The Daily StockTips Newsletter 10.25.2022

UPDATE: Many of you will notice your subscription has ended. This is the start of the refund process. Yes, your subscription has ended. But you’re still a free subscriber. I’m still trying to figure things out on the Stripe end. I ask that you hold tight & be patient. As compared to the countries of Europe & other areas of the world, the United States is increasing rates much faster. The result? An exceptionally strong dollar by comparison! This is a mixed bag. The stronger the dollar, the more we can buy from other countries when converting the dollar into foreign currency. However, this also can mean that other countries are able to buy less of our exports. It can also mean that people around the world are more prone to buy our stocks, bonds, & equities. Regardless of the import/export implications, remember that inflation is a worldwide problem. If other countries don’t take fast action, their inflation will continue to spiral out of control … feeding our inflation. And I still assess that the Fed is going to stay the course until the labor market begins to cool. And the Fed interest rate decision is Wednesday NEXT WEEK … followed by the next inflation cut Thursday the week after. Listen folks, I don’t care what that inflation cut looks like. I’m seeing the prices of goods on the shelves skyrocket. I see that a value meal from McDonalds costing more than $10. I see that I can’t sit down to a meal at a normal restaurant without paying over $25 per person. I notice that I can’t go shopping to pick up a few things without dropping more money than I’m accustomed to. It’s insanity out there! From my perspective & budget, things are obviously getting more expensive. And with the holiday season coming up, I’m not sure things are going to let up … until January … the economic data of which will be reported in February. Looks like were going back to the recession day’s. Buy nice gifts for the kids … get cheap gifts or nothing at all for everyone else. Either way even JP Morgan believes the bottom isn’t in yet. Bloomberg says a recession is certain. The writing is on the wall now. People aren’t even speculating good news at this point. And who is going to invest in the markets with such an outlook? At this point large retirement fund managers are essentially throwing their clients money away by not waiting for lower lows. Regardless, there is time for you. Certainly there will be massive short squeezes and opportunities between now & an assessed recession. But why gamble? Put your money in safe bets. Low returns but responsible yields. Save money & take care of your family. Get a jump on this … especially if you aren’t secure in employment. Prepare yourself as if hard times are coming … because they likely are! God Bless!

IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. Past performance does not guarantee future results. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.If you liked this post from StockTips Newsletter, why not share it? |

Older messages

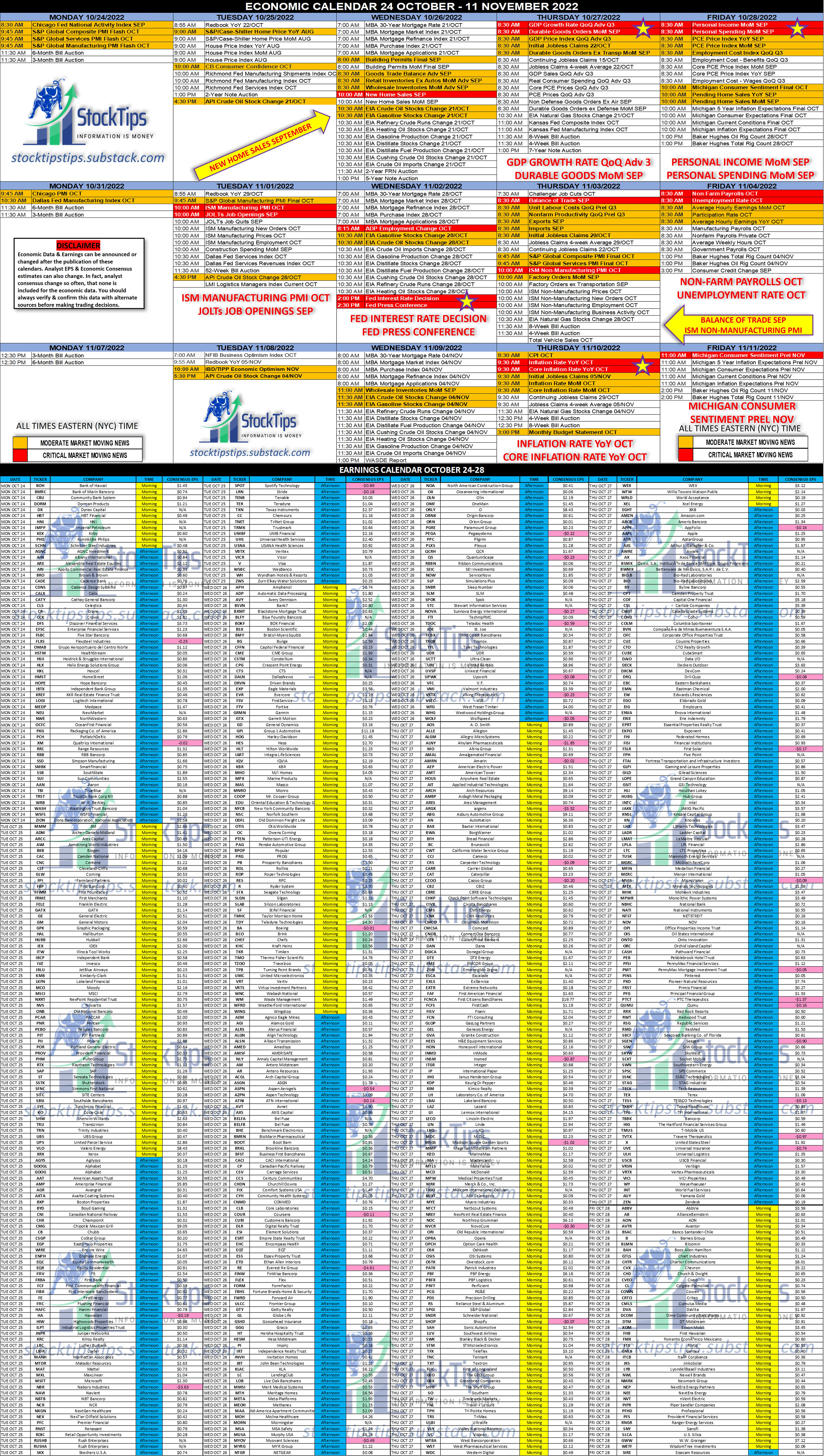

ECONOMIC CALENDAR 24 OCT - 11 NOV

Monday, October 24, 2022

I figured I would keep giving you folks something however long it takes to finish up.

STATUS UPDATE

Tuesday, October 18, 2022

And some important notes on markets

The Daily StockTips Newsletter 10.14.2022

Friday, October 14, 2022

(Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 10.13.2022

Thursday, October 13, 2022

(Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 10.12.2022

Wednesday, October 12, 2022

(Published 7:30 AM ET MON-FRI)

You Might Also Like

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Boring, but important

Friday, February 28, 2025

For those life moments you might need . . . ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Last Trader Standing

Friday, February 28, 2025

The Evolution of FX Markets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

My secret 15-minute video sharing my triple digit options strategy

Friday, February 28, 2025

Free training + book ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👋 Bye bye, bitcoin

Thursday, February 27, 2025

Bitcoin's biggest one-day blow, Trump's latest tariff threat, and robots playing soccer | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 28th in 3:12 minutes.

Don't Overlook this Sector Billionaires are Quietly Investing In

Thursday, February 27, 2025

The Billionaires' Energy Secret (You Can Get In) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Giveaway: Set Sail on Your Next Adventure 🚢

Thursday, February 27, 2025

Enter to win a chance to win a free trip from Virgin Voyages. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏