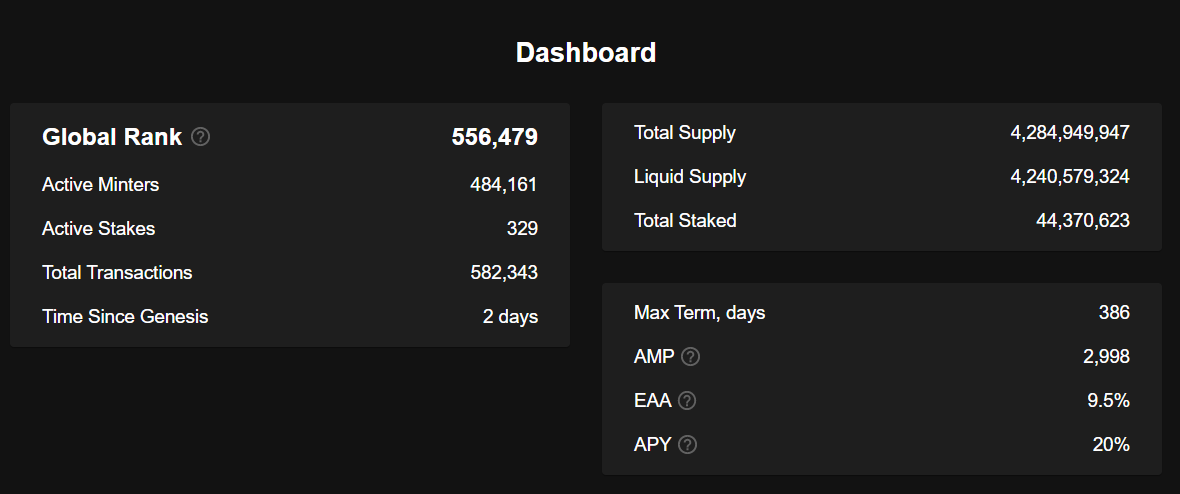

Author: @0xMavWisdom In recent days, XEN Crypto, a project that claims to be founded by Jack Levin, Google's No. 21 employee, has caused FOMO in communities both at home and abroad. With its unique Proof of Participation mining mechanism, XEN Crypto has raised the original single-digit Gas fee on Ethereum to around 30 gwei and is still going up. At the beginning of the launch, in the face of such a novel model, social media all called it a revolution. MEXC, which has always been chasing hot spots, had already forcibly launched XEN (XEN Crypto claimed that it would never go to CEX). However, after just under 3 days, doubts grew and the XEN price dropped 99% in one day, forcing MEXC to temporarily suspend its trading. In my opinion, XEN Crypto was doomed to failure, having underestimated the determination of the deal-hunters and mistakenly equated long-term holding with value investing. Proof of Participation mining mechanism Proof of Participation (PoP), as the name suggests, is simply literal; anyone who participates in the casting of an XEN has full ownership through self-disposal. A simple analysis of its principle, XEN has no upper limit of supply, starting from zero supply minting, each address can be mint once, users can choose the minting waiting period (the expiration can be claimed). The longer the waiting period, the more XEN can be claimed. At the end of the waiting period, in addition to being claimed and sold, they can also be staked for mining, but only very few people choose to do this. There are two basic formulas for casting XEN which are ① Minting quantity = log2 (global ranking - address ranking) * minting waiting period * Reward Amplifier * (1+ Early Adopter Amplification factor(%)) Reward Amplifier (AMP): starts at 3,000 at creation and decreases by 1 every day until it reaches 1. Early Adopter Amplification (EAA,%): decreases in a linear way by 0.1% for every 100,000 global ranking increase, starting from 10%. (Both figures can be viewed in real time in the data panel on the official website) ② Waiting period limit: global address rank ≤ 5000, waiting period max 100; > 5000, waiting period limit = 100 + log2 (global rank) * 15 This means that the earlier you participate in minting, i.e. the lower the address ranking, and the more addresses that participate, the more XEN you will claim over the duration of the minting waiting period; the longer the number of days chosen for the minting waiting period, the more you will claim. Furthermore, as the number of addresses minting XEN increases and the global ranking continues to rise, the upper limit of the waiting period will increase logarithmically, with the 5001st address having a maximum waiting period of approximately 287.5 days. Although XEN has no upper limit, its two basic formulas are both logarithmic functions. The naturally skewed output curve is logarithmic in nature, meaning that as more and more wallet addresses participate in the interaction, it will become increasingly difficult to claim more and more XEN. As a result, new participating addresses will claim fewer and fewer XEN, and the game is whether it is worth adding more minting waiting periods to get more tokens. The interface presented to the user is very simple: dashboard - mint - stake - events - charts. Even novices who can only use wallets will know how to operate when they open this interface. Just manually select a waiting period and click to mint. Gambling The value of the XEN depends on the difference between the inflation rate and the built-in allocation, as it becomes more difficult to mint XEN as more addresses are involved. The value is created by the market forces of the participants and as more and more market participants participate in minting XEN, the number of XEN minted will tend to decrease and the total amount will gradually stabilise, which has the effect of dampening the inflation rate to some extent. The only way to mint more XEN in the future is to extend the waiting time required to obtain minted tokens. 1.In addition to paper hands and diamond hands, there are deal-hunters Since the number of days to wait can be set artificially, some users will choose 1 day, while others may choose to wait hundreds of days to claim more Tokens. Users who choose 1 day can claim their XEN more quickly. Although the number of users who claim XEN is far less than those who wait for hundreds of days, it is better than those who wait for hundreds of days at the beginning of the project. It has high flow, low circulation and hype, and can be realized more quickly. It is understood that for the early addresses participating in the minting, the cost is just under 5u Gas fee, and after MEXC goes live, it can be realised to get 500u or more, a return of more than 100x. But if it was just paper hands and diamond hands, then perhaps the experiment could go ahead. Outside of the two, there is a sea of deal-hunters, easily dozens of addresses, who go out of their way to mint GAS costs, generate large numbers of addresses in bulk to mint 1d XEN, and then go on to cash in. As long as the number of addresses claimed * market price > minted + received GAS (<10u), there is room for the deal-hunter to make a profit. Even if the addresses were minted yesterday morning, there were about 50,000 XEN by this morning, and at a market price of $0.0004, there is still a profit margin of 10u per address. Although the profit margin has been reduced to a very small amount, it cannot be offset by the volume of addresses. While this profit margin is still there, the price of XEN cannot go up, which is why the price of XEN fell by more than 95% within 1 day after the launch of MEXC. In particular, when the next 100 days expire, there is a strong selling pressure on the first 5000 interactive addresses. Another clue can be seen from the proportion of XEN stake amount in the total. XEN stake rate only accounts for 1%, and the user loyalty is very low. After claiming the Token, they will directly sell it. 2.Long-term holding ≠ value investment The slope of the logarithmic function y=loga x is very steep in the early stage. With the progress of the x-axis (where x is the subtraction of the global ranking and its own ranking, and the variable is the global ranking), the number of addresses involved in minting increases and the slope gradually becomes gentle, the number of newly minted XEN decreases and the total amount y tends to be stable. The traffic and buzz generated by the project created by the "Google employee" has resulted in a large number of users participating, and early participants will inevitably promote the project to others while it is still hot, in order to drive more users in and thus increase the global ranking. Due to the traffic and heat brought by the projects created by "Google employe", many users participated. In addition, in order to claim more XEN, early participants are bound to market crazily to others while the heat is still on, so as to drive more users into the market, thus increasing the number of global rankings. XEN Crypto does not have any measures for inflation, relying only on the later stages of the logarithmic function, but not taking into account that early inflationary volumes can annihilate a project instantly and not last the later stages. Within three days of its birth, XEN's supply had ballooned from zero to more than four billion, an insane expansion that far outstripped buyer power in the market. The price of XEN plummeted, and it didn't last more than a day after launching MXEC. After the previous LUNA de-peg incident, the price drop due to the wildly inflated supply was terrifying. As long as the minting gate remains open and there is still room for arbitrage, prices are only likely to go down. Even if LUNC is no longer minting new tokens, it has been reduced to a MEME and its market value is unlikely to return to its peak. For institutions that had staked LUNA for a long time, the book value of their LUNA holdings evaporated when supply swelled. Going back to XEN Crypto, even if a period of time existed where there was no arbitrage and early users were not unlocked, I think the price was in a half-dead state. Simply put, there is no reason to buy it for any kind of market participant, and it has no utility on its own, other than for minting and staking. The identity of the founder as a "Google employee" is now being questioned even more, and this form of pyramid scheme is being criticised. When the hype is over, the number of actual users involved will become scarce; When the arbitrage space is very small, the deal-hunter is also withdrawn and not willing to mint; Secondary market participants are already in a weak position, and they will not buy a Token that has neither value nor MEME at this time. As the waiting period for more addresses ends, participants with profits are more likely to cash out, while those without profits may have forgotten. 3.Return to ETH, which is the most valuable In this XEN Crypto event, what impressed me most was the strength of Ethereum's economic model after Merge and EIP-1559, which also strengthened my determination to long ETH. The FOMO caused by the XEN Crypto alone destroyed over 2000 ETH in two days and at one point sent ETH into deflation. If it were a bull market and the Ethereum ecosystem was booming, there would be more valuable applications that could cause FOMO's in the community, which would eventually feed into the ETH price itself. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish If you liked this post from Wu Blockchain, why not share it? |

Older messages

CEX data report for August: Bybit Phemex Soar, Crypto.com plunge

Monday, October 10, 2022

Wublockchain's statistics showed that: In September, the main CEX spot trading volume, up 15% month on month. The top three increases were Bybit (Spot) +250%, Bitfinex +72% and KuCoin +42%. The top

Global Crypto Mining News (Oct 3 to Oct 9)

Monday, October 10, 2022

1. Core Scientific produced 1213 bitcoins in September. The Company sold 1576 bitcoins at an average price of $20460 per bitcoin. As of September 30, 2022, the Company held 1051 bitcoins and

Exclusive: The real buyer of Huobi is Justin Sun, possibly with the help of SBF

Monday, October 10, 2022

In the early morning of October 8th, Huobi announced that the controlling shareholder company has transferred all the shares of HuobiGlobal held by the fund of About Capital Management. But

Weekly Project Update:The Otherside community launches its first mini-game "Flappy Koda" and Top 10 Projects

Saturday, October 8, 2022

Author:Mingyao Editor:Colin Wu 1. Binance's weekly summary 1.1 BNB Chain hacked, over $500 million in funds involved (updating) link 1.2 Binance will start the LUNC burning process link Binance

Exclusive: Largest Chinese Crypto Exchange Huobi Finally Acquired by About Capital Management in Hong Kong

Friday, October 7, 2022

WuBlockchain learned exclusively that on October 8(UTC+8), Huobi is acquired by About Capital Management's M&A Funds(百域资本). About Capital Management became the largest shareholder and actual

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%