Top of the lyne - If in doubt, Paddle out.

If in doubt, Paddle out.3000 customers. 200 markets. 2,475% revenue growth. $1.4Bn in valuation. 2 acquisitions. Meet Paddle: The only payments infrastructure for SaaS🤝

The state treasury, known as the aerarium, was divided into two parts: the common treasure and the sacred treasury. If there were a G2 rating for ‘ease of doing business’ in ancient Rome, they’d do very well on this front. But, with the lack of a concrete economic structure, came its own administrative challenges. Emperors consolidated wealth in their own hands, and with rising costs of protecting borders, bribing away barbarians, greedy middle-men, and costs maintaining infrastructure and military and social welfare— The Roman Empire eventually collapsed 🤯 Today, modern society has learned many public finance lessons from our predecessors. Good governance is a universally-accepted basic societal expectation, along with diligent decision-making and efficient resource allocation. There are laws, a currency exchange rate, taxation policies native to a region, and ‘auditable’ public scrutiny. Today, businesses must adhere to these multiple laws and can no longer create arbitrary procedures for self-interest. The ease of doing business has definitely taken a hit. But, for the common good. Amidst all of these regulations, there is one company that’s pioneering the path of selling software (aka today’s version of Julius Caeser’s conquests) better (read: faster, easier, tax-compliant, fraud-proof) 💪🏻 Meet Paddle: The only payments infrastructure for all Software Businesses 🤝 Ten years in the making. 3000 customers. 200 markets. 2,475% revenue growth. $1.4Bn in valuation. 2 acquisitions. And they’re just getting started. ❤️🔥 Never underestimate the power of teenage conviction! The year is 2010 ⏱ 16-year-old Christian Owens living in Corby, a small town in England, has dropped out of high school. Not because of any disagreeable behavior or an unfortunate accident. Like one would usually accrue to such an occurrence. No, not Christian. Christian was a self-taught developer and had been building websites for people in the neighborhood since he was 12. By 14, he had built his first commercial software to help people invoice better. He no longer wanted to be in high school, was obviously bored with the curriculum, and had already figured out what he could do for a living. His parents were wary but also proud. Aware of the perils of dropping out, they'd made only one condition— "If you can make £100,000 a year doing 'this' by the time you can give up school, we will allow you to do that" - Mr. and Mrs. Owens Christian and his partner in Needless to say, Christian was now allowed to drop out. The year is 2012 ⏱ Christian and Harisson moved from Corby to London on what they ambitiously described as "the Amazon of buying software." The marketplace fell flat on its face. Software businesses did not need another sales channel to eat into their profits. They did, however, need infrastructure to sell their software better.

With this crucial insight that software businesses only cared about one feature, they threw 90 % of their 'marketplace' out and focussed on building only one thing right. Enter Paddle. 🚣🏽 A SaaS eCommerce service to scaling software startups seeking to offload the headache of administering international sales so they can focus on building core products, with a simple tagline: Spend time Building, not billing. The duo would sell to anybody that needed them: desktop software businesses, single payment web apps, services, and downloadable content companies, to name a few. The year is 2016, and we just hit PMF, baby! 🎉 Paddle's one-line pitch was this: "a platform for software companies to manage checkout, billing, customer relationships and run their business." Software was now eating the world at an alarming pace. By now, 80% of Paddle's customers were SaaS companies scaling internationally. By choosing Paddle, they no longer had to figure out how to build internal teams, tooling, and expertise to support their further growth.

On the back of this early growth, the team announced a $3.2M Series A — led by BGF Ventures, with participation from Spring Partners. Today, Paddle has raised over $293.3Mn, with the latest Series D round of $200Mn raised in May this year, led by KKR (Kohlberg Kravis Roberts & Co) with participation from FTV Capital, 83North, Notion Capital, Kindred Capital, with debt from Silicon Valley Bank — valuing the London-based co. at a whopping $1.4 billion 🤩

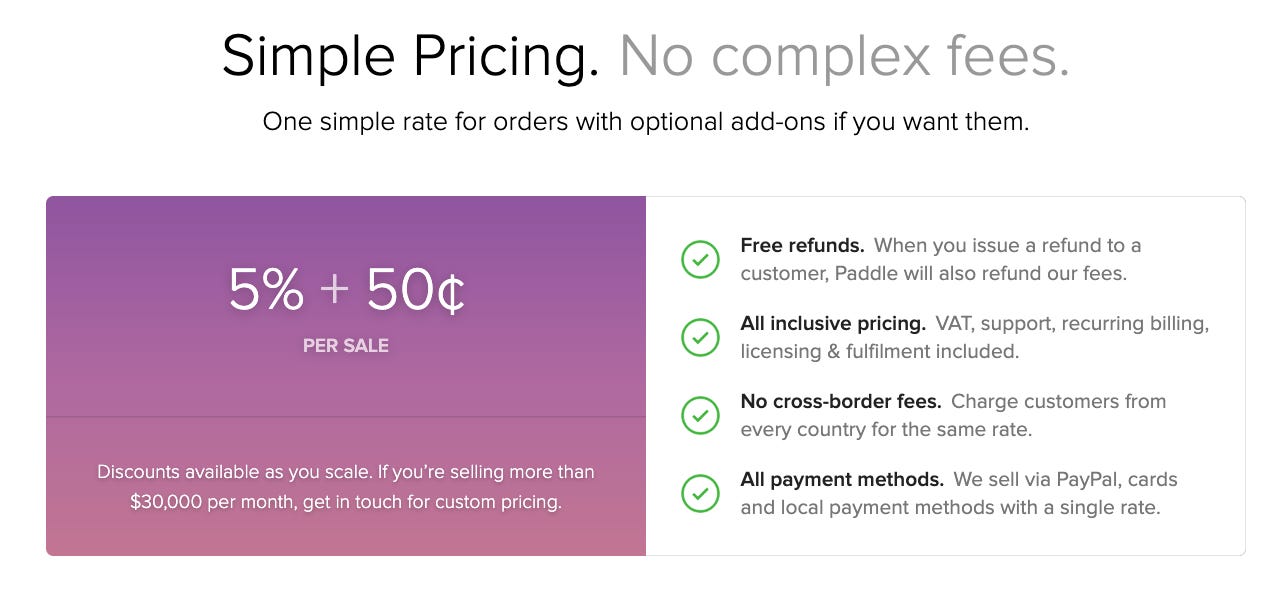

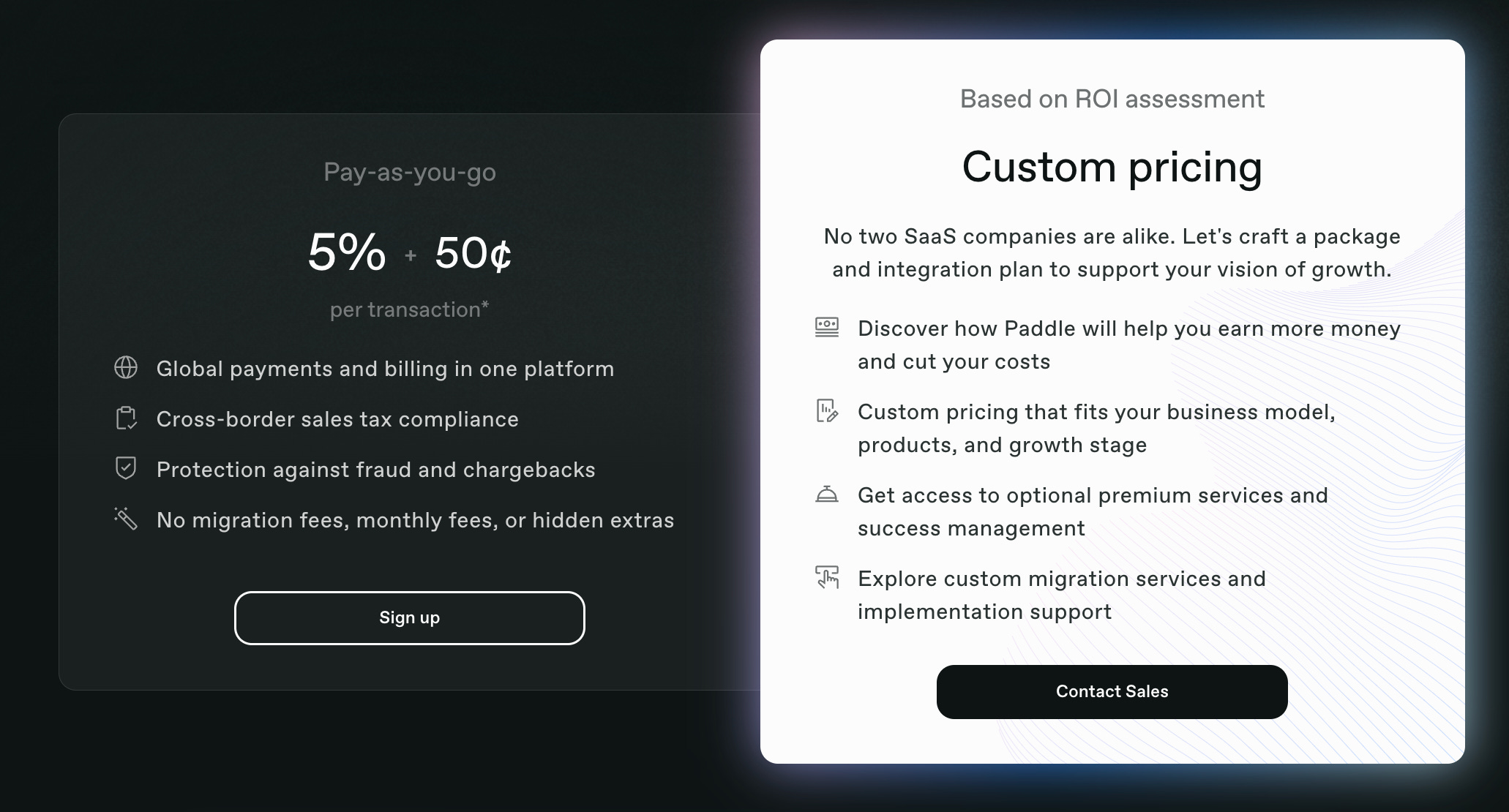

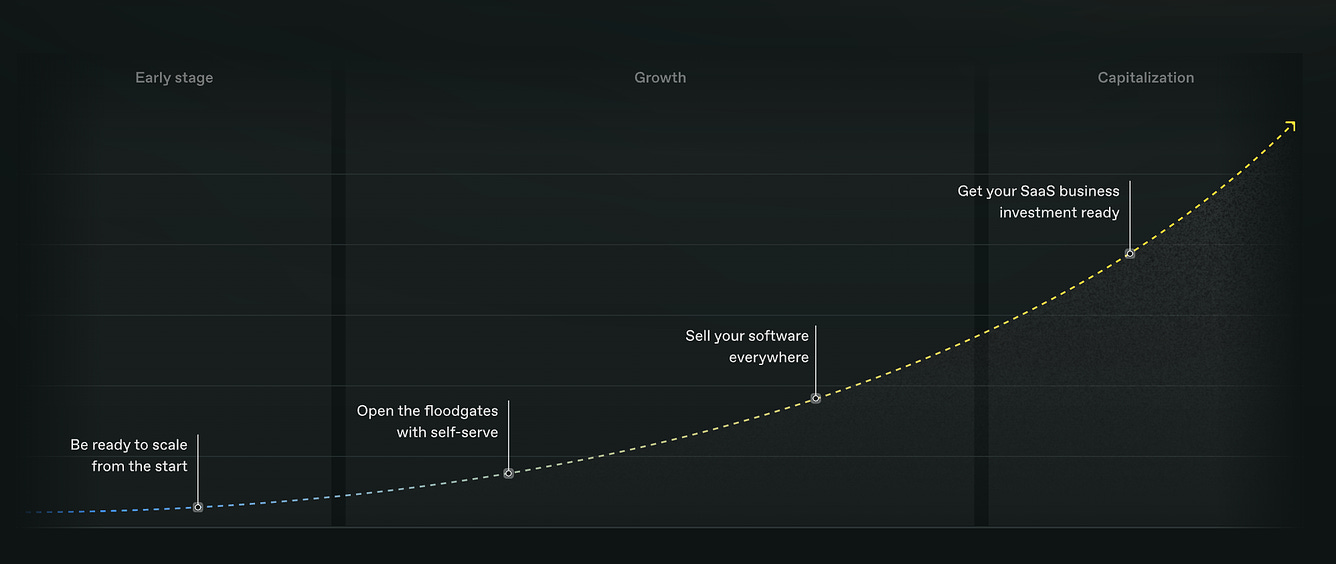

3000 customers. 200 markets. 2,475% revenue growth Paddle's story is a masterclass in building a truly global SaaS behemoth. So, how did they get SO big? Let's dive right in 👇🏼 Started from Payments, now we here 💪🏻With Paddle, SaaS companies can focus on their business and product and not on 'revenue deliverability.' Whether pre-launch or seeing early growth, every SaaS business must choose between either building or buying its payments stack. Around for over nine years, Paddle has helped over 3,000+ SaaS companies across different stages: launch, early-stage, hyper-growth, and even IPO and exit-stage; sell faster, pivot easier, and be 100% tax-compliant and fraud-proof. Long story short, Paddle helps offload the burden of managing payments and the associated liabilities by providing SaaS companies with the following: 💵 Checkout allows you to automate their entire Checkout workflow with customizable, flexible features, including multiple payment methods, languages, and win-back emails + post-purchase emails. 🚲 Subscriptions: From trial periods to flexible subscription APIs, dunning logic to subscription pausing, Paddle makes it easier to retain and expand your customer base throughout the entire lifecycle. ⚖️ Tax and Compliance: Paddle handles customer authentication, ensures SOC-compliant data protection, provides all necessary information on customer communications, and adheres to regional and international laws to protect you and the end customers. 📈 Reporting: Paddle's performance dashboards and downloadable reports help track your acquisition, recurring revenue, retention, and more. With downloadable reports, bespoke insights, and audience segmentation, you can focus your attention on accounts on the verge of churn. 🤑 Upsell insights feature groups customers from the same business domain who made purchases through your checkout. Your sales team can then upsell them into a more lucrative business account and send seamless invoices at a higher ACV. With all of these use cases tied into a payments infrastructure, the decision to opt for Paddle is easily a no-brainer. But let's dive into everything they're doing right to grab the loudest voice and share in the market👇🏼 🚶🏻♀️Walking the Product-led TalkGrowth happens slowly, and then, all of a sudden. ⛹🏻 True for high-growth companies and especially true for Paddle. Back in the 2010s, Paddle did as much business in 2 and a half years as they do today, in A DAY! The company runs a tight, Product-led Growth 🤝 Sales hybrid GTM motion. This has helped them open the floodgates of the top of the funnel with the PLG motion while also ensuring that the closing happens👩🏻⚖️ and the money hits the bank💰 with the Sales motion. 🏷 Transparent PricingFrom the very beginning, Paddle ran itself purely self-serve. Its business model is a volume-based SaaS, with the service charging customers a flat-rate of 5% + $0.50 per transaction fee. Today, Paddle has retained the same self-serve, pay-as-you-go pricing model for most software businesses.

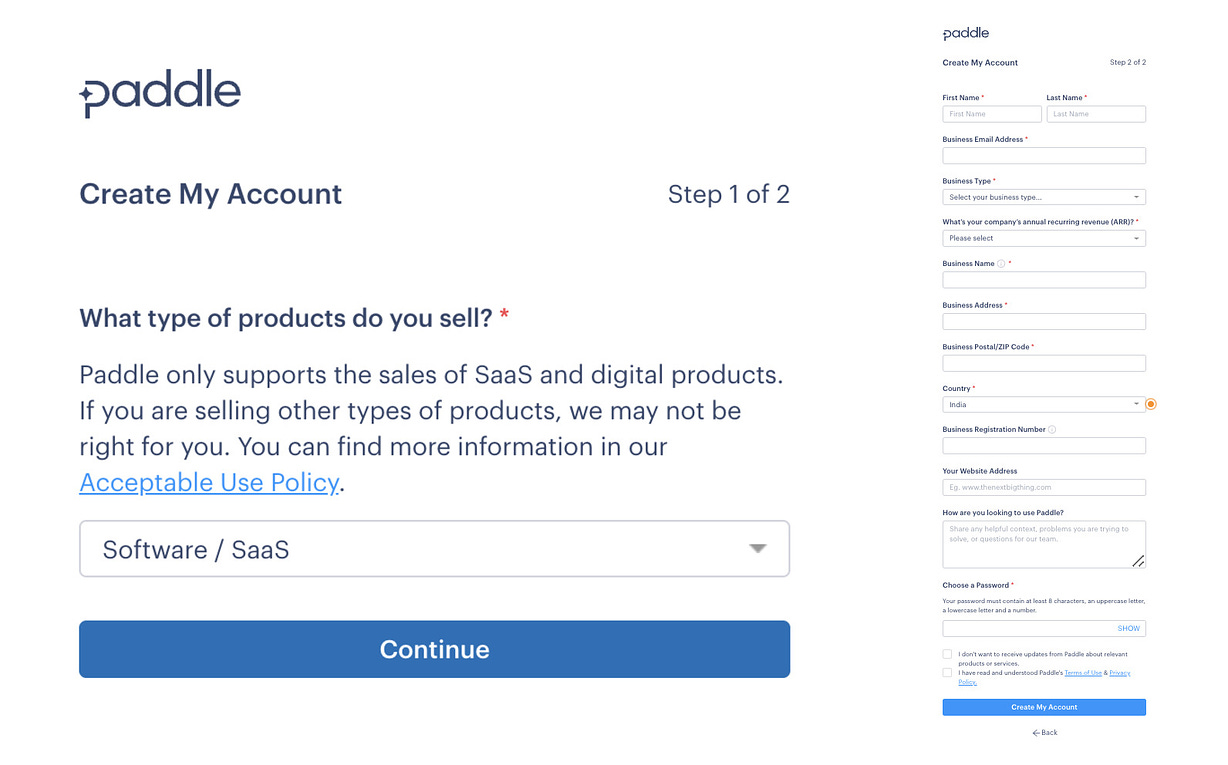

🎢 Seamless OnboardingPaddle's onboarding process is surprisingly simple for a product that's so hard to explain in a 30-second elevator pitch. A two-step process, and you're in! No cumbersome required fields. Paddle's 2-step onboarding process to enter the sandbox...

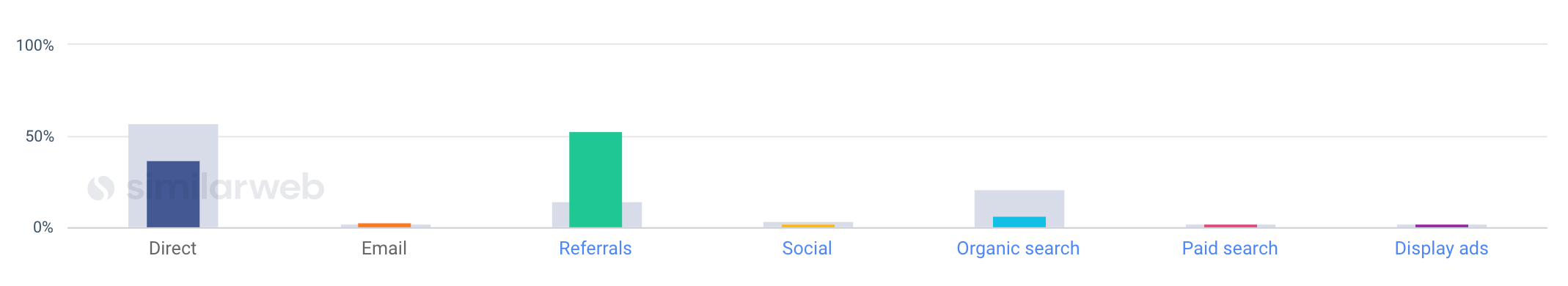

The only fee that's deducted is once a transaction is processed. 🤑 Product-led AcquisitionOff their recent Series D acquisition, Paddle acquired financial-metrics company, Profitwell in a $200Mn cash and equity deal. The rationale? Both have a strong sense of shared mission: To help software companies grow faster and more efficiently by taking care of operational and financial hurdles. Companies increasingly aren't just looking for tools to solve their problem but offload the solutionizing completely. Riding on the new wave of "do it for you," Paddle benefits from Profitwell's industry-renowned subscription intelligence, which helps over 30,000 customers (yep, that's right) with its free-forever product, Profitwell metrics, with advanced reporting on all their subscription analytics, helping them reduce churn, get a clear picture of their revenue growth. With this acquisition, Paddle owns the product and technology, and all of Profitwell's customers are now Paddle's customers. Cross-selling and up-selling, then, is just a matter of time. (and excellent account management + customer success!) Payments and related services being a low-margin business, Paddle's acquisition is a classic playbook of creating an ecosystem of products under a more significant umbrella use case that helps establish the company as an authority on the subject (in this case, everything SaaS revenue and finance!), and help lock in customers' loyalty. Instead of several vendors for different finance-related use-case: Stripe for collecting payments, Chargebee for subscription management, Avalara for tax compliance, and so on…cos. now simply have to go to Paddle, who then DOES IT ALL FOR YOU! 💆🏻 Optimized for YOU!Software built but not sold is pointless. And Paddle knows this. With their ICP etched in their GTM strategy, Paddle has broken down the complicated software buying process, into specific use cases, for SaaS companies of all sizes and stages. For early-stage seed companies, Paddle's ready-to-go payments infrastructure and experienced support team let you focus on building your product. For blitzscaling startups in the hyper-growth phase, Paddle helps you pivot into a new pricing model in days (instead of months), sell software globally (and be tax-compliant from day 1), introduce self-serve seamlessly, and unify self-serve and sales-assisted (by reconciling all revenue data). For late-stage companies, Paddle makes their entire financial infrastructure integrated, open, and auditable, making them investment-ready, acquisition-ready, or even ready to go public. (yes, IPO!) 📑 Robust Content StrategyAs of Sep '22 - Oct '22, Paddle has raked in an average daily organic traffic of upwards of 70,000, totaling monthly organic traffic to +2.1Mn visitors. 💪🏻 Let's take a look at how they do this. 🔎 Now you SEO mePaddle has created a content marketing and SEO engine that works in tandem. They publish highly-researched, quality content at godspeed. With 1,000+ website pages, most of the articles published are directly tied to intent and therefore have a high traffic value. ($55K+ in traffic value from organic traffic) They rank for over 12,000 organic keywords in the 1st position for ~177 keywords, both branded and non-branded, such as net revenue retention, financial forecasting, product launching strategy, go-to-market strategy template, and volume pricing. Most of their traffic is direct, having built a brand synonymous with their created category. ☠️ No-BS BlogDivided into categories that directly matter to the ICP, the Paddle Blog covers SaaS insights, expert opinions, and talking points and provides a guide for growing a SaaS business. Most of the articles are written by in-house experts themselves. E.g. Andrew Davies, the CMO at Paddle, has authored a recently-published no-BS article on Changing SaaS Valuations and what founders need to keep in mind.

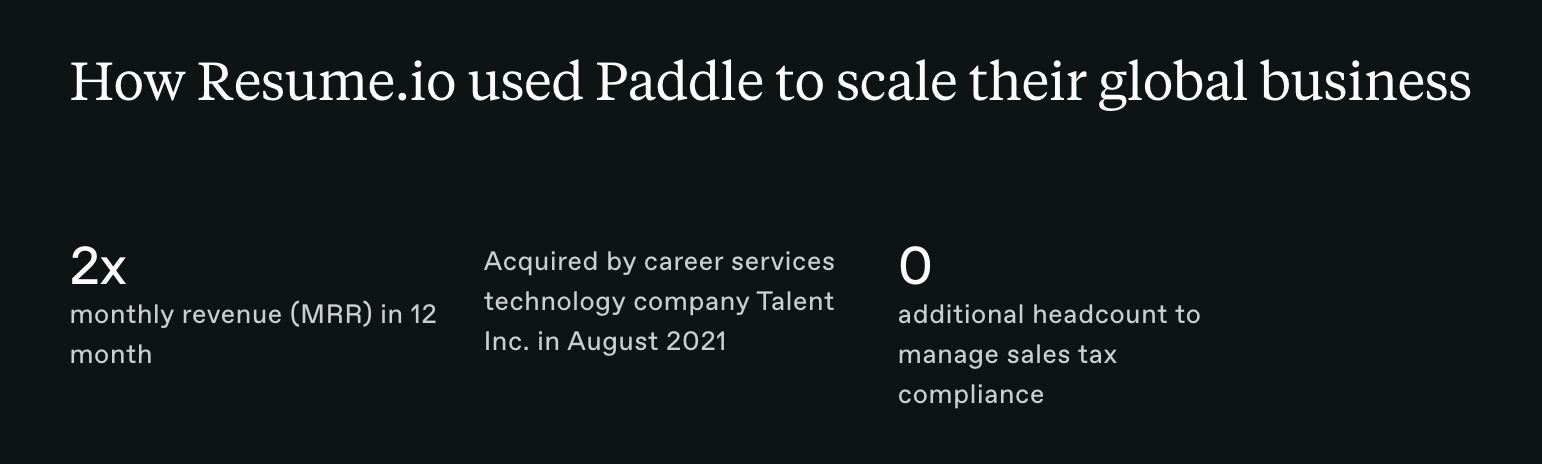

With no-BS case studies, Paddle showcases the value it drives for its customers in a super-simple and easily understandable way.

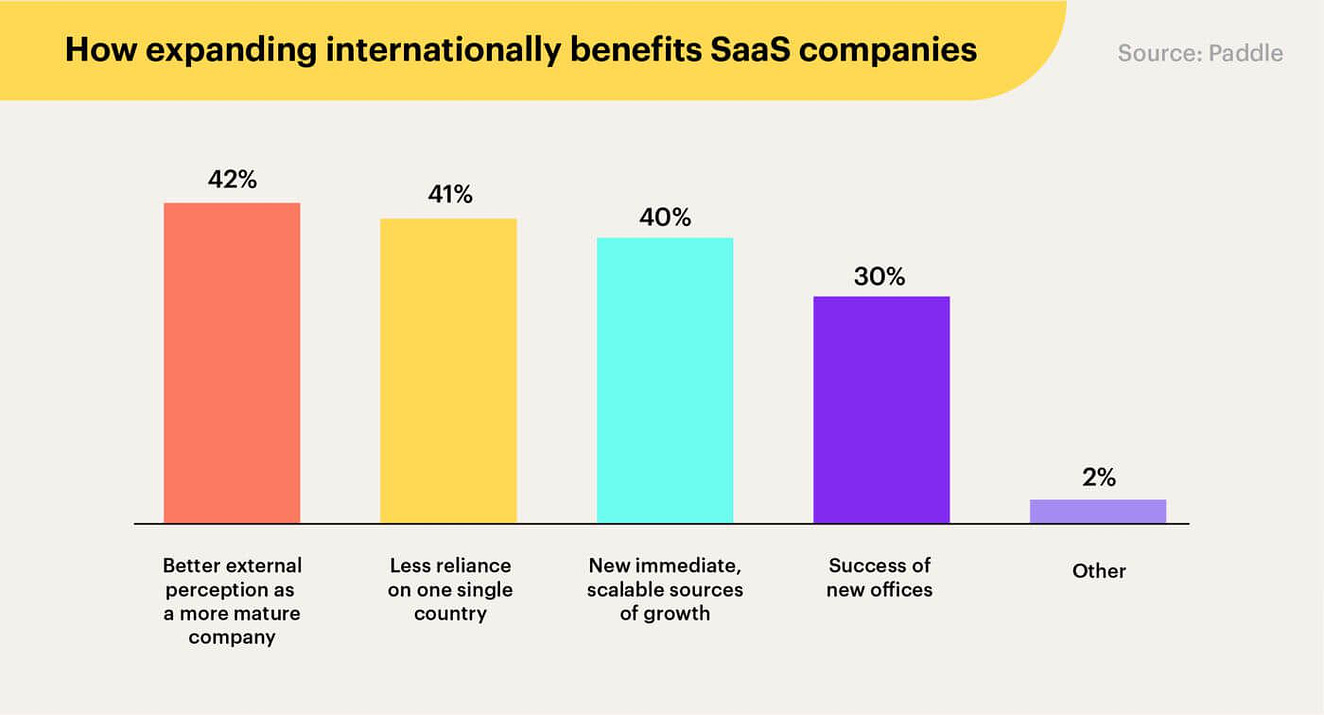

Verticals are spearheaded by Paddle's in-house show producer Ben Hillman and take a deep dive into top SaaS companies and the secret sauce to their success, companies that are pioneering their verticals and crushing the competition. Here's the latest one on How Skype blew a 10-year lead to Zoom 🔥 🗺 Sell More. Sell Globally = Increased TAMCompanies grow by increasing their TAM, their Total Addressable Market, which drives their ARR. This approach to scaling their business has enabled Paddle to achieve 2,475% revenue growth in the four years leading to 2019.

The five north-star metrics for Growth at Paddle are:

Paddle uses data to determine which geographies they'll target next. Analyzing data from their sellers along with external data, Paddle's "software universe" enables them to identify which markets are ripe for expansion and assess what factors will lead to success in those regions. Infographic by Paddle on why selling globally = increased TAM = increased ARR. Next on their hit list? Asia and the Middle East. They've also ingrained the mindset of making small incremental changes to enter international markets. This could look as small as enabling payment methods of the local region, as opposed to needing a physical office there. 🤝 PLG meets SalesA match made in heaven, Paddle has a free version of at least part of its offering via Profitwell, a completely no-touch, self-serve with transparent pricing (5% + 50¢ per transaction), and a "Contact Sales" CTA option for more complex businesses, that need Paddle to do most or all of the heavy lifting 🏋🏼♀️ The Sales team is led by Adam Kay, the SVP of Sales, and Tripp Brockway, the VP of Global Sales, and consists of a tight ship of Sales leaders, SDRs, AEs, and RevOps Managers. Together the team owns all revenue metrics and is responsible for hitting the quarterly and annual quota. This includes qualifying, prospecting, building rapport, identifying stakeholders (Champions, Decision-Makers, Legal, Procurement, Finance, etc.) in the client's consensus decision-making structure, determining best practices for navigating and influencing the conversation, and course, closing multi-figure deals. (the company has not disclosed official revenues yet) 🔮 What's next? All Paddled up.While there are several Merchants of Record (read: PayPal, Stripe, RazorPay) and several other vendors that help with tax compliance, fraud, revenue intelligence, and so on, Paddle has proven without a doubt that there is a business to be made by merging all the complicated, different moving parts into one well-oiled engine, and making software companies' lives a When it comes to EVERYTHING that Paddle offers, there is no competition. As a market leader in a unique bring-it-all-together and do-it-for-you finance and payments category that they have created, the future might look bright for 28-year-old (yes, they've been around for ~ ten years now) Christian Owens and his team of Paddle-rs. Off the fresh Series D funding and the Profitwell acquisition, international growth is definitely on the charts, along with a foray into ancillary products that provide standalone value. The team has also just built an alternative to Apple's in-app payments service, giving app-makers more autonomy on how they charge customers, how much they pay, etc. The launch has been stalled because Apple's case with Epic (one of the most outspoken critics of IAP) has dragged on. With aspirations like taking on Apple head-on, Owens and his team are keeping us all paddled up💪🏻— In anticipation of the next phase of their growth story unfolding. 💥 When was the last time you shared our article? Better late than never👇🏼 We help PLG companies (such as this one☝🏼) with their GTM experiments: be it monetization, activation, or retention. Start small, rapidly iterate and deploy at scale 🚀 Some housekeeping… Is your mailbox trying to keep our content away from you? 💔 What can you do about it? Mark this email as ‘not spam’ 😱 or move it from your promotions to the primary folder 👉🏻 It’s very easy! Thanks again, and please tell a few friends if you feel like it. How did you like this week’s newsletter? Legend 🤩 - Great 😄 - Good 🙂 - OK 😶 - Meh 😒 If you liked this post from Top of the Lyne, why not share it? |

Older messages

No code, no problem 🫡

Thursday, October 6, 2022

👋 Hey, Ruchin here! Welcome to this week's edition of the ✨Top of the Lyne✨ newsletter. Each week we publish the hottest news from the beautiful world of product-led growth! (PLG) The outcome we

Think In-App? Think AppCues

Tuesday, October 4, 2022

The first impression is the last impression. Don't believe us? Ask your users.

Time = flat circle

Thursday, September 29, 2022

The latest from the PLG world - and why your déjà vu probably isn't misplaced

Heyo, Tray.io!

Tuesday, September 27, 2022

A look at the growth strategies that led to Tray.io to become a $ 600Mn company, with marquee clients like Zendesk, Udemy and Bain & Co.

Take a long, hard look at yourself

Thursday, September 22, 2022

Fresh off the PLG press🗞: Figma sells out, Dreamforce takes over downtown SF, Fazz and Codacy get wings, and a lot more!

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏